Table of Contents

Overview

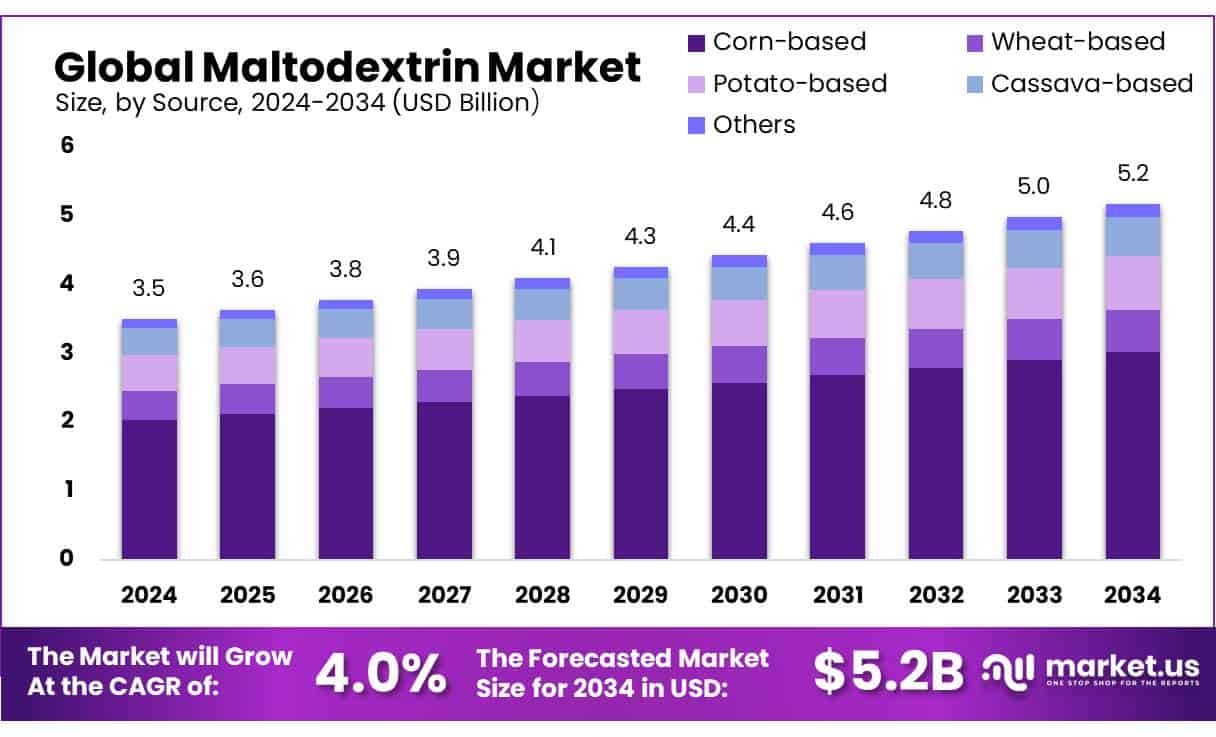

New York, NY – May 15, 2025 – The global Maltodextrin Market is growing steadily, driven by increasing demand from food, beverage, and pharmaceutical industries. Valued at USD 3.5 billion in 2024, the market is expected to reach USD 5.2 billion by 2034, growing at a 4.0% CAGR from 2025 to 2034.

In 2024, corn-based maltodextrin commanded a 58.2% market share, driven by corn’s abundant global supply and high starch content, enabling efficient and cost-effective production. Food-grade maltodextrin led in 2024 with a 69.5% market share, fueled by its extensive use in processed foods such as snacks, soups, sauces, and baked goods. Spray-dried powder dominated in 2024, holding a 72.3% market share due to its fine texture, high solubility, and extended shelf life.

