Table of Contents

Introduction

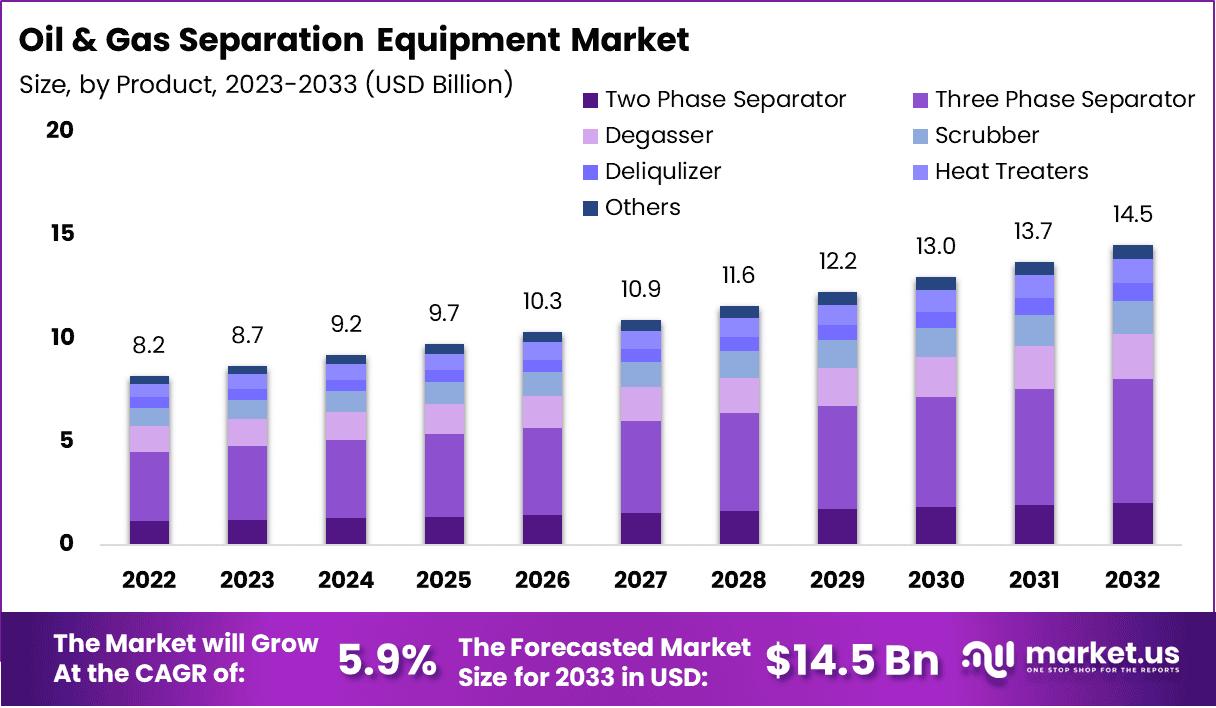

The Oil and Gas Separation Equipment Market is projected to reach approximately USD 14.5 billion by 2033, up from USD 8.2 billion in 2023, reflecting a CAGR of 3.80% over the forecast period 2024–2033.

The Oil and Gas Separation Equipment Market plays a critical role in upstream and midstream operations, facilitating the efficient separation of oil, gas, water, and solids from produced well fluids. Oil and gas separation equipment includes separators, filters, scrubbers, and demulsifiers, which ensure the removal of unwanted contaminants, improving product quality, operational efficiency, and compliance with environmental regulations.

The market for this equipment is driven by the increasing global energy demand, the expansion of offshore and onshore exploration activities, and stringent environmental regulations mandating effective hydrocarbon processing. Technological advancements, such as enhanced automation, compact separators, and AI-driven monitoring systems, are further propelling market growth by optimizing efficiency and reducing operational costs. The rise in unconventional oil and gas production, including shale gas and deepwater drilling, has intensified the demand for advanced separation technologies that can handle complex fluid compositions.

Additionally, the integration of digital solutions, such as IoT-enabled separators, is providing real-time performance monitoring, further enhancing equipment reliability and reducing downtime. Opportunities in the market lie in the growing adoption of modular separation systems, which offer flexibility and cost-effectiveness, especially for remote and offshore installations.

The Asia-Pacific region is expected to witness significant growth due to increasing energy consumption and investments in oil and gas infrastructure, while North America remains a key market owing to its extensive shale reserves. However, challenges such as fluctuating crude oil prices and high initial investment costs may impact market dynamics. Overall, the oil and gas separation equipment market is poised for steady expansion, driven by technological innovation and evolving industry demands.

