Table of Contents

Introduction

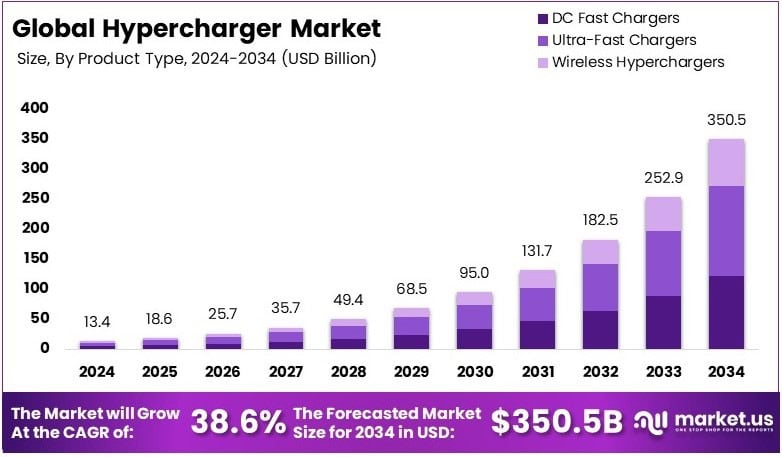

New York, NY – April 01, 2025 – The Global Hypercharger Market size is projected to reach approximately USD 350.5 billion by 2034, up from USD 13.4 billion in 2024. The market is anticipated to expand at a compound annual growth rate (CAGR) of 38.6% throughout the forecast period from 2025 to 2034.

A Hypercharger is an advanced charging solution designed to facilitate ultra-fast charging for electric vehicles (EVs), enabling significantly reduced charging times compared to conventional chargers. Typically, these systems utilize high power levels, ranging from 150 kW to 350 kW or more, and are often deployed at public charging stations, commercial hubs, and strategic transportation corridors.

The Hypercharger Market, therefore, refers to the global industry focused on the production, distribution, and integration of these high-capacity charging systems. The market is witnessing rapid growth, driven by the increasing adoption of electric mobility, advancements in battery technology, and the rising need for efficient charging infrastructure. Governments and private enterprises are investing significantly in hypercharging networks to support the expansion of electric vehicles, particularly in urban and intercity travel contexts.

Key growth factors include government incentives promoting EV adoption, increasing consumer preference for fast and reliable charging options, and the commitment of automotive manufacturers to expand their EV portfolios. Additionally, the demand for Hyperchargers is anticipated to surge due to the growing fleet of electric buses and trucks, which require high-power charging solutions to support long-haul operations. Opportunities within the Hypercharger Market are abundant, particularly in regions where urbanization and sustainable mobility initiatives are accelerating.

Strategic collaborations between energy companies, automakers, and infrastructure developers are fostering innovation and market penetration. Furthermore, the integration of renewable energy sources into Hypercharger installations presents a promising avenue for reducing operational costs and aligning with global sustainability goals. As the market continues to evolve, the emphasis on enhancing charging speed, efficiency, and user convenience will be crucial in maintaining competitive advantage.

Key Takeaways

- The Hypercharger Market was valued at USD 13.4 billion in 2024 and is projected to reach USD 350.5 billion by 2034, registering a robust CAGR of 38.6%.

- In 2024, Ultra-Fast Chargers emerged as the leading product type, capturing 42.7% of the market share.

- The 100–200 kW segment led the power output category in 2024, accounting for 39.8% of the market share.

- Passenger Vehicles accounted for the largest share within the vehicle type segment in 2024, representing 47.3% of the market.

- The CCS (Combined Charging System) dominated the charging standard segment in 2024 with a market share of 38.6%.

- The Commercial end-user segment held the largest market share in 2024, with 55.3%.

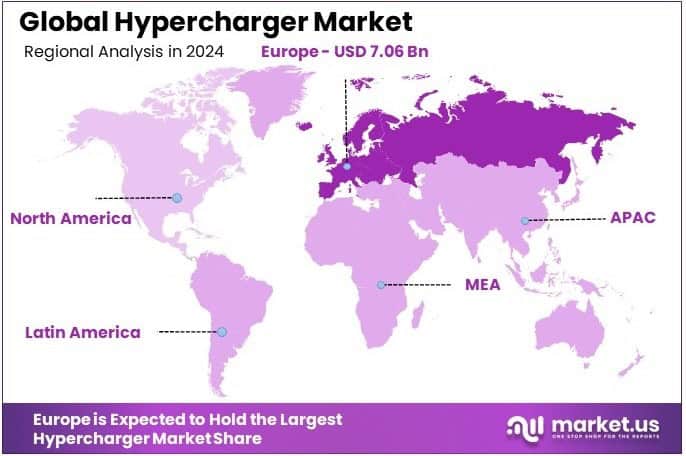

- Europe was the leading regional market for Hyperchargers in 2024, accounting for 52.7% of the global market and generating revenues of USD 7.06 billion.

