Table of Contents

Introduction

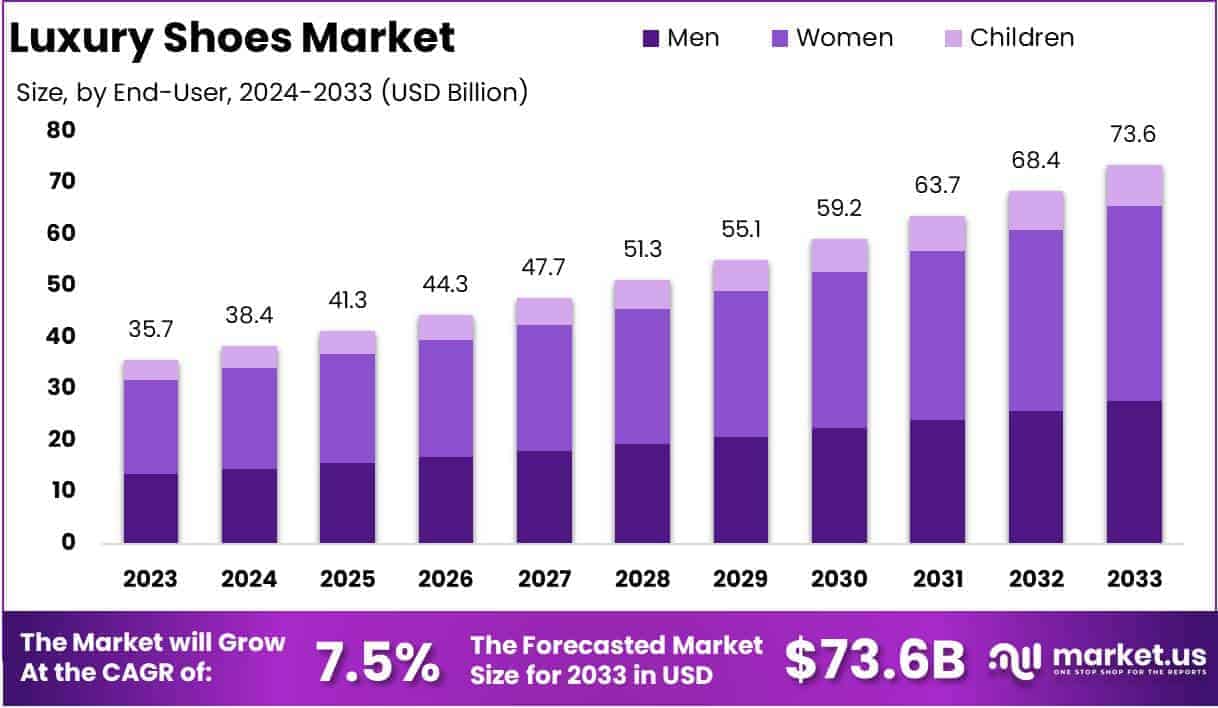

The Global Luxury Shoes Market is projected to reach a value of approximately USD 73.6 billion by 2033, up from USD 35.7 billion in 2023, representing a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2024 to 2033.

Luxury shoes are high-end footwear products that are typically distinguished by their superior craftsmanship, premium materials, brand prestige, and exclusivity. They cater to a niche consumer segment that values both fashion and quality, often symbolizing status and sophistication. Luxury shoes are produced by renowned fashion houses and are priced significantly higher than mass-market footwear due to their attention to detail, bespoke designs, and limited availability. This segment includes men’s and women’s shoes, spanning categories such as dress shoes, sneakers, boots, and sandals, often incorporating artistic design and innovative materials.

The luxury shoes market is a segment within the broader luxury goods industry, characterized by its appeal to affluent consumers who are willing to invest in high-quality, exclusive products. This market includes iconic brands such as Gucci, Louis Vuitton, Prada, and Christian Louboutin, and is influenced by fashion trends, brand perception, and consumer disposable income. It operates in a highly competitive environment, with both traditional brick-and-mortar retail and growing e-commerce platforms. Globalization and increasing wealth in emerging markets, particularly in Asia, have also become significant drivers of the market’s expansion.

