Table of Contents

Introduction

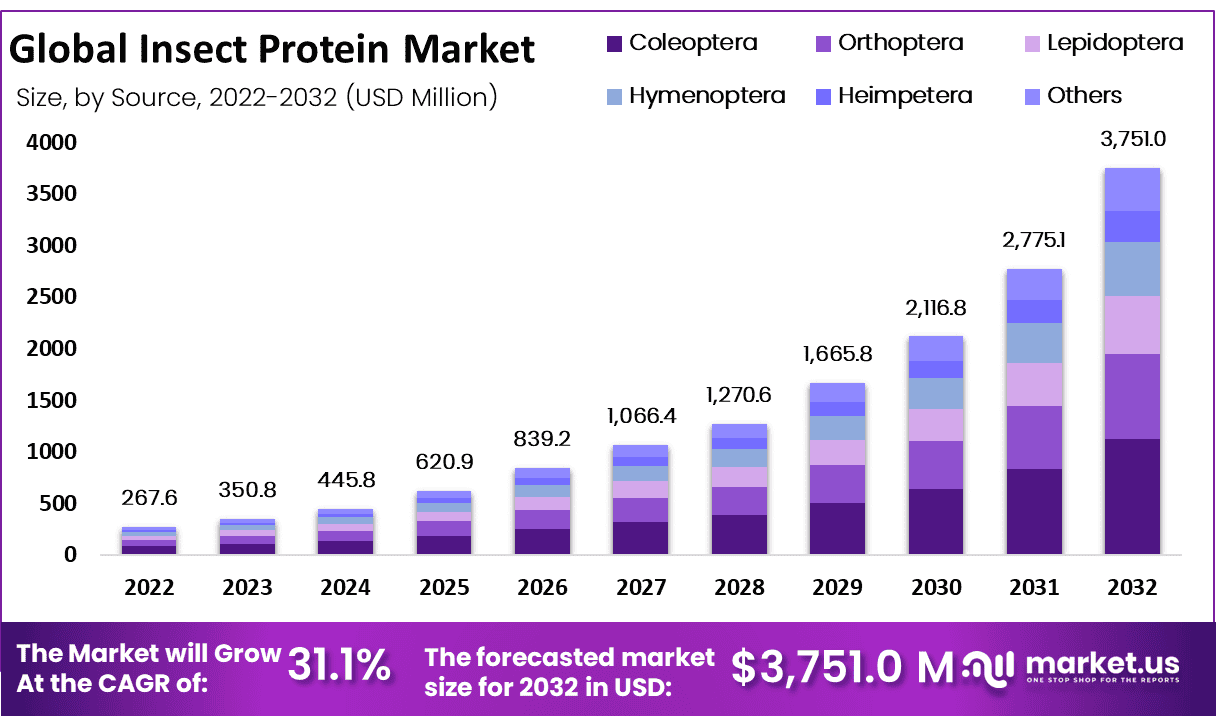

The global insect protein market is experiencing significant growth, projected to rise from USD 267.6 million in 2022 to USD 3,715.0 million by 2032, reflecting a robust compound annual growth rate (CAGR) of 31.10%. This growth is driven by increasing consumer awareness of the health benefits and environmental advantages associated with insect protein. Sourced from crickets, mealworms, and black soldier flies, insect protein is emerging as a sustainable alternative due to its high protein content and eco-friendly production process, making it an attractive option for both human consumption and animal feed.

Despite its promising potential, the market still faces notable challenges. Inadequate regulatory frameworks in several regions create barriers to market expansion and acceptance. Furthermore, cultural perceptions and consumer preferences vary greatly across the globe, slowing down the adoption of insect-based products, particularly in regions where the consumption of insects is not traditionally accepted.

Recent developments indicate a growing industry focus on overcoming these challenges through strategic investments and innovation. Major players such as Aspire Food Group and EnviroFlight LLC are scaling up their production facilities to meet increasing demand.

Additionally, the market has witnessed a surge in startups entering the space, driving innovation and diversifying the applications of insect protein into sectors such as food and beverages, pharmaceuticals, and cosmetics. These advancements highlight the market’s growing potential and its role in supporting sustainable nutrition and industry solutions.

