Table of Contents

Introduction

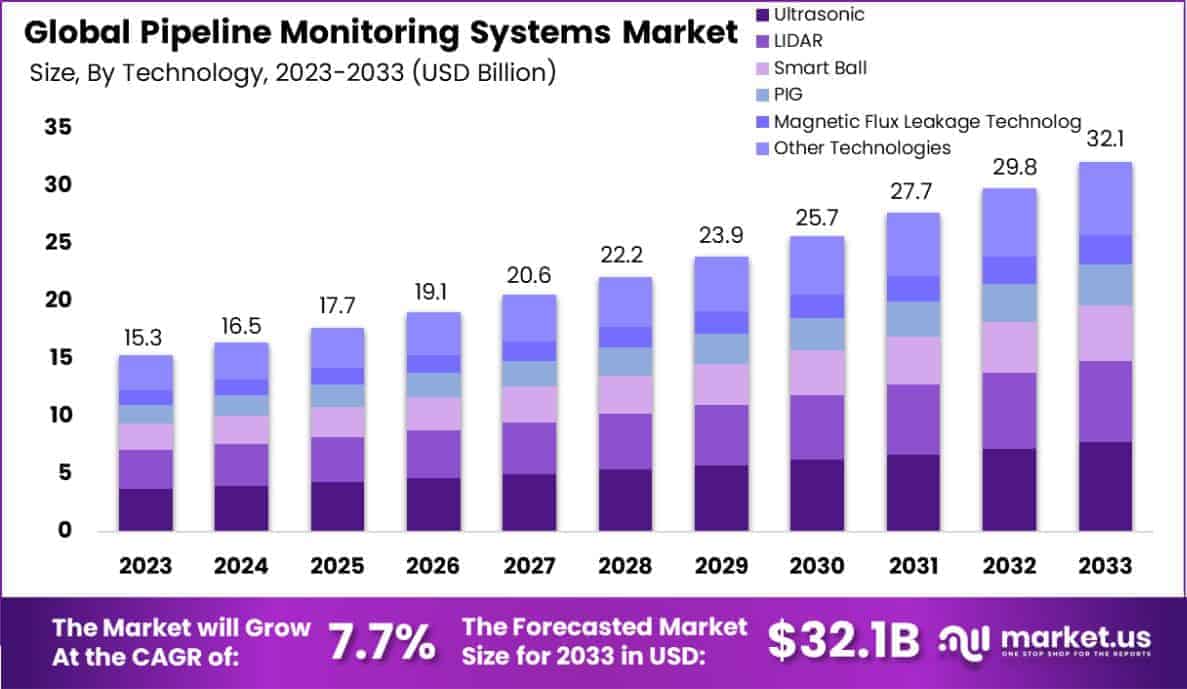

The Global Pipeline Monitoring Systems Market is projected to reach approximately USD 32.1 billion by 2033, rising from USD 15.3 billion in 2023. This market is anticipated to grow at a compound annual growth rate (CAGR) of 7.7% over the forecast period from 2024 to 2033.

Pipeline monitoring systems are integral components designed to oversee the operation and condition of pipelines, ensuring safety, efficiency, and compliance with regulatory standards. These systems utilize sensors, software, and other technologies to detect leaks, monitor corrosion, and assess pressure changes within pipelines. The market for pipeline monitoring systems encompasses the sale and distribution of these technologies, along with related services across various industries including oil and gas, water and wastewater, and chemicals.

The growth of the pipeline monitoring systems market can be attributed to several factors. Increasing investments in pipeline infrastructure due to growing energy demands globally, coupled with stringent regulatory requirements for safety and environmental protection, are primary growth drivers. Additionally, technological advancements in monitoring solutions and increased awareness of the need for operational safety further propel market expansion. The demand for these systems is bolstered by the rising adoption in emerging economies where infrastructure development is rapid. Opportunities within this market are vast, particularly in the development of more sophisticated, integrated, and real-time monitoring technologies that can offer enhanced predictive maintenance capabilities and improved cost-efficiency for operators.

Key Takeaways

- The global Pipeline Monitoring Systems market is anticipated to reach approximately USD 32.1 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 7.7% from 2024 to 2033. This represents a significant increase from the USD 15.3 billion recorded in 2023.

- In 2023, the Ultrasonic technology captured a leading share of 24.2% in the Pipeline Monitoring Systems market, indicating its prevalent adoption.