Several factors contribute to the growth of the luxury shoes market. A key driver is the rising disposable income of affluent consumers, particularly in emerging economies like China and India. The increasing demand for luxury products as symbols of status and self-expression further fuels market expansion. Additionally, the growing prominence of e-commerce and digital platforms has provided brands with broader reach and new avenues for customer engagement. The shift toward sustainable and ethically produced luxury goods is also gaining traction, influencing consumer purchasing behavior in favor of brands that incorporate sustainability into their offerings.

Demand for luxury shoes remains strong among high-net-worth individuals (HNWIs) and millennials, with younger consumers increasingly investing in premium footwear. The growing trend of casual luxury, where high-end sneakers and athleisure footwear are incorporated into everyday wardrobes, is expanding the market’s consumer base. Furthermore, collaborations between luxury shoe brands and streetwear designers have enhanced appeal among fashion-forward consumers. The global demand for personalized and exclusive products is also pushing luxury shoe manufacturers to offer bespoke services, creating a unique and individualized customer experience.

Opportunities in the luxury shoes market lie in the continued expansion into emerging markets, especially in Asia-Pacific and Latin America, where increasing affluence is creating new demand for premium products. Digital transformation offers significant potential through e-commerce, with brands leveraging online platforms for direct-to-consumer engagement and personalized marketing. Additionally, the rise in sustainability and ethical consumerism presents an opportunity for brands to innovate with eco-friendly materials and transparent supply chains. The growing acceptance of unisex designs and inclusive sizing further opens up avenues for brands to tap into a broader consumer base, extending the luxury footwear market’s appeal across demographic segments.

Key Takeaways

- The global luxury shoes market is anticipated to grow from USD 35.7 billion in 2023 to USD 73.6 billion by 2033, with a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2024 to 2033.

- In 2023, sneakers accounted for the largest segment of the market, holding a 26.5% share, driven by the continued popularity of the athleisure trend and the integration of sustainable materials.

- The women’s segment dominates the market, representing 51.3% of total sales, fueled by strong demand for fashion-forward styles and seasonal luxury footwear collections.

- Offline retail channels remained the leading distribution method, capturing 64.1% of the market in 2023, underscoring the importance of in-store experiences and luxury shopping destinations.

- North America continues to lead the global luxury footwear market, accounting for 31.7% of the market share, supported by high disposable incomes, strong brand loyalty, and a robust luxury retail presence.

Luxury Shoes Statistics

- On average, women in the US own 17 pairs of shoes but wear only 3 pairs regularly.

- Each year, women purchase 3 pairs of shoes, spending $49 per pair on average.

The global average women’s shoe size is between 7 and 8. - In the US, the average women’s shoe size is 8.5 to 9.

- Women make up 63% of shoe purchases, while girls account for just 5.6%.

- Women have 148% more boot brands to choose from than men.

- Women also enjoy 168% more clog options and 128% more slippers than men.

- 60% of women in the US would continue wearing uncomfortable shoes for fashion.

- More than 50% of women worldwide prefer being barefoot to wearing painful shoes.

- 50% of women’s shoe purchases are driven by desire, not necessity.

- 19% of women buy shoes to boost their happiness.

- 50% of women own more than 10 pairs of shoes, and 13% own over 30 pairs, yet only 39% consider themselves “shoe people.”

- One out of every 12 women owns 100 or more pairs of shoes.

- 1 in 7 women admit to keeping at least one shoe purchase a secret from their partner.

- There are 7 shoe categories where more brands offer options for women than for men.

- Athletic footwear for women is sold by 25% more brands than for men.

- Women have 568% more sandal brands and 142% more slipper brands to choose from than men.

- There are 163% more brands offering women’s boots than men’s boots.

- Men have 495% more oxford options, 4% more trainers, and 10% more loafers than women.

- Men also have 46% more outdoor and 15% more work shoe brands than women.

- Women dominate in 8 of the 12 shoe categories in terms of brand availability.

- In total, there are 787,784 shoe options for women across 12 categories.

- Men have 345,121 shoe options available across 10 categories.

- Women have 1062% more clogs and 352% more slippers to choose from compared to men.

- Men have 747% more oxford options than women.

- Men also have 62% more loafers, 41% more trainers, and 20% more athletic footwear than women.

- Women’s shoes make up 36% of the offerings from Reebok and PUMA.