Aspire Food Group has made significant strides in the insect protein market by acquiring Exo, a company renowned for its cricket-based protein bars. This strategic move allows Aspire to enhance its product portfolio and seamlessly integrate Exo’s offerings with its advanced cricket farming operations. The acquisition is aimed at developing innovative products, expanding market reach, and driving growth for both companies while contributing to the broader industry’s development.

Similarly, EnviroFlight LLC has been scaling up its operations, with a major milestone achieved in 2019 when it launched its first commercial production facility in Kentucky. This facility marked a crucial advancement in increasing the production of black soldier fly-derived protein, further solidifying EnviroFlight’s position as a leading player in the growing insect protein market.

Insect Protein Statistics

Nutritional Efficiency and Content

- Protein Content: Ranges from 30% to 85% (dry matter), surpassing traditional sources like milk (30%), eggs (52%), beef (50%), and soybeans (45%).

- Digestibility: Comparable to animal protein, with a range of 76-96%.

- Energy Value: Varies from 293 to 777 kcal per 100 g (dry matter), depending on fat content and development stage.

- Fat Content:

- Grasshoppers, crickets, locusts: 13.4%

- Beetles and larvae: 33.4%

- High-Protein Example: House cricket (Acheta domesticus) contains 65% protein (dry matter).

Sustainability and Production Advantages

- Efficiency: Insects are 36 times more feed-efficient than cattle.

- Resource Use:

- Land: Only 1 square meter needed for 1 kilogram of insect protein.

- Feed: 2 kilograms of feed produce 1 kilogram of insect mass.

- Global Demand: By 2100, the population will reach 11 billion, requiring 50-75% more food by 2050 to combat hunger, which could affect 830 million to 1.09 billion people.

Global Consumption and Acceptance

- Adoption: Approximately 2 billion people consume edible insects worldwide.

- Species: Over 2,100 species are consumed, with 470 species in Africa alone.

- Consumer Attitudes: Around 35-40% are open to consuming insects as food.

Emerging Trends

Diversification of Insect Protein Applications: The insect protein market is experiencing significant growth, driven by increasing consumer awareness of its health benefits, sustainability, and technological advancements in food production. While traditionally used in animal feed, insect protein is now diversifying into human food products such as snacks, protein bars, and bakery items. This expansion is supported by its high protein content and eco-friendly advantages, including significantly lower land and water requirements compared to conventional livestock protein sources.

Emergence in Food and Beverage Industry: A key trend shaping the market is the growing incorporation of insect protein into mainstream food and beverages. Products like pasta, burgers, and functional foods now include insect protein as an ingredient, appealing to health-conscious consumers due to its high digestibility and nutrient density. Advancements in processing technologies are playing a pivotal role by making insect proteins more palatable, versatile, and suitable for a variety of culinary applications, further driving consumer acceptance.

Regulatory Support and Market Expansion: Regulatory developments, particularly in Europe, are fostering market growth by approving insect proteins for human consumption. This supportive regulatory environment has encouraged more companies to enter the sector and innovate new products. As consumers become increasingly aware of the nutritional and environmental benefits of insect-based foods, their integration into everyday diets is expected to rise, further propelling market demand.

Investments and Startups Fueling Growth: The market is witnessing significant investments and the emergence of numerous startups focused on expanding insect protein production and applications. These investments are accelerating innovation and scalability, opening substantial opportunities in both human food and animal nutrition sectors. Collectively, these factors highlight a strong growth trajectory for the insect protein market, with immense potential for innovation, sustainability, and widespread adoption.

Use Cases

Insect Protein in Animal Nutrition: Insect protein plays a vital role in animal feed due to its exceptional nutritional value, particularly in aquaculture and poultry feed. Its high digestibility and balanced amino acid profile make it an ideal ingredient for meeting the dietary needs of fish and poultry. This growing adoption is largely driven by the sustainability of insect farming, which provides an eco-friendly alternative to conventional feed sources like fishmeal and soybean meal. By reducing reliance on resource-intensive feed production, insect protein supports both animal health and environmental sustainability.

