Table of Contents

Introduction

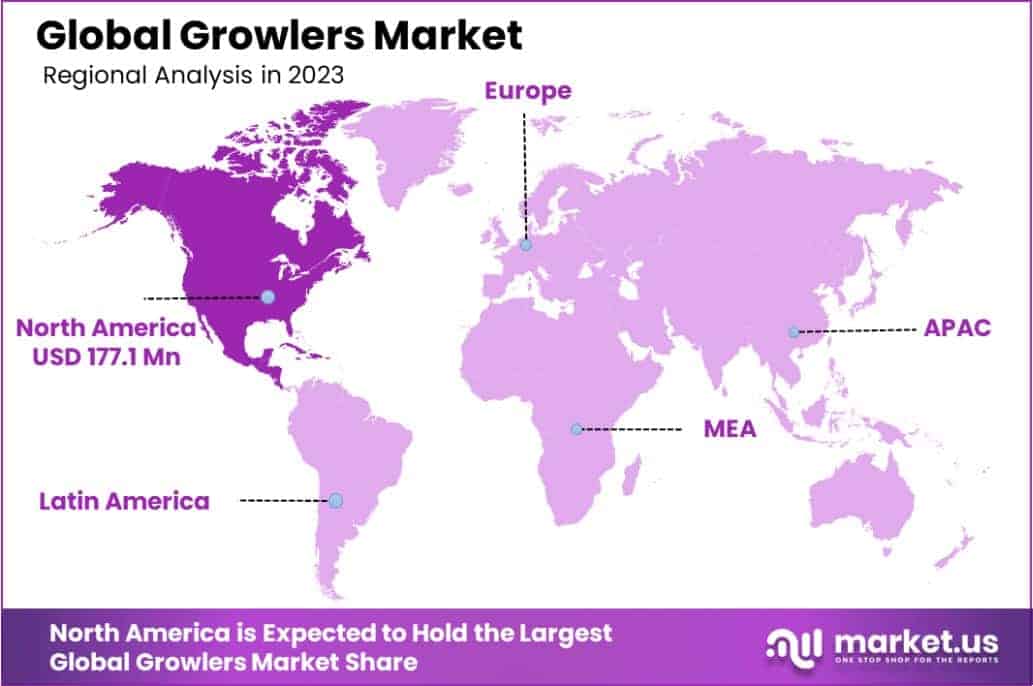

The Global Growlers Market is projected to reach approximately USD 799.0 million by 2033, up from USD 550.3 million in 2023, reflecting a compound annual growth rate (CAGR) of 3.8% from 2024 to 2033. In 2023, North America held the largest market share at 32.2%, generating revenue of USD 177.1 million in the Growlers Market.

A growler is a reusable container, typically made of glass, designed to transport draft beer from breweries or taprooms. The growlers market refers to the industry involved in the production, sale, and distribution of these containers, which have seen growing popularity, particularly alongside the rise of craft beer consumption. Several factors are driving market growth, including the increasing demand for craft and local beers, heightened consumer focus on sustainability, and the shift towards at-home drinking experiences.

As beer drinkers seek fresh, high-quality options outside of traditional retail channels, growlers offer an eco-friendly and convenient solution. Additionally, rising disposable incomes and a growing interest in artisanal, small-batch products contribute to the market’s expansion. Opportunities within the growlers market include the development of innovative packaging solutions, strategic partnerships with local breweries, and the potential for expansion into emerging markets where craft beer culture is gaining traction. The reusable nature of growlers aligns with broader environmental trends, further boosting demand.

Key Takeaways

- The Global Growlers Market is anticipated to reach USD 799.0 Million by 2033, growing from USD 550.3 Million in 2023, representing a compound annual growth rate (CAGR) of 3.8%. This growth is driven by increasing consumer demand for reusable containers and the growing craft beer culture, particularly in North America and Europe.

- In 2023, Stainless Steel Growlers dominated the market in terms of material. Stainless steel’s durability, insulation properties, and ability to preserve beverage freshness have made it the preferred choice for consumers and businesses, particularly in the craft beer sector.

- The 64 oz growler held a significant market share of 42.2% in 2023. This size is the most common and popular choice among craft beer enthusiasts, as it offers a balance between portability and quantity, making it ideal for a trip to a local brewery or for home consumption.

- Screw Caps were the most preferred closure type in 2023. They offer an easy-to-use, secure, and airtight seal, which helps in maintaining the quality and freshness of the beverages inside, making them a practical choice for both consumers and breweries.

- Craft Breweries held the largest share in the End-User segment in 2023. The craft beer industry continues to expand, and breweries are increasingly offering growlers as a convenient way for customers to take home their beer. This trend supports both local and sustainable drinking habits, boosting the demand for growlers.

