Table of Contents

Introduction

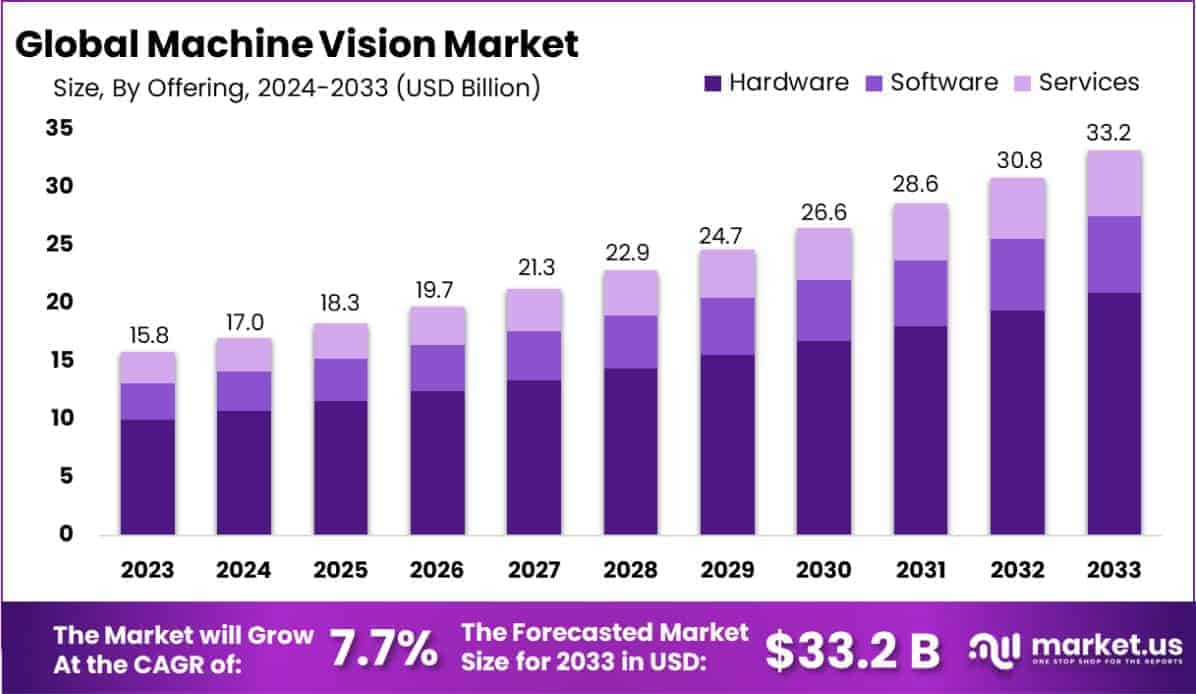

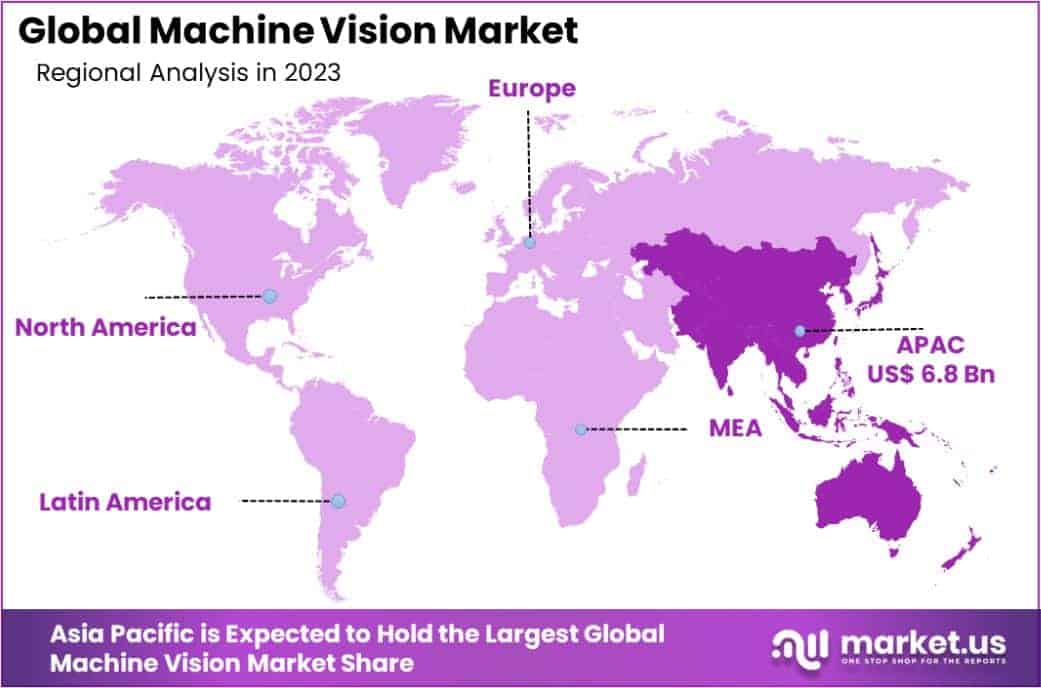

The Global Machine Vision Market is projected to reach approximately USD 33.2 billion by 2033, up from USD 15.8 billion in 2023, growing at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2033. In 2023, the Asia Pacific region held the largest market share, accounting for 43.1% of the total market, with a revenue of USD 6.8 billion.

Machine vision refers to the use of computer-based systems to provide imaging-based automatic inspection, process control, and analysis in manufacturing and industrial applications. It typically involves the integration of hardware such as cameras, lighting, and sensors, along with advanced software for image processing and analysis. Machine vision systems enable automated tasks such as quality control, sorting, and data collection, all of which contribute to enhanced efficiency and reduced errors in industrial settings.

The machine vision market has experienced significant growth due to increased demand for automation across various sectors, such as automotive, electronics, pharmaceuticals, and food processing. Factors driving this growth include the rising need for quality control, greater operational efficiency, and advancements in AI and machine learning, which enhance the capabilities of vision systems.

Key Takeaways

- The Global Machine Vision Market is projected to grow from USD 15.8 billion in 2023 to USD 33.2 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.7% during the forecast period (2024-2033).

- In 2023, the Hardware segment led the market in terms of offering, capturing a significant 63.1% share.

- The PC-Based product segment dominated the market in 2023, with a substantial 55.2% market share.

- The Quality Assurance and Inspection application held the largest market share in 2023, accounting for 52.3% of the total machine vision market.

- The Automotive sector was the leading end-use segment, commanding 20.5% of the market in 2023.

- Asia Pacific held the largest market share in 2023, accounting for 43.1% of the global machine vision market, with a revenue contribution of USD 6.8 billion.

Emerging Trends

- Integration with Artificial Intelligence (AI) and Deep Learning: Machine vision systems are increasingly integrating AI and deep learning technologies. These advancements enhance the ability of vision systems to process complex images and make more accurate decisions, especially in dynamic or challenging environments. By improving image recognition and analysis, AI-powered systems can perform tasks that were previously not feasible, such as identifying subtle defects in manufacturing or recognizing specific patterns in medical imaging.