- Metallic pipes were the most commonly monitored pipe type, holding a dominant 75.1% market share in 2023, reflecting their widespread use in pipeline infrastructures.

- Leak Detection emerged as the primary application within the Pipeline Monitoring Systems market in 2023, accounting for 43.1% of the market, underscoring the critical importance of monitoring and maintaining pipeline integrity.

- The Oil and Gas sector was the predominant end-use industry for Pipeline Monitoring Systems in 2023, with a substantial market share of 67.2%, highlighting the sector’s reliance on effective monitoring systems to ensure operational safety and efficiency.

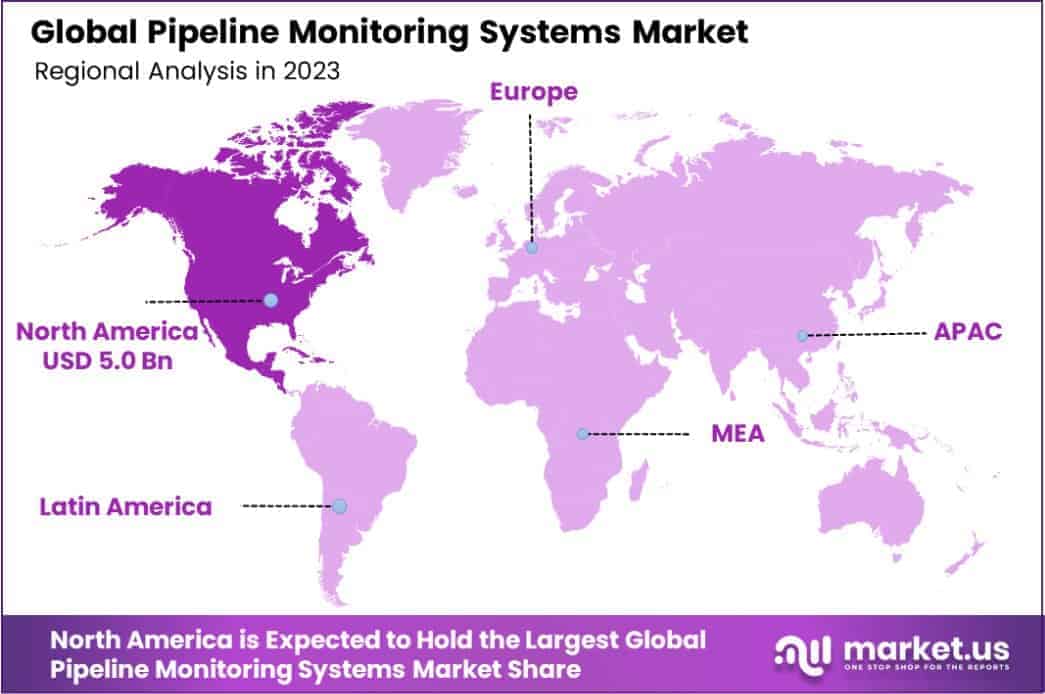

- North America led the global market with a 33.1% share in 2023, generating revenue of USD 5.0 billion, reflecting robust market activity and technological adoption in the region.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 15.3 Billion |

| Forecast Revenue (2033) | USD 32.1 Billion |

| CAGR (2024-2033) | 7.7% |

| Segments Covered | By Technology(Ultrasonic, LIDAR, Smart Ball, PIG, Magnetic Flux Leakage Technology, Other Technologies), By Pipe Type(Metallic, Non-Metallic), By Application(Operating Condition, Pipe Leakage Detection, Leak Detection, Other Applications), By End-Use Industry(Water and Wastewater, Oil and Gas, Other End-Use Industries) |

| Competitive Landscape | ABB Ltd., Honeywell International Inc., Emerson Electric Co., Huawei Investment and Holding Co. Ltd., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Generic Electric Co., ORBCOMM Inc., QinetiQ Group Plc, Xylem Inc., Other Key Players |

Emerging Trends

- Integration of IoT and AI Technologies: There is a significant trend towards the integration of Internet of Things (IoT) and Artificial Intelligence (AI) in pipeline monitoring systems. These technologies enhance real-time data collection and predictive capabilities, improving operational safety and efficiency across pipeline networks.

