Table of Contents

Introduction

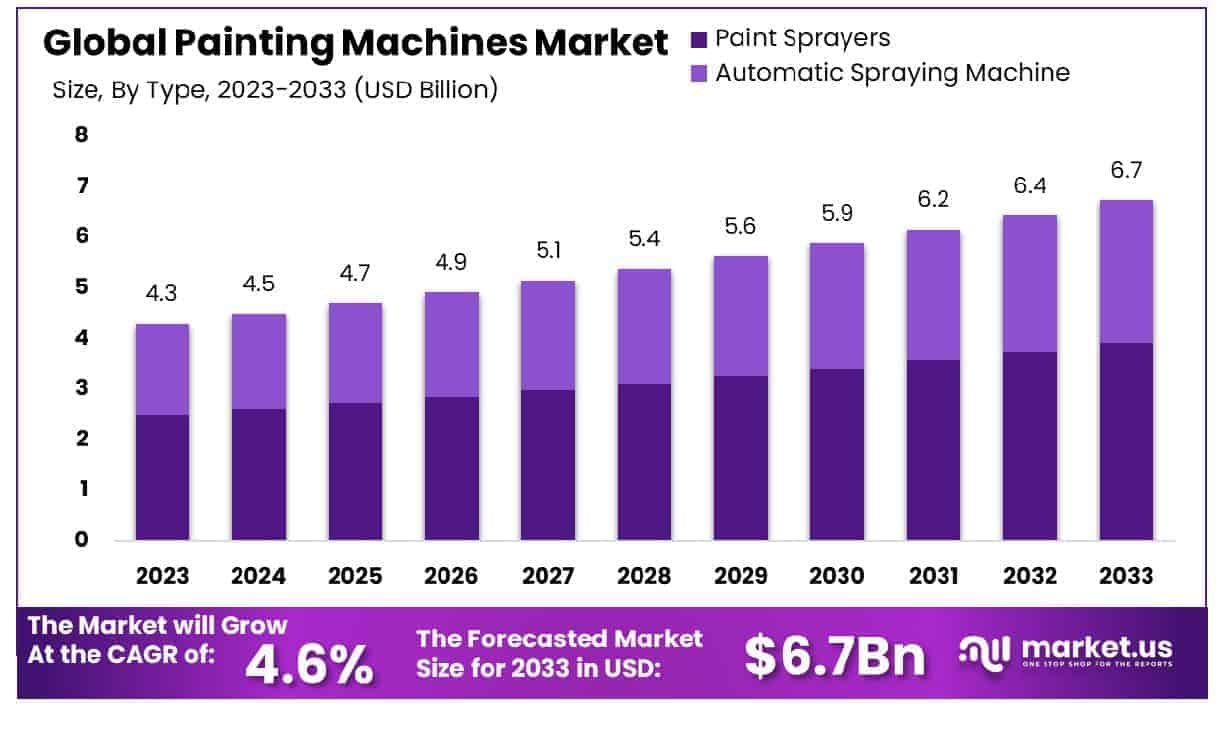

The Global Painting Machines Market is projected to reach approximately USD 6.7 billion by 2033, up from USD 4.3 billion in 2023, reflecting a compound annual growth rate (CAGR) of 4.60% over the forecast period from 2024 to 2033.

The painting machines market encompasses a diverse range of equipment designed for the application of coatings, paints, and finishes across various surfaces. These machines are integral to industries such as automotive, construction, packaging, and consumer goods manufacturing, facilitating the efficient and consistent application of paint, coatings, and protective finishes. The market is driven by the growing demand for high-quality, cost-effective, and automated painting solutions, as well as advancements in machine technology.

A key factor contributing to market growth is the increased adoption of automated and robotic systems, which enhance precision, reduce labor costs, and improve operational efficiency. Moreover, rising industrialization and urbanization are driving demand for painting machines, particularly in sectors like automotive, where high volumes of production require fast and uniform coating processes. The shift towards environmentally friendly solutions is also a prominent growth factor, as industries adopt low-VOC (volatile organic compounds) and water-based paints, which are compatible with modern painting technologies.

