Table of Contents

Introduction

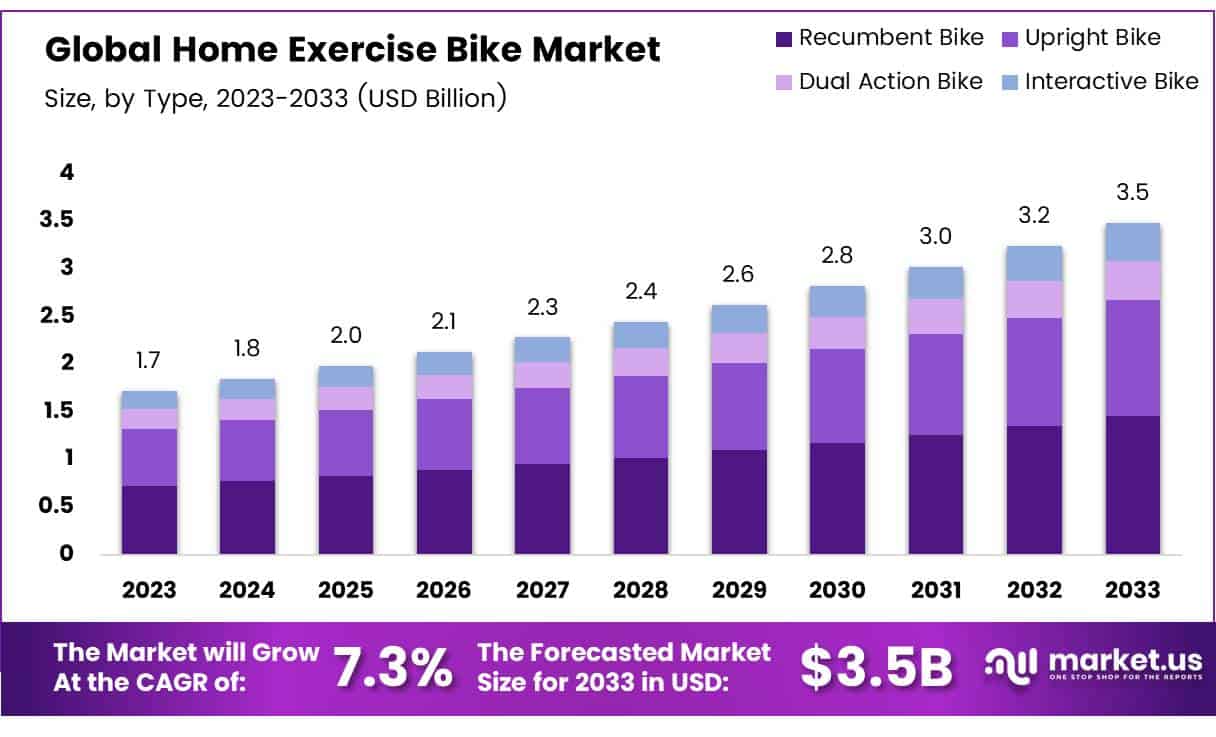

The Global Home Exercise Bike Market is projected to reach approximately USD 3.5 billion by 2033, rising from an estimated value of USD 1.72 billion in 2023. This growth is expected to occur at a compound annual growth rate (CAGR) of 7.3% over the forecast period from 2024 to 2033.

A home exercise bike is a stationary fitness device designed for indoor cardiovascular workouts, enabling users to simulate cycling within the comfort of their homes. These bikes typically come in three major types upright, recumbent, and indoor cycling (spin) bikes—each offering distinct features tailored to various fitness needs and preferences. The home exercise bike market refers to the global industry involved in the design, production, distribution, and retail of these fitness equipment units for residential use.

This market has been experiencing sustained growth, primarily driven by increasing health consciousness, the rise of home-based fitness routines, and technological advancements such as app integration, virtual training, and real-time performance tracking. The shift toward digital fitness solutions, amplified by the pandemic-induced transition to home workouts, has significantly influenced consumer behavior, fostering increased adoption of connected and smart exercise bikes. Additionally, growing concerns around lifestyle-related health conditions, including obesity and cardiovascular diseases, are encouraging proactive fitness habits, thereby contributing to market expansion.

The demand for home exercise bikes is further supported by demographic trends such as the aging population, which prefers low-impact yet effective exercise solutions, and urban professionals seeking time-efficient workout options. Moreover, rising disposable incomes in emerging economies and growing awareness of fitness benefits are opening new avenues for manufacturers. The opportunity lies in the development of cost-effective, customizable, and compact home fitness solutions integrated with immersive digital ecosystems. Strategic collaborations with fitness platforms, expansion into untapped regions, and continuous innovation in design and technology are anticipated to unlock further market potential in the coming years.

