Table of Contents

Introduction

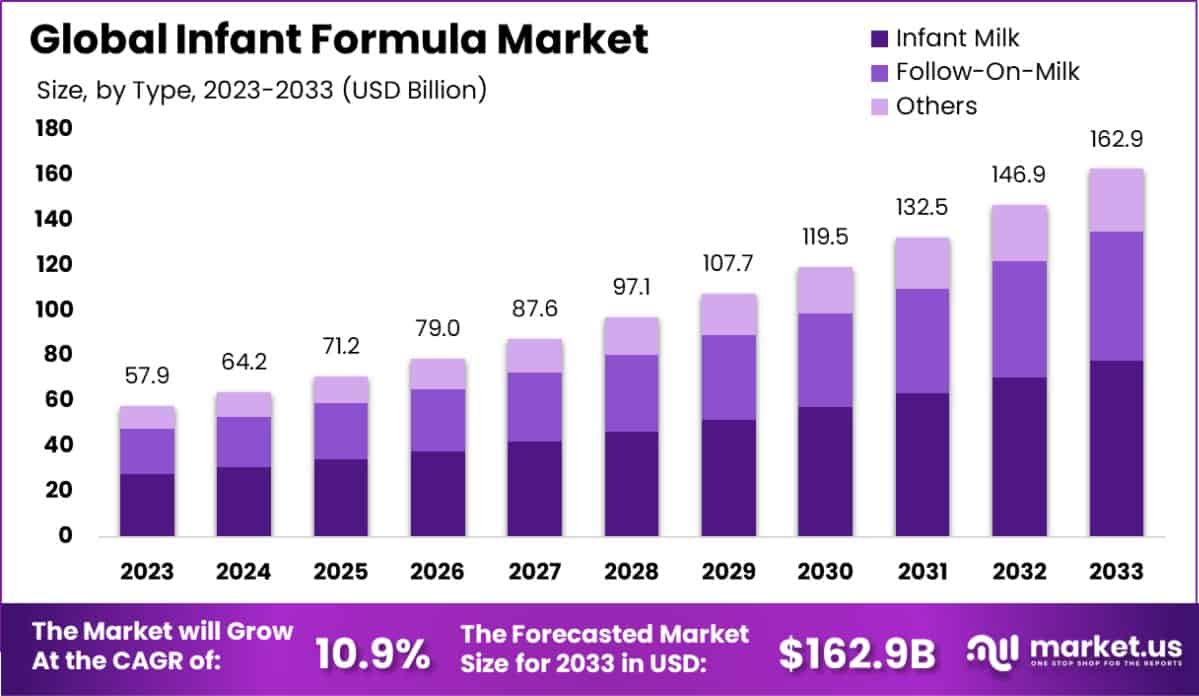

New York, NY – February 06, 2025 – The global Infant Formula Market is experiencing significant growth and is projected to reach a value of approximately USD 162.9 billion by 2033, up from USD 57.9 billion in 2023, reflecting a strong compound annual growth rate (CAGR) of 10.9% during the forecast period from 2024 to 2033.

The increasing demand for infant formula is primarily driven by the rising awareness of the benefits of balanced nutrition for infants, particularly in regions with a high working mother population. As more parents turn to infant formula as a reliable and convenient alternative to breastfeeding, the market’s popularity continues to soar.

Additionally, the expansion of distribution channels and the growing availability of organic and specialized formulas have further enhanced market opportunities. Other factors fueling market growth include higher disposable incomes, the growth of e-commerce platforms for easy access to infant nutrition products, and technological advancements in formula production. The demand for infant formula is also expected to increase due to rising birth rates in developing economies, along with improved healthcare access and government initiatives to support maternal and infant health. These elements are poised to drive a robust expansion of the infant formula market in the coming years.

Key Takeaways

- The Global Infant Formula Market is expected to be worth around USD 162.9 Billion by 2033, up from USD 57.9 Billion in 2023, and grow at a CAGR of 10.9% from 2024 to 2033.

- Infant milk dominates the type segment, holding a significant 48.1% share of the infant formula market.

- Protein hydrolysate is a leading ingredient in infant formulas, accounting for 44.1% of the market.

- Special milk products represent 37.1% of the product type segment in the infant formula industry.

- Powdered infant formula is the most common form, comprising 67.1% of the market.

- Hypermarkets and supermarkets are the primary distribution channels, with a 48.1% market share.

- In 2023, Asia-Pacific held 48.2% of the Infant Formula Market, valued at USD 28.08 billion.

