Table of Contents

Introduction

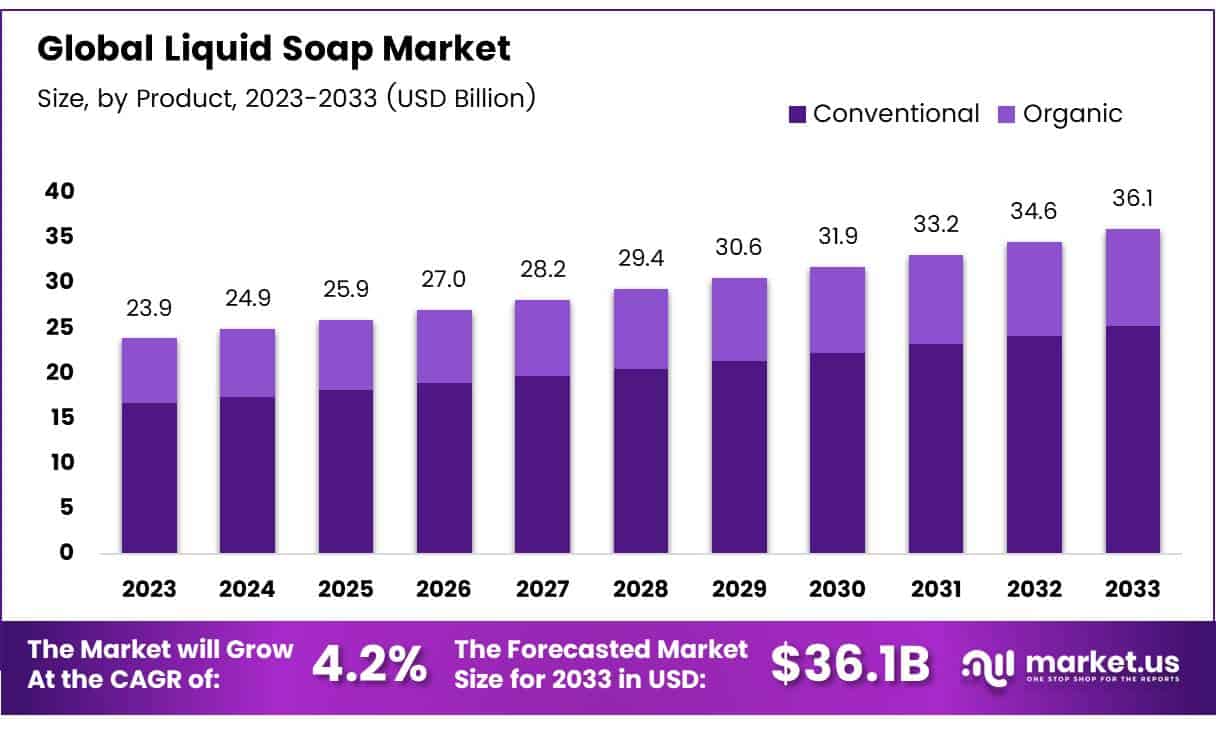

New York, NY – April 11, 2025 – The Global Liquid Soap Market is projected to reach approximately USD 36.1 billion by 2033, rising from an estimated value of USD 23.9 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2024 to 2033.

The liquid soap market comprises a dynamic segment of the global personal care and hygiene industry, focused on the manufacturing and distribution of liquid-based cleansing products used for handwashing, facial cleansing, and general sanitation. Unlike bar soap, liquid soap offers improved convenience, hygiene, and versatility, making it a preferred choice across residential, commercial, and institutional sectors.

The market is witnessing sustained growth driven by rising consumer awareness regarding personal hygiene, increasing demand for antibacterial and moisturizing formulations, and expanding middle-class populations in emerging economies. Additionally, growing concerns over skin sensitivity have led to a surge in demand for organic, paraben-free, and dermatologically tested liquid soap products. In developed markets, product innovation, premiumization, and the introduction of refillable and sustainable packaging are key trends supporting brand differentiation and consumer loyalty.

However, international trade dynamics, such as the imposition of tariffs on imported raw materials—especially in the United States have impacted manufacturing costs, prompting companies to optimize supply chains and explore local sourcing strategies. The e-commerce boom and rapid retail penetration in Asia-Pacific and Latin America are opening new avenues for market expansion, particularly in urban and semi-urban regions.

Commercial establishments such as hotels, healthcare centers, and food service outlets are also increasing their procurement of bulk-packaged liquid soaps, driven by regulatory hygiene standards and operational efficiency. As consumer preferences evolve toward eco-conscious and health-focused solutions, the liquid soap market is positioned for steady advancement, with substantial opportunities emerging from sustainable innovations and tailored product offerings in both mature and developing economies.

