Table of Contents

Introduction

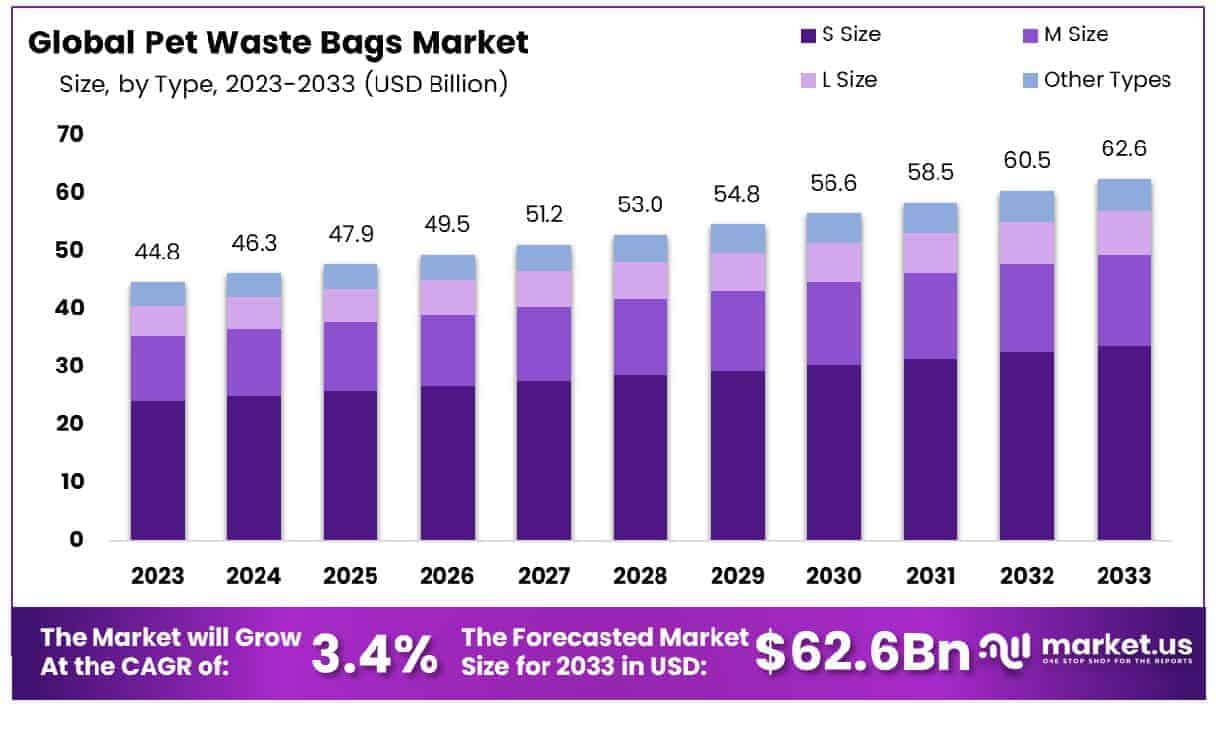

The Global Pet Waste Bags Market is projected to reach approximately USD 62.6 billion by 2033, up from USD 44.8 billion in 2023, reflecting a CAGR of 3.40% over the forecast period 2024–2033.

The pet waste bags market is a growing segment within the broader pet care industry, driven by increasing pet ownership and heightened awareness of environmental sustainability. Pet waste bags are disposable bags designed for the hygienic collection and disposal of pet waste, ensuring cleanliness in public spaces and reducing environmental contamination. The market for these products is expanding due to rising pet adoption rates, particularly in urban areas where responsible waste disposal is a regulatory and social necessity.

Growth is further supported by stringent government regulations regarding pet waste management and the increasing consumer preference for biodegradable and compostable alternatives over traditional plastic bags. The demand for pet waste bags is also fueled by a shift toward eco-friendly and sustainable products, as pet owners seek environmentally responsible solutions to align with global sustainability goals. In addition, e-commerce platforms have significantly boosted market penetration, providing easy access to a variety of pet waste bags with different features, such as scented, unscented, and extra-durable options.