US Tariff Impact on Market

President Trump’s proposed tariffs, including a 10% universal tariff and reciprocal tariffs on over 60 countries, could significantly disrupt the U.S. food and beverage industry. These additive tariffs—combining the 10% universal rate with country-specific levies, such as 34% on China, 24% on Japan, 46% on Vietnam, and 20% on the EU will increase the cost of imported goods. The USDA reports that 17% of the U.S. food supply is imported, and these tariffs will raise expenses for importers, distributors, retailers, and consumers.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-maltodextrin-market/request-sample/

The 34% tariff on Chinese imports, which totaled USD 450 billion, will particularly impact products like fresh and processed fruits and vegetables, apple juice, garlic, spices, tea, and shrimp. Notable Chinese exports to the U.S. include USD 1.3 billion in fish, USD 850 million in animal and vegetable oils, and USD 1.3 billion in vegetables, fruits, and nuts. China dominates global garlic production (over 80%) and supplies two-thirds of U.S. apple juice as the world’s leading producer and exporter of concentrated apple juice. These tariffs could render Chinese imports unaffordable for many consumers, reshaping supply chains and market dynamics.

Key Takeaways

- Maltodextrin Market size is expected to be worth around USD 5.2 billion by 2034, from USD 3.5 billion in 2024, growing at a CAGR of 4.0%.

- Corn-based maltodextrin held a dominant market position, capturing more than a 58.2% share.

- Food Grade held a dominant market position, capturing more than a 69.5% share.

- Spray Dried Powder held a dominant market position, capturing more than a 72.3% share.

- Food and Beverages held a dominant market position, capturing more than 87.4% share.

- North America emerged as the leading region in the global maltodextrin market, capturing a substantial 43.8% share, equivalent to approximately USD 1.5 billion.

Report Scope

| Market Value (2024) | USD 3.5 Billion |

| Forecast Revenue (2034) | USD 5.2 Billion |

| CAGR (2025-2034) | 4.0% |

| Segments Covered | By Source (Corn-based, Wheat-based, Potato-based, Cassava-based, Others), By Grade (Food Grade, Pharmaceutical Grade, Others), By Form (Spray Dried Powder, Agglomerated), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others) |

| Competitive Landscape | ADM, Agrana Group, Avebe, Cargill, Grain Processing Corporation, Gulshan Polyols, Ingredion, Lehmann Food Ingredients, Matsutani America, Nowamyl, Roquette, Tate and Lyle, Tereos, ZhuchengDongxiao Biotechnology |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147564

Key Market Segments

By Source

- In 2024, corn-based maltodextrin commanded a 58.2% market share, driven by corn’s abundant global supply and high starch content, enabling efficient and cost-effective production. Major corn-producing nations like the United States, China, and India benefit from large-scale farming, ensuring a stable supply and pricing. Corn-based maltodextrin’s neutral flavor, excellent solubility, and non-GMO options make it a preferred choice across food, beverage, pharmaceutical, and animal feed industries. Government subsidies and R&D support for maize production further solidify corn’s dominance over other sources, reinforced by a robust supply chain.

By Grade

- Food-grade maltodextrin led in 2024 with a 69.5% market share, fueled by its extensive use in processed foods such as snacks, soups, sauces, and baked goods. Its texture-enhancing properties, shelf-life extension, and easy blending capabilities make it a staple for manufacturers. With a neutral taste and high solubility, it suits a variety of edible products, particularly as demand for convenient, packaged foods rises in urban areas. Regulatory approvals from global food safety bodies and growing consumer preference for ready-to-eat meals and nutritional products bolstered its dominance over pharmaceutical and industrial grades.

By Form

- Spray-dried powder dominated in 2024, holding a 72.3% market share due to its fine texture, high solubility, and extended shelf life. Its quick-dissolving nature and smooth mixing properties make it ideal for instant drinks, baby foods, and powdered supplements. Food and beverage manufacturers favor it for its consistent quality, ease of blending, and packaging convenience, which streamlines production. The form’s stability during storage and transport further enhances its appeal, maintaining its lead over agglomerated or granular alternatives.

By Application

- The food and beverage sector led in 2024 with an 87.4% market share, driven by maltodextrin’s widespread use in sauces, snacks, dairy, confectionery, instant soups, and beverages. Its ability to enhance mouthfeel, thicken textures, and prolong shelf life makes it essential for producers. Valued for its clean taste and rapid solubility, it’s ideal for powdered drinks, energy products, and low-calorie foods. Growing demand for processed and packaged foods, particularly in developing regions’ urban and rural markets, cemented the sector’s heavy reliance on maltodextrin.