- Increased Use in Autonomous Systems: Machine vision is playing a critical role in autonomous vehicles and robotics. Cameras and vision-based systems help vehicles “see” and understand their surroundings, enabling safe navigation and decision-making. This trend is further fueled by the expansion of electric vehicles (EVs) and autonomous delivery systems, driving the demand for vision-based sensing technologies.

- Advancements in 3D Imaging and Sensing: 3D machine vision technologies are gaining traction, offering more detailed depth perception than traditional 2D systems. By incorporating advanced 3D cameras and sensors, these systems are better suited for tasks such as quality inspection in complex assemblies, robotic picking, and accurate measurements in manufacturing. This shift toward 3D vision is expected to enhance performance in a wide range of industries, from automotive to electronics.

- Miniaturization of Vision Systems: The miniaturization of machine vision systems, including smaller cameras and embedded vision processors, is facilitating their integration into a broader range of applications. Smaller, more compact systems are being used in industries like consumer electronics, mobile devices, and wearables, where size, weight, and power efficiency are critical factors. This trend is enabling vision systems to be deployed in environments where space and power resources are limited.

- Cloud Computing and Edge Processing: The rise of cloud computing and edge processing is transforming how machine vision data is processed and analyzed. In cloud-based systems, data from machine vision cameras can be sent to remote servers for analysis, allowing for powerful processing capabilities without the need for local hardware. Edge processing, on the other hand, enables real-time analysis directly on the device, reducing latency and bandwidth needs, making it ideal for applications where immediate action is necessary, such as in manufacturing or quality control processes.

Top Use Cases

- Automated Quality Inspection in Manufacturing: Machine vision is widely used in automated quality inspection, particularly in industries like automotive, electronics, and food production. Vision systems inspect products for defects, ensuring that only defect-free items reach the consumer. For example, vision systems are employed to check the alignment, size, and color of products on production lines, helping companies maintain high standards of quality and reduce the need for manual inspections.

- Robotic Guidance for Pick-and-Place Operations: In warehouses and logistics, machine vision systems are essential for guiding robots in pick-and-place tasks. By using vision to identify and locate objects, robots can efficiently and accurately pick up and place items in the right locations. This application is particularly prevalent in e-commerce and supply chain sectors, where automation is key to meeting growing demand and optimizing operational efficiency.