- Advancements in Ultrasonic and Smart Ball Technologies: The adoption of ultrasonic and smart ball technologies is growing. These methods are favored for their non-intrusive nature and advanced diagnostic capabilities, which help in accurately detecting anomalies and changes in flow within pipelines.

- Increased Use of Non-Metallic Pipes: There is a noticeable shift towards using non-metallic pipes like HDPE and PVC due to their corrosion resistance and cost-effectiveness, especially in less hazardous operations.

- Enhanced Leak Detection Systems: Developments in leak detection technologies that use advanced algorithms to compare volume and mass at different points along the pipeline are becoming more prevalent. These systems are crucial for early detection of leaks to prevent significant financial and environmental damage.

- Focus on Sustainable and Safe Operations: The industry is increasingly prioritizing sustainable practices and safety, with pipeline monitoring systems playing a crucial role in ensuring the integrity of pipeline operations and compliance with environmental regulations.

Top Use Cases

- Leak Detection: This is the most significant application, using technologies to quickly identify leaks and prevent large-scale environmental and operational issues.

- Pipeline Break Detection: Systems designed to detect sudden breaks in pipelines are crucial for minimizing damage and service interruptions, particularly in oil, gas, and water mains.

- Operating Condition Monitoring: Monitoring systems assess the operational status of pipelines to detect any performance anomalies that could indicate potential failures, ensuring ongoing operational efficiency.

- Corrosion and Bacteriological Control: These systems are used to monitor and evaluate corrosion control programs and manage bacteriological risks within pipelines, crucial for maintaining long-term pipeline integrity.

- Risk Evaluation and Regulatory Compliance: Pipeline monitoring systems collect data essential for pipeline risk assessments and help operators comply with stringent regulatory requirements.

Major Challenges

- High Installation and Maintenance Costs: The initial setup and ongoing maintenance of advanced monitoring systems can be prohibitively expensive, limiting their adoption especially in regions with lower economic resources.

- Technical Complexities and Integration Issues: Integrating new technologies with existing pipeline infrastructure poses significant technical challenges, which can hinder system efficiency and reliability.

- Regulatory and Environmental Challenges: Navigating the complex landscape of regulatory compliance and environmental protection requirements continues to be a major hurdle for pipeline operators.

- Cybersecurity Threats: As pipeline monitoring systems become more connected through IoT, they become vulnerable to cyber-attacks, which can compromise critical infrastructure.

- Lack of Awareness and Skilled Workforce: There is a notable gap in understanding the benefits of pipeline monitoring systems among stakeholders, compounded by a shortage of skilled professionals to operate and maintain these systems effectively.

Top Opportunities

- Expansion into Emerging Markets: Increasing industrial activities in Asia-Pacific and Middle East regions present significant opportunities for the deployment of advanced monitoring systems.

- Development of Advanced Detection Technologies: Continuous innovation in detection technologies offers growth opportunities, especially in enhancing the accuracy and speed of leak and break detections.

- Adoption in Alternative Applications: Expanding the use of monitoring technologies in water and wastewater management, as well as in the mining and chemicals sectors, provides new avenues for growth.

- Enhancements in Non-Metallic Pipeline Applications: As the use of non-metallic pipes increases, there is a growing opportunity to develop monitoring solutions tailored for these materials, which are becoming popular due to their cost-effectiveness and corrosion resistance.

- Integration with Smart City Infrastructure: As cities become smarter and more integrated, pipeline monitoring systems can play a crucial role in the urban infrastructure management system, promoting safer and more efficient utility services.

Key Player Analysis

- ABB Ltd.: ABB has demonstrated its commitment to innovation in the pipeline monitoring sector by introducing advanced technologies such as the Mobile Gas Leak Detection System, HoverGuard. This system enhances environmental protection and gas leak detection capabilities, making significant advancements in natural gas monitoring. ABB’s dedication to technological advancement has positioned it as a leader in the market.

- Honeywell International Inc.: Honeywell is actively engaged in the pipeline monitoring systems market, focusing on integrating IoT and AI-driven solutions. This approach allows for advanced leak detection and predictive maintenance capabilities. Honeywell’s solutions aim to enhance operational safety and efficiency, thereby supporting the pipeline industry’s demands for advanced monitoring technologies.

- Siemens AG: Siemens offers a comprehensive range of pipeline monitoring solutions that incorporate data analytics, machine learning, and IoT technologies. These systems are designed to improve the reliability and security of pipeline operations across various environments. Siemens’ commitment to innovation and sustainability in its monitoring solutions reinforces its strong market presence.