- 62% of all Skechers shoes are designed for women.

- Footwear manufacturers spend over $517 million annually on advertising targeted at the US market.

- Only 1% of sneakers purchased in the US are made domestically.

- Only 12% of US consumers regularly shop for shoes online due to convenience.

Emerging Trends

- Sustainability and Eco-Friendly Materials: The demand for sustainability in luxury shoes is growing rapidly, with a shift towards eco-friendly materials such as vegan leather, recycled textiles, and biodegradable soles. Consumers are increasingly prioritizing brands that emphasize environmental responsibility. For example, a significant percentage of luxury shoe consumers, particularly in Europe, are willing to pay a premium for products made from sustainable materials, signaling a broader trend of eco-conscious purchasing behavior.

- Customization and Personalization: Luxury footwear brands are leveraging advanced technology to offer more personalized experiences, allowing customers to design their own shoes. This includes options for unique colors, materials, and even bespoke fittings. The ability to customize shoes has become a key differentiator in the luxury market, catering to consumers seeking exclusivity and individuality.

- Smart Footwear and Integration with Technology: The integration of wearable technology into luxury shoes is emerging as a high-end trend. Innovations like built-in sensors that track movement, posture correction, and even health metrics are increasingly incorporated into high-fashion shoes. This blend of luxury with technology not only caters to the tech-savvy consumer but also offers practical benefits that enhance the overall user experience.

- Luxury Sneakers Becoming a Dominant Segment: Sneakers have moved from the sportswear category to become a dominant part of the luxury market. With a rise in streetwear culture, luxury sneakers are no longer just athletic footwear but a status symbol. High-end designers are increasingly releasing sneakers that blend comfort with premium design, making them highly sought-after by younger, fashion-forward buyers.

- Expansion of Digital and Virtual Shopping: The digital transformation of the luxury footwear market continues to accelerate, with online shopping becoming an integral part of the customer experience. Augmented reality (AR) and virtual try-on technologies are making it easier for consumers to shop for high-end shoes from the comfort of their homes, without compromising on the luxury experience. Virtual showrooms and exclusive online collections are gaining traction as brands look to enhance online engagement and reach a global audience.

Top Use Cases

- High-End Fashion and Red Carpet Events: Luxury shoes are an essential part of high fashion, worn by celebrities and influencers at major events like red carpet appearances and fashion shows. These shoes often play a key role in the overall styling of a celebrity’s outfit, contributing significantly to the image of both the wearer and the brand.

- Corporate and Professional Wear: In corporate settings, luxury shoes are considered a status symbol, often worn by executives and professionals to convey success and refinement. High-quality leather shoes, including custom-made options, are typically favored in industries where a polished, professional appearance is essential. Luxury footwear brands are increasingly offering more formal styles suitable for the corporate world, contributing to a surge in demand for high-end business attire.

- Luxury Sports and Active Lifestyle: There is an emerging market for luxury athletic shoes that blend performance with high-end design. Brands are now offering shoes that combine cutting-edge athletic technology with premium materials and aesthetics. This includes luxury running shoes, basketball sneakers, and other active footwear, which cater to wealthy individuals who prioritize both fashion and function in their active lifestyles.

- Casual and Streetwear: The luxury sneaker market has seen explosive growth due to the rise of casual and streetwear fashion. High-end brands now release limited edition sneakers designed for everyday wear, appealing to younger consumers who want to wear luxury items in casual settings. This growing trend has made luxury shoes more versatile, with consumers wearing them in both formal and informal settings.

- Gifting and Special Occasions: Luxury shoes are often purchased as high-value gifts for significant occasions like birthdays, anniversaries, or holidays. Due to their exclusivity and high price point, these shoes make for prized possessions or symbolic gifts that convey prestige. This market segment is especially popular in regions like the Middle East and East Asia, where gifting culture is prevalent, and status items like luxury footwear are highly sought after.

Major Challenges

- Counterfeit Products and Brand Protection: The luxury shoe market faces significant challenges from counterfeit products that dilute brand value and harm consumer trust. With the rise of online marketplaces, counterfeiters are able to produce high-quality replicas, making it difficult for consumers to differentiate authentic luxury footwear from fake ones. Luxury brands are investing in advanced technologies like blockchain and NFC chips to combat counterfeiting and ensure product authenticity.

