Table of Contents

Overview

The Global Human Milk Oligosaccharides (HMO) Market is anticipated to surge from USD 282.9 billion in 2024 to a substantial USD 1455.7 billion by 2034, at a robust CAGR of 17.8% during the forecast period. HMOs, complex carbohydrates present in human breast milk, are pivotal in fostering infant health by promoting gut microbiota, enhancing immune function, and offering protection against pathogens. Their inclusion in infant formulas and functional foods has gained significant traction, driven by rising consumer awareness and evolving dietary trends.

In 2024, 2’FL dominated the market with a 43.4% share, owing to its essential role in mimicking human breast milk. Meanwhile, Neutral HMOs captured a 78.9% share, valued for their stability and versatile applications in infant nutrition. The Infant Formula segment led with a 64.2% share, reflecting the increasing demand for nutrient-dense products that replicate breastfeeding benefits. Regionally, North America commanded a dominant 42.9% market share, generating approximately USD 121.3 million in revenue. The region’s strong market presence is attributed to heightened consumer awareness, government support for nutritional products, and advanced production technologies.

Experts Review

Government initiatives are playing a pivotal role in propelling the HMO market forward. In 2022, Royal DSM’s GlyCare 2′-FL received regulatory approval in Canada for inclusion in infant and toddler formulas, setting a precedent for market growth in North America. Similarly, Kirin Holdings launched a dedicated HMO production facility in Thailand in November 2022, aiming to meet surging demand in the Asia-Pacific region. Investment opportunities are emerging in microbial fermentation and plant-based production, as companies strive to lower production costs and expand HMO availability. However, the high cost of R&D and stringent regulatory requirements remain substantial risks.

Technological advancements are transforming the HMO market landscape. Microbial fermentation and enzymatic synthesis are emerging as scalable, cost-effective production methods, allowing manufacturers to meet increasing demand without reliance on human milk extraction. Regulatory bodies like the FDA and EFSA are enforcing stringent guidelines, pushing manufacturers to ensure product safety and efficacy. Consumer awareness regarding the health benefits of HMOs is steadily rising, particularly in infant nutrition, further driving market demand. In 2025, the HMO market is expected to witness increased adoption in dietary supplements and functional foods, presenting lucrative growth prospects for industry players.

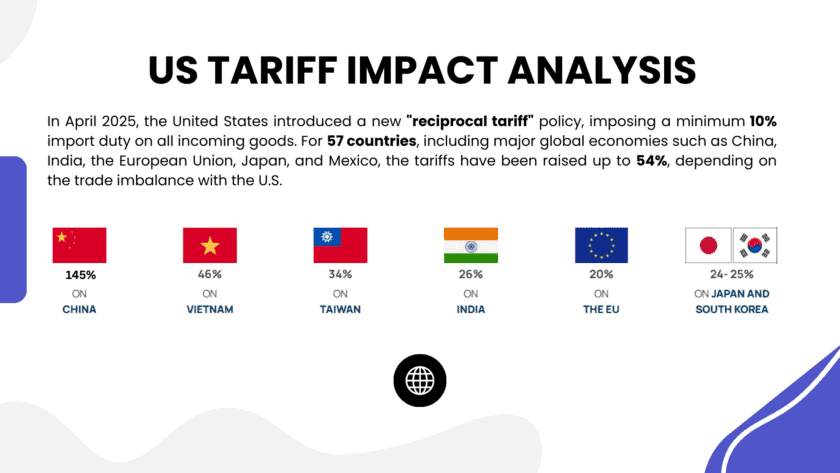

US Tariff Impact on Human Milk Oligosaccharides Market

The recent escalation in US tariffs is projected to significantly impact the Human Milk Oligosaccharides (HMO) market. The United States has imposed a 25% tariff on key imports from Canada and Mexico, affecting the flow of HMO ingredients and raw materials. In retaliation, Canada’s outgoing Prime Minister Justin Trudeau announced a 25% tariff on over USD 100 million worth of US goods, which may disrupt the HMO supply chain, increasing costs for manufacturers reliant on imported ingredients.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/human-milk-oligosaccharides-market/free-sample/

China has also implemented a 10-15% tax on food imports, which could indirectly impact the HMO market by raising costs for companies sourcing ingredients or packaging from Chinese suppliers. Additionally, Mexico’s President Claudia Sheinbaum is set to announce tariffs on US products, further exacerbating cost pressures for US-based HMO producers.