Key Takeaways

- The global home exercise bike market is anticipated to reach USD 3.5 billion by 2033, expanding at a CAGR of 7.3% from 2024 to 2033, indicating sustained consumer interest in at-home fitness solutions.

- Recumbent bikes emerged as the dominant segment in 2023, supported by rising demand for low-impact and ergonomically comfortable workouts, particularly among older adults and individuals with mobility concerns.

- Physical retail stores led the market in 2023, as a significant portion of consumers preferred to physically evaluate the product for quality, size, and comfort before making a purchase decision.

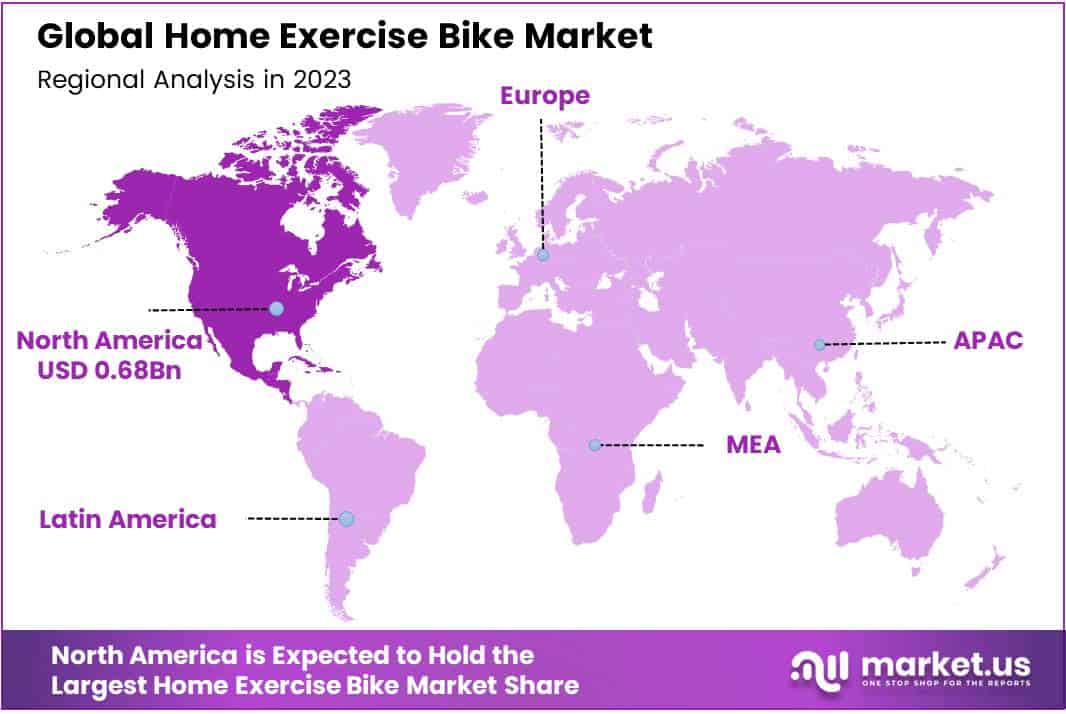

- North America held the largest share in the global home exercise bike market, accounting for 40% of the total market in 2023, with an estimated value of USD 0.68 billion, driven by high health consciousness and a strong home fitness culture.

Home Exercise Bike Statistics

Cycling is growing in popularity across the globe.

- The number of cyclists who completed at least one 100-mile ride rose by 22%.

- Currently, 42% of households globally own at least one bicycle, totaling over 580 million bikes.

- About 7% of all urban trips worldwide are completed using a bicycle.

- In some Chinese cities, up to 60% of daily urban trips are made by bike.

- More than 600 cities now run bike-share systems, with new programs added every year.

- According to the World Economic Forum, there are around 2 billion bicycles in use today.

- That number could grow to 5 billion by the year 2050.

- In Copenhagen, 52% of residents commute by bike, making it a model for cycling infrastructure.

- Replacing a car with a bicycle helps save roughly 150 grams of CO2 per kilometer.

- A typical car releases about 8,887 grams of CO2 for every gallon of gasoline it uses.

- Bicycling can save between 700 million and 1.6 billion gallons of fuel each year.

Cycling also has safety challenges.

- In the U.S., 2% of traffic deaths involve bicyclists.

- Only 21% of men with head or neck injuries wore a helmet while biking.

