Table of Contents

Introduction

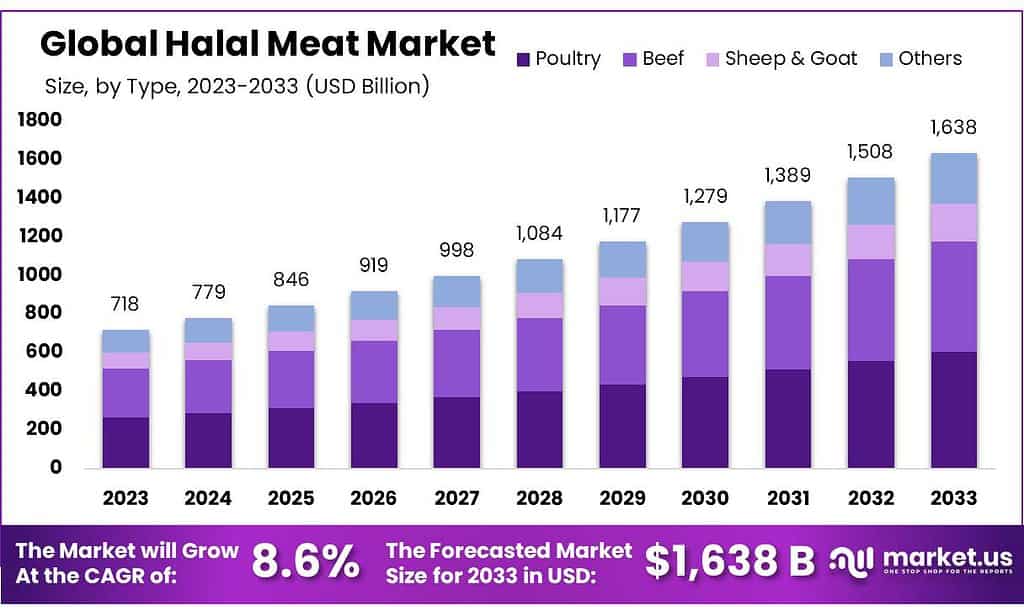

The Global Halal Meat Market is anticipated to grow from USD 718 billion in 2023 to an estimated USD 1638 billion by 2033, achieving a compound annual growth rate (CAGR) of 8.6% during the forecast period. This expansion is attributed to increasing consumer awareness and the profound impact of religious beliefs that mandate adherence to Islamic dietary laws.

However, the market is confronted with challenges, notably the lack of a unified Halal certification standard. This absence of uniformity leads to confusion and inefficiencies, complicating international trade in Halal meat due to differing standards and certification bodies across countries.

Recent industry developments include strategic alliances aimed at expanding market influence and ensuring product authenticity. For example, in August 2023, BRF collaborated with the Halal Products Development Company, backed by Saudi Arabia’s Public Investment Fund, to strengthen its market position. Additionally, the surge in Halal certifications, with more than 3,500 awarded to manufacturers by 2023, underscores the escalating demand for certified Halal products.

The Halal Meat Market includes strategic moves by key players like BRF Global, which formed a significant joint venture with the Halal Products Development Company, a subsidiary under Saudi Arabia’s Public Investment Fund, in August 2023.

This partnership aims to enhance BRF’s market influence and cater to the growing demand for Halal meat products. The venture, where BRF holds a 70% stake, underscores its shift from merely exporting to becoming a domestic provider in strategic markets.

The industry is also benefiting from the growth of the global Muslim population, which is expected to significantly increase by 2030, thereby enhancing the demand for Halal meat products worldwide.

Key Takeaways

- Market Growth Projection: Halal Meat Market is expected to reach USD 1638 billion by 2033, with an 8.6% CAGR between 2023-2033.

- Poultry Dominance: Poultry hold a 35.3% market share in 2024 due to versatility and lower fat content.

- Certification Preference: Solid Halal Certification captures over 64.2% market share in 2024, emphasizing consumer trust.

- Packaging Preference: Fresh meat dominates with 85.6% market share in 2024, driven by freshness and taste.

- Distribution Channel: Convenience stores lead with 72.4% market share in 2024, offering accessibility and extensive products.

- End-user Dominance: Household consumers hold a 34.5% market share in 2024, driving market demand.

- Regional Analysis: Asia Pacific dominates the market with a 38.9% share in 2024, driven by the Muslim population and investments.