With President Trump hinting at a 25% tariff on European imports, HMO producers sourcing ingredients or packaging from the EU could face higher costs. These rising costs are likely to be passed down to consumers, potentially hindering the adoption of premium HMO-enriched products in North America.

Key Takeaways

- Human Milk Oligosaccharides Market size is expected to be worth around USD 1455.7 Billion by 2034, from USD 282.9 Billion in 2024, growing at a CAGR of 17.8%.

- 2’FL held a dominant market position, capturing more than a 43.4% share.

- Neutral held a dominant market position, capturing more than a 78.9% share of the Human Milk Oligosaccharides (HMO) market by concentration.

- Infant Formula held a dominant market position, capturing more than a 64.2% share.

- North America held a dominant position in the global Human Milk Oligosaccharides (HMO) market, capturing 42.9% of the market share, equivalent to approximately USD 121.3 million.

Report Scope

| Market Value (2024) | USD 282.9 Bn |

| Forecast Revenue (2034) | USD 1455.7 Billion |

| CAGR (2025-2034) | 17.8% |

| Segments Covered | By Type (2’FL, 3’FL, 3’SL, 6’SL, LNT, LNnT, DFL), By Concentration (Neutral, Acidic), By Application (Infant Formula, Food & Beverages, Dietary Supplements, Pharmaceuticals, Others) |

| Competitive Landscape | Abbott Laboratories, BASF SE, Biosynth Carbosynth, Novonesis Group, Dextra Laboratories Limited, DSM, DUPONT, Elicityl S.A, FrieslandCampina Ingredients, Glycom A/S, Gnubiotics Sciences S.A, Inbiose N.V, Kyowa Hakko Europe GmbH, Nestle, RAJVI ENTERPRISE, ZuChem Inc. |

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=148423

Report Segmentation

- By Type: The HMO market is segmented into 2’FL, 3’FL, 3’SL, 6’SL, LNT, LNnT, and DFL. In 2024, 2’FL led the segment with a 43.4% share, driven by its essential role in infant nutrition and its widespread inclusion in infant formulas. 3’FL and 3’SL are gaining traction due to their proven benefits in promoting gut health and immune development.

- By Concentration: The market is categorized into Neutral and Acidic HMOs. Neutral HMOs dominated with a 78.9% share in 2024, attributed to their stability and versatility in formulations. Acidic HMOs, though less prevalent, are anticipated to witness increased demand due to their role in reducing infection risks and enhancing gut health.

- By Application: The application segment comprises Infant Formula, Food & Beverages, Dietary Supplements, Pharmaceuticals, and Others. Infant Formula held the largest share of 64.2% in 2024, driven by increasing consumer demand for nutritional products that closely mimic breast milk composition. The dietary supplements segment is expected to grow substantially, fueled by rising health awareness and HMO inclusion in adult nutrition products.

- By Region: North America held a dominant market share of 42.9% in 2024, valued at approximately USD 121.3 million, driven by advanced production capabilities and regulatory support. Asia-Pacific is projected to experience significant growth due to increasing investments in HMO production facilities and rising consumer awareness of infant nutrition. Europe, led by Germany and the UK, is also witnessing robust growth due to regulatory approvals and expanding product lines.

Top Use Cases

- Infant Formula Enhancement: HMOs are added to infant formulas to mimic the benefits of breast milk, supporting the development of a healthy gut microbiota and strengthening the infant’s immune system. Clinical studies have shown that formulas supplemented with HMOs, such as 2′-fucosyllactose (2′-FL), can positively influence the gut microbiota composition, making it more similar to that of breastfed infants .

- Dietary Supplements: HMOs are utilized in dietary supplements aimed at improving gut health and immune function in adults. Their prebiotic properties promote the growth of beneficial bacteria like bifidobacteria, enhancing metabolic activity and overall well-being.

