Table of Contents

Overview

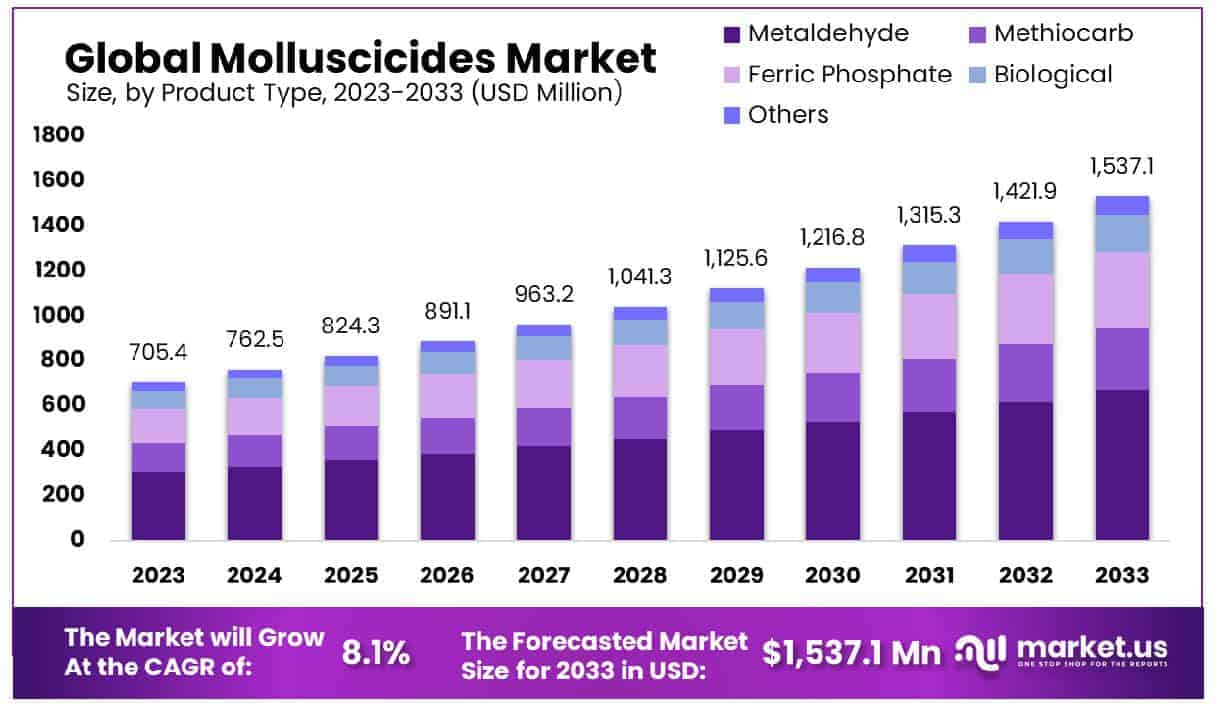

New York, NY – January 9, 2025 –The global molluscicides market is projected to grow significantly, with expectations to increase from USD 705.4 million in 2023 to USD 1,537.1 million by 2033, demonstrating a robust compound annual growth rate (CAGR) of 8.1%.

This growth is driven by the increasing need to control invasive mollusk populations like zebra and quagga mussels, which pose serious threats to aquatic ecosystems and industrial operations through biofouling.

However, the market faces several challenges. The control of invasive species like zebra mussels has proven costly and complex, requiring sophisticated detection and eradication strategies. For example, early detection technologies are crucial, yet they often come with high implementation costs.

Environmental concerns also pose significant challenges, as the use of chemical molluscicides can have detrimental effects on non-target aquatic species. The need for environmentally friendly and species-specific control methods is pressing, highlighted by research into alternatives like low concentrations of carbon dioxide and biological control agents like Zequanox®.

Recent developments in the market include advancements in chemical and biological control methods tailored to specific environmental conditions and mussel species. For instance, the use of carbon dioxide to prevent mussel settlement and the development of microparticle methods that target delivery to dreissenid mussels are gaining traction.

These methods aim to reduce the impact on non-target species and increase the effectiveness of control measures, particularly in open-water applications.

Key Takeaways

- The Global Molluscicides Market size is expected to be worth around USD 1,537.1 Million by 2033, From USD 705.4 Million by 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

- Asia Pacific holds 42.5% of the molluscicides market, valued at USD 300 million.

- Metaldehyde accounts for 43.6% of product type in pesticide formulations, primarily targeting gastropod pests.

- Pellets/granules constitute 66.4% of pesticide forms, offering convenient application methods for farmers.

- Agricultural applications dominate, comprising 82.6% of pesticide usage, emphasizing the sector’s reliance on pest control.

- Growth Opportunities: The global molluscicides market is set to grow through the development of eco-friendly solutions and the expanding aquaculture industry, driven by environmental concerns and increased seafood demand.