- The University of Missouri found that the average price of Halal meat in the United States was 20% higher than conventional meat in 2023.

- University of Florida found that the demand for Halal meat in the United States is expected to increase by 10% annually until 2024 due to the growing Muslim population.

Halal Meat Statistics

Global Halal Food Market Dynamics

- The global Halal food market was valued at US$ 1.27 trillion in 2021 and is forecast to reach US$ 1.67 trillion by 2025.

- In 2020, the Organization of Islamic Cooperation (OIC) reported a Halal food export deficit of around US$ 67 billion.

- The Oneonta Halal Meat Processing Facility in New York received a $200,000 Empire State Development Grant.

- In Illinois, the annual fee for a Halal Certificate of Registration is $75.00.

New Jersey’s Division of Consumer Affairs conducted 318 inspections of Halal food businesses in 2018, finding all in compliance.

Halal Meat Consumption Insights

- Top Halal Food Consumers: Muslim-majority countries consume about 80% of halal food products worldwide.

- Non-Muslim Market Share: Non-Muslims contribute to around 20% of the global halal food market.

- Halal Meat Consumption: Over 80% of halal-certified products are meat-related.

- Leading Halal Meat Producers: Brazil, Australia, and India are among the top exporters of halal meat, accounting for 90% of global halal meat production.

- Halal Food Industry Employment: The halal food sector employs over 2 million people globally.

Trends in Online Halal Markets

- Online Halal Market Growth: E-commerce platforms witness a 15% annual growth in halal food sales.

- Percentage of weekly beef consumers: 69%

- Total fresh beef substitute sales: $175 million

- The projected decrease in beef consumption in 2023: 5%

- Percentage of meals cooked with beef in the USA: 75%

Consumer Behavior and E-commerce

- Percentage of households eating most meals at home: 76%

- Percentage of online grocery shoppers buying beef: 44%

- E-commerce projected share of total grocery sales by 2026: 20%

- Online shopping satisfaction levels: 75%-85%

- Percentage of Canadians who are Muslim: Nearly 5% according to the 2021 census.

Halal Meat Export and Standards

- Amount lent by the infrastructure bank to BC Ferries for zero-emission vessels: $75 million.

- Exports of halal meat from New Zealand started in the 1970s, constituting 26% of red meat exports.

- Approximately 45% of New Zealand’s red meat exports are halal-certified.

- The Food Standards Agency in the United Kingdom asserts that 88% of halal-slaughtered animals in Britain are stunned first though there is debate among Islamic (as well as Jewish) scholars on what manners of stunning are more acceptable or whether stunning itself is humane at all.

- In November 2014, South Australian dairy company Fleurieu Milk and Yoghurt was forced to drop a $50,000 contract with airline Emirates due to public pressure, as the contract required the products to be halal-certified.

Emerging Trends

- Rising Global Demand for Halal Products: The Muslim population worldwide is expected to increase to 2.2 billion by 2030, spurring demand for Halal-certified products. This trend extends beyond the Muslim community, attracting non-Muslims as well due to the perceived ethical standards, quality, and health benefits of Halal products. Major food companies like Nestle are broadening their Halal product lines, which in turn strengthens consumer trust and brand loyalty.

- E-Commerce and Digital Innovation in Halal Markets: The Halal industry is embracing digital transformation, significantly propelled by e-commerce growth. This includes the emergence of specialized online platforms for Halal products, encompassing food, cosmetics, and travel services. Digital advancements are enhancing transparency and traceability, bolstering consumer trust in the legitimacy of Halal certifications.

- Expansion of Halal Tourism: Halal tourism is on the rise, with an increasing number of countries, including those with non-Muslim majorities, adapting their offerings to appeal to Muslim travelers. This sector provides tailored Halal-friendly accommodations and services, opening new avenues for growth in the travel and hospitality sectors.

- Innovations in Halal FinTech: The financial industry is also transforming with the development of Islamic FinTech solutions, such as blockchain for Halal certification and Shariah-compliant digital banking. These innovations are making Islamic financial services more accessible and supporting investments in Halal-aligned businesses.

- Sustainability and Ethical Practices in Halal Consumption: Consumers are placing greater emphasis on sustainability and ethical consumption, values that are compatible with Halal principles. Halal brands are increasingly adopting sustainable practices, including organic farming and environmentally friendly packaging, to attract consumers who are conscious about the environment.