Additionally, the rise of e-commerce and the packaging sector has led to increased demand for high-speed painting machines used in packaging applications. Opportunities in the market lie in the development of smarter, more energy-efficient machines equipped with IoT connectivity, allowing for real-time monitoring and predictive maintenance. As industries continue to seek ways to reduce waste, lower operational costs, and improve production speeds, the painting machines market is poised for steady expansion, driven by ongoing technological innovations and the increasing need for precision in industrial coating processes.

Key Takeaways

- The global painting machines market is projected to grow from USD 4.3 billion in 2023 to USD 6.7 billion by 2033, with a CAGR of 4.60% from 2024 to 2033.

- North America is expected to witness significant growth, with a 32% increase in market share, driven by rising demand for automated painting solutions.

- Paint sprayers are increasingly favored in the automotive sector due to their precision and efficiency in application.

- The automotive industry dominates, accounting for 35% of the total paint sprayer usage, indicating the growing adoption of automated painting in vehicle production.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 4.3 Billion |

| Forecast Revenue (2033) | USD 6.7 Billion |

| CAGR (2024-2033) | 4.60% |

| Segments Covered | By Type(Paint Sprayers, Automatic Spraying Machine), By End User(Automotive, Industrial, Construction, Manufacturing, Other End-Users) |

| Competitive Landscape | J. Wagner GmbH, Graco Inc., Exel Industries Société Anonyme, Cefla s.c., ABB Ltd., Dürr Group, Eisenmann LacTec GmbH, RIGO S.R.L., SPMA |

Emerging Trends

- Automation and Smart Technology Integration: Increasingly, painting machines are being integrated with automation and smart technology. This trend is enhancing precision, reducing human error, and increasing production efficiency. As industries move toward more automated systems, the demand for high-tech painting machines is expected to rise.

- Robotic Painting Systems: Robotic painting systems are gaining traction due to their ability to offer consistent, high-quality finishes at faster speeds. They can handle complex shapes and hard-to-reach surfaces with greater accuracy, minimizing waste and improving product uniformity.

- Sustainability Focus: The market is shifting towards sustainable painting processes, with companies focusing on minimizing emissions and using eco-friendly paints. New technologies like electrostatic spray painting and powder coating are gaining popularity due to their reduced environmental impact.

- Customization and Versatility: Painting machines are becoming more versatile, offering customization options to cater to different industries and needs. This includes adjustments in speed, nozzle sizes, and spray patterns, providing more flexibility to manufacturers in various sectors, including automotive and furniture.

- Adoption of Artificial Intelligence (AI): Artificial intelligence is being incorporated into painting machines to optimize performance. AI-driven systems can predict maintenance schedules, detect defects in real-time, and ensure higher efficiency during production cycles.

Top Use Cases

- Automotive Industry: The automotive industry relies heavily on painting machines to achieve high-quality finishes for car bodies and parts. Advanced automated systems ensure precision in the application of paints, coatings, and finishes, leading to enhanced durability and aesthetics.

- Furniture Manufacturing: Painting machines are widely used in the furniture industry, especially for mass production. Automated spraying systems ensure uniform coating, improve efficiency, and reduce wastage of paint, thereby optimizing production costs.

- Metal Coatings: In metal processing, painting machines are used for applying protective coatings to prevent corrosion and wear. These machines are essential for industries like aerospace and construction, where metal components require durability and longevity.

- Appliance Manufacturing: Household appliance manufacturers rely on painting machines for consistent coating quality on refrigerators, washing machines, and other devices. These systems provide uniform paint layers, which are essential for the aesthetics and durability of products.

- Packaging and Consumer Goods: Painting machines are used in the packaging sector to enhance the appearance of products and packaging. Automated machines ensure fast and consistent application of paint on various packaging materials, including bottles, cans, and boxes.

Major Challenges

- High Initial Investment Costs: The cost of acquiring and installing advanced painting machines can be prohibitive, particularly for small and medium-sized enterprises (SMEs). This high capital expenditure can limit market penetration for new players.

- Complex Maintenance and Downtime: Painting machines require regular maintenance to ensure optimal performance. Complex machinery, especially automated systems, can lead to longer downtime in case of breakdowns, affecting production schedules and increasing operational costs.