- Supply Chain Disruptions: Luxury footwear brands, like many industries, face ongoing supply chain challenges, particularly concerning the availability of rare and premium materials. Issues such as shipping delays, import/export restrictions, and rising raw material costs can significantly impact production timelines, forcing brands to adapt quickly to market changes.

- Fluctuating Consumer Preferences: The fast-paced evolution of fashion trends presents a challenge for luxury shoe brands to stay relevant. Consumer preferences can shift rapidly, especially among younger demographics, who are increasingly focused on streetwear, casual styles, and personalized products. Keeping up with these shifting demands while maintaining traditional brand aesthetics and values requires significant agility from luxury footwear companies.

- Price Sensitivity Among Younger Consumers: Younger generations, particularly Gen Z and millennials, are becoming key consumers of luxury shoes. However, this demographic is generally more price-sensitive and values practicality alongside status. Many luxury brands face the challenge of attracting this audience without compromising on exclusivity or price. Offering more accessible entry points into the luxury market, like limited edition or lower-priced versions, is one solution, but it must be done carefully to avoid diluting brand prestige.

- Sustainability Expectations: As sustainability becomes a central concern for consumers, luxury shoe brands are under pressure to adopt ethical and environmentally friendly practices. Meeting these expectations without sacrificing product quality or design is a delicate balance. Implementing sustainable sourcing practices, reducing carbon footprints, and transitioning to more eco-friendly materials can increase production costs, making it a significant challenge for brands that prioritize profit margins.

Top Opportunities

- Expanding E-Commerce Platforms: The luxury footwear market presents significant growth opportunities through e-commerce. Online sales of high-end shoes are expected to continue growing, as more consumers seek the convenience of shopping from home. Brands that invest in enhancing their online shopping experiences with virtual try-ons, fast shipping, and exclusive online collections stand to benefit from a broader customer base and increased sales.

- Tapping into Emerging Markets: Emerging markets, especially in regions like Asia-Pacific, Latin America, and the Middle East, represent major growth opportunities for luxury shoe brands. Rising disposable incomes, changing consumer preferences, and a growing appetite for luxury products are driving demand for high-end footwear in these regions. Localization strategies and targeted marketing campaigns tailored to local cultures will be key to capturing this expanding customer base.

- Expanding into the Women’s Footwear Market: While luxury footwear has traditionally been dominated by men’s shoes, there is a growing opportunity to tap into the women’s luxury shoe market. As female consumers increasingly embrace luxury fashion, brands have an opportunity to expand their offerings with exclusive collections that cater to women’s needs, from formal wear to casual sneakers and everything in between.

- Collaborations and Limited-Edition Collections: Collaborations between luxury shoe brands and high-fashion designers, celebrities, or influencers are proving to be highly successful. Limited-edition releases create a sense of exclusivity and drive demand through scarcity. This trend offers brands the opportunity to expand their reach, engage new audiences, and generate buzz within both luxury and streetwear circles.

- Advancements in Footwear Technology: Integrating technology into luxury shoes presents a unique opportunity to create products that offer both style and performance. Smart shoes with features like fitness tracking, heat regulation, and even self-lacing technology are gaining traction. Investing in R&D to create innovative footwear solutions can help brands tap into a niche market of tech-savvy, luxury-conscious consumers seeking functional, high-tech solutions in their fashion choices.

Key Player Analysis

- LVMH (Moët Hennessy Louis Vuitton): LVMH, a global luxury powerhouse, leads the footwear market through its high-end brands like Louis Vuitton, Dior, and Fendi. With a 2023 revenue of €79.2 billion, LVMH offers premium footwear that blends timeless elegance with modern trends. Known for exceptional craftsmanship and exclusivity, LVMH appeals to both traditional luxury buyers and younger, fashion-forward consumers.

- Chanel Limited: Chanel, with an estimated 2023 revenue of $15.6 billion from fashion and footwear, is synonymous with luxury and exclusivity. The brand’s shoes, including its iconic ballet flats and heels, are prized for their quality and timeless design. Chanel maintains its prestige by limiting availability, attracting discerning customers who value luxury and craftsmanship.