- Alternative Proteins and Halal Food Security: The demand for alternative protein sources is growing amid heightened concerns about food security and health. Halal-certified plant-based meats are becoming more popular, appealing to those seeking sustainable and healthy dietary options.

- Strengthening Halal Regulatory Frameworks: As the Halal product market expands, regulatory oversight is also intensifying. Governments are implementing stricter Halal regulations to ensure product quality and authenticity, pushing businesses in the Halal market towards greater compliance and transparency.

Use Cases

- Food Services and Retail Impact: Halal meats are prevalent in food service environments like restaurants and catering services, especially in areas with large Muslim communities. These sectors value the guarantee of Halal authenticity to comply with Islamic dietary rules. Similarly, the retail industry features a broad selection of Halal meats in supermarkets and other large stores to satisfy consumer needs.

- Pharmaceuticals and Cosmetics Integration: In the pharmaceutical sector, adherence to Halal standards is essential, particularly to avoid ingredients that are prohibited under Islamic law, such as certain animal derivatives not processed according to Halal practices. The cosmetics industry similarly leverages Halal certification to appeal to consumers seeking products that align with Islamic ethical standards.

- Tourism Adaptations: Halal tourism is expanding quickly, providing services that adhere to Halal norms, including food and prayer facilities. This sector is growing not only in predominantly Muslim regions but also in non-Muslim majority areas, adapting to accommodate Muslim travelers.

- Technological Advancements in Food Production: Innovation in the Halal food industry is advancing, especially in meat production techniques like lab-grown meat, which must comply with Halal standards to be permissible. Factors like the origin of the cells used and the materials involved in the growth process are pivotal in determining Halal compliance.

- Growth of Digital and E-commerce: The rise of online shopping has significantly increased the accessibility of Halal products, with digital platforms becoming essential in distributing these goods. Consumers worldwide can now easily purchase a variety of Halal-certified items, ranging from food to personal care and pharmaceutical products, all meeting Halal requirements.

Major Challenges

- Variability in Certification Standards: The absence of a uniform global halal certification standard leads to confusion among consumers and complicates international trade. Different nations and certifying authorities have varied criteria for what qualifies as halal, which can undermine consumer trust and complicate global commerce.

- Complexities in Supply Chain Management: The process of maintaining halal integrity from the point of slaughter to delivery at the consumer’s table demands rigorous oversight. This includes the need for strict separation of halal and non-halal products during processing, transport, and storage, which introduces significant logistical challenges and increased costs.

- Lack of Awareness and Understanding: A widespread lack of knowledge about halal standards and requirements among both consumers and producers can result in certification delays and compliance issues. This gap in understanding can hinder the efficient production and distribution of halal products.

- High Costs of Maintaining Compliance: The financial burden associated with achieving and maintaining halal compliance is significant. This includes costs related to sourcing appropriate ingredients, training personnel, and undergoing certification processes, which can be particularly challenging for smaller businesses.

- Debates Over Ethical Practices: Ethical debates, especially concerning the practice of non-stun slaughter, prevalent in some halal methodologies, can affect public perception and lead to regulatory challenges. These debates often focus on animal welfare concerns and can impact both market access and industry growth.

Market Growth Opportunities

- Expanding Markets: In Malaysia, the growth in disposable income among large Muslim populations presents a significant opportunity for halal food producers. The demand for halal-certified products in Malaysia is increasing, driven by more affluent consumers with evolving dietary habits, offering a promising market for U.S. agricultural exports.

- Halal Tourism: The Philippines has identified halal tourism as a key area for development. By enhancing halal-certified food options and awareness, the country aims to attract more Muslim tourists, which in turn could increase demand for halal food products significantly.

- Processing Hubs: The Philippine government is working to position the country as a hub for halal food processing. This initiative aims to enhance the processing and exportation of halal products to regions with significant Muslim populations, creating a gateway for entering global halal markets.

- Emerging Markets: Brazil, as a major producer of halal meat, sees a robust opportunity to expand its exports to the Middle East and other predominantly Muslim regions. The rising income levels and urbanization in these regions offer a growing market for Brazil’s halal meat products.

