Table of Contents

Introduction

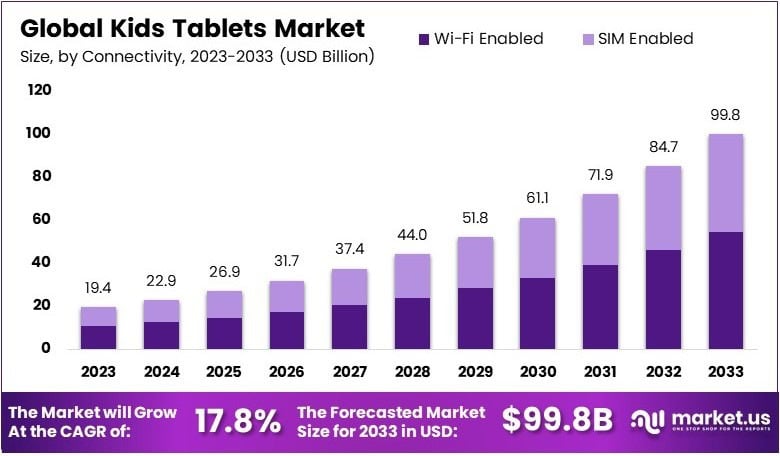

The Global Kids Tablets Market is projected to reach approximately USD 99.8 billion by 2033, rising from an estimated value of USD 19.4 billion in 2023. This growth reflects a robust compound annual growth rate (CAGR) of 17.8% during the forecast period spanning from 2024 to 2033.

Kids tablets refer to specially designed digital devices tailored for children, typically featuring robust parental controls, age-appropriate content, durable construction, and user-friendly interfaces. These devices aim to combine entertainment with education, offering access to e-learning apps, games, videos, and books in a secure and controlled environment.

The kids tablets market refers to the global industry involved in the production, distribution, and sale of these child-centric devices. It encompasses a range of stakeholders including manufacturers, software developers, educational content providers, and retail distributors. The growth of the kids tablets market is being driven by several key factors, including the increasing digitization of education, rising parental awareness regarding early childhood development through technology, and a surge in remote learning initiatives, especially in the post-pandemic era.

Additionally, growing household spending on educational tools and entertainment devices for children further contributes to the rising demand. Emerging markets are witnessing a notable uptick in product adoption, supported by increasing internet penetration and the availability of low-cost tablets. Moreover, manufacturers are investing in the integration of artificial intelligence and adaptive learning features, enhancing the educational value proposition of these devices.

The opportunity landscape is further bolstered by government initiatives in several countries promoting digital literacy among young learners. Furthermore, partnerships between educational institutions and technology firms are likely to expand the application scope of kids tablets beyond home use to schools and learning centers. These combined factors are expected to create a favorable environment for sustained market growth over the coming years.

Key Takeaways

- The Kids Tablets Market was valued at USD 19.4 billion in 2023 and is projected to reach USD 99.8 billion by 2033, expanding at a robust CAGR of 17.8% during the forecast period.

- Wi-Fi Enabled Tablets emerged as the leading segment, accounting for 54.3% of the market share in 2023, reflecting user preference for wireless connectivity and cost-effective internet access.

- Tablets with 1 GB and Above RAM dominated the RAM size segment, securing 66.3% of the market share. This trend highlights the increasing demand for higher-performing devices to support gaming, multimedia, and educational applications.

- The Android OS led the operating system segment with a 72.4% share in 2023, attributed to its affordability, diverse device options, and strong developer ecosystem.

- Educational Tablets held a dominant 60.5% share of the application segment, underlining their growing role in supporting interactive and digital learning environments for children.

- The 5 to 10 Years age group represented the largest share among end users, comprising 61.3% of the market in 2023, indicating a strong adoption of tablets in early learning and entertainment for school-aged children.

Kids Tablets Statistics

- 58% of moms said technology helped their kids stay connected with friends during the pandemic.

- 62% of parents feel guilty about giving devices to their kids.

- Nearly 80% of parents want a tablet with easy control over settings.

- 80% of parents feel more confident buying a device if they can manage it from their own phone.