- Prada S.p.A: Prada, generating €4.5 billion in 2023, is a leading force in luxury footwear. Known for its bold, stylish designs, Prada offers a range of products from elegant heels to high-end sneakers. Its ability to innovate while maintaining luxury craftsmanship attracts both traditional buyers and younger, trend-savvy consumers.

- Salvatore Ferragamo: With a revenue of €1.4 billion in 2023, Salvatore Ferragamo is recognized for its elegant, finely crafted leather shoes. The brand offers a range of luxury footwear, including iconic loafers and pumps, focusing on comfort, quality, and sophisticated design. Ferragamo remains a key player in the high-end footwear market.

- Dr. Martens: Dr. Martens, with a revenue of £1.3 billion in 2023, has evolved from work boots to a luxury footwear icon. Its signature boots combine durability with style, appealing to consumers seeking a blend of function and fashion. The brand’s edgy image and premium offerings have secured its place in the luxury footwear market.

Recent Developments

- In 2023, Kering, the French luxury goods company, acquired a 30% stake in the Italian fashion brand Valentino from the Qatari investment fund Mayhoola for €1.7 billion ($1.87 billion). This strategic move comes after a decline in Gucci’s sales performance and includes an option for Kering to buy the remaining shares of Valentino by 2028. The deal is expected to be finalized by the end of the year, as Kering seeks to diversify its portfolio beyond Gucci and strengthen its position in the luxury sector.

- In 2023, L’Oréal announced the successful completion of its acquisition of the luxury beauty brand Aesop, following an agreement made in April. Nicolas Hieronimus, L’Oréal’s CEO, expressed excitement about the addition of Aesop, citing the brand’s unique urban and luxurious appeal. L’Oréal plans to drive Aesop’s growth, particularly in China, capitalizing on the brand’s potential in the fast-growing luxury beauty market.

- In October 2024, Mytheresa and Richemont revealed that Mytheresa will acquire 100% of the share capital of YNAP (Yoox Net-a-Porter), forming a leading digital luxury retail group. This acquisition will allow Mytheresa to expand its portfolio of premium brands, creating a stronger presence in the global luxury e-commerce market.

- In 2023, HanesBrands announced the sale of its Champion brand’s intellectual property and assets to Authentic Brands Group for $1.2 billion. The deal, which includes performance-based contingencies, marks the next phase in HanesBrands’ strategic realignment.

- In 2024, Under Armour appointed Eric Liedtke as Executive Vice President of Brand Strategy, following the acquisition of UNLESS Collective, a zero-plastic, regenerative fashion brand. The acquisition aligns with Under Armour’s focus on sustainability and innovation in its product offerings.

- In July 2024, EssilorLuxottica agreed to acquire the iconic Supreme® brand from VF Corporation for $1.5 billion. The acquisition strengthens EssilorLuxottica’s portfolio of premium brands, further solidifying its leadership in the eyewear industry.

- In 2024, Hudson’s Bay Company (HBC) entered into a definitive agreement to acquire the luxury retailer Neiman Marcus for $2.65 billion. This acquisition marks a significant expansion for HBC, bolstering its position in the North American luxury market.

- In 2023, Tapestry, Inc. and Capri Holdings announced that Tapestry would acquire Capri Holdings for approximately $8.5 billion, with Capri shareholders receiving $57 per share. This strategic consolidation brings together brands like Coach, Kate Spade, Versace, and Michael Kors under one umbrella, strengthening Tapestry’s position in the global luxury goods market.

Conclusion

The global luxury shoes market is poised for significant growth, driven by rising disposable incomes, the increasing desire for exclusivity, and the growing influence of fashion-forward consumers. The sector’s evolution is being shaped by key trends such as sustainability, customization, and the integration of technology, which are reshaping consumer expectations and purchasing behaviors.

As digital platforms continue to gain traction, luxury footwear brands must adapt by embracing e-commerce and offering personalized online experiences. Furthermore, expanding into emerging markets and tapping into the growing demand for women’s luxury footwear will present new growth opportunities. To remain competitive, brands will need to balance traditional craftsmanship with innovative, sustainable practices while catering to the diverse needs of modern consumers, including those seeking both style and functionality in their footwear choices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)