- Increasing Consumer Demand in Non-Muslim Countries: South Africa is experiencing growing consumer interest in halal products within its retail sector. This reflects a broader global trend where halal products are gaining traction not just among Muslims but also among non-Muslim consumers who associate halal with ethical and quality food standards.

Key Players Analysis

- BRF Global has significantly enhanced its presence in the Halal meat market, particularly by forming a joint venture with the Halal Products Development Company under Saudi Arabia’s Public Investment Fund. This partnership is aimed at more than just export; it’s about establishing local production in the Middle East to better integrate into the market and extend BRF’s reach within the Halal sector. Additionally, BRF is setting up a new processed food factory in Saudi Arabia, reinforcing its position as a leader in the Halal market.

- Al Islami Foods, located in Dubai, UAE, has stood out in the Halal meat market for its dependable quality since 1981. The company produces a wide array of products such as whole chickens and chicken parts, burgers, and more under its Aladdin and Al Islami brands, meeting high standards and consumer expectations which solidify its strong market stance.

- SIS Company from Mumbai, India, is known for specializing in buffalo meat, emphasizing high quality and 100% Halal certification. They offer a range of frozen meats that adhere to rigorous Halal standards, appealing to both domestic and international markets and affirming their reputation as a reliable source in the global Halal meat industry.

- Al Kabeer Group ME, a prominent entity in the Middle East’s frozen food industry, offers an extensive portfolio of over 200 products, including a variety of meat and seafood. Founded over 40 years ago, Al Kabeer operates with a commitment to high-quality standards and Halal compliance across its production units, serving major markets in the GCC from strategic locations in the UAE and Saudi Arabia.

- Prairie Halal Foods in Alberta, Canada, specializes in premium Halal meats such as beef, veal, and lamb, targeting Middle Eastern markets with high-quality gourmet products. Supported by a consortium of reputable Canadian food companies, Prairie Halal Foods stands as a testament to Western Canada’s rich agricultural practices, focusing on ethical raising and environmental sustainability of their meat products.

- Nema Food, based in Fairfield, NJ, USA, is notable for its high-quality Halal meat products served both locally and internationally. Utilizing advanced manufacturing technologies and a knowledgeable team, Nema ensures top-tier quality and compliance with Halal standards across its U.S. production locations, making it a trusted name in North America’s Halal food sector.

- Thomas International’s Lobethal branch in Australia encountered significant challenges in maintaining Halal certification standards, which affected their meat exports to Singapore. The stringent Halal integrity checks by the Majlis Ugama Islam Singapura (MUIS) and relevant authorities led to the halt of these exports, highlighting the strict compliance required in the Halal meat industry.

- Al-Aqsa, a major U.S. player in the Halal meat market, offers a wide selection of Halal poultry and meat products. Their focus on producing antibiotic-free and hormone-free meats assures high-quality and natural products, establishing Al-Aqsa as a trusted name in both domestic and Gulf country markets. Their commitment to strict Halal standards and excellent customer service ensures they meet the diverse needs of their customer base effectively.

- Doux has positioned itself as a leader in the global Halal meat industry, especially noted for its poultry products. The company adheres to sustainable farming practices and ethical treatment of animals, ensuring all products meet stringent Halal certification criteria. This commitment helps Doux serve significant Muslim populations worldwide, maintaining its reputation as a trusted Halal poultry provider.

- Herd & Grace stands out in the Halal meat sector by offering high-quality, ethically produced meats such as Wagyu and grass-fed varieties, delivered directly to consumers. Established in 2023, they prioritize ethical and sustainable farming practices, free from hormones and GMO feeds, aligning with the strict Halal standards necessary for certification. Herd & Grace’s focus on ethical practices and premium products sets them apart in the Halal meat market.

Conclusion

The halal meat market is poised for considerable expansion, driven by the global increase in Muslim populations and enhanced recognition of the ethical and quality assurances provided by Halal certification.

Anticipated to achieve significant market value in the coming years, the sector extends across various industries including food services, pharmaceuticals, and cosmetics. Additionally, emerging areas such as Halal tourism and advanced food technologies are gaining traction.

The rise of e-commerce has also played a crucial role in broadening the accessibility of Halal products, ensuring their distribution meets stringent Halal standards worldwide. This growth reflects the market’s ongoing evolution and its growing significance to an ethically minded consumer base looking for quality and compliance in their consumption choices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)