Obtain A Sample Copy Of This Report at https://market.us/report/kids-tablets-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 19.4 Billion |

| Forecast Revenue (2033) | USD 99.8 Billion |

| CAGR (2024-2033) | 17.8% |

| Segments Covered | By Connectivity (Wi-Fi Enabled, SIM Enabled), By RAM Size (Less Than 1 GB, 1 GB and Above), By Operating System (Android, iOS, Windows), By Purpose (Entertainment, Educational), By End-User (Less Than 5 Years, 5 to 10 Years, 10 to 15 Years) |

| Competitive Landscape | Amazon (Fire Tablets), Apple (iPad, iPad Mini), Samsung Electronics (Galaxy Tab series), LeapFrog Enterprises (LeapPad), Kurio (TechnoSource), Fuhu ( nabi Tablets), VTech Electronics (InnoTab series), Archos (Kids Tablets), Huawei (MatePad T series), Lenovo (Tab M series), Mattel (Fisher-Price Smart Tablet), Pritom (Kids Tablets), Asus (ZenPad for Kids), TCL (Tab 10 Kids), Ematic (Kids Tablets) |

Emerging Trends

- Integration of Educational Content: Manufacturers are increasingly embedding educational applications and interactive learning tools into children’s tablets to enhance digital literacy from an early age.

- Enhanced Parental Controls: Advanced parental control features are being incorporated, allowing caregivers to monitor and restrict content, ensuring a safe digital environment for children.

- Durable and Child-Friendly Designs: There is a growing emphasis on creating robust devices with ergonomic designs tailored to withstand rough usage by children.

- Increased Adoption of 5G Connectivity: The introduction of 5G-enabled tablets facilitates faster internet speeds, improving streaming and interactive experiences for educational and entertainment purposes.

- Focus on Affordable Pricing: Manufacturers are offering cost-effective models to cater to a broader demographic, ensuring accessibility to digital learning tools across various economic segments.

Top Use Cases

- Educational Applications: Tablets serve as platforms for interactive learning apps, aiding in subjects like mathematics, language, and science through engaging content.

- Entertainment Purposes: Devices are utilized for streaming child-friendly videos, playing games, and reading e-books, providing a source of entertainment.

- Remote Learning: Tablets facilitate virtual classrooms and online assignments, becoming essential tools in distance education scenarios.

- Creative Development: Applications that encourage drawing, music creation, and storytelling help in nurturing creativity among children.

- Communication: With appropriate controls, tablets enable video calls and messaging, allowing children to stay connected with family members.

Major Challenges

- Screen Time Management: Excessive use of tablets raises concerns about screen time and its impact on children’s health and development.

- Content Safety: Ensuring access to age-appropriate and safe content remains a challenge for parents and manufacturers alike.

- Digital Literacy Gap: Variations in digital literacy among parents can affect the effective utilization and monitoring of children’s tablet usage.

- Affordability Issues: Despite efforts to produce cost-effective models, high-quality tablets may still be unaffordable for certain segments, limiting accessibility.

- Rapid Technological Obsolescence: Fast-paced technological advancements can render devices obsolete quickly, posing challenges for consumers to keep up with the latest features.

Top Opportunities

- Development of Multilingual Content: Creating content in various languages can cater to a diverse user base, enhancing learning experiences for children from different linguistic backgrounds.

- Collaboration with Educational Institutions: Partnering with schools to integrate tablets into curricula can expand market reach and reinforce the educational value of these devices.

- Incorporation of Augmented Reality (AR): Utilizing AR can provide immersive learning experiences, making complex subjects more accessible and engaging.

- Focus on Special Needs Education: Designing tablets with features tailored for children with special needs can address an underserved segment, promoting inclusive education.

- Expansion into Emerging Markets: Targeting developing regions with affordable and durable tablets can tap into new customer bases, driving market growth.

Key Player Analysis

In 2024, the Global Kids Tablets Market continues to be shaped by a diversified group of players, each leveraging distinct technological capabilities, brand strength, and child-centric features to secure market share. Amazon maintains a dominant position with its Fire Tablets, owing to robust parental controls, curated content via Amazon Kids+, and competitive pricing. Apple’s iPad and iPad Mini, although priced at a premium, remain highly preferred for their intuitive interface, high-performance hardware, and strong app ecosystem.

Samsung’s Galaxy Tab series sustains relevance with customizable child modes and durable designs. LeapFrog Enterprises and VTech Electronics, with their LeapPad and InnoTab series respectively, focus heavily on educational content, appealing to parents prioritizing learning. Kurio, Fuhu (nabi), and Ematic cater to budget-conscious segments while offering essential safety features. Huawei, Lenovo, and TCL drive growth in emerging markets through localized content and affordable pricing. Mattel, Asus, Archos, and Pritom also contribute niche innovations, enhancing market competitiveness through targeted functionality.