- Skilled Labor Shortage:There is a growing demand for skilled workers who can operate, troubleshoot, and maintain advanced painting machines. The shortage of qualified personnel in the manufacturing industry can hinder the adoption of these technologies.

- Environmental Regulations: Strict environmental regulations, particularly regarding volatile organic compounds (VOCs) in paints, can pose challenges for manufacturers. Compliance with these regulations often requires significant investment in developing new coatings and adapting machines.

- Integration with Existing Systems: Integrating new painting machines into existing production lines can be complex, requiring adjustments in workflow, system compatibility, and employee training. This can lead to operational inefficiencies and increased transition costs.

Top Opportunities

- Expansion in Emerging Markets: As manufacturing industries expand in emerging economies, there is a growing opportunity for painting machines in regions like Asia-Pacific and Latin America. These markets present untapped potential for industrial growth and technological adoption.

- Technological Advancements: Continued innovation in machine technology, such as the integration of AI and IoT, presents significant opportunities. These advancements can further enhance the efficiency and performance of painting machines, driving market growth.

- Increase in Sustainable Manufacturing: The global shift towards sustainability presents an opportunity for painting machine manufacturers to develop eco-friendly solutions. Demand for non-toxic, water-based, and powder coatings is likely to increase as companies seek greener alternatives.

- Customized Solutions for Niche Markets: There is an opportunity to provide customized painting machines designed for specific sectors, such as electronics, medical devices, or custom automotive applications. Tailored solutions can cater to the unique needs of these industries, opening new revenue streams.

- Adoption of Robotics and AI: The integration of robotic technology and AI into painting systems can improve precision, reduce operational costs, and enhance product quality. This growing trend offers opportunities for manufacturers to tap into markets requiring high levels of automation and efficiency.

Key Player Analysis

In 2024, the global painting machines market is anticipated to be significantly influenced by key players such as J. Wagner GmbH, Graco Inc., and Exel Industries Société Anonyme, among others. J. Wagner GmbH is recognized for its advanced coating solutions, contributing extensively to the growth of the market through its innovation in airless and electrostatic spraying systems. Graco Inc. continues to dominate with its high-performance spraying and fluid handling technologies, catering to diverse industrial applications.

Exel Industries is noted for its robust portfolio of automated spray equipment, further strengthening its position in the European and North American markets. Cefla s.c. and ABB Ltd. leverage their expertise in automation and digitalization to enhance product precision, while Dürr Group and Eisenmann LacTec GmbH bring forth industry-leading painting lines and coating systems that cater to automotive and industrial sectors. Together, these companies are shaping the future of the market by driving technological advancements and meeting rising demands for efficiency and sustainability.

Top Market Key Players

- J. Wagner GmbH

- Graco Inc.

- Exel Industries Société Anonyme

- Cefla s.c.

- ABB Ltd.

- Dürr Group

- Eisenmann LacTec GmbH

- RIGO S.R.L.