Key Takeaways

- The oil and gas separation equipment market is projected to expand from USD 8.2 billion in 2023 to USD 14.5 billion by 2033, achieving a CAGR of 5.9%.

- North America leads the market with a 35.4% share, reflecting strong demand and a well-established energy infrastructure.

- Three-phase separators hold a dominant 41.3% market share, underscoring their essential role in efficiently separating oil, gas, and water in upstream operations.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 335.5 Million |

| Forecast Revenue (2032) | USD 487.20 Million |

| CAGR (2023-2032) | 3.80% |

| Segments Covered | By Product(Two Phase Separator, Three Phase Separator, Degasser, Scrubber, Deliqulizer, Heat Treaters, Others), By Vessel Type(Horizontal, Vertical, Spherical) |

| Competitive Landscape | Honeywell, Alpha Laval, ACS Manufacturing, Fenix Process Technologies Pvt. Ltd., Worthington, HAT International, Amacs, Doyle Dryers LLC, Valerus, BNF Engineering Pte Ltd., eProcess Technologies, Burgess-Manning, Inc., Godrej Process Equipment, CAT Technologies, ATLAS Oil & Gas Process Systems Inc. |

Emerging Trends

- Digital Transformation: The integration of digital technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), is enhancing operational efficiency. AI-powered maintenance can reduce equipment downtime by up to 30%, while IoT-enabled rigs provide real-time monitoring, optimizing resource allocation and safety.

- Advanced Separation Technologies: Innovations like membrane separation and electrostatic coalescers are improving efficiency and reducing operational costs in separation processes.

- Environmental Sustainability: There is a growing emphasis on developing efficient and environmentally friendly separation technologies, such as advanced filtration and membrane systems, to enhance the efficiency and sustainability of oil and gas processes.

- Enhanced Oil Recovery (EOR) Techniques: The adoption of EOR methods is increasing, leading to a higher demand for separation equipment capable of handling complex fluid mixtures.

- Deepwater Exploration: Advancements in technology have enabled production from ultra-high-pressure oil fields, such as Chevron’s Anchor project in the Gulf of Mexico, which can withstand subsea pressures up to 20,000 psi.

Top Use Cases

- Onshore and Offshore Production: Separation equipment is essential in both onshore and offshore oil and gas production facilities to separate oil, gas, and water phases efficiently.

- Refineries: Refineries utilize separation equipment to process crude oil into various petroleum products, ensuring the removal of impurities and enhancing product quality.

- Enhanced Oil Recovery (EOR) Projects: In EOR projects, separation equipment manages the additional water and gases injected into reservoirs, optimizing oil recovery processes.

- Natural Gas Processing: Separators are used to remove liquid condensates from the gas stream in natural gas processing plants, preventing pipeline corrosion and ensuring smooth gas transport.

- Offshore Platforms: Due to space constraints, offshore platforms rely on compact separators to optimize the use of limited deck space while ensuring efficient separation processes.

Major Challenges

- Fluctuating Oil Prices: Volatility in oil prices can create market uncertainty, prompting oil and gas companies to defer or abandon investment decisions, affecting the demand for separation equipment.

- Regulatory Compliance: Navigating complex and evolving environmental regulations requires continuous updates and modifications to separation equipment, increasing operational challenges.

- Technological Integration: Integrating advanced technologies such as AI and IoT into existing separation systems can be costly and complex, requiring specialized expertise.

- Infrastructure Limitations: The shift towards electrification in drilling operations faces challenges related to grid infrastructure and costs, hindering the adoption of electric-powered separation equipment.

- Environmental Concerns: Addressing environmental impacts, such as emissions and wastewater management, necessitates the development of more efficient and sustainable separation technologies.

Top Opportunities

- Redevelopment of Mature Oil Wells: As mature fields account for nearly 60% of daily global oil production, redeveloping these wells presents opportunities for separation equipment to handle increased water and gas production.

- Technological Advancements: Developing compact and high-efficiency separators can reduce operational costs and improve efficiency, meeting the industry’s evolving needs.

- Environmental Regulations: Stricter environmental regulations drive the adoption of separators that minimize gas flaring and reduce hydrocarbon losses, creating opportunities for innovative equipment solutions.

- Unconventional Oil and Gas Exploration: The rise of shale gas and tight oil production increases the need for advanced separation technologies capable of handling emulsified and contaminated fluids.

- Digital Oilfield Technologies: The growing adoption of digital oilfield technologies accelerates the integration of smart separation systems, enhancing operational efficiency and monitoring capabilities.