Opportunities exist for manufacturers to innovate by integrating recycled materials, improving bag durability, and expanding product portfolios to include dispensers and refill packs. The growing trend of premium and customized pet care products presents further avenues for differentiation and market expansion. Additionally, the increasing focus on smart packaging and branding strategies is expected to enhance customer engagement and product adoption. With sustained innovation and evolving consumer preferences, the pet waste bags market is poised for steady growth, with key players focusing on sustainability, convenience, and regulatory compliance to strengthen their market presence.

Key Takeaways

- The global pet waste bags market is projected to reach USD 62.6 billion by 2033, up from USD 44.8 billion in 2023. The market is anticipated to grow at a CAGR of 3.40% during the forecast period (2024-2033).

- Asia-Pacific holds the largest market share of 40%, making it the dominant regional market for pet waste bags.

- S Size pet waste bags account for 25% of the total market share, making it the most preferred size segment.

- Dogs represent the largest application segment, commanding 42% of the market share.

Pet Waste Bags Statistics

Dog Waste Statistics

- Pet dogs in the U.S. produce 21.2 billion pounds of waste annually.

- Each dog excretes between 0.5 and 0.75 pounds of waste per day.

- 10 million tons of dog waste is generated every year.

- 10–50% of airborne bacteria in urban areas comes from dog feces.

Dog Owners’ Waste Disposal Habits

- 60% of dog owners pick up after their pets.

- 40% of owners admit to leaving dog waste behind.

- Biodegradable dog waste bags sell over 19 million units annually.

Eco-Friendly Dog Waste Bags

- Bags made from PBAT and PLA are fully compostable.

- They leave no harmful residues and decompose completely.

- Decomposition starts in 3 months and completes in 5 months during storage.

- Bag thickness ranges from 1.6 to 1.8 mils, ensuring durability.

- Naturally antistatic and soft to the touch for easy handling.

Emerging Trends

- Sustainability Focus: There is a notable shift towards eco-friendly and biodegradable pet waste bags, driven by increasing environmental awareness among consumers.

- Customization and Personalization: Manufacturers are offering a variety of bag sizes, colors, and packaging designs to cater to diverse consumer preferences.

- E-commerce Expansion: The market has seen significant growth in online sales, providing consumers with convenience and a wider selection of products.

- Innovative Features: Advancements include the integration of antimicrobial properties and smart dispensers with sensors to enhance user experience.

- Regulatory Compliance: Governments are implementing stricter regulations on pet waste disposal, influencing market dynamics and product offerings.

Top Use Cases

- Urban Pet Waste Management: Essential for maintaining cleanliness in cities, especially in public parks and sidewalks.

- Residential Use: Pet owners utilize these bags for convenient and hygienic waste disposal at home.

- Pet Service Providers: Facilities such as kennels and pet daycares use waste bags to manage pet waste efficiently.

- Veterinary Clinics: Clinics employ pet waste bags to ensure sanitary conditions during medical examinations and procedures.

- Travel and Outdoor Activities: Pet owners rely on portable waste bags during walks, hikes, or travels to maintain environmental cleanliness.

Major Challenges

- Environmental Impact: The use of non-biodegradable materials contributes to plastic pollution, raising ecological concerns.

- Lack of Standardization: The absence of uniform regulations for product quality and labeling leads to inconsistencies and consumer confusion.

- Consumer Awareness: Educating pet owners about the importance of proper waste disposal and the benefits of eco-friendly products remains a challenge.

- Cost Factors: Biodegradable and compostable bags often come at a higher price point, which may deter cost-conscious consumers.

- Supply Chain Issues: Fluctuations in raw material availability and costs can disrupt production and pricing strategies.

Top Opportunities

- Development of Affordable Eco-Friendly Bags: Innovating cost-effective biodegradable materials can attract a broader consumer base.

- Expansion into Emerging Markets: Growing pet ownership in developing regions presents new market entry possibilities.

- Subscription Services: Offering regular delivery of pet waste bags can enhance customer convenience and brand loyalty.

- Educational Campaigns: Raising awareness about environmental impacts and proper disposal methods can drive demand for sustainable products.