Request A Sample Copy Of This Report at https://market.us/report/hypercharger-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 13.4 Billion |

| Forecast Revenue (2034) | USD 350.5 Billion |

| CAGR (2025-2034) | 38.6% |

| Segments Covered | By Product Type (DC Fast Chargers, Ultra-Fast Chargers, Wireless Hyperchargers), By Power Output (Up to 100 kW, 100–200 kW, Above 200 kW), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Electric Buses, Two-Wheelers), By Charging Standard (CCS, CHAdeMO, Tesla Supercharger, GB/T), By End-User (Residential, Commercial – Charging Stations, Parking Spaces, Industrial) |

| Competitive Landscape | ABB Ltd., Siemens AG, Tesla, Inc., Schneider Electric SE, ChargePoint Holdings, Inc., EVBox Group, Delta Electronics, Inc., Alfen N.V., Blink Charging Co., Tritium DCFC Limited, Fastned B.V., Electrify America LLC, Ionity GmbH |

Emerging Trends

- Expansion of Ultra-Fast Charging Networks: Companies are aggressively deploying hyperchargers along major highways and urban areas to support the growing EV fleet.

- Technological Advancements in Charging Systems: Innovations such as megawatt charging systems are being developed to cater to heavy-duty vehicles, enhancing charging efficiency and reducing downtime.

- Integration with Renewable Energy Sources: There is a growing emphasis on coupling hyperchargers with renewable energy to promote sustainable charging solutions and reduce grid dependency.

- Standardization of Charging Protocols: Efforts are underway to standardize charging interfaces like the Combined Charging System (CCS) to ensure compatibility across various EV models and charging stations.

- Adoption of Vehicle-to-Grid (V2G) Technology: Hyperchargers are increasingly incorporating V2G capabilities, allowing EVs to supply energy back to the grid, thereby enhancing grid stability and offering potential economic benefits to users.

Top Use Cases

- Public Charging Infrastructure: Deployment of hyperchargers in public areas facilitates quick charging for EV users, reducing range anxiety and promoting EV adoption.

- Fleet Operations: Commercial fleets, including taxis and delivery vehicles, benefit from hyperchargers by minimizing downtime and maximizing operational efficiency.

- Highway Charging Stations: Installation of hyperchargers along highways enables long-distance travel for EVs, supporting intercity and interstate journeys.

- Urban Charging Hubs: Urban centers are establishing hypercharging hubs to cater to the increasing number of EVs in metropolitan areas, addressing the need for rapid charging in densely populated regions.

- Heavy Commercial Vehicles: Electric buses and trucks utilize hyperchargers to meet their high energy demands, ensuring timely operations and reducing reliance on fossil fuels.

Major Challenges

- High Installation Costs: Establishing hypercharging stations requires substantial investment in equipment and infrastructure, posing financial challenges for widespread deployment.

- Grid Capacity Constraints: Hyperchargers demand significant power, which can strain existing electrical grids, especially in areas with limited infrastructure.

- Standardization Issues: The lack of universal charging standards can lead to compatibility problems between different EV models and charging stations.

- Rural Infrastructure Deficiency: Inadequate charging facilities in rural areas limit the accessibility of hypercharging solutions for EV users in these regions

- Technological Integration: Integrating advanced technologies like V2G and renewable energy sources into hypercharging systems presents technical and logistical challenges.

Top Opportunities

- Government Incentives: Various governments are offering subsidies and tax benefits to promote the installation of hyperchargers, encouraging investment in charging infrastructure.

- Private-Public Partnerships: Collaborations between private companies and public entities can accelerate the development of comprehensive hypercharging networks.

- Advancements in Battery Technology: Improvements in battery capacity and charging capabilities enhance the effectiveness and appeal of hyperchargers.

- Emerging Markets: Developing countries present significant growth potential for hypercharger deployment as they increasingly adopt EV technologies.

- Integration with Smart Grids: Incorporating hyperchargers into smart grid systems can optimize energy distribution, improve grid resilience, and enable dynamic pricing models.

Key Player Analysis

The Global Hypercharger Market in 2024 is significantly shaped by the presence of key players that demonstrate robust innovation, extensive product portfolios, and strategic alliances. Among the most influential companies, ABB Ltd. and Siemens AG stand out for their advanced charging technologies and global infrastructure projects, leveraging their industrial expertise to support high-speed charging networks. Tesla, Inc. remains a dominant force with its Supercharger network, setting industry standards for charging speed and convenience.