- Medical Imaging and Diagnostics: In healthcare, machine vision plays a critical role in medical imaging and diagnostics. For instance, machine vision systems are used to analyze X-rays, MRIs, and other medical scans to detect anomalies such as tumors, fractures, or diseases. These systems enhance the accuracy of diagnoses by reducing human error and enabling faster analysis, which is essential for timely treatment.

- Agricultural Automation: Machine vision is increasingly applied in agriculture, particularly in precision farming. Vision systems are used for tasks like monitoring crop health, identifying pests, and determining the optimal time for harvesting. This improves crop yields and reduces the need for chemical treatments, promoting more sustainable farming practices. Vision-based drones are also used to survey large fields, enabling farmers to gather data in real-time and make more informed decisions.

- Security and Surveillance: Machine vision is widely used in security systems for surveillance and monitoring purposes. Cameras equipped with machine vision algorithms can automatically detect and track people, vehicles, and objects in various settings, from public spaces to private properties. These systems are capable of recognizing unusual behavior or unauthorized access, enhancing security measures in both urban and industrial environments.

Major Challenges

- High Initial Investment Costs: The setup of advanced machine vision systems often requires significant upfront investments in equipment, software, and infrastructure. Small and medium-sized businesses (SMBs) may find it difficult to justify these costs, particularly if they do not have the resources to support ongoing maintenance and upgrades. While the cost of hardware is decreasing, the overall financial commitment remains a key barrier.

- Complexity in Integration with Existing Systems: Machine vision systems need to integrate seamlessly with existing manufacturing and operational processes, which can be challenging. Legacy systems often lack the compatibility or infrastructure to support modern vision technologies, requiring additional investments in software and hardware to bridge the gap. This complexity can delay the adoption of machine vision solutions in some industries.

- Lighting and Environmental Conditions: Machine vision performance can be highly sensitive to changes in lighting and environmental conditions. Variations in natural light, shadows, or reflections can distort the vision system’s ability to correctly interpret images. In industries like manufacturing or outdoor applications, maintaining consistent lighting and environmental controls can be difficult, leading to reduced accuracy in image processing and potential errors.

- Data Overload and Processing Power: The vast amounts of visual data captured by machine vision systems can overwhelm traditional computing resources, especially in high-resolution applications or real-time processing scenarios. Handling and analyzing large volumes of data requires powerful processing capabilities, which can increase the cost and complexity of deploying machine vision systems. Moreover, inefficient data processing can lead to delays or reduced system performance.

- Lack of Skilled Labor: There is a growing shortage of skilled professionals capable of operating and maintaining machine vision systems. The complexity of the technology requires knowledge in both computer vision and industry-specific applications. As demand for machine vision solutions rises, finding and retaining talent with the right technical expertise becomes a significant challenge for many businesses.

Top Opportunities

- Expansion into Emerging Markets: As industries in emerging economies continue to develop, there is significant potential for the growth of machine vision systems in regions such as Asia-Pacific, Africa, and Latin America. With the expansion of manufacturing, agriculture, and healthcare industries, the demand for automation and quality control solutions is expected to increase, creating opportunities for machine vision providers to enter these untapped markets.

- Advancements in Vision-Based Automation for Small and Medium Enterprises (SMEs): The growing accessibility of affordable machine vision solutions presents an opportunity for small and medium-sized enterprises (SMEs) to implement automation in their operations. As hardware and software become more affordable, SMEs can adopt vision-based systems for applications such as quality inspection and inventory management, improving operational efficiency and competitiveness.

- Increasing Demand for Smart Manufacturing: The ongoing trend towards Industry 4.0 and smart manufacturing provides a significant opportunity for machine vision systems. These systems enable real-time quality control, process optimization, and predictive maintenance, contributing to the overall digitalization of manufacturing. The integration of machine vision with other smart technologies such as IoT and AI will further enhance its role in future industrial applications.

- Integration with Augmented Reality (AR) and Virtual Reality (VR): The convergence of machine vision with AR and VR technologies is unlocking new opportunities in various sectors, including education, healthcare, and entertainment. For instance, in healthcare, machine vision can be used alongside AR to assist surgeons in real-time operations by providing detailed visual overlays. Similarly, in training and simulation applications, machine vision can enhance the immersive experience by enabling interactive, vision-based feedback.

- Sustainability in Agriculture and Environmental Monitoring: Machine vision’s role in sustainable farming and environmental monitoring is expected to grow significantly. By helping monitor soil health, water quality, and crop conditions, machine vision can enable more efficient resource management, reduce waste, and promote sustainable agricultural practices. As the global focus on environmental sustainability intensifies, machine vision solutions will play a pivotal role in these industries.