Report Scope

| Market Value (2024) | USD 57.9 Billion |

| Forecast Revenue (2034) | USD 162.9 Billion |

| CAGR (2025-2034) | 10.9% |

| Segments Covered | By Type (Infant Milk, Follow-On-Milk, Others), By Ingredient (Protein Hydrolysate, Whey Protein Concentrate, Soy Protein Concentrate), By Product Type (Special Milk, Toddlers Milk, Follow-On-Milk, Starting Milk), By Form (Liquid, Powder, Ready to Feed), By Distribution Channel (Hypermarkets and Supermarkets, Pharmacy/Medical Stores, Specialty Stores, Others) |

| Competitive Landscape | Abbott Laboratories, Arla Foods, Ausnutria Dairy Corporation Ltd., Beingmate Group, Bellamy’s Organic, Danone S.A. , Friesland Campina, Hain Celestial Group, HIPP, Mead Johnson Nutrition, Meiji Holdings Co. Ltd., Nestle S.A., Perrigo Company plc, Pfizer, Reckitt Benckiser Group PLC, Synutra International, The Kraft Heinz Company, Yili Group |

Emerging Trends

- Organic and Clean-Label Products: Consumers are increasingly opting for organic and clean-label infant formulas, driven by concerns over the quality and safety of ingredients. This trend is led by a growing preference for products free from artificial additives, preservatives, and hormones, reflecting a demand for more natural and healthier alternatives.

- Personalized Nutrition: There is a rise in personalized infant formulas tailored to specific health needs. These formulas are developed to meet the unique nutritional requirements of individual infants, taking into account factors such as age, allergies, or digestive sensitivities, offering a more customized approach to infant nutrition.

- Plant-Based Infant Formula: The demand for plant-based infant formulas is on the rise as more parents look for dairy-free options due to concerns over lactose intolerance, allergies, or ethical considerations. Soy, almond, and oat-based formulas are gaining traction in the market as plant-based diets become more mainstream.

- E-commerce Growth: Online sales of infant formula are rapidly growing, as e-commerce platforms offer convenience, variety, and competitive pricing. Parents are increasingly relying on online shopping for their infant formula needs, driven by the ease of home delivery, promotions, and subscription services for regular purchases.

- Technological Advancements in Production: Innovations in production technologies are improving the nutritional value and safety of infant formulas. Advanced processing methods like spray-drying and microencapsulation are being used to enhance the stability of sensitive ingredients, making the formula closer to breast milk in terms of nutritional composition.

Use Cases

- Convenience for Working Parents: The infant formula offers a practical solution for working parents who may not always be available to breastfeed their babies. With the ease of preparation and storage, formula feeding ensures that babies can still receive balanced nutrition, making it an essential choice for parents with busy schedules.

- Alternative to Breastfeeding: For mothers who cannot breastfeed due to medical reasons, low milk supply, or personal choice, infant formula provides a reliable and nutritious alternative. It allows mothers to ensure their infants are receiving the necessary nutrients for growth and development, with formulas designed to closely mimic breast milk.

- Support for Babies with Special Nutritional Needs: Specialized formulas, such as hypoallergenic or lactose-free options, are designed for infants with specific health issues like allergies, intolerances, or digestive sensitivities. These formulas cater to babies who may not be able to tolerate regular infant formulas or breast milk, ensuring proper nutrition and comfort.

- Supplementing Breastfeeding: Some mothers use infant formula to supplement breastfeeding, especially if they are returning to work or experiencing challenges in maintaining an adequate milk supply. The formula provides an additional source of nutrition, helping ensure that babies receive enough calories and nutrients to thrive while still benefiting from breast milk.

- Travel and On-the-Go Feeding: Infant formula is an essential companion for parents on the go, offering a convenient feeding solution during travel or outings. Formula can be easily prepared and stored, allowing parents to feed their babies without the need to find a place to nurse, ensuring babies are well-fed at any time or location.

Major Challenges

- High Cost: One of the major challenges of infant formula is its high cost. Premium and specialized formulas can be expensive, making it difficult for some families to afford long-term use. This is especially problematic in developing regions where parents may struggle to provide consistent, quality nutrition for their babies.

- Health Concerns and Safety Issues: There are ongoing concerns about the safety of infant formula, particularly regarding contamination risks during manufacturing or improper handling. Additionally, some parents worry about the long-term health effects of formula feeding compared to breastfeeding, which has natural antibodies and other health benefits.

- Formula Shortages and Supply Chain Disruptions: The infant formula market has faced supply chain disruptions, leading to shortages in certain regions. These disruptions can occur due to manufacturing delays, raw material shortages, or logistical issues, leaving parents struggling to find necessary products for their infants during times of high demand or emergencies.

- Regulatory Challenges: Infant formula is subject to strict regulations and quality standards, which can vary across countries. Navigating these regulations can be difficult for manufacturers, especially when expanding into new markets. Compliance with labeling, ingredient, and safety standards often requires substantial investment, impacting the speed at which new products can reach consumers.

- Lack of Awareness in Developing Regions: In certain developing markets, there is still a lack of awareness regarding the nutritional value and benefits of infant formula. Many parents may not be familiar with the importance of providing balanced nutrition during the early stages of a baby’s life, leading to low adoption rates of formula in those regions.

Market Growth Opportunities

- Expanding E-Commerce Channels: The growth of online shopping presents a significant opportunity for the infant formula market. E-commerce platforms allow for easier access to a wide range of formula products, especially in rural or underserved areas. The convenience of online purchasing, combined with home delivery, is expected to boost sales, especially in emerging markets.