- Huawei Investment & Holding Co. Ltd.: At the Mobile World Congress, Huawei unveiled a smart pipeline inspection system that utilizes distributed fiber optic sensing. This technology significantly enhances the efficiency and security of pipeline monitoring, shifting away from traditional manual inspection methods. Huawei’s investment in this advanced technology underscores its role in transforming pipeline monitoring through digital innovation.

- QinetiQ Group Plc: QinetiQ has carved a niche in the pipeline monitoring market with its advanced sensor technologies and intelligence capabilities. The company’s focus on pipeline safety and security solutions enables real-time monitoring and threat detection, which are critical for maintaining pipeline integrity. QinetiQ’s strategic approach to client partnerships enhances its reputation as a trusted provider in the sector.

Regional Analysis

North America Leads Pipeline Monitoring Systems Market with Largest Market Share of 33.1%

In 2023, the pipeline monitoring systems market in North America was valued at USD 5.0 billion, representing a dominant share of 33.1% of the global market. This significant market share can be attributed to the extensive and aging pipeline infrastructure across the region, necessitating advanced monitoring solutions to ensure safety and efficiency.

The growth of the market in North America is further supported by stringent regulatory standards and a high adoption rate of technologically advanced monitoring systems. Key market players in the region are investing in research and development to innovate and enhance monitoring technologies, which is expected to sustain the market dominance of North America in the coming years. This region’s leadership in the market underscores its critical role in shaping trends and technological advancements in pipeline monitoring systems globally.

Recent Developments

- In 2024, Vaillant Group, based in Remscheid, reported a revenue of €3.8 billion for 2023, a 3% increase from the prior year. Their heat pump division saw exceptional growth, nearly 50%, significantly outperforming the broader European market. In Germany, the sector’s growth exceeded 100%, positioning Vaillant as the national market leader and the third-largest in Europe. The company also sustained its global leadership in gas heating technologies.

- On July 4, 2023, Midea Building Technologies unveiled two new products in Budapest, Hungary, emphasizing their commitment to environmental sustainability. The launch, themed “EVER GREEN EVER FORWARD,” featured the MCube Series Liquid Chiller and the next-generation M thermal R290 Nature Series Heat Pump.

- In 2025, Phillips 66 announced an acquisition deal with EPIC Y-Grade GP, LLC, and EPIC Y-Grade, LP, purchasing the firms for US$2.2 billion. This strategic move, including long haul natural gas liquids pipelines and processing facilities, is expected to positively affect Phillips 66’s earnings immediately.

- In 2025, Howard Energy Partners revealed their acquisition of EPIC Midstream Holdings’ ethylene pipeline, which runs 120 miles and supports the petrochemical sector in Texas. This expansion not only enhances HEP’s infrastructure but also complements its existing operations, supporting its growth strategy.

- On December 30, 2024, EQT Corporation finalized its joint venture with Blackstone Credit & Insurance, receiving $3.5 billion. This partnership led to significant debt reduction for EQT, aligning with its financial strategy.

- In December 31, 2024, ONEOK, Inc. completed the sale of its interstate natural gas pipeline systems to DT Midstream, Inc. for $1.2 billion. This transaction marks a strategic shift for ONEOK, optimizing its asset management and aligning with its long-term objectives. DT Midstream is committed to maintaining high standards of safety and operational excellence.

Conclusion

The pipeline monitoring systems market is poised for substantial growth over the next decade, driven by increasing global energy demands and the need for enhanced pipeline safety and efficiency. As industries and economies continue to expand, especially in emerging markets, the importance of sophisticated monitoring technologies becomes paramount. The integration of advanced technologies such as IoT, AI, and non-intrusive diagnostic tools is transforming the landscape of pipeline monitoring, offering improved predictive maintenance and operational safety.

Furthermore, the shift towards sustainable and safe operations, along with innovations in leak and break detection technologies, is set to further propel the market forward. While challenges such as high costs, technical complexities, and cybersecurity threats persist, the ongoing development of cost-effective and efficient monitoring solutions is likely to foster significant opportunities for market expansion and technological advancements in pipeline monitoring systems. This growth is indicative of a broader trend towards more resilient and intelligent infrastructure management, ensuring the long-term integrity and reliability of global pipeline networks.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)