Table of Contents

Introduction

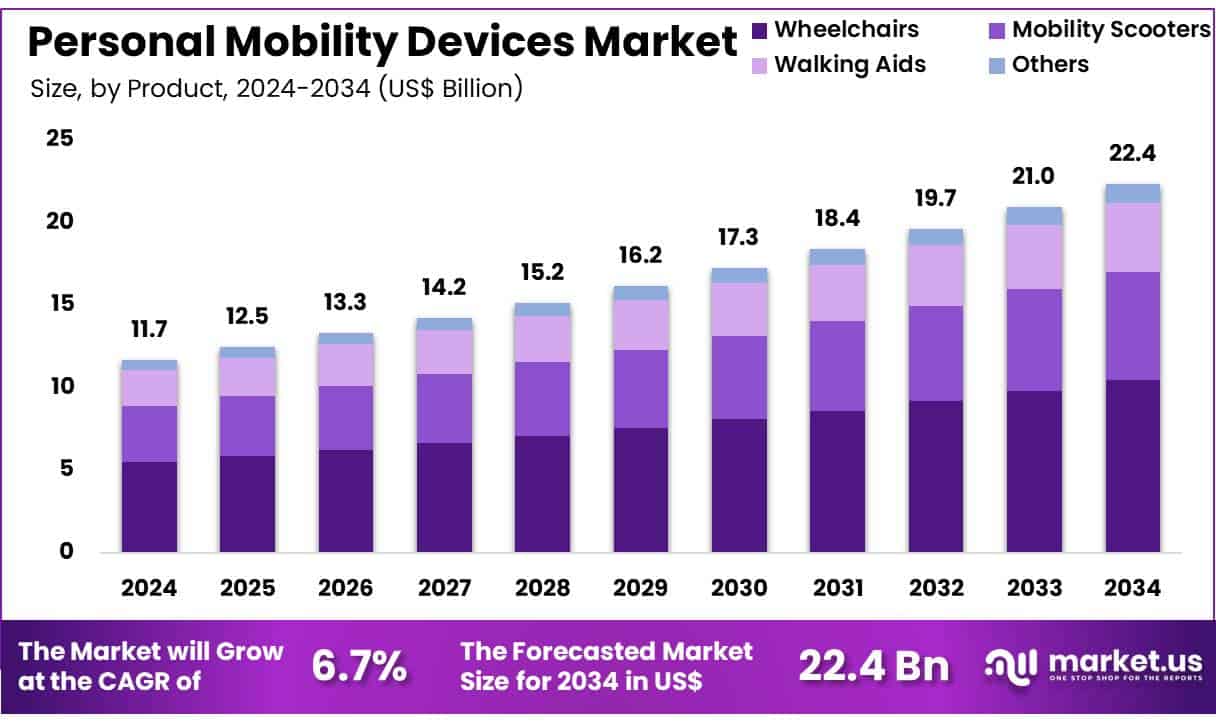

New York, NY – March 18 , 2025 – The Global Personal Mobility Devices Market is anticipated to expand from USD 11.7 billion in 2024 to approximately USD 22.4 billion by 2034, demonstrating a compound annual growth rate (CAGR) of 6.7% during the forecast period from 2025 to 2034. In 2023, North America was the leading market, capturing a 35.7% share with revenues of USD 1.6 billion.

Personal Mobility Devices encompass a range of products designed to assist individuals with mobility impairments, enhancing their ability to navigate and perform daily activities independently. These devices include wheelchairs, scooters, walking aids, and more, tailored to various needs and disabilities. The Personal Mobility Devices Market, therefore, refers to the commercial landscape involved in the production, distribution, and sale of these aids, a sector driven by demographics, technological advancements, and regulatory environments.

Growth in this market can be attributed to increasing geriatric populations globally, heightened awareness and acceptance of mobility aids, and advancements in product technology that offer enhanced comfort and functionality. Additionally, rising incidences of conditions that impair mobility, such as arthritis, osteoporosis, and neurological disorders, significantly contribute to the escalating demand. There is a pronounced opportunity within this sector for innovation, particularly in the development of smarter, connected devices that integrate seamlessly into the lives of users.

Companies that invest in lightweight materials, compact designs, and digital features such as GPS tracking and health monitoring systems are positioned to capture a significant share of the market. This market is expected to continue its growth trajectory, fueled by an aging population, increased healthcare spending, and a growing preference for personalized mobility solutions that promote independence and quality of life.

Key Takeaways

- The Personal Mobility Devices Market is projected to increase from approximately USD 11.7 billion in 2024 to around USD 22.4 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.7% during the forecast period from 2025 to 2034.

- The market segments include wheelchairs, mobility scooters, walking aids, and others. Wheelchairs dominated the product segment, capturing a substantial 46.8% market share in 2023.

- The division between end-users shows a predominance of personal users, who accounted for 58.4% of the market, compared to institutional users.

