Table of Contents

Introduction

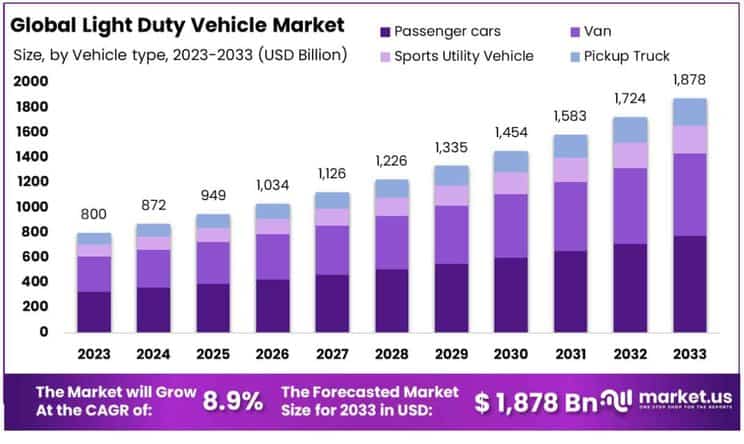

The Global Light Duty Vehicle Market is projected to reach approximately USD 1878 billion by 2033, up from USD 800.0 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 8.90% from 2024 to 2033.

Light Duty Vehicles (LDVs) are typically defined as passenger vehicles, including cars and light trucks, that have a gross vehicle weight rating (GVWR) of up to 8,500 pounds. These vehicles are primarily designed for personal transport and are characterized by their efficiency and compact size compared to heavier vehicles. The Light Duty Vehicle Market encompasses the sale and distribution of these vehicles across various segments, including sedans, SUVs, and small trucks, with a significant focus on evolving consumer preferences and technological advancements.

The growth of the Light Duty Vehicle Market is influenced by several factors, including economic growth, rising personal income levels, urbanization, and the expansion of the automotive industry in emerging economies. Additionally, environmental concerns and the increasing stringency of emission regulations are driving the demand for more fuel-efficient and environmentally friendly vehicles. This shift is further supported by technological innovations in engine design and the integration of hybrid and electric vehicles into the mainstream market. Consumer trends towards more sustainable and cost-effective personal transport options are also contributing to the growth of this sector.

Opportunities within the Light Duty Vehicle Market are abundant, particularly in the development and increased adoption of electric and hybrid vehicles. Manufacturers are investing heavily in research and development to improve battery technology and reduce costs, making these vehicles more accessible to a broader audience. Additionally, the expansion of charging infrastructure and governmental incentives are playing a crucial role in promoting the adoption of eco-friendly vehicles. Overall, the Light Duty Vehicle Market is poised for significant growth, driven by both consumer demand for more efficient vehicles and the global push towards sustainability in the automotive industry.

Key Takeaways

- The Global Light Duty Vehicle Market is projected to grow from USD 800 billion in 2023 to around USD 1878 billion by 2033, with a CAGR of 8.90% over the forecast period from 2024 to 2033.

- Passenger cars are the leading vehicle type, accounting for over 41.3% of the market.

- Gasoline is the predominant fuel type, capturing more than 71.3% of the market.

- Manual transmissions are the most common, holding more than 60.8% of the transmission segment.

- Front-wheel drive is the most frequent drivetrain option, comprising over 47.4% of its market segment.

- North America is the leading region with a 31.4% share of the market.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 800 Billion |

| Forecast Revenue (2033) | USD 1878 Billion |

| CAGR (2024-2033) | 8.90% |

| Segments Covered | By Vehicle type(Passenger cars, Van, Sports Utility Vehicle, Pickup truck), By Fuel type(Diesel, Gasoline, Hybrid, Electric), By Transmission(Manual, Automatic), By Drivetrain(Front-wheel, Rear wheel, Four wheel, All-wheel) |

| Competitive Landscape | BMW AG, Daimler AG, Fiat Chrysler Automobiles N.V, Ford Motor Company, General Motors Company, Honda Motor Company,ltd, Hyundai Motor Company, Nissan Motor Company Ltd, Subaru Corporation, Toyota Motor Corporation, AB Volvo, Aston Martin, Ferrari s.p.a |

Emerging Trends

- Electrification and Sustainability: The automotive industry is witnessing significant growth in electric vehicles (EVs) due to increased environmental awareness and advancements in technology. Electric SUVs, especially more affordable models, are gaining traction in markets like the US, where policy reforms are anticipated to boost sales.

- Technological Innovations: There is a growing integration of Advanced Driver Assistance Systems (ADAS) in light duty vehicles, enhancing the driving experience with safety features and fuel efficiency.

- Increasing Demand for Commercial Use: Light duty trucks are increasingly used in commercial settings, reflecting a broader trend of vehicles being tailored for specific industrial applications.

Top Use Cases

- Personal and Office Use: Passenger cars dominate the light duty vehicle segment, driven by their use in personal transport and for business commuting.

- Commercial Applications: The expansion of pickup trucks in the construction and logistics sectors highlights their utility in more rugged, practical roles.

