Table of Contents

Introduction

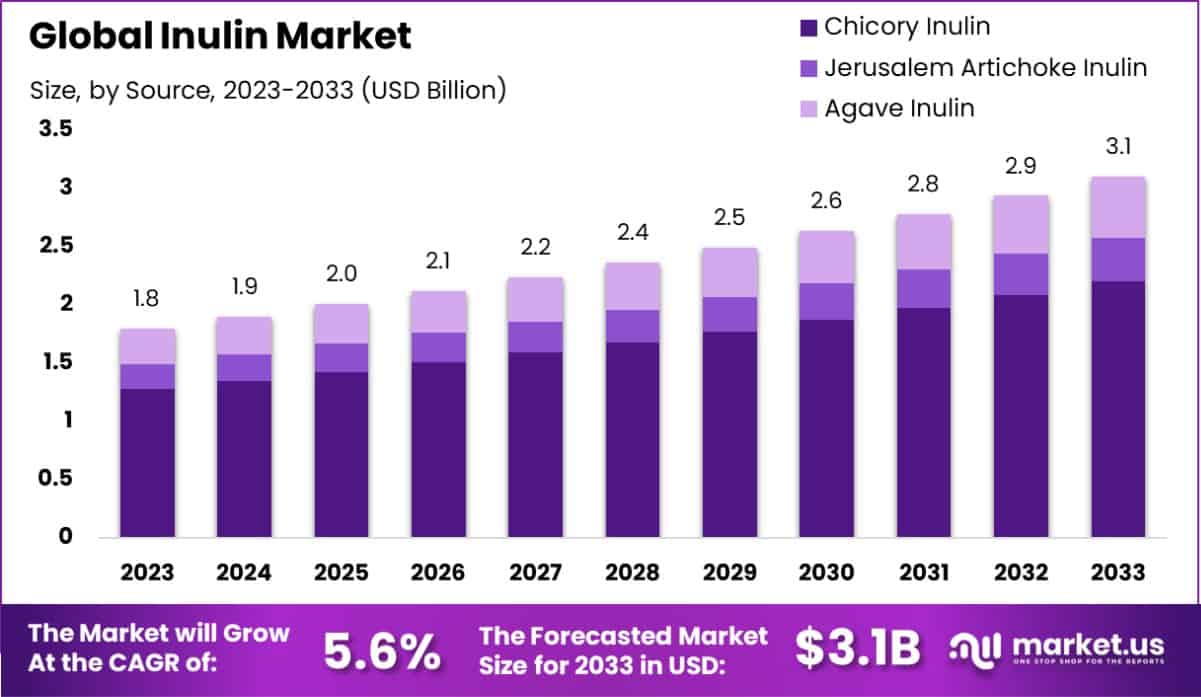

New York, NY – February 17, 2025—The global Inulin Market is projected to experience significant growth. Its value is expected to reach approximately USD 3.1 billion by 2033, up from USD 1.8 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2033.

This growth is primarily driven by the increasing consumer preference for natural and organic ingredients. Inulin is a plant-based soluble fiber known for its health benefits, including improved digestive health and reduced cholesterol levels. The rising health consciousness among consumers has led to a surge in demand for functional foods and beverages, dietary supplements, and pharmaceuticals incorporating inulin.

Additionally, the growing prevalence of digestive disorders and obesity has created opportunities for inulin as a dietary supplement. The dairy and confectionery industries are leveraging inulin’s fat-replacing properties to develop low-fat and sugar-free products with improved texture and taste. Furthermore, the increasing adoption of plant-based diets and the demand for clean-label products are contributing to the market’s expansion. As a result, the inulin market is poised for substantial growth, driven by these factors and the expanding applications of inulin across various industries.

Key Takeaways

- The Global Inulin Market is expected to be worth around USD 3.1 Billion by 2033, up from USD 1.8 Billion in 2023, and grow at a CAGR of 5.6% from 2024 to 2033.

- The Inulin market is predominantly driven by chicory inulin, accounting for 71.2% of the share.

- Conventional inulin leads the market with a significant 69.1% share, reflecting widespread consumer preference.

- Serving as a bifidus-promoting agent, inulin dominates with a 48.1% market share by function type.

- Powdered inulin represents a remarkable 78.6% share, showcasing its popularity in diverse formulations and industries.

- The food and beverages sector holds the highest application share at 59.1%, driving consistent growth.