Key Takeaways

- The global liquid soap market is projected to reach USD 36.1 billion by 2033, expanding at a CAGR of 4.2% from 2024 to 2033, indicating steady demand growth driven by increasing hygiene awareness and consumer preferences for convenient personal care products.

- In 2023, conventional liquid soaps accounted for 72% of the total market share, primarily due to their cost-effectiveness and widespread consumer acceptance across both developed and emerging economies.

- The bath & body soaps segment led the product category in 2023 with a 60% market share, supported by their regular use in personal hygiene routines and growing popularity among consumers prioritizing skincare.

- Hypermarkets and supermarkets emerged as the leading distribution channel in 2023, driven by product variety, promotional offers, and convenient access to consumers seeking a one-stop shopping experience.

- The household segment held the largest end-use share in 2023, attributed to the versatility of liquid soaps for handwashing, bathing, and surface cleaning, aligning with evolving consumer hygiene habits.

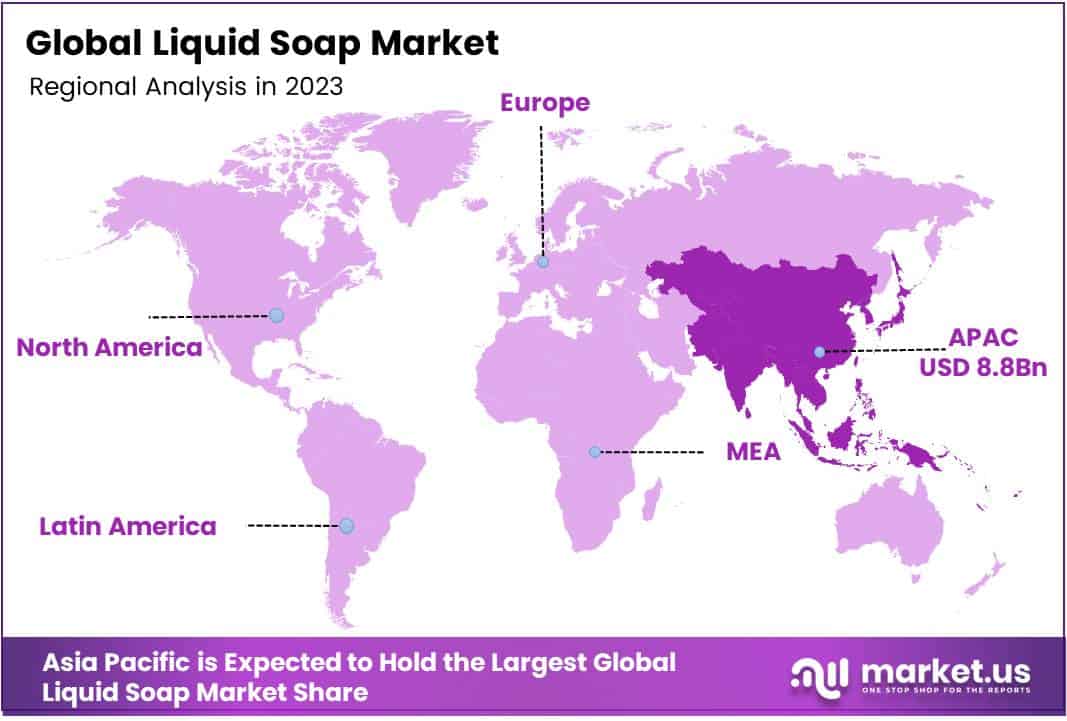

- Asia Pacific led the global market in 2023, capturing 37% of the total market share, valued at USD 8.8 billion, bolstered by rapid urbanization, population expansion, and heightened public awareness of hygiene and sanitation practices.

Trump Tariff Threat Assessment: Implications for Global Trade and Market Stability Get sample copy of this Report Here https://market.us/report/liquid-soap-market/request-sample/

Impact of U.S. Tariffs on Liquid Soap Market

Escalation in Production Costs

Tariffs on imported raw materials and packaging components have led to increased production costs for liquid soap manufacturers. For instance, Procter & Gamble, a major player in the industry, faces higher expenses due to tariffs on Chinese-made plastic hand pumps and soap ingredients, which are integral to their products like Head & Shoulders and Olay.

Supply Chain Disruptions

The tariffs have disrupted established supply chains, compelling companies to seek alternative suppliers, which is often a complex and time-consuming process. This disruption can lead to delays in product availability and increased logistics costs, affecting the overall efficiency of the liquid soap market.