- Among women with similar injuries, only 28% wore a helmet.

- Just 12% of injured children under 17 wore helmets during their accidents.

- Only 6% of Black cyclists and 7.6% of Hispanic cyclists reported wearing helmets.

Impact of U.S. Tariffs on Home Exercise Bike Market

- Elevated Import Duties: As of March 2025, cumulative tariffs on bicycles and components imported from China have reached up to 56%, while electric bikes face a 45% tariff. These increased duties have substantially raised the cost of importing home exercise bikes and their parts.

- Increased Consumer Prices: The heightened tariffs have led to a rise in retail prices for exercise bikes. For instance, a 60% tariff on a bike valued at $1,000 at port could result in a retail price increase from $3,000 to approximately $3,500–$4,000, representing a 17–33% hike.

- Supply Chain Challenges: Manufacturers and importers are grappling with the complexities of adjusting supply chains to mitigate tariff impacts. Relocating production to countries with lower tariffs is a consideration, but such transitions are time-consuming and may not be feasible for all companies.

- Market Accessibility Concerns: The increased costs have made home exercise bikes less accessible to price-sensitive consumers. This has led to a potential decline in sales, particularly affecting entry-level and budget-friendly models.

- Strategic Adjustments by Companies: Some companies, like Peloton, have managed to mitigate tariff impacts through strategic sourcing and cost-cutting measures. Peloton, for example, sources many of its products from Taiwan and has indicated that the unmitigated tariff impact on its Connected Fitness Products from China is minimal.

Emerging Trends

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): Manufacturers are incorporating AI and ML to offer personalized workout plans, real-time feedback, and adaptive resistance levels, enhancing user engagement and satisfaction.

- Rise of Virtual Fitness Communities: The growth of virtual fitness communities is fostering a sense of belonging among users, encouraging consistent use of home exercise bikes.

- Emphasis on Sustainable and Green Equipment: There is a growing demand for eco-friendly fitness equipment, with manufacturers focusing on sustainable materials and energy-efficient designs.

- Development of Compact and Foldable Designs: To cater to consumers with limited space, companies are designing compact and foldable exercise bikes without compromising on functionality.

- Integration with Health-Tech Wearables: Home exercise bikes are increasingly being integrated with health-tech wearables, allowing users to monitor their fitness metrics seamlessly.

Top Use Cases

- Home Fitness Routines: Exercise bikes provide a convenient and effective way for individuals to maintain fitness routines at home, offering low-impact cardio workouts suitable for various fitness levels.

- Rehabilitation and Physical Therapy: Healthcare providers utilize exercise bikes for rehabilitation purposes, aiding in the recovery of patients by improving mobility and circulation.

- Corporate Wellness Programs: Companies are incorporating exercise bikes into wellness initiatives, promoting employee health and productivity through accessible fitness solutions.

- Training for Cyclists and Athletes: Athletes and cycling enthusiasts use home exercise bikes for training, benefiting from features like customizable resistance and performance tracking.

- Integration into Digital Fitness Platforms: Exercise bikes are being integrated into digital platforms that offer personalized workout plans, enhancing user experience and engagement.

Major Challenges

- High Cost of Advanced Equipment: The initial investment required for high-end exercise bikes with advanced features can be a barrier for many consumers.

- Underutilization of Equipment: A significant number of users abandon their exercise bikes after initial enthusiasm wanes, leading to underutilization of the equipment.

- Intense Market Competition: The market is highly competitive, with numerous brands offering similar products, making differentiation challenging.

- Need for Continuous Innovation: Rapid technological advancements necessitate continuous innovation, requiring substantial investment in research and development.

- Consumer Demand for Personalization: Meeting the diverse preferences of consumers for personalized workout experiences poses a challenge for manufacturers.

Top Opportunities

- Expansion in Emerging Markets: Growing urbanization and rising disposable incomes in regions like Asia Pacific and Latin America present opportunities for market expansion.

- Development of Affordable Models: Introducing budget-friendly exercise bikes without compromising essential features can attract a broader consumer base.

- Partnerships with Digital Fitness Platforms: Collaborations with digital fitness platforms can enhance the value proposition of exercise bikes, offering users a comprehensive fitness ecosystem.

- Focus on Sustainable Product Design: Emphasizing eco-friendly materials and energy-efficient designs can appeal to environmentally conscious consumers.

- Integration of AI for Personalized Workouts: Leveraging AI to provide customized workout plans and real-time feedback can enhance user engagement and satisfaction.