- Technological Integration: Incorporating features like odor control and easy-tie handles can improve product functionality and appeal.

Key Player Analysis

The pet waste bags market is driven by key players that focus on innovation, sustainability, and convenience. Manna Pro Products LLC is a well-established company offering a wide range of pet waste management solutions with a strong market presence. Crown Poly Inc. specializes in high-quality plastic pet waste bags, known for their durability and ease of use.

BioBag International AS is a leader in biodegradable and compostable waste bags, catering to the increasing demand for eco-friendly solutions. HOUNDSCOOP LLC provides user-friendly pet waste disposal products, including dispensers and durable waste bags, ensuring customer satisfaction.

Scot-Petshop Ltd, based in the UK, emphasizes sustainability by offering biodegradable pet waste bags, aligning with the growing trend of environmentally responsible pet ownership. These companies continue to shape the market through product innovation and a commitment to sustainability.

Top Market Key Players

- Manna Pro Products LLC

- Crown Poly Inc.

- BioBag International AS

- HOUNDSCOOP LLC

- Scot-Petshop Ltd

- The Sustainable People GmbH

- Arlington Brands LLC

- Dog Waste Depot.

- Pogi’s Pet Supplies

- Doggy Do Good

Regional Analysis

Asia-Pacific Leads the Pet Waste Bags Market with the Largest Market Share of 40% in 2024

The Asia-Pacific region dominates the global pet waste bags market, accounting for 40% of the total market share in 2024, with a valuation of approximately USD 17.9 billion. The region’s leadership is driven by increasing pet adoption rates, rising urbanization, and growing awareness of pet hygiene and waste management solutions. Countries such as China, Japan, and India are experiencing a surge in pet ownership, leading to higher demand for environmentally friendly and biodegradable waste disposal solutions.

Additionally, stringent environmental regulations and government initiatives promoting sustainable waste management practices further support market expansion. The presence of key manufacturers and the rapid growth of e-commerce platforms have also contributed to the widespread availability and adoption of pet waste bags in the region. With these factors, Asia-Pacific continues to be the primary growth engine of the global pet waste bags market.

Recent Developments

- In 2024, General Mills, Inc. (NYSE: GIS) announced the completion of its acquisition of Whitebridge Pet Brands’ North American premium pet food and treat division from NXMH. The deal, valued at $1.45 billion, adds the Tiki Pets and Cloud Star brands to its portfolio, strengthening its position in the premium pet nutrition market.

- In 2024, Novolex® and Pactiv Evergreen Inc. (NASDAQ: PTVE) revealed a definitive merger agreement worth $6.7 billion. The transaction is set to form a major player in the food, beverage, and specialty packaging industry, expanding capabilities and market reach.

- In 16 January 2024 – United Petfood, a global pet food manufacturer, confirmed the signing of a share purchase agreement for the acquisition of Vital Petfood Group in Ølgod, Denmark. This move marks United Petfood’s entry into the Nordic market, aligning with its long-term growth strategy.

- In 2024, Swedencare AB’s subsidiary Pet MD Brands, Inc. announced the acquisition of Riley’s, a provider of organic and premium dog treats, for 78.4 million SEK ($7.5 million USD). The deal aims to enhance Swedencare’s presence in the U.S. pet treat segment.

- In 21 December 2023, United Petfood, a leading manufacturer of dog and cat food, announced the acquisition of De Haan Petfood, a Dutch company known for its high-quality canned wet pet food. With over 60 years of experience, De Haan Petfood strengthens United Petfood’s production expertise and global reach.

Conclusion

The global pet waste bags market is poised for steady growth, driven by increasing pet ownership, heightened environmental awareness, and stringent regulations on pet waste disposal. The Asia-Pacific region leads the market, accounting for 40% of the share, with Europe and North America also contributing significantly. Key players are focusing on sustainable and innovative solutions, such as biodegradable bags and smart dispensers, to meet evolving consumer preferences and regulatory requirements. The market’s expansion is further supported by the convenience of e-commerce platforms, offering a diverse range of products to a growing customer base.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)