Schneider Electric SE capitalizes on its energy management solutions to integrate hyperchargers within smart grid systems. ChargePoint Holdings, Inc. and EVBox Group are recognized for their expansive public and commercial charging solutions. Delta Electronics, Inc. and Alfen N.V. focus on energy-efficient charging systems, catering to sustainable urban mobility. Blink Charging Co. and Tritium DCFC Limited prioritize rapid deployment in urban areas, while Fastned B.V., Electrify America LLC, and Ionity GmbH enhance long-distance travel through strategically located hypercharger stations across key corridors.

Top Companies in the Market

- ABB Ltd.

- Siemens AG

- Tesla, Inc.

- Schneider Electric SE

- ChargePoint Holdings, Inc.

- EVBox Group

- Delta Electronics, Inc.

- Alfen N.V.

- Blink Charging Co.

- Tritium DCFC Limited

- Fastned B.V.

- Electrify America LLC

- Ionity GmbH

Regional Analysis

Europe Hypercharger Market: Dominating Region with Largest Market Share of 52.7% in 2024

Europe holds the dominant position in the global hypercharger market, accounting for a substantial 52.7% of the market share in 2024. This remarkable share is attributed to the region’s proactive stance on sustainable mobility and the increasing adoption of electric vehicles (EVs) supported by comprehensive government policies.

The European hypercharger market is projected to reach a value of USD 7.06 billion, driven by the robust EV infrastructure expansion across key countries, including Germany, France, and the United Kingdom. The European Union’s stringent emission norms, alongside substantial investments in charging infrastructure, have significantly propelled the market growth.

The widespread adoption of hyperchargers in Europe can be attributed to initiatives such as the European Green Deal and national-level policies promoting e-mobility. Additionally, automotive giants and tech companies have been actively collaborating to develop high-speed charging networks, enhancing consumer confidence and adoption rates.

The presence of key players and rapid urbanization in leading economies within Europe has further fueled the demand for hyperchargers. The dominance of Europe in this sector underscores its commitment to reducing carbon emissions and achieving net-zero targets, positioning the region as the largest and most influential market for hyperchargers globally.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=137224

Recent Developments

- In 2024, Tesla announced the upcoming launch of its fourth-generation Supercharger cabinet, designed to support up to eight Supercharger stalls simultaneously. The V4 cabinet, capable of delivering charging speeds of up to 500 kW, is compatible with vehicles featuring electrical architectures ranging from 400 to 1000 volts. This innovation is expected to boost the Cybertruck’s charging efficiency by approximately 30 percent, while charging speeds for the Model 3, Model Y, Model S, and Model X will remain unchanged. As a long-standing leader in public EV charging, Tesla’s Supercharger network is poised to see significant enhancements with this new technology.

- In 2023, Shell USA, Inc., a subsidiary of Shell plc, finalized its acquisition of Volta Inc. in a transaction valued at approximately USD $169 million. This acquisition, conducted entirely in cash, solidifies Shell’s position as one of the largest public EV charging network operators in the United States. The transaction was completed following necessary regulatory approvals and consent from Volta’s stockholders, marking a strategic expansion of Shell’s EV infrastructure portfolio.

- In 2024, Hypercharge Networks Corp., recognized as a key provider of intelligent EV charging solutions, released its unaudited financial statements for the quarters ending September 30, 2024. These reports, encompassing both three-month and six-month periods, offer insights into the company’s financial performance and operational strategies. Hypercharge remains committed to advancing its charging network capabilities, reflecting its ongoing dedication to enhancing sustainable mobility solutions.

- In 2024, Mercedes-Benz High-Power Charging announced its plans to introduce Alpitronic’s Hypercharger 400 to the U.S. market, as part of a $1 billion investment aimed at building a robust North American charging infrastructure. The Hypercharger 400 units will be manufactured domestically at a Wisconsin-based facility, offering up to 400 kW of charging power. This strategic move underscores Mercedes-Benz’s commitment to strengthening local supply chains and providing fast, reliable charging options.

- In 2024, Delta introduced the UFC 500, a 500kW DC Ultra-fast EV Charger, to the EMEA region. This charger addresses the growing demand for high-power EV charging while efficiently managing space constraints. The UFC 500, designed for heavy-duty electric vehicles such as e-trucks and e-buses, can deliver 460 kW of power, enabling a full charge within two hours. This solution highlights Delta’s innovation in merging compact design with powerful charging capabilities, catering to the evolving needs of EV charging operators.

Conclusion

The Hypercharger Market is expected to experience robust growth in the coming years, driven by the increasing adoption of electric vehicles and the rising demand for efficient, high-speed charging solutions. Technological advancements, government incentives, and the expansion of charging infrastructure are key factors propelling market development. Strategic collaborations between energy companies, automotive manufacturers, and infrastructure developers are anticipated to further enhance market penetration, while innovations in ultra-fast charging technologies will support the widespread adoption of electric mobility globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)