Price Increases for Consumers

The additional costs incurred by manufacturers due to tariffs are frequently passed on to consumers, resulting in higher retail prices for liquid soap products. This price escalation can influence consumer purchasing decisions and potentially reduce demand.

Strategic Reassessment by Companies

In response to the financial pressures imposed by tariffs, companies are re-evaluating their sourcing strategies. This includes exploring suppliers in countries not affected by the tariffs, such as those in Southeast Asia, Europe, and South America, to mitigate cost increases and maintain competitiveness.

Impact on Market Dynamics

The increased production costs and supply chain challenges have led to shifts in market dynamics. Companies with more resilient supply chains or domestic production capabilities may gain a competitive advantage, while others may struggle to maintain market share amidst the changing economic landscape.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 23.9 Billion |

| Forecast Revenue (2033) | USD 36.1 Billion |

| CAGR (2024-2033) | 4.2% |

| Segments Covered | Reckitt Benckiser Group plc., Godrej Consumer Products, NEW AVON LLC., Procter & Gamble, Kao Chemicals, Bluemoon Bodycare, Unilever, 3M, Lion Corporation, GOJO Industries, Inc. |

| Competitive Landscape | By Product (Conventional, Organic), By Product Type (Bath and Body Soaps, Dish Wash Soaps, Laundry Soaps, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others), By End Use (Household, Conventional) |

Emerging Trends

- Preference for Natural and Organic Products: There is a growing consumer inclination towards liquid soaps formulated with natural ingredients, driven by concerns over synthetic chemicals. This trend is influencing manufacturers to develop products that are plant-based and free from harmful additives.

- Innovations in Packaging and Product Formulation: Manufacturers are investing in research and development to create liquid soaps with added benefits such as antibacterial, moisturizing, and anti-aging properties. Simultaneously, there is a focus on environmentally friendly packaging, including recyclable and biodegradable materials, to reduce environmental impact.

- Increased Hygiene Awareness: Heightened awareness of personal hygiene has led to a surge in demand for liquid soaps, particularly those with antibacterial properties. Consumers are seeking products that provide effective cleaning and protection against germs.

- Technological Advancements in Dispensers: The integration of technology into soap dispensers, such as touchless and smart dispensers, is enhancing user convenience and promoting frequent handwashing. These innovations are contributing to the growth of the liquid soap market.

- Expansion of E-commerce Channels: The rise of online retail platforms has made liquid soaps more accessible to consumers, offering a wide range of products and facilitating easy comparison and purchase. This shift is influencing purchasing behaviors and expanding market reach.

Top Use Cases

- Household Hygiene: Liquid soaps are extensively used in households for handwashing and bathing purposes, offering convenience and effective hygiene maintenance.

- Healthcare Facilities: Hospitals and clinics utilize liquid soaps to ensure high standards of hygiene, particularly in preventing the spread of infections.

- Hospitality Industry: Hotels and restaurants employ liquid soaps to maintain cleanliness and provide guests with quality hygiene products, enhancing customer satisfaction.

- Public and Commercial Spaces: Public restrooms and commercial establishments use liquid soaps in dispensers to promote hygiene among users and reduce the risk of contamination.

- Industrial Applications: Industries incorporate liquid soaps for employee hygiene and sanitation processes, ensuring compliance with health and safety regulations.

Major Challenges

- Environmental Concerns: The use of plastic packaging in liquid soaps contributes to environmental pollution, raising concerns among environmentally conscious consumers and prompting calls for sustainable alternatives.

- High Competition and Market Saturation: The liquid soap market is highly competitive, with numerous brands vying for market share, leading to price wars and the need for continuous innovation to stand out.

- Regulatory Compliance: Manufacturers must navigate complex regulations regarding product formulations and labeling, which can vary across regions and increase operational challenges.

- Consumer Price Sensitivity: In price-sensitive markets, consumers may opt for traditional bar soaps over liquid alternatives, affecting the adoption rate of liquid soaps in certain regions.

- Supply Chain Disruptions: Fluctuations in the availability and cost of raw materials can disrupt production and affect pricing strategies, posing challenges for manufacturers.

Top Opportunities

- Development of Eco-Friendly Products: There is an opportunity to innovate in creating biodegradable liquid soaps and sustainable packaging solutions to meet the demand of environmentally conscious consumers.

- Expansion into Emerging Markets: Growing awareness of hygiene in emerging economies presents a chance to introduce liquid soap products tailored to local preferences and price points.

- Product Diversification: Offering a variety of liquid soap formulations, including those with natural ingredients, specific skin benefits, and appealing fragrances, can attract a broader consumer base.

- Leveraging Digital Marketing: Utilizing online platforms and social media for marketing can increase brand visibility and engage consumers effectively, especially among younger demographics.

