Table of Contents

Introduction

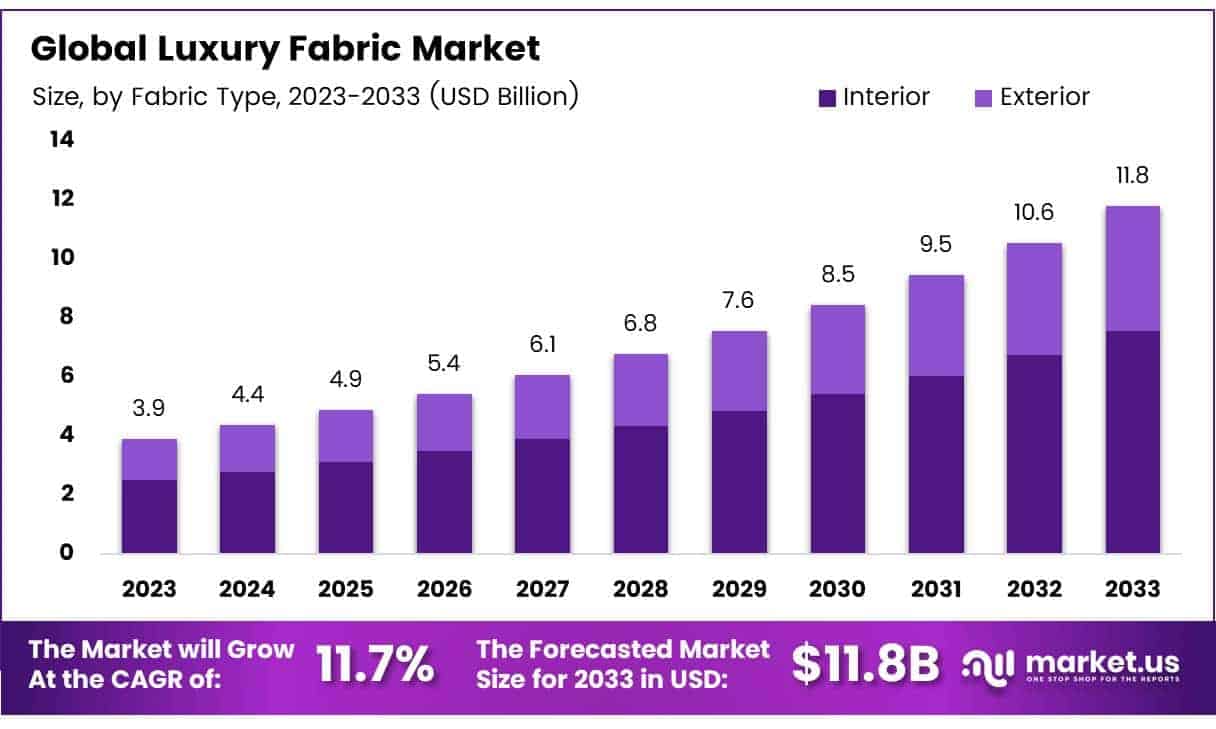

The Global Luxury Fabric Market is projected to reach approximately USD 11.8 billion by 2033, rising from a valuation of USD 3.9 billion in 2023. This growth is expected to occur at a compound annual growth rate (CAGR) of 11.7% during the forecast period spanning 2024 to 2033.

The luxury fabric market represents a premium segment within the global textile industry, comprising high-end materials such as silk, cashmere, velvet, satin, linen blends, and fine wool, which are distinguished by superior quality, craftsmanship, exclusivity, and elevated aesthetic appeal. These fabrics are primarily utilized in haute couture, premium apparel, luxury home furnishings, and automotive interiors.

The luxury fabric market refers to the global trade and consumption of these high-value textiles, catering to discerning consumers and brands that prioritize exclusivity, durability, and elegance. The market has witnessed a steady expansion, driven by rising disposable incomes, increasing brand consciousness, and the aspirational lifestyle adopted by emerging middle classes in developing economies, particularly in Asia-Pacific.

Additionally, the growing influence of fashion weeks, celebrity endorsements, and luxury brand collaborations has enhanced consumer awareness and fueled demand across high-net-worth individuals and fashion-forward segments. Key growth factors include urbanization, digital penetration of luxury fashion, and expansion of luxury retail infrastructure. Moreover, sustainability is becoming a defining trend, with luxury consumers showing increasing interest in eco-friendly, ethically sourced fabrics, thereby opening avenues for organic silk, sustainable cotton, and cruelty-free wool.

Demand is especially robust in the fashion and interior décor segments, where premium aesthetics and long-lasting quality are crucial. The shift toward personalization in luxury fashion also supports growth, as bespoke clothing relies heavily on high-grade fabrics. Opportunities lie in emerging markets such as India, China, and the UAE, where increasing affluence and evolving fashion sensibilities are projected to significantly augment luxury fabric consumption in the coming years.