Key Player Analysis

In 2024, the global oil and gas separation equipment market remains competitive, driven by technological advancements, efficiency improvements, and regulatory compliance. Honeywell continues to lead with its advanced automation and digital monitoring solutions, enhancing separation efficiency and reducing operational costs. Alfa Laval, known for its innovative heat transfer and separation technologies, remains a key player in offshore and onshore applications.

ACS Manufacturing and Worthington strengthen their market position through customized equipment offerings tailored for various oil and gas operations. Fenix Process Technologies Pvt. Ltd. and HAT International leverage their expertise in mass transfer solutions, improving separation performance in complex processing environments. Companies such as Amacs, Doyle Dryers LLC, and Valerus focus on optimizing dehydration and gas-liquid separation processes.

Meanwhile, BNF Engineering Pte Ltd. and eProcess Technologies continue to expand their footprint through advanced cyclone-based separation technologies. Burgess-Manning, Inc., Godrej Process Equipment, CAT Technologies, and ATLAS Oil & Gas Process Systems Inc. contribute to market growth with specialized solutions for gas-liquid separation and filtration, catering to both upstream and downstream sectors.

Кеу Маrkеt Рlауеrѕ

- Honeywell

- Alpha Laval

- ACS Manufacturing

- Fenix Process Technologies Pvt. Ltd.

- Worthington

- HAT International

- Amacs

- Doyle Dryers LLC

- Valerus

- BNF Engineering Pte Ltd.

- eProcess Technologies

- Burgess-Manning, Inc.

- Godrej Process Equipment

- CAT Technologies

- ATLAS Oil & Gas Process Systems Inc.

Regional Analysis

North America Leads the Oil and Gas Separation Equipment Market with Largest Market Share of 45%

North America dominates the global oil and gas separation equipment market, accounting for 45% of the total market share in 2024. The region’s market size is valued at approximately USD 2.9 billion, driven by the strong presence of major oil and gas exploration and production activities, particularly in the United States and Canada.

The rising demand for advanced separation technologies, stringent environmental regulations, and increasing investments in unconventional oil and gas extraction, such as shale oil and tight gas, further support market expansion. The U.S. leads the region, benefiting from ongoing offshore and onshore drilling projects, enhanced oil recovery techniques, and a well-established midstream and downstream infrastructure. Additionally, the adoption of high-efficiency separators and automation in processing units is fostering market growth, positioning North America as the key contributor to the global oil and gas separation equipment industry.

Recent Developments

- In 2023, Chevron secured a $53 billion all-stock acquisition of Hess, expanding its presence in offshore Guyana and the Bakken Shale. The deal strengthens Chevron’s asset base with significant new reserves.

- In April 2024, SLB finalized an agreement to acquire ChampionX Corporation (NASDAQ: CHX) through an all-stock transaction. The acquisition, approved unanimously by ChampionX’s board, enhances SLB’s capabilities in energy technology and services.

- In 2025, Phillips 66 announced a $2.2 billion cash acquisition of EPIC Y-Grade GP, LLC and EPIC Y-Grade, LP. The deal includes extensive natural gas liquids pipelines, fractionation facilities, and distribution networks, expanding Phillips 66’s midstream operations.

- In 2024, Harbour Energy completed the acquisition of Wintershall Dea’s upstream asset portfolio, effective June 30, 2023. This transaction significantly increases Harbour Energy’s production capacity and operational reach.

- In October 2024, SM Energy Company closed its acquisition of an 80% stake in XCL Resources’ Uinta Basin oil and gas assets. The transaction includes additional adjacent properties, strengthening SM Energy’s regional footprint.

- In 2024, ConocoPhillips completed the acquisition of Marathon Oil Corporation (NYSE: MRO). The deal enhances ConocoPhillips’ U.S. unconventional portfolio with high-quality, low-cost supply assets and is expected to generate over $1 billion in annual synergies.

- In 2024, Equinor and Shell agreed to merge their UK offshore oil and gas assets, forming Equinor UK Ltd. The new company will become the UK North Sea’s largest independent producer, leveraging both firms’ expertise to drive efficiency and production growth.

Conclusion

The oil and gas separation equipment market is poised for steady growth, driven by increasing global energy demands and ongoing exploration and production activities. Technological advancements, such as membrane separation and electrostatic coalescers, are enhancing operational efficiency and reducing costs. The integration of digital technologies like AI and IoT is further optimizing performance and enabling predictive maintenance. However, challenges such as high initial investment costs and regulatory complexities persist. Regionally, North America maintains a significant market share due to substantial oil and gas production and exploration projects, while the Asia-Pacific region is experiencing rapid growth owing to industrialization and urbanization.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)