- Collaborations and Partnerships: Forming partnerships with retailers and other stakeholders can enhance distribution networks and facilitate market penetration.

Key Player Analysis

In the global liquid soap market in 2024, key players such as Reckitt Benckiser Group plc., Procter & Gamble, and Unilever are maintaining dominant positions through strong brand equity, extensive distribution networks, and continuous product innovation. These multinational corporations are actively expanding their product portfolios with formulations emphasizing skin health, antibacterial properties, and eco-friendly packaging, responding to rising consumer demand for hygiene and sustainability.

Similarly, companies like GOJO Industries, Inc. and 3M are leveraging institutional and healthcare partnerships to strengthen their presence in the B2B segment. Meanwhile, Asian players such as Godrej Consumer Products, Kao Chemicals, and Lion Corporation are capitalizing on regional consumer preferences and localized strategies to enhance market penetration. Emerging firms such as Bluemoon Bodycare and NEW AVON LLC. are differentiating themselves through niche offerings and digital-first retail strategies. Overall, the competitive landscape is marked by a mix of legacy strength and agile innovation, shaping a dynamic and responsive global liquid soap market.

Top Key Players in the Market

- Reckitt Benckiser Group plc.

- Godrej Consumer Products

- NEW AVON LLC.

- Procter & Gamble

- Kao Chemicals

- Bluemoon Bodycare

- Unilever

- 3M

- Lion Corporation

- GOJO Industries, Inc.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=135244

Regional Analysis

Asia Pacific Leads the Liquid Soap Market with the Largest Market Share of 37% in 2024

In 2024, Asia Pacific emerged as the leading region in the global liquid soap market, accounting for the largest market share of 37%, underpinned by a total market valuation of approximately USD 8.8 billion. This dominance is primarily attributed to rising consumer awareness regarding hygiene, increasing urbanization, and the expanding middle-class population across major countries such as China, India, Japan, and South Korea.

The region has witnessed a significant shift in consumer preferences toward liquid-based hygiene products, supported by heightened demand in both residential and commercial sectors, including healthcare, hospitality, and educational institutions.

Moreover, robust population growth combined with improving disposable incomes has led to a surge in the consumption of personal care and household hygiene products. Government initiatives promoting public health and sanitation, particularly in countries like India under programs such as Swachh Bharat Abhiyan, have further catalyzed market expansion.

Additionally, the presence of major regional and global players investing in product innovation and distribution networks has reinforced Asia Pacific’s position in the global landscape. Increasing online retail penetration and consumer adoption of e-commerce platforms have also facilitated wider access to liquid soap products, contributing to sustained market growth. With continued economic development and shifting consumer behavior, the region is anticipated to maintain its leading position in the coming years.

Recent Developments

- In 2023, Godrej Consumer Products launched its affordable liquid detergent, Godrej Fab, targeting households across South India. The product was introduced at a competitive price of INR 99 for a one-litre bottle, making it accessible to a wide consumer base. To support the launch, the company released a television commercial created by its in-house team, Lightbox. The ad featured well-known South Indian comedians VTV Ganeshan and Redin Kingsley, adding a relatable and humorous touch to the campaign.

- In 2023, Unilever introduced Lifebuoy dishwash liquid in Indonesia, marking the brand’s entry into the home care segment. This new product was designed to meet the growing demand for high-quality and budget-friendly cleaning solutions. Known for its personal care range, the Lifebuoy brand leveraged its strong reputation to bring value to the dishwash category, complementing the existing Sunlight portfolio, which holds a strong position in the market.

- In 2023, Wipro Consumer Care strengthened its personal care portfolio by acquiring three brands from VVF. This strategic move included Jo, a popular soap brand in North, East, and West India; Doy, which operates in the premium segment; and Bacter Shield, known for its antibacterial properties. Combined, these brands generated over INR 210 crore in revenue during the financial year, adding depth and diversity to Wipro’s consumer offerings.

- In July 2024, Reckitt Benckiser Group Plc announced a new organisational strategy to streamline its operations and focus on core strengths. The company revealed plans to reshape its brand portfolio and build a more efficient structure to enhance long-term performance. This approach was aimed at positioning Reckitt as a leading player in health and hygiene, with stronger margins and sustained growth.

Conclusion

The global liquid soap market is poised for steady growth, driven by increasing consumer awareness of hygiene, a shift towards natural and organic products, and advancements in product formulations and packaging. While Asia Pacific maintains a leading position due to its large population and rising health consciousness, other regions also contribute significantly to market expansion. Key industry players are focusing on innovation and strategic initiatives to meet evolving consumer preferences and maintain competitive advantage in this dynamic market landscape.