Key Takeaways

- The global luxury fabric market is expected to grow significantly, rising from USD 3.9 billion in 2023 to USD 11.8 billion by 2033. This represents a compound annual growth rate (CAGR) of 11.7% over the forecast period.

- Interior fabrics accounted for the largest share of the fabric type segment in 2023, capturing 64.3% of the global market, indicating strong demand for luxury materials in interior applications.

- Silk emerged as the most preferred raw material in 2023, representing 24.5% of the total market share. Its premium quality and aesthetic appeal continue to drive its dominance in luxury applications.

- Offline distribution channels remained dominant in 2023, holding a 62.5% share of the global market. This reflects consumer preference for tactile product evaluation and personalized service in the luxury segment.

- Europe led the global luxury fabric market in 2023, contributing 33% of the overall market share, equivalent to a market value of USD 1.28 billion.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3.9 Billion |

| Forecast Revenue (2033) | USD 11.8 Billion |

| CAGR (2024-2033) | 11.7% |

| Segments Covered | By Fabric Type (Interior, Exterior), By Raw Material (Silk, Velvet, Linen, Jacquard, Cashmere, Cotton, Others), By Distribution Channel (Offline, Online) |

| Competitive Landscape | Jim Thompson Fabrics, Sattler Group (SUN-TEX GmbH), Sanderson Design Group, Perennials and Sutherland L.L.C., Pierre Frey, LVMH Moët Hennessy Louis Vuitton (Loro Piana), Ermenegildo Zegna N.V., The Romo Group, Kravet Inc., De Le Cuona |

Unlock Insights with Our Sample PDF – Download Now at https://market.us/report/luxury-fabric-market/request-sample/

Emerging Trends

- Sustainability and Circular Fashion: There is a growing emphasis on eco-friendly practices, with luxury brands adopting sustainable materials and circular fashion models to meet consumer demand for environmental responsibility.

- Digital Integration: The incorporation of digital technologies, such as artificial intelligence (AI) and augmented reality (AR), is transforming design processes and enhancing customer experiences in the luxury fabric sector.

- Personalization: Consumers increasingly seek tailored experiences, prompting brands to offer customized luxury fabric products that reflect individual styles and preferences.

- Resurgence of Traditional Materials: A renewed interest in traditional materials, including fur, has been observed, reflecting consumers’ desire for luxury and heritage.

- Inclusivity and Diversity: The luxury fabric market is embracing inclusivity, with brands expanding their offerings to cater to diverse body types and cultural backgrounds.

Top Use Cases

- High-End Fashion Apparel: Luxury fabrics are predominantly used in creating exclusive clothing lines that exemplify quality and sophistication.

- Luxury Home Textiles: Premium fabrics are utilized in home décor items such as bedding, curtains, and upholstery to enhance interior aesthetics.

- Automotive Interiors: High-quality fabrics are employed in luxury vehicle interiors to provide comfort and elegance.

- Accessories: Luxury fabrics are crafted into accessories like scarves, ties, and handbags, adding a touch of opulence to everyday items.

- Event Drapery: Premium fabrics are used in event settings to create lavish atmospheres through elegant drapery and decorations.

Major Challenges

- Sustainability Concerns: Addressing environmental impacts and adopting sustainable practices remain significant challenges.

- Supply Chain Disruptions: Global events and logistical issues can disrupt the supply chain, affecting the availability of luxury fabrics.

- Economic Fluctuations: Economic downturns can reduce consumer spending on luxury items, impacting market growth.

- Counterfeit Products: The proliferation of counterfeit luxury fabrics undermines brand integrity and affects sales.

- Technological Adaptation: Integrating new technologies into traditional manufacturing processes poses challenges for some luxury fabric producers.

Top Opportunities

- Sustainable Innovations: Developing eco-friendly materials and processes presents significant growth opportunities.

- Digital Transformation: Embracing digital tools can enhance design, production, and marketing strategies.

- Emerging Markets: Expanding into emerging markets with growing affluent populations offers new revenue streams.

- Collaborations: Partnering with technology firms can lead to innovative product offerings and improved customer engagement.

- Customization Services: Offering personalized luxury fabric products can cater to individual consumer preferences, enhancing brand loyalty.

Key Player Analysis

The global luxury fabric market in 2024 is shaped by a dynamic mix of heritage brands, design-centric manufacturers, and vertically integrated luxury houses. Jim Thompson Fabrics continues to strengthen its position in Asian and global markets through a distinct blend of traditional Thai silk craftsmanship and contemporary design. Sattler Group (SUN-TEX GmbH) remains prominent in the premium outdoor textiles segment, offering innovation in performance fabrics.