Major Challenges

- Volatility in Raw Materials Prices: Fluctuating prices for essential manufacturing materials are causing cost pressures on manufacturers, which can impede market growth as production costs rise.

- Regulatory and Supply Chain Issues: Larger EVs face sustainability and supply chain challenges due to their larger batteries and the minerals required for them.

Top Opportunities

- Expansion into Emerging Markets: The increasing affordability and popularity of electric vehicles, particularly in China, present significant growth opportunities.

- Technological Advancements in Vehicles: Innovations such as AI integration and IoT connectivity in light duty vehicles are opening new avenues for market expansion

Key Player Analysis

In 2024, the Global Light Duty Vehicle Market remains highly competitive, driven by innovation, sustainability, and evolving consumer preferences. BMW AG and Daimler AG continue to lead the luxury and electric vehicle (EV) segments, focusing on premium electric mobility. Fiat Chrysler Automobiles N.V., now part of Stellantis, strengthens its global presence through strategic partnerships and electrification. Ford Motor Company and General Motors Company push forward with aggressive EV strategies, leveraging technology and infrastructure investments.

Honda Motor Company, Ltd., Hyundai Motor Company, and Nissan Motor Company Ltd. maintain strong positions through hybrid and fuel-efficient models. Toyota Motor Corporation, a dominant force, expands hybrid and hydrogen fuel cell technologies. Subaru Corporation remains niche-focused with AWD and safety innovations. AB Volvo advances sustainable transport with electric trucks and SUVs. Luxury brands like Aston Martin and Ferrari S.p.A. embrace electrification while maintaining performance-driven branding. Together, these players shape the future of light-duty vehicles with sustainability, technology, and consumer-driven advancements.

Top Маrkеt Кеу Рlауеrѕ

- BMW AG

- Daimler AG

- Fiat chrysler Automobiles N.V

- Ford Motor Company

- General Motors Company

- Honda motor company,ltd

- Hyundai motor company

- Nissan Motor Company Ltd

- Subaru Corporation

- Toyota motor corporation

- AB Volvo

- Aston Martin

- Ferrari s.p.a

Regional Analysis

North America Leads the Light Duty Vehicle Market with the Largest Market Share of 31.4% in 2024

The North American region is set to dominate the light duty vehicle market, accounting for 31.4% of the global market share in 2024. This region’s market value is projected to reach USD 521.2 billion, driven by robust automotive industry infrastructure and increasing consumer demand for light duty vehicles. Factors contributing to this growth include advanced manufacturing techniques, stringent environmental regulations promoting the adoption of eco-friendly vehicles, and a strong presence of leading automotive manufacturers.

Moreover, the rise in urbanization and the growing need for personal mobility solutions further fuel the demand for light duty vehicles in North America. This region’s dominance in the market is also bolstered by significant investments in electric and hybrid vehicle technologies, aimed at reducing carbon emissions and enhancing fuel efficiency. As such, North America not only leads in market share but also in pioneering advancements that define the global light duty vehicle landscape.

Recent Developments

- In 2025, Alliance for Automotive Innovation released new data on the U.S. electric vehicle market, providing an in-depth state-by-state analysis for Q3 2024. The Get Connected Electric Vehicle Report highlights EV sales, market trends, and powertrain share from 2016 to 2024. It also examines California’s Advanced Clean Cars II (ACC II) program and its impact on other states.

- In 2024, REE Automotive (NASDAQ: REE) and Motherson Group (IN: MOTHERSON) entered a strategic agreement to enhance EV production. Motherson will manage supply chain operations and support the assembly of REEcorner® and REE P7 electric trucks, the first full by-wire, software-driven medium-duty electric truck. Additionally, Motherson will appoint a director to REE’s board.

- In 2025, ZEEKR Intelligent Technology Holding Limited (NYSE: ZK) completed strategic integration transactions with Geely entities. This move makes Lynk & Co an indirect non-wholly-owned subsidiary of Zeekr, strengthening its position in the premium new energy vehicle sector.

- In 2024, Stellantis N.V. introduced STLA Large, a flexible BEV-native platform designed for global markets. This new platform supports high-performance, energy-efficient, and off-road capable vehicles. It will first be used for Dodge and Jeep® models in North America, followed by Alfa Romeo, Chrysler, and Maserati, with eight models set to launch between 2024 and 2026.

Conclusion

The Global Light Duty Vehicle Market is poised for substantial growth in the coming decade, driven by technological advancements, evolving consumer preferences, and a global shift towards sustainable transportation solutions. The increasing adoption of electric and hybrid vehicles, bolstered by innovations in battery technology and expanded charging infrastructure, is transforming the market landscape. Additionally, the integration of Advanced Driver Assistance Systems (ADAS) is enhancing vehicle safety and efficiency, meeting the rising demand for modern features among consumers. However, challenges such as fluctuating raw material prices and supply chain complexities persist, necessitating strategic planning and investment from manufacturers. Overall, the market’s trajectory indicates a dynamic evolution, with opportunities emerging from technological integration and a collective move towards environmentally friendly vehicle options.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)