Growing Demand in Food and Beverages: The food and beverage industry is witnessing a surge in demand for insect protein as consumers seek sustainable and nutritious alternatives. Insect protein is being incorporated into a variety of food products, including protein bars, bakery items, and even pastas, due to its versatility and high protein content. This trend reflects the rising consumer interest in environmentally friendly food options that are rich in essential nutrients. As technological advancements improve the processing and palatability of insect protein, its integration into mainstream food products continues to gain momentum.

Pharmaceuticals and Supplements: The pharmaceutical and dietary supplement sectors are beginning to leverage insect protein for its unique health benefits. Rich in protein and bioactive components like lauric acid and chitin, insect protein offers properties that support immune function and promote gut health. These qualities make it a valuable ingredient in functional foods and dietary supplements aimed at improving overall well-being. With growing interest in natural and nutrient-dense health solutions, insect protein is increasingly recognized for its therapeutic potential.

Applications in Personal Care and Cosmetics: Insect protein is emerging as a promising ingredient in the personal care and cosmetics industry, thanks to its amino acid profile and anti-inflammatory properties. These characteristics make it ideal for skin health applications, where it can help improve hydration, elasticity, and repair. The growing trend toward sustainable and natural ingredients in personal care products further supports the adoption of insect protein in cosmetics. Its ability to address skincare needs while aligning with eco-conscious practices positions insect protein as an innovative solution for the beauty industry.

Major Challenges

Cultural Resistance and Consumer Acceptance: In many Western societies, consuming insects is uncommon and often met with aversion. Surveys reveal that a significant portion of the population is hesitant to include insects in their diet. For example, a study presented at the European Congress on Obesity found that nearly half of the British participants were unwilling to eat insects.

Regulatory Hurdles: The regulatory landscape for insect protein varies across regions, creating complexities for market entry and expansion. While some areas have approved insect protein for animal feed and human consumption, others lack clear guidelines, leading to uncertainty for producers and consumers. For instance, the European Union authorized insect-derived processed animal proteins in poultry and pig feed in 2021, but such approvals are not universal.

Production and Supply Chain Challenges

- Technological Limitations: Mass-producing insects efficiently requires advanced technology and infrastructure, which are still under development. The lack of automation and optimized farming techniques can hinder large-scale production.

- Supply Chain Complexity: Establishing a reliable supply chain for insect protein involves challenges in sourcing feed, maintaining quality control, and ensuring consistent processing methods. These factors can affect product availability and pricing.

Allergenicity and Food Safety Concerns: Insect proteins may pose allergen risks, especially for individuals allergic to shellfish, due to similar protein structures. Ensuring food safety involves addressing potential contaminants, pathogens, and heavy metals that insects might accumulate. Proper labeling and risk management strategies are essential to mitigate these concerns.

Economic Viability: the cost of producing insect protein is relatively high compared to traditional protein sources. Achieving economies of scale is crucial to make insect protein a financially viable alternative. Investments in technology and infrastructure are needed to reduce production costs and make insect protein competitive in the market.

Market Growth Opportunities

Sustainable and Efficient Production: Insect farming offers a sustainable alternative to traditional livestock farming. Insects require significantly less land, water, and feed, and produce fewer greenhouse gases. For example, cricket farming uses 8 to 10 times less land and up to 5 times less water compared to conventional livestock farming.

Diversification in Food and Beverage Industry: Insect protein is increasingly being incorporated into various food products, including protein bars, bakery items, and pastas. This diversification caters to the growing consumer demand for sustainable and nutritious food sources. The versatility of insect protein allows it to be used in a variety of food products, catering to the growing demand for protein-rich and environmentally friendly food options.

Adoption in Animal Feed: The use of insect protein in animal feed, particularly in aquaculture and poultry, is on the rise. In 2023, the demand for insect protein in animal feed was projected to account for more than 40% of the global revenue. This significant demand is mainly due to the rising need for sustainable and nutrient-rich alternatives to traditional feed sources like soy and fishmeal.

Investment and Innovation: Significant investments and the emergence of numerous startups are focusing on expanding insect protein production and applications. For instance, companies like Protix and Ÿnsect have attracted substantial funding to scale up operations, indicating strong investor confidence in the sector.

Regulatory Approvals: Regulatory bodies in various regions are beginning to approve insect protein for human consumption and animal feed, facilitating market growth. For example, the European Union authorized the use of insect-derived processed animal proteins in poultry and pig feed in 2021, which has further catalyzed market expansion by fostering regulatory acceptance and encouraging adoption across agricultural sectors.