- SPMA

Regional Analysis

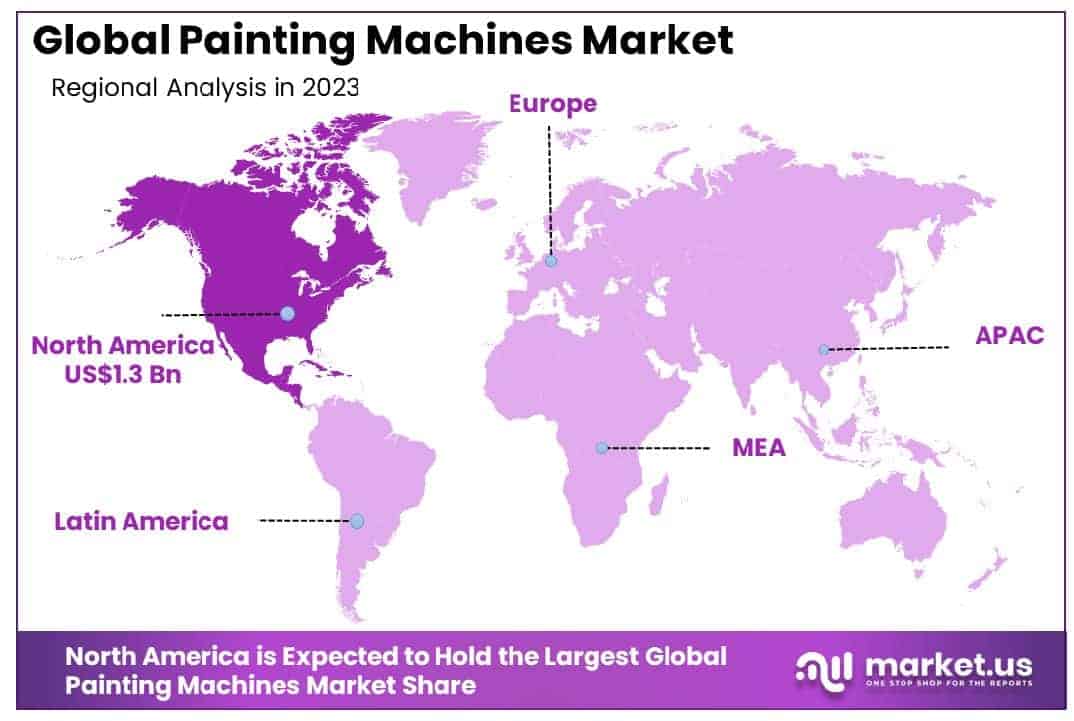

North America Painting Machines Market with Largest Market Share of 32% in 2024

The painting machines market in North America is poised to retain its dominance, accounting for approximately 32% of the global market share in 2024, valued at USD 1.3 billion. This significant market share can be attributed to the robust industrial base, especially in the automotive and manufacturing sectors, where painting machines are critical for high-precision applications and efficiency. The region benefits from advanced technological adoption, with increased automation in production lines driving demand for high-performance painting equipment.

Additionally, the presence of key industry players, along with ongoing investments in research and development, further strengthens North America’s leadership in this market. The North American market is expected to continue its growth trajectory, supported by the increasing demand for environmentally friendly and energy-efficient coating solutions. These factors combined position North America as the leading region in the global painting machines market.

Recent Developments

- In June 26, 2023 – Nordson Corporation (Nasdaq: NDSN) disclosed that it has finalized an agreement to acquire ARAG Group and its subsidiaries in a cash transaction valued at €960 million. ARAG, based in Rubiera, Italy, is a prominent player in the development and production of precision control systems and advanced fluid components for agricultural spraying. The company’s portfolio includes key product categories such as nozzles, pumps, filters, smart flow control components, and control systems, enhanced by proprietary software and data solutions. ARAG operates seven facilities worldwide and serves over 80 countries.

- In April 4, 2023 – Graco Inc. (NYSE: GGG), a leader in fluid handling equipment, launched the Ultra® QuickShot™. This innovative electric-powered airless spray gun is designed to provide painting contractors with faster, higher-quality results, setting a new industry standard.

- In June 12, 2024 – Apex, a spacecraft manufacturing firm located in Los Angeles, secured $95 million in Series B funding. The funding round was led by XYZ Venture Capital, alongside contributions from CRV, Upfront, 8VC, Toyota Ventures, and other strategic investors, marking a significant step in Apex’s growth.

- In 2023, PPG (NYSE: PPG), a global leader in coatings and specialty materials, announced its agreement to divest its architectural coatings business in the U.S. and Canada for $550 million to American Industrial Partners (AIP), a private equity firm focused on industrial investments.

Conclusion

The global painting machines market is on a steady growth trajectory, driven by the increasing demand for high-precision, automated, and sustainable coating solutions across various industries. Technological advancements, such as the integration of robotic systems, AI, and IoT, are enhancing machine performance, reducing costs, and improving operational efficiency. Key industries, including automotive, construction, and packaging, continue to drive the demand for advanced painting machines, while sustainability trends push for eco-friendly solutions. Despite challenges like high initial costs and skilled labor shortages, the market holds significant opportunities, particularly in emerging markets and through technological innovation. As manufacturers seek to meet growing demand and improve production processes, the painting machines market is well-positioned for sustained expansion in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)