- Indirect sales channels dominate the market with a 67.1% share, underlining their importance in distribution networks globally.

- In 2023, North America’s inulin market captured 47.1%, valued at USD 0.8 billion.

Report Scope

| Market Value (2024) | USD 1.8 Billion |

| Forecast Revenue (2034) | USD 3.1 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Source (Chicory Inulin, Jerusalem Artichoke Inulin, Agave Inulin), By Nature (Organic, Conventional), By Function Type (Bifdus Promoting Agent, Fiber Enhancer, Sugar Alternative, Fat Alternative or Replacer, Others), By Form (Liquid, Powder), By Application (Food and Beverages, Dietary Supplements, Animal Feed Additive, Others), By Sales Channel (Direct Sales, Indirect Sales) |

| Competitive Landscape | Archer Daniels Midland Co., BENEO GmbH, Cargill Incorporated, Cosucra Groupe Warcoing SA, Dow DuPont, Eli Lilly Company, FMC Corporation, Green Labs LLC, Jarrow Formulas, Koninklijke DSM N.V., Novo Nordisk, PMV Nutrient Products PVT Ltd., Qingdao Oriental Tongxiang International Trading Co. Ltd., S Cargill Incorporated, Sensus B.V., Steviva Brands, Inc., Sudzucker Group, Tate & Lyle PLC, Tereos S.A., The IIDEA Company, TIC Gums, Tierra Group, TrooFoods Ltd. |

Emerging Trends

- Increased Demand for Dietary Fiber: Consumers are becoming more health-conscious, leading to a higher demand for dietary fiber. Inulin, a naturally soluble fiber, is gaining popularity as a supplement to support digestive health and overall well-being.

- Natural Sweetener in Food and Beverages: Inulin is being utilized as a natural sweetener in various food and beverage products. Its ability to enhance sweetness while providing health benefits makes it an attractive alternative to traditional sugars.

- Functional Foods and Nutraceuticals: The rise in health awareness has spurred the development of functional foods and nutraceuticals incorporating inulin. These products offer added health benefits, such as improved gut health and weight management.

- Sugar Reduction in Confectionery: Inulin is being used to reduce sugar content in confectionery items like chocolates and sweets. This trend caters to the growing consumer preference for healthier, lower-sugar options without compromising taste.

- Inclusion in Baby and Pet Foods: There is an emerging trend of incorporating inulin into baby and pet foods. This inclusion aims to provide digestive health benefits to these sensitive populations, expanding the market for inulin-based products.

Use Cases

- Digestive Health Enhancement: Inulin serves as a prebiotic, promoting the growth of beneficial gut bacteria. This supports digestive health by improving bowel regularity and alleviating constipation. Additionally, it may aid in managing irritable bowel syndrome (IBS) symptoms.

- Blood Sugar Regulation: Inulin has a minimal impact on blood sugar levels, making it beneficial for individuals managing diabetes. It can help stabilize blood glucose by slowing carbohydrate digestion and absorption.

- Weight Management: By increasing feelings of fullness, inulin can assist in controlling appetite and reducing overall calorie intake, thereby supporting weight loss efforts.

- Bone Health Improvement: Inulin enhances the absorption of essential minerals like calcium and magnesium, contributing to stronger bones and potentially reducing the risk of osteoporosis.

- Heart Health Support: Regular consumption of inulin may help lower cholesterol levels, particularly LDL (bad) cholesterol, thereby supporting cardiovascular health.

Major Challenges

- Availability of Substitutes: Alternative ingredients like oligofructose offer similar health benefits and functionalities as inulin. These substitutes are often more cost-effective and widely available, posing a competitive threat to the inulin market.

- Supply Chain Constraints: The cultivation of inulin-rich plants is limited by geographic and climatic factors, leading to supply fluctuations. This variability can result in difficulties meeting consistent demand and may affect pricing stability.

- Regulatory Compliance: Navigating diverse regulatory frameworks and labeling requirements for inulin and dietary fibers across different regions can be complex. Non-compliance risks and the need for continuous monitoring can pose challenges for manufacturers.

- Consumer Awareness and Education: While awareness of insulin’s health benefits is growing, there is still a need for consumer education to address misconceptions and promote wider acceptance. Effective communication strategies are essential to inform consumers about the advantages of inulin.

- Competition from Alternative Ingredients: The presence of other ingredients with similar health benefits, such as other prebiotics and dietary fibers, intensifies competition. This rivalry can affect market share and necessitate differentiation strategies.