Key Players Analysis

Aspire Food Group excels in the insect protein sector by spearheading innovative farming and production technologies. Notably, they’ve recently expanded by acquiring Exo, a brand specializing in cricket-based protein bars, enhancing their product range and market presence. Aspire’s efforts are focused on scaling up cricket protein production, evidenced by their large-scale facility initiatives. These strategic moves position Aspire as a leader in sustainable protein alternatives, catering to a growing global demand for eco-friendly and nutritious food solutions.

EnviroFlight LLC is making significant strides in the insect protein industry by specializing in the production of black soldier fly larvae. Their approach focuses on sustainable practices and the transformation of organic waste into high-quality protein, primarily for animal feed. The opening of their commercial production facility in Kentucky marks a significant expansion in their capabilities. EnviroFlight’s operations underscore a commitment to environmental sustainability and innovation, aiming to meet the increasing demand for alternative protein sources.

Swarm Nutrition GmbH is distinguishing itself in the insect protein sector by specializing in the production of insect-based protein bars. Their products, which include unique flavors like hazelnut, raw cacao, and red berries, cater to a growing consumer base looking for sustainable and innovative nutritional options. The company’s focus on using sustainable protein from insects aligns with increasing market demands for environmentally friendly and health-conscious food choices.

Next Protein Inc. is emerging as a key player in the insect protein market, though specific recent activities or expansions were not detailed in the latest reports. Generally, companies like Next Protein are part of a broader industry trend where innovation in sustainable food sources is critical. They are expected to contribute to the sector’s growth by expanding the range of available insect-based products, enhancing food sustainability, and meeting the protein needs of a growing global population.

Ynsect NL Nutrition & Health B.V. is at the forefront of the insect protein industry, focusing on the production and refinement of yellow mealworm ingredients for various applications. The company’s cutting-edge vertical farming technology and automation enable the scalable production of high-quality insect protein, which is being increasingly utilized in animal feed, food products, and even in agricultural nutrients. Ynsect’s innovative approach and sustainable practices position it as a leader in contributing to the global food chain’s sustainability.

Entomo Farms is a pioneer in the North American insect protein market, specializing in the cultivation and processing of crickets for human consumption. They offer a range of products, from whole roasted crickets to cricket powder, catering to the growing demand for sustainable and high-protein food options. Entomo Farms focuses on eco-friendly practices and is committed to educating consumers about the nutritional benefits of insect-based foods, making significant strides in changing perceptions and increasing acceptance of insects as a viable food source.

Protix is a leading figure in the insect protein sector, known for its innovations in sustainable protein production. The company has partnered with Tyson Foods to enhance the insect ingredient industry, focusing on creating more sustainable protein and lipid solutions. This collaboration includes a joint venture to construct an insect ingredient facility in the U.S., which will produce high-quality proteins and lipids mainly for pet food, aquaculture, and livestock industries. Protix’s role in this partnership emphasizes its strategic expansion and commitment to sustainable food solutions.

Insect Technology Group Holdings Limited is dedicated to advancing the insect protein industry through technological innovations and sustainable practices. The company emphasizes the development and scale-up of systems that convert organic waste into valuable insect-based products, enhancing sustainability in the food and agriculture sectors. This approach not only addresses waste management challenges but also supports the production of high-quality, sustainable protein sources, positioning the company as a key player in promoting a circular economy in the food system.

Conclusion

The insect protein market is on track for significant growth, driven by a growing awareness of its health benefits and environmental advantages. As both consumers and industries look for sustainable and nutritious alternatives to traditional protein sources, insect protein is gaining traction across various sectors such as animal feed, food and beverages, pharmaceuticals, and cosmetics.

With its high protein content, essential amino acids, and reduced environmental impact, insect protein presents a compelling option in the global shift toward sustainable development. Additionally, the market’s growth is fueled by advancements in production technologies and increasing regulatory support, particularly in Europe, where insect protein is becoming more integrated into mainstream diets. As acceptance and awareness continue to grow, insect protein is poised to become a key player in addressing global food and nutrition security challenges.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)