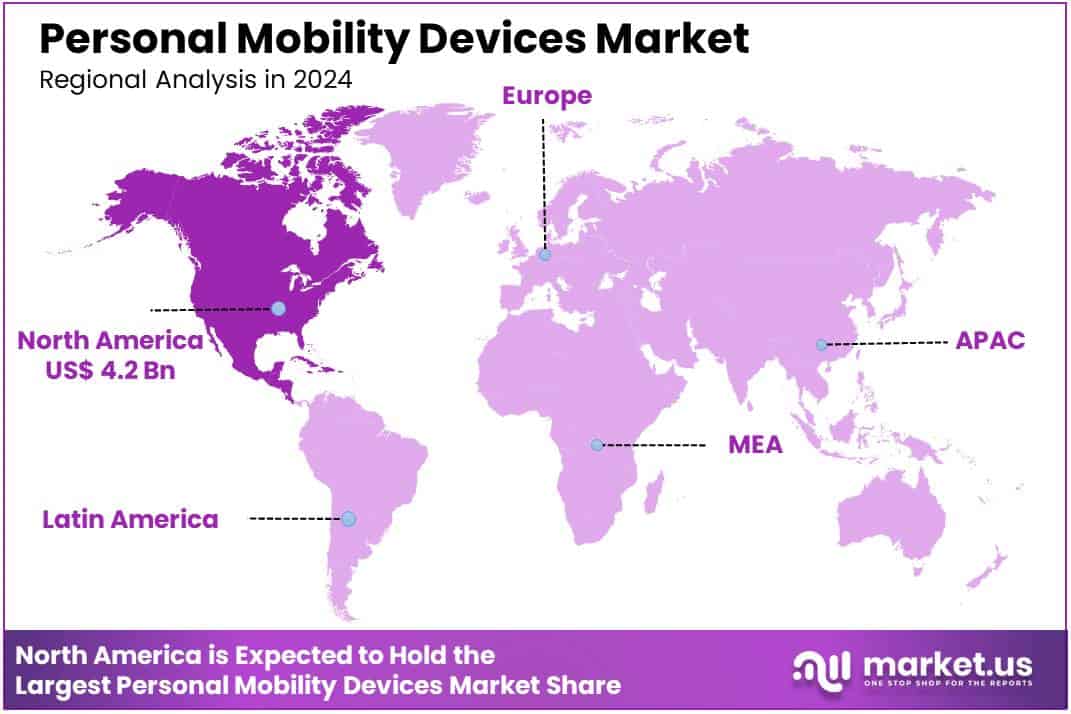

- North America emerged as a leading region in the personal mobility devices market, holding a commanding 35.7% share in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | US$ 11.7 billion |

| Forecast Revenue (2034) | US$ 22.4 billion |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Product (Wheelchairs, Mobility Scooters, Walking Aids, and Others), By End-user (Personal Users and Institutional Users) |

| Competitive Landscape | Rollz International, Performance Health, NOVA Medical Products, Medline Industries, Inc, Invacare Corporation, Falcon Mobility, Drive DeVilbiss Healthcare, and Briggs Healthcare. |

Emerging Trends

- Subscription-Based Accessibility: There’s an emerging trend towards subscription-based models for accessing premium mobility devices. This approach allows users to enjoy high-end products without a significant upfront financial commitment, reshaping consumer behavior and market dynamics.

- Technological Integration: Advances in technology are profoundly impacting wheelchair design, with innovations like lightweight materials, enhanced maneuverability, and increased comfort features. Such developments are making personal mobility devices more appealing and functional.

- Micromobility Solutions: The popularity of micromobility solutions like e-scooters and e-bikes is growing, particularly in urban settings. These devices are valued for their convenience, affordability, and reduced environmental impact.

- AI and IoT Enhancements: Artificial intelligence and the Internet of Things are increasingly integrated into mobility devices, offering features like GPS tracking and health monitoring, which enhance user safety and connectivity.

- Customizable and Adaptable Designs: There is a push towards devices that can be customized to meet individual needs, further driven by collaborations with tech companies. This trend is making mobility aids more adaptable and user-friendly.

Top Use Cases

- Home Healthcare: Enhanced home healthcare services are a significant use case due to the convenience and comfort provided by modern mobility devices in home settings.

- Elderly Mobility Support: As the global population ages, mobility devices are crucial for assisting elderly individuals, particularly in maintaining independence and enhancing the quality of life.

- Post-operative Care: Mobility aids are extensively used in post-operative care to assist patients during their recovery period, ensuring mobility while promoting healing.

- Disability Support: Supporting individuals with permanent or temporary disabilities remains a primary use of personal mobility devices, offering essential aid in daily activities.

- Obesity and Other Health Conditions: Devices like wheelchairs and scooters are increasingly used to assist individuals affected by obesity or other conditions that impair mobility.

Major Challenges

- High Costs: The advanced features and technologies in modern mobility devices often come with high costs, which can be prohibitive for many potential users.

- Market Penetration: Expanding market reach in less developed regions remains challenging due to affordability issues and lack of awareness.