- Functional Foods: Incorporation of HMOs into functional foods, such as yogurts and nutrition bars, is gaining traction. These products aim to deliver the health benefits of HMOs, including improved digestion and immune support, to a broader population beyond infants.

- Pharmaceutical Applications: Research is exploring the use of HMOs in pharmaceuticals for their potential to prevent infections and modulate the immune system. Their ability to inhibit pathogen adhesion and influence immune responses makes them candidates for therapeutic applications .

- Management of Gastrointestinal Disorders: HMOs have been studied for their role in managing gastrointestinal disorders such as irritable bowel syndrome (IBS). Supplementation with specific HMOs has shown promise in alleviating symptoms and improving gut health in affected individuals .

Key Player Analysis

Abbott Laboratories: In 2023, Abbott continued to enhance its infant nutrition products by incorporating HMOs, emphasizing their role in supporting infant immunity and gut health. The company invested in research to better understand the benefits of HMOs in early-life nutrition.

BASF SE: BASF focused on developing HMOs through biotechnological processes in 2023, aiming to supply high-quality ingredients for infant formula manufacturers. Their efforts included scaling up production capabilities to meet growing market demand.

Biosynth Carbosynth: In 2023, Biosynth Carbosynth expanded its portfolio of HMOs, offering a range of oligosaccharides for research and commercial applications. The company emphasized the importance of HMOs in promoting beneficial gut bacteria.

Dextra Laboratories Limited: Dextra Laboratories continued to supply specialized carbohydrates, including HMOs, in 2023. Their focus remained on providing high-purity ingredients for pharmaceutical and nutritional research.

DSM: In 2023, DSM received FDA “No Questions” letters for three of its HMO ingredients, affirming their safety for use in infant nutrition products. The company emphasized the role of HMOs in supporting gut health and immunity.

DuPont: DuPont, in partnership with Lonza, continued to develop HMOs for inclusion in infant nutrition products in 2023. Their joint venture focused on producing HMOs that mimic those found in human breast milk.

Elicityl S.A: Elicityl S.A specialized in synthesizing complex carbohydrates, including HMOs, in 2023. Their work supported research into the health benefits of HMOs and their potential applications in nutrition and medicine.

FrieslandCampina Ingredients: In 2024, FrieslandCampina Ingredients achieved regulatory approvals for its Aequival® 2′-FL HMO ingredient in Thailand, expanding its reach in the early-life nutrition market.

Glycom A/S: Glycom A/S, acquired by DSM in 2020, continued to focus on the production of HMOs through fermentation processes in 2023, supplying these ingredients for use in infant formula.

Gnubiotics Sciences S.A: In 2024, Gnubiotics Sciences developed functional and structural mimics of HMOs aimed at the consumer health market, focusing on products that support gut health and immunity.

Inbiose N.V: Inbiose received FDA “No Questions” letters for five of its HMOs in 2023, validating their safety for use in food products. The company emphasized the scalability of its production methods for complex HMOs.

Kyowa Hakko Europe GmbH: In 2024, Kyowa Hakko Bio’s 2′-Fucosyllactose received Novel Food approval in the EU, allowing its use in various food products. This milestone expanded their HMO offerings in the European market.

Nestlé: Nestlé launched its first HMO-containing product in China in late 2023 under the Illuma brand, combining lipids and proteins with HMOs to support gut and cognitive health in growing-up milk.

RAJVI ENTERPRISE: RAJVI ENTERPRISE, based in India, offered HMOs in powder form for food and pharmaceutical applications in 2023, catering to the growing demand in the Indian market.

ZuChem Inc.: ZuChem Inc. continued its work in developing and producing specialty carbohydrates, including HMOs, in 2023, focusing on scalable production methods for use in nutrition and health products.

Conclusion

The Human Milk Oligosaccharides market is poised for robust growth, driven by rising demand for infant nutrition and advancements in fermentation technologies. Despite challenges related to high production costs and regulatory compliance, market players focusing on innovative production methods and sustainable solutions are likely to capitalize on emerging opportunities. The dominance of 2’FL and Neutral HMOs underscores the market’s emphasis on stability and nutritional efficacy, while expanding applications in dietary supplements and functional foods are set to further propel market expansion through 2034.