Key Player Analysis

In 2024, the competitive landscape of the global home exercise bike market continues to be shaped by strategic initiatives, product innovation, and market expansion led by prominent players. KPS Capital Partners, through its portfolio company Schwinn, leverages operational restructuring and supply chain optimization to enhance product affordability and brand presence. Ciclotte focuses on premium, design-centric bikes targeting luxury fitness consumers, setting itself apart in the high-end segment.

Johnson Health Tech and Icon Health & Fitness Inc. maintain dominant positions through continuous technological innovation and strong brand portfolios such as Matrix and NordicTrack, respectively. Sunny Health and Fitness expands its footprint in budget-friendly home fitness solutions, appealing to a cost-conscious customer base. Body-Solid and Nautilus emphasize durable and user-friendly machines to cater to both novice and experienced users. Precor and Technogym integrate smart connectivity and ergonomic design to target wellness-driven and tech-savvy consumers. Meanwhile, Paradigm Health & Fitness enhances its market reach through affordable offerings and robust e-commerce strategies.

Top Key Players in the Market

- KPS Capital Partners

- Ciclotte

- Johnson Health Tech

- Icon Health & Fitness Inc.

- Sunny Health and Fitness

- Body-Solid

- Nautilus

- Precor

- Technogym

- Paradigm Health & Fitness

Regional Analysis

North America Leads the Home Exercise Bike Market with the Largest Market Share of 40% in 2024

In 2024, North America is expected to dominate the global home exercise bike market, accounting for the largest market share of 40%, equivalent to a market value of approximately USD 0.68 billion. This regional growth is primarily driven by rising health consciousness, increasing obesity rates, and the growing preference for home-based fitness solutions across the United States and Canada.

The popularity of smart and connected fitness equipment has also seen a notable rise in this region, with consumers showing strong demand for technology-integrated bikes that offer interactive training sessions and performance tracking. Moreover, the prevalence of sedentary lifestyles and the increasing penetration of virtual fitness platforms have further reinforced the adoption of home exercise bikes among consumers across age groups.

The United States, being the largest contributor to the regional market, has witnessed steady consumer investment in fitness equipment, especially during and post the pandemic era. However, the market dynamics are partially influenced by trade policies, particularly U.S. tariffs on imported exercise equipment, which have increased the cost of several foreign-manufactured models.

These tariffs have encouraged some domestic manufacturers to scale up production capacities, while importers have faced price challenges and supply chain adjustments. Despite this, the overall demand remains robust, underpinned by strong brand presence, favorable consumer expenditure patterns, and widespread product availability through online retail channels. The regional dominance of North America in the home exercise bike market is expected to remain firm in the near term, supported by continuous product innovations and strategic marketing initiatives from leading players.

Recent Developments

- In 2023, Quell, a UK-based fitness gaming company, raised $10 million in Series A funding. The round was led by Tencent, with support from Khosla Ventures, Heartcore Capital, Social Impact Capital, and Naval Ravikant. This brought Quell’s total funding to $15.6 million. The company plans to use the funds to grow its gaming platform that combines fitness and immersive gameplay.

- In 2024, Magic AI, a fitness tech firm based in London, raised $5 million to boost the development of its smart fitness mirror. The round was led by IW Capital, with backing from Baleen Capital, SFC Capital, Ventures Together, and angel investors from top tech firms. This follows a previous $2.5 million round and supports the company’s expansion in AI-driven home workouts.

- In 2024, Portl, an Indian fitness and wellness startup, secured $3 million in funding led by Bharat Innovation Fund. T-Hub Foundation and Kalaari Capital also joined the round. The capital will be used to develop new AI features, grow its product line, and reach more users across India and beyond.

- In 2023, Magic AI raised $2.5 million to enhance its AI personal trainer platform, ReflectAI®. The funding round was led by Fasanara Capital and SFC Capital. This investment will help Magic AI expand its presence in the home fitness market and improve its smart training experience using artificial intelligence.

Conclusion

The global home exercise bike market is experiencing steady growth, driven by increasing health awareness, the convenience of at-home workouts, and technological advancements. The integration of features such as virtual training, real-time performance tracking, and AI-powered customization is enhancing user engagement. Demographic shifts, including an aging population seeking low-impact exercise options and urban professionals desiring time-efficient fitness solutions, are further propelling market expansion. While North America currently holds the largest market share, emerging economies are presenting new opportunities for manufacturers. Challenges such as the high cost of advanced equipment and intense market competition persist; however, innovations in design, affordability, and digital integration are expected to address these issues. Overall, the market is poised for sustained growth as it adapts to evolving consumer preferences and technological trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)