Key Player Analysis

- Allied Vision Technologies GmbH: Allied Vision Technologies GmbH is a prominent player in the machine vision market, known for its high-performance cameras and image processing systems. The company specializes in providing innovative machine vision solutions to industries such as manufacturing, robotics, and medical imaging. Allied Vision has a strong portfolio of products that cater to a wide range of applications, including industrial automation, quality inspection, and traffic surveillance. As of 2023, the company continues to expand its presence in key markets and focuses on advancing its product offerings through continuous research and development efforts.

- Basler AG: Basler AG, a leading German company, specializes in the development and production of high-quality industrial cameras and components for machine vision applications. The company’s products are used in a wide array of industries, including automotive, electronics, and pharmaceuticals. In 2022, Basler reported a revenue growth of approximately 15%, reflecting the increasing demand for automated visual inspection and quality control in various industrial sectors. Basler’s innovative camera systems are designed to support precision tasks such as optical inspection, robot guidance, and automation.

- Cognex Corporation: Cognex Corporation is a global leader in machine vision systems, providing comprehensive vision solutions for industries including automotive, electronics, and consumer goods. The company’s portfolio includes vision sensors, barcode readers, and software tools that enable automation and quality control in manufacturing. Cognex reported a revenue of $1.3 billion in 2022, underlining its strong market presence. With continuous innovation in vision technologies, Cognex remains one of the top players, driving advancements in deep learning-based image recognition, inspection systems, and AI-powered automation.

- Keyence Corporation: Keyence Corporation is a leading Japanese manufacturer of industrial automation products, including machine vision systems, sensors, and measurement equipment. The company has carved a niche in the machine vision market with its sophisticated imaging technologies that cater to industries such as electronics, automotive, and food processing. Keyence’s revenue in 2022 reached over $5 billion, demonstrating its strong foothold in the market. The company’s focus on research and development, alongside its broad range of innovative machine vision solutions, has made it a significant player in the automation and inspection industry.

- LMI Technologies Inc.: LMI Technologies Inc. specializes in 3D machine vision and inspection systems, serving industries such as automotive, robotics, and manufacturing. Known for its advanced 3D laser scanning technology, LMI’s products are used for precise measurements and quality control. In 2023, LMI Technologies reported significant growth in its 3D vision systems, which offer critical applications in automation and process monitoring. LMI Technologies’ continuous focus on innovation and expanding its product range has solidified its position as a leading player in the machine vision space.

Asia Pacific Machine Vision Market

The Asia Pacific region continues to maintain its dominance in the global machine vision market, accounting for a significant share of 43.1% in 2023, valued at approximately USD 6.8 billion. This growth is largely driven by the rapid industrialization and adoption of automation technologies across key economies such as China, Japan, South Korea, and India. The increasing demand for precision manufacturing, quality control, and robotics integration in industries such as automotive, electronics, pharmaceuticals, and food processing further fuels the region’s market expansion.

China, as the region’s largest economy, plays a pivotal role, contributing to more than half of the market share within Asia Pacific. The country’s thriving manufacturing sector, coupled with government initiatives promoting smart factories and Industry 4.0, is propelling the adoption of machine vision systems. Japan follows closely, driven by its robust automotive and electronics industries, which have long been early adopters of advanced manufacturing technologies. South Korea and India are also seeing considerable investments in machine vision, particularly as their manufacturing sectors modernize and demand for automation increases.

Additionally, the Asia Pacific region benefits from a strong local presence of both global and regional players, providing tailored machine vision solutions to a diverse range of industries. The availability of cost-effective technologies and a growing focus on research and development are further propelling the market in this region. The continued trend toward smart manufacturing, driven by the need for operational efficiency and high-quality standards, positions Asia Pacific as the dominant player in the global machine vision market.

Conclusion

The machine vision market is poised for substantial growth in the coming years, driven by the increasing demand for automation and advancements in imaging technologies. As industries continue to prioritize operational efficiency, quality control, and precision, machine vision systems will play a critical role in enhancing productivity across sectors such as automotive, healthcare, and manufacturing.

Emerging technologies like artificial intelligence, 3D imaging, and cloud computing are expected to further expand the capabilities and applications of machine vision systems, providing opportunities for companies to innovate and capture new market segments. While challenges such as high initial investment costs and integration complexities persist, the long-term outlook remains positive, with significant opportunities arising from the expansion into emerging markets, advancements in smart manufacturing, and the growing focus on sustainability. As these trends continue to unfold, the machine vision market will be a key enabler of digital transformation across industries worldwide.