- Growth in Emerging Markets: Developing countries, particularly in Asia, Africa, and Latin America, present untapped opportunities for the infant formula market. Rising disposable incomes, urbanization, and growing awareness of infant nutrition are driving demand for infant formula. Brands expanding into these markets can tap into a growing middle-class population looking for convenient, high-quality nutrition for their babies.

- Organic and Natural Product Demand: As consumer awareness about food quality and safety increases, there is a growing demand for organic and natural infant formulas. Offering products that are free from additives, preservatives, and artificial ingredients can help brands differentiate themselves in a competitive market, appealing to health-conscious parents looking for cleaner alternatives.

- Personalized Nutrition for Infants: There is a rising trend for personalized infant nutrition that caters to individual health needs. Tailoring infant formulas based on factors like allergies, digestion issues, or prematurity opens up new market segments. Companies that develop specialized formulas targeting these needs can capture the attention of parents seeking more customized solutions for their infants.

- Sustainability Initiatives: As sustainability becomes a key concern for consumers, companies focusing on eco-friendly packaging and sustainable sourcing will be well-positioned to capitalize on this growing trend. Offering environmentally responsible products not only helps brands stand out but also appeals to eco-conscious parents who want to make a positive impact on the planet.

Recent Developments

1. Abbott Laboratories

- Recent Developments:

- Innovation: In 2023, Abbott launched a new infant formula product, Similac 360 Total Care Sensitive, designed for babies with sensitive stomachs. This product is lactose-free and includes HMO (human milk oligosaccharides) to support immune health.

- Partnerships: Abbott partnered with ByHeart, a US-based infant nutrition company, in 2023 to enhance research on infant gut health and microbiome development.

- Regulatory Compliance: In 2022, Abbott resumed production at its Michigan facility after a temporary shutdown due to FDA investigations related to contamination concerns. The company implemented stricter quality control measures to ensure safety.

- Contribution: Abbott’s innovations in HMO-based formulas and focus on sensitive infant nutrition have set new standards in the industry.

2. Arla Foods

- Recent Developments:

- Investment: In 2023, Arla Foods invested €200 million in its Danish production facilities to expand its organic infant formula production capacity.

- Sustainability Initiatives: Arla launched a carbon-neutral infant formula product line in 2022, aligning with its goal to reduce carbon emissions by 63% by 2030.

- Partnerships: Arla partnered with Danone in 2023 to develop advanced probiotic blends for infant nutrition, focusing on immune and digestive health.

- Contribution: Arla’s focus on organic and sustainable infant formula has positioned it as a leader in eco-friendly infant nutrition.

3. Ausnutria Dairy Corporation Ltd.

- Recent Developments:

- Acquisition: In 2022, Ausnutria acquired Hyproca Nutrition, a Dutch infant formula manufacturer, to expand its presence in the European market.

- Innovation: Ausnutria launched Kabrita Goat Milk Formula in 2023, targeting parents seeking alternative protein sources for infants with cow milk allergies.

- Partnerships: Ausnutria partnered with Alibaba Health in 2023 to enhance its e-commerce capabilities and reach more consumers in China.

- Contribution: Ausnutria’s focus on goat milk formulas and strategic acquisitions has strengthened its position in the global infant formula market.

4. Beingmate Group

- Recent Developments:

- Investment: Beingmate invested $50 million in 2023 to upgrade its production facilities in Hangzhou, China, focusing on producing high-quality infant formula with advanced sterilization technology.

- Innovation: In 2022, Beingmate launched Beingmate Youbo, a premium infant formula enriched with probiotics and prebiotics to support gut health.

- Partnerships: Beingmate partnered with Royal FrieslandCampina in 2023 to co-develop infant nutrition products tailored for the Chinese market.

- Contribution: Beingmate’s focus on probiotic-enriched formulas and partnerships with global dairy leaders has enhanced its product portfolio.

5. Bellamy’s Organic

- Recent Developments:

- Acquisition: In 2022, Bellamy’s Organic was acquired by China Mengniu Dairy, a leading Chinese dairy company, to expand its reach in the Asian market.

- Innovation: Bellamy’s launched Bellamy’s Organic Step 4 Toddler Milk in 2023, targeting children aged 3+ with organic ingredients and no added sugars.

- Sustainability: Bellamy introduced 100% recyclable packaging for its infant formula products in 2023, aligning with its commitment to environmental sustainability.

- Contribution: Bellamy’s focus on organic and sustainable infant nutrition has made it a trusted brand globally.

Conclusion

The Infant Formula Market is poised for substantial growth, driven by factors such as increasing demand for convenient and nutritious feeding options, expanding e-commerce channels, and rising awareness of infant nutrition. As the market evolves, opportunities for innovation in product offerings, such as organic, personalized, and allergy-friendly formulas, will continue to shape the landscape. While challenges such as high costs, regulatory issues, and ethical concerns remain, the overall outlook for the market is positive. With expanding market reach in emerging economies, technological advancements, and a focus on sustainability, the infant formula industry is well-positioned to cater to the changing needs of parents worldwide.