Regional Analysis

- North America led the global maltodextrin market, securing a 43.8% share valued at roughly USD 1.5 billion, with the United States as the primary driver. The region’s strong food and beverage sector heavily utilizes maltodextrin in processed foods, sports nutrition, and pharmaceuticals. Rising demand for low-calorie, fast-digesting carbohydrates has spurred market growth.

- Furthermore, the trend toward clean-label and non-GMO products has driven manufacturers to innovate with organic and plant-based maltodextrin options, aligning with health-conscious consumer preferences and fostering strategic collaborations between suppliers and food companies to meet these evolving needs.

Top Use Cases

- Thickener in Processed Foods: Maltodextrin acts as a thickener in snacks, soups, and sauces, enhancing texture and consistency. Its neutral taste ensures it blends seamlessly without altering flavors, making it ideal for packaged foods. The rising demand for convenient, ready-to-eat meals drives its widespread use in the food industry.

- Stabilizer in Beverages: In sports drinks and instant beverage mixes, maltodextrin stabilizes emulsions, preventing ingredient separation. Its high solubility ensures smooth mixing, improving product quality. With growing consumer interest in functional drinks, its role in maintaining beverage stability is increasingly vital.

- Energy Source in Sports Nutrition: Maltodextrin provides quick-digesting carbohydrates in energy drinks, gels, and recovery supplements for athletes. It rapidly replenishes glycogen stores, boosting performance during intense workouts. The expanding sports nutrition market relies on its fast energy-release properties to meet active lifestyle demands.

- Fat Replacer in Low-Calorie Foods: Maltodextrin substitutes fat in low-calorie snacks, dairy, and desserts, mimicking creamy textures without adding calories. It appeals to health-conscious consumers seeking guilt-free indulgences. Its use in reduced-fat products aligns with the growing trend toward healthier, low-calorie packaged foods.

- Bulking Agent in Confectionery: In candies and chocolates, maltodextrin adds bulk and improves mouthfeel without excessive sweetness. Its ability to control texture makes it a go-to ingredient for confectionery manufacturers. Rising demand for innovative sweets drives their application in creating appealing, high-quality products.

Recent Developments

1. ADM (Archer Daniels Midland)

- ADM has been expanding its maltodextrin production to meet rising demand in sports nutrition and functional foods. The company focuses on non-GMO and clean-label maltodextrin to cater to health-conscious consumers. ADM also invests in sustainable sourcing to reduce environmental impact. Their recent innovations include low-glycemic maltodextrin alternatives for diabetic-friendly products.

2. Agrana Group

- Agrana has introduced organic-certified maltodextrin to align with the growing organic food trend. The company emphasizes EU-sourced raw materials to ensure quality and traceability. Agrana’s maltodextrin is widely used in infant formula and clinical nutrition due to its high purity. They are also exploring plant-based and allergen-free variants.

3. Avebe

- Avebe specializes in potato-based maltodextrin, offering a gluten-free and non-GMO alternative to corn-derived products. The company has enhanced its production efficiency to meet rising demand in vegan and clean-label foods. Avebe’s recent developments include customized maltodextrin solutions for protein shakes and meal replacements.

4. Cargill

- Cargill has launched tapioca-based maltodextrin as a sustainable alternative, targeting the Asia-Pacific market. The company focuses on transparent sourcing and eco-friendly production. Cargill’s recent innovations include low-calorie maltodextrin for weight management products. They also collaborate with food brands to develop functional and fortified ingredients.

5. Grain Processing Corporation (GPC)

- GPC has expanded its corn-based maltodextrin portfolio with high-purity grades for pharmaceutical applications. The company emphasizes consistent quality and rapid solubility, making it ideal for instant beverages and supplements. GPC is also investing in energy-efficient manufacturing to reduce its carbon footprint.

Conclusion

The Maltodextrin’s versatility drives its strong demand across food, beverage, sports nutrition, and pharmaceutical industries. Its role as a thickener, stabilizer, and energy source, combined with the rise of clean-label and non-GMO variants, aligns with consumer trends toward health and convenience. With expanding applications in functional foods and global processed food markets, maltodextrin’s growth trajectory remains robust, supported by innovation and evolving consumer preferences.