- Regulatory Hurdles: Navigating the regulatory landscape for approval and reimbursement of mobility devices can be complex and time-consuming.

- Supply Chain Issues: Global supply chain disruptions can affect the manufacturing and distribution of mobility devices, impacting availability and cost.

- Technological Integration Challenges: While technological advances offer significant benefits, they also present challenges in terms of maintenance, user training, and initial adoption barriers.

Top Opportunities

- Technological Advances: Continuing to innovate with new materials and digital technologies can create more advanced, user-friendly devices.

- Expansion in Emerging Markets: Increasing awareness and improving healthcare infrastructure in emerging markets present significant growth opportunities.

- Government Support and Funding: Leveraging government initiatives that provide subsidies or support for mobility aids can open up new markets and increase accessibility.

- Customization and Personalization: Offering customizable options that cater to the specific needs of individuals can differentiate products in a competitive market.

- Integration of Health Monitoring Features: Incorporating health and activity monitoring features can add value to personal mobility devices, appealing to a broader demographic.

Key Player Analysis

In the global personal mobility devices market, a diverse array of key players is poised to influence market dynamics in 2024. Rollz International continues to distinguish itself with innovative rollators that enhance user independence. Performance Health maintains a strong presence through its extensive range of rehabilitation and recovery products. NOVA Medical Products is set to capitalize on its reputation for high-quality mobility aids, strengthening its market share.

Medline Industries, Inc. leverages its vast distribution network to ensure widespread availability of its mobility solutions. Invacare Corporation remains a pivotal figure due to its comprehensive range of products that cater to varying mobility needs. Falcon Mobility is making significant inroads with its focus on lightweight and versatile mobility devices. Drive DeVilbiss Healthcare is expected to expand its footprint by introducing technologically advanced mobility devices. Lastly, Briggs Healthcare is set to solidify its position by providing reliable and durable mobility aids, supporting the elderly and physically challenged populations effectively. Collectively, these companies are crucial in shaping the competitive landscape and driving innovation in the personal mobility devices market.

Top Key Players

- Rollz International

- Performance Health

- NOVA Medical Products

- Medline Industries, Inc

- Invacare Corporation

- Falcon Mobility

- Drive DeVilbiss Healthcare

- Briggs Healthcare

Regional Analysis

North America Leads the Personal Mobility Devices Market with the Largest Market Share of 35.7%

The personal mobility devices market in North America is distinguished by a robust growth trajectory, with its market valuation projected to reach USD 4.2 billion. This region holds the dominating share, accounting for 35.7% of the global market in 2024. Such preeminence in the market can be attributed to advanced healthcare infrastructure, heightened awareness regarding mobility aids, and significant investments in healthcare technology. The North American market benefits from a substantial aging population that drives the demand for personal mobility devices, alongside favorable government policies supporting healthcare accessibility and reimbursement frameworks. Furthermore, the presence of key industry players who continuously innovate and expand their product portfolios contributes to the sustained growth and expansion of this market segment. As such, North America not only leads in market size but also sets trends for innovations in the personal mobility devices sector.

Recent Developments

- In 2023, Sunrise Medical successfully completed the acquisition of Ride Designs. As a leading entity in the assistive mobility solutions sector, Sunrise Medical enhanced its portfolio with Ride Designs’ expertise in high-quality custom seating systems. This move not only broadens Sunrise Medical’s capabilities in clinical support and service but also integrates seamlessly with its existing range of mobility products, both manual and powered.

- In 2023, Permobil expanded its reach by acquiring PDG Mobility, a Canadian firm known for its pioneering designs in manual tilt wheelchairs. This acquisition enables Permobil to offer improved functionality and skin protection for users, thereby strengthening its position in the manual wheelchair market.

- On June 24, 2024, Drive DeVilbiss Healthcare announced its acquisition of Mobility Designed, Inc.’s comprehensive product range. This strategic decision is set to enhance DDH’s innovative medical equipment offerings by incorporating cutting-edge industrial design capabilities into its operations.

- On June 5, 2024, saw Platinum Equity signing an agreement to acquire Sunrise Medical from Nordic Capital. This acquisition, set to finalize in the third quarter of 2024 pending regulatory approval, promises to bolster Platinum Equity’s presence in the global market for assistive mobility solutions. Sunrise Medical is renowned for its wide array of products including wheelchairs, mobility scooters, and therapeutic devices, serving a vast network of dealers across more than 130 countries.

Conclusion

The personal mobility devices market is poised for significant expansion, driven by a confluence of demographic shifts, technological advancements, and evolving consumer preferences. As populations age and awareness of mobility solutions increases, the demand for devices that enhance independence and quality of life continues to rise. Innovations in device functionality and integration of digital technologies are further enriching the user experience, making personal mobility aids not only more accessible but also more integral to managing health and mobility challenges. The sector’s growth is also supported by a robust regulatory and funding framework that increasingly favors healthcare access and innovation. Moving forward, the industry stands to gain from continued technological advancements and strategic expansions into emerging markets, ensuring that it remains at the forefront of healthcare solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)