Top Key Players in the Market

- Amazon (Fire Tablets)

- Apple (iPad, iPad Mini)

- Samsung Electronics (Galaxy Tab series)

- LeapFrog Enterprises (LeapPad)

- Kurio (TechnoSource)

- Fuhu (nabi Tablets)

- VTech Electronics (InnoTab series)

- Archos (Kids Tablets)

- Huawei (MatePad T series)

- Lenovo (Tab M series)

- Mattel (Fisher-Price Smart Tablet)

- Pritom (Kids Tablets)

- Asus (ZenPad for Kids)

- TCL (Tab 10 Kids)

- Ematic (Kids Tablets)

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=133917

Regional Analysis

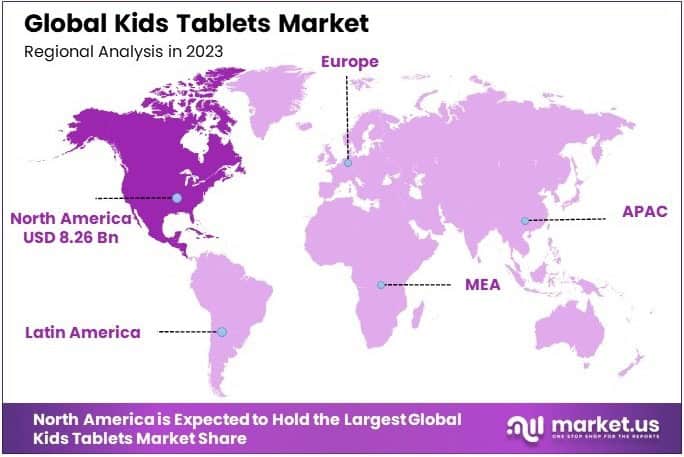

North America Leads the Global Kids Tablets Market with the Largest Market Share of 42.6% in 2024

In 2024, North America emerged as the leading region in the global kids tablets market, accounting for a substantial market share of 42.6%, which corresponds to a market valuation of approximately USD 8.26 billion. This dominance can be attributed to the region’s high penetration of digital learning technologies, widespread internet accessibility, and strong consumer spending on educational electronics.

The presence of prominent market players and early adoption of e-learning tools among children aged 3–12 have significantly contributed to the expansion of the kids tablets segment in the United States and Canada. Additionally, robust parental awareness regarding child-safe digital content and rising integration of educational apps in school curricula have supported sustained demand across the region.

Recent Developments

- In 2025, Buffalo Games expanded its digital footprint by acquiring an Ohio-based company that makes children’s writing tablets. The move supports Buffalo’s strategy to combine creative play with interactive technology. CEO Nagendra Raina noted the deal aligns with their long-term plans. Previously, the company offered a licensed tablet, but this acquisition now allows Buffalo to bring such products fully in-house.

- In 2024, AT&T introduced its first kids’ tablet, the amiGO Jr. Tab™, along with a custom app built for parental control. The launch reflects a growing demand for child-safe digital environments. The tablet helps parents manage screen time and content, ensuring children can explore the digital world safely and responsibly.

- In 2024, EPIC Foundation launched India’s first AI-powered education tablet, MILKYWAY, built with local innovation in mind. Developed in partnership with VVDN Technologies, MediaTek India, and CoRover.ai, the tablet is designed to be both repairable and upgradable. This approach supports digital learning while also addressing concerns related to electronic waste and accessibility.

- In 2024, Apple revealed a new iPad mini powered by the A17 Pro chip and Apple Intelligence. The device features an 8.3-inch Liquid Retina display and enhanced performance for demanding tasks. New features include improved photo capabilities, document scanning, and compatibility with Apple Pencil Pro, giving users more tools for productivity and creativity.

Conclusion

The kids tablets market is experiencing significant growth, driven by the increasing integration of educational content, enhanced parental controls, and child-friendly designs. Manufacturers are embedding interactive learning tools to promote digital literacy, while advanced parental controls ensure a safe digital environment. Durable designs cater to children’s usage patterns, and the adoption of 5G connectivity enhances streaming and interactive experiences. Affordability remains a focus, expanding access across various economic segments. However, challenges such as managing screen time, ensuring content safety, and addressing rapid technological obsolescence persist. Opportunities lie in developing multilingual content, collaborating with educational institutions, incorporating augmented reality, and focusing on special needs education. Key players like Amazon, Apple, and Samsung continue to innovate, while regional analysis indicates North America’s leading market share. Overall, the market is poised for continued expansion, reflecting a balance between technological advancements and the need for responsible usage.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)