Market Growth Opportunities

- Functional Foods and Beverages: Inulin’s versatility as a prebiotic and fat replacer makes it valuable in developing functional foods and beverages. Its ability to enhance digestive health and improve product texture aligns with the growing consumer demand for health-oriented food options.

- Dietary Supplements: The increasing health consciousness among consumers is driving the demand for dietary supplements. Inulin’s role in supporting digestive health and weight management positions it as a key ingredient in this expanding market.

- Pharmaceutical Applications: Inulin’s prebiotic properties and potential health benefits open avenues for its use in pharmaceutical formulations. Its inclusion in drug delivery systems and as a component in nutraceuticals offers promising growth prospects.

- Plant-Based and Vegan Products: With the rise of plant-based and vegan diets, inulin’s plant-derived nature makes it an attractive ingredient. Its applications in vegan dairy alternatives, meat substitutes, and other plant-based products are expanding, catering to a growing market segment.

- Personal Care and Cosmetics: Inulin’s moisturizing and skin-conditioning properties are being recognized in the personal care industry. Its inclusion in skincare and haircare products offers opportunities for growth in this sector.

Recent Developments

1. Archer Daniels Midland Co. (ADM)

- Recent Developments:

- Partnerships: ADM partnered with a leading probiotics company in 2023 to develop synbiotic products combining probiotics and prebiotics like inulin.

- Sustainability Initiatives: ADM has been working on sustainable sourcing of chicory root, a primary raw material for inulin, as part of its 2025 sustainability goals.

- Contribution to the Inulin Sector:

- Increased production capacity for inulin-based ingredients.

- Development of innovative synbiotic products combining inulin with probiotics.

2. BENEO GmbH

- Recent Developments:

- Acquisition: In 2022, BENEO acquired a majority stake in a European chicory root processor to secure its supply chain for inulin production.

- Innovation: BENEO launched a new organic inulin product in 2023, targeting the organic food and beverage market.

- Partnerships: Collaborated with a major European dairy company in 2023 to develop lactose-free dairy products fortified with inulin.

- Contribution to the Inulin Sector:

- The strengthened supply chain for chicory-based inulin.

- Expanded product portfolio with organic inulin options.

3. Cargill Incorporated

- Recent Developments:

- Innovation: In 2023, Cargill introduced a new low-calorie sweetener blend combining inulin with stevia, targeting the health-conscious consumer market.

- Partnerships: Partnered with a leading bakery brand in 2023 to develop high-fiber bread using inulin.

- Contribution to the Inulin Sector:

- Enhanced production capacity for inulin in Europe.

- Development of innovative inulin-based sweeteners and bakery products.

4. Cosucra Groupe Warcoing SA

- Recent Developments:

- Innovation: The company launched a new water-soluble inulin product in 2022, designed for use in clear beverages and functional drinks.

- Sustainability: Cosucra has been certified for its sustainable chicory farming practices under the EU’s Farm to Fork Strategy.

- Contribution to the Inulin Sector:

- Increased production capacity and improved product versatility.

- Promoted sustainable farming practices for chicory.

5. DowDuPont (Corteva Agriscience)

- Recent Developments:

- Innovation: DowDuPont’s nutrition division launched a new inulin-based ingredient in 2022 for use in plant-based meat alternatives.

- Partnerships: In 2023, the company partnered with a major food manufacturer to develop high-fiber snacks using inulin.

- Research: DowDuPont has been actively involved in research on the health benefits of inulin, particularly its role in gut health and immune support.

- Contribution to the Inulin Sector:

- Expanded applications of inulin in plant-based foods and snacks.

- Advanced research on the health benefits of inulin.

Conclusion

The Inulin Market is poised for substantial growth, driven by increasing consumer demand for natural and functional ingredients across various industries. Inulin’s versatility as a prebiotic, fat replacer, and dietary fiber positions it favorably in sectors such as food and beverages, dietary supplements, and pharmaceuticals. The rising health consciousness among consumers, coupled with the growing prevalence of digestive disorders and obesity, further propels the demand for inulin-based products. Additionally, the shift towards plant-based diets and clean-label products presents new opportunities for inulin applications. However, challenges such as supply chain constraints, competition from alternative ingredients, and the need for consumer education remain. Addressing these challenges through strategic innovation, effective communication, and sustainable sourcing will be crucial for stakeholders aiming to capitalize on the expanding inulin market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)