Key Market Segments

In 2023, Metaldehyde dominated the Molluscicides Market, holding over 43.6% of the share due to its affordability and effectiveness. Methiocarb followed with significant market presence, valued for its prolonged efficacy.

Ferric Phosphate, an eco-friendly alternative, gained popularity for its minimal environmental impact. The Biological segment also grew, driven by consumer preference for sustainable, natural pest control solutions, offering an environmentally friendly approach to managing mollusk infestations.

In 2023, the Molluscicides Market saw Pellets/Granules leading the by-form segment with over 66.4% market share, appreciated for their ease of use and effective soil delivery. Meanwhile, Liquid molluscicides, preferred for rapid action and precise dosing, also held a significant market presence.

Pellets/Granules’ versatility in application across various agricultural scenarios has solidified their dominance, although liquids remain crucial for quick uptake needs in integrated pest management.

In 2023, the agriculture sector dominated the Molluscicides Market, holding over 82.6% of the market share, crucial for protecting diverse crop types and ensuring high agricultural productivity. Fruits and vegetables also represented a significant segment, with molluscicides essential for maintaining their quality and yield.

Cereals and grains, as well as oilseeds and pulses, relied heavily on molluscicides for protection against pests, underlining their importance in global food security. The non-agricultural use, though smaller, highlighted the versatility of molluscicides in managing pests in residential and commercial settings.

Regional Analysis

The Asia Pacific region dominates the global molluscicides market with a 42.5% share, driven by agricultural growth in China and India and the need for effective pest control. North America and Europe follow, leveraging advanced farming technologies and sustainable practices.

The Middle East & Africa and Latin America show moderate growth, focusing on agricultural modernization and integrated pest management to combat crop pest challenges.

Top Use Cases of Molluscicides Market

Agricultural Crop Protection: Molluscicides are extensively used in agriculture to protect crops from snail and slug damage. For example, molluscicides like metaldehyde and iron phosphate are applied to fields to prevent these pests from consuming plant leaves and stems, which can significantly reduce crop yields.

Aquatic Invasive Species Control: Products like Zequanox® and Earthtec QZ® are utilized to manage zebra and quagga mussels in freshwater systems. These molluscicides help prevent the extensive damage these invasive species can cause to water infrastructure and native aquatic ecosystems. The application of these substances is carefully managed to avoid harming non-target species and to adapt to different environmental conditions such as water temperature.

Public Health Programs: In regions affected by schistosomiasis, molluscicides are used to control populations of freshwater snails that host the disease-causing parasites. By reducing snail numbers, the transmission cycle of schistosomiasis to humans can be interrupted, thereby aiding in disease control efforts.

Golf Course and Turf Management: Molluscicides are used in turf management to protect golf courses, gardens, and other landscaped areas from the destructive activities of slugs and snails. These products are applied seasonally or as needed to maintain the aesthetic and health of the grass and plants, which are critical for the business and recreational aspects of such venues.

Research and Environmental Studies: Molluscicides are used in ecological research to understand the dynamics of mollusk populations and their impact on ecosystems. For instance, carbon dioxide has been studied for its efficacy in controlling zebra mussels at cooler water temperatures, potentially offering a more environmentally friendly control method.

Recent Developments

In 2023, BASF SE continued to enhance its molluscicides offerings, focusing on sustainable agriculture solutions within its Agricultural Solutions segment. Throughout the year, BASF worked on developing products that are safer for the environment and more effective against pests.

In 2023, Bayer AG continued to develop its agricultural solutions, focusing on molluscicides as part of its broader crop protection efforts. Bayer provided advanced solutions to farmers, enabling them to cultivate and safeguard their crops more efficiently by using fewer resources such as land, water, and energy.

In 2023, Syngenta AG, a key player in the agricultural sector, experienced a decrease in its financial performance compared to the previous year. The company reported a net income of $1,086 million, a drop from $1,909 million in 2022. The overall sales fell by 4%, adjusted for constant exchange rates, with both crop protection and seed sales seeing a decline.

In 2023, Lonza reported sales of CHF 6.7 billion, reflecting a 7.9% growth at actual exchange rates (10.9% at constant exchange rates), with a CORE EBITDA of CHF 2 billion, resulting in a margin of 29.8%. These solid financial results were driven by the Biologics and Small Molecules divisions, with softer performance in Cell & Gene and Capsules & Health Ingredients.

In 2023, AgroAdvanced International Ltd. registered Cripthum, a biostimulant containing humic and fulvic acids, enhancing soil quality and plant growth. Their focus remains on sustainable agriculture, providing effective and environmentally friendly solutions to farmers.

Conclusion

The molluscicides market is evolving with increasing demand for eco-friendly and sustainable solutions. Traditional chemicals like Metaldehyde and Methiocarb remain popular for their effectiveness, while organic alternatives like Ferric Phosphate and biological options are gaining traction due to environmental concerns. The market is expected to continue diversifying in response to consumer preferences for safer, natural pest control.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)