Sanderson Design Group, with its historic British legacy, leverages its diverse portfolio to address both residential and contract markets. Perennials and Sutherland L.L.C. reinforces its luxury outdoor positioning through weather-resistant yet refined textile innovations. Pierre Frey upholds artisanal excellence rooted in French tradition, while LVMH’s Loro Piana division exemplifies ultra-premium positioning via rare fibers and vertical integration. Ermenegildo Zegna N.V. complements this with heritage-driven fabric innovation. Meanwhile, The Romo Group, Kravet Inc., and De Le Cuona cater to high-end interiors, emphasizing bespoke offerings, textural richness, and global design appeal.

Top Key Players in the Market

- Jim Thompson Fabrics

- Sattler Group (SUN-TEX GmbH)

- Sanderson Design Group

- Perennials and Sutherland L.L.C.

- Pierre Frey

- LVMH Moët Hennessy Louis Vuitton (Loro Piana)

- Ermenegildo Zegna N.V.

- The Romo Group

- Kravet Inc.

- De Le Cuona

Regional Analysis

Europe Leads the Luxury Fabric Market with the Largest Market Share of 33% in 2024

Europe has emerged as the dominant region in the global luxury fabric market, accounting for the largest market share of 33% in 2024. The regional market was valued at USD 1.28 billion in the same year, underscoring its strong foothold and advanced textile manufacturing infrastructure. This dominance can be attributed to the region’s deep-rooted heritage in fashion, design innovation, and high consumer preference for premium textile products. Countries such as Italy, France, and the United Kingdom serve as global fashion capitals, housing several luxury fashion houses and textile brands that significantly contribute to the demand for high-end fabrics.

Additionally, the presence of well-established textile manufacturers and designers, along with the high purchasing power of consumers, has accelerated the consumption of luxury fabrics in both apparel and interior applications. Europe’s focus on sustainable and ethically sourced materials has also supported the market growth, with increased investments in eco-friendly textile production. The European Union’s supportive policies toward sustainable fashion and textile innovation are further enhancing the competitive advantage of the region.

Recent Developments

- In 2025, Sunrise Group of China confirmed a $230 million investment in Morocco. The agreement was signed during an official ceremony led by Head of Government Aziz Akhannouch in Rabat. This step supports Morocco’s industrial goals and aligns with the long-term vision of HM King Mohammed VI to build the country into a manufacturing and export leader in the region. The investment includes the creation of two major industrial units in Skhirat and Fez. Around 7,000 direct jobs and more than 1,500 indirect jobs will be generated. The project will also help local textile companies by reducing costs and delivery times, while expanding their global reach.

- In 2024, Dormeuil introduced three exclusive fabrics for Indian brand P N Rao. The luxury textile maker launched Forever Gold, Extreme Vicuna, and Pashmina fabrics in a continued partnership with P N Rao. This collaboration reflects shared values in fine craftsmanship and premium quality. Dormeuil’s leadership sees P N Rao as a key partner in growing its presence in India. Both companies aim to deliver excellence in luxury menswear through this partnership.

- In 2024, Inditex launched a €50 million fund to support green innovation. The owner of Zara announced this fund to promote sustainability and innovation in the textile sector. The investment is focused on helping startups that are working on eco-friendly solutions. Inditex plans to reduce its total emissions by 50% before 2030, and this initiative is part of that roadmap.

- In 2023, EURATEX published a manifesto ahead of the 2024 EU elections. The document listed 15 key priorities to support the textile and clothing industry in Europe. The sector includes 192,000 companies, employs 1.3 million people, and generates €167 billion in turnover. The manifesto urged policymakers to back innovation and support competitive conditions for European businesses.

- In 2024, LVMH reported €86.2 billion in annual revenue for 2023. This reflects an organic growth of 13% compared to the previous year. Most business segments showed strong growth, especially in Europe and Asia. Wines & Spirits had slower growth due to earlier high sales and inventory. The company remains the global leader in the luxury goods sector.

Conclusion

The global luxury fabric market is expected to witness strong growth in the coming years, driven by increasing demand for premium materials in fashion, interiors, and automotive applications. Factors such as rising brand awareness, digital transformation, and a growing focus on sustainability are shaping market dynamics. Consumer preferences are shifting toward eco-friendly and ethically sourced fabrics, prompting innovation and sustainable practices among key players. Despite challenges like supply chain disruptions and counterfeit concerns, opportunities lie in customization, digital integration, and expansion into emerging markets. Overall, the market is positioned for steady advancement, supported by evolving consumer lifestyles and technological progress.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)