- North America accounted for 32.2% of the total Growlers Market share in 2023, generating USD 177.1 Million in revenue. This region’s dominance is largely attributed to the high popularity of craft beer in the U.S. and Canada, coupled with a growing preference for eco-friendly, reusable packaging options among consumers.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 550.3 Million |

| Forecast Revenue (2033) | USD 799.0 Million |

| CAGR (2024-2033) | 3.8% |

| Segments Covered | Based on Material(Glass Growlers, Stainless Steel Growlers, Ceramic Growlers, PET Plastic Growlers), Based on Capacity(32 oz, 64 oz, 128 oz), Based on the Closure Type(Screw Cap, Swing Top, Flip Top, Other Closure Types), Based on End-User(Craft Breweries, Bars & Pubs, Restaurants, Home Use, Other End-Users) |

| Competitive Landscape | DrinkTanks, Hydro Flask, Klean Kanteen, uKeg by GrowlerWerks, Miir, BrüMate, YETI, Stanley, The Portland Growler Company, EcoVessel, Other Key Players |

Key Segments Analysis

In 2023, stainless steel growlers dominated the growler market, holding over 40% of the market share. Their popularity is driven by durability, excellent insulation for maintaining beverage quality, and sustainability, making them a preferred choice among craft beer enthusiasts and outdoor consumers. Stainless steel growlers also offer recyclability, aesthetic appeal, and customization options like engraving, further boosting their demand. As the craft beer industry grows globally, the demand for premium, reusable containers has strengthened, solidifying the leading position of stainless steel growlers in the market.

In 2023, 64 oz growlers dominated the “Based on Capacity” segment of the Growlers Market, holding a 42.2% share. This size is favored by craft beer enthusiasts for its ideal balance between portability and volume, making it perfect for social gatherings and small-scale events. The growing trend of moderate consumption and craft beer tasting events, along with its compatibility with alcohol transport regulations, further boosts its popularity. Retailers and breweries cater to this demand by offering a variety of designs and customization options, reinforcing the 64 oz growler’s central role in the market.

In 2023, Screw Cap closures dominated the Growlers Market, holding around 45% of the market share due to their reliability, cost-effectiveness, and ability to seal in freshness, crucial for beverages like craft beer and carbonated drinks. Their leak-proof properties, ease of use, and affordability make them a preferred choice for both consumers and manufacturers, offering convenience during transport and storage. With their adaptability to different bottle neck sizes and growing demand for portable beverage containers, Screw Caps are expected to maintain their leadership position in the market, especially as the craft beverage industry continues to expand.

In 2023, Craft Breweries held a dominant 38% share of the growler market, driven by the rise of the craft beer movement, which emphasizes unique, locally brewed beers often sold directly from breweries. Growlers allow these breweries to extend their reach beyond their physical locations, offering customers fresh, draft beer to take home. This practice fosters customer engagement, brand loyalty, and aligns with eco-conscious values, as growlers are reusable. With the ongoing shift toward artisanal products and the growing popularity of craft beer, Craft Breweries are expected to maintain a strong position in the market.

Emerging Trends

- Rise of Craft Beer Consumption: The global craft beer industry is growing at a steady pace, driving demand for growlers as consumers look for ways to take home fresh, high-quality beer. Craft beer drinkers are increasingly seeking unique, small-batch brews, and growlers provide a way to transport beer without compromising on taste and freshness.

- Eco-friendly Packaging Solutions: As sustainability becomes a key concern for consumers, there’s a growing preference for reusable growlers. Glass and stainless steel growlers are becoming more popular due to their long-term environmental benefits. This shift is prompting breweries and bars to offer eco-conscious packaging options.

- Convenience of Home Delivery: Online platforms are enabling the home delivery of growlers, especially in areas where local breweries and pubs are well-established. This trend is gaining traction, as consumers seek convenience while enjoying fresh beer from their favorite local brewers.

- Growth of Specialty and Limited Edition Beers: There is an increasing interest in limited-edition and seasonal beers, which breweries often offer in growlers. These products tend to have a loyal following, with consumers willing to pay premium prices for exclusive beers that are only available in small quantities.

- Integration with Smart Technology: Some breweries are exploring smart growlers, which include features like temperature monitoring, RFID tracking, and even digital labeling that updates beer information in real-time. This trend is aimed at enhancing the consumer experience and providing more information on the product’s freshness and quality.

Top Use Cases

- Beer Freshness Preservation: Growlers are primarily used for transporting fresh draft beer from breweries to consumers’ homes. They are designed to preserve the quality of the beer, maintaining carbonation and flavor longer than regular bottles or cans. For example, a typical glass growler can keep beer fresh for up to two weeks if stored properly.

- Specialty and Local Beer Access: Many beer enthusiasts use growlers to access limited-edition or seasonal brews that may not be available in stores. This is particularly common in microbreweries where customers can take home unique, small-batch beers that aren’t distributed widely.

- Tasting Events and Beer Sampling: Growlers are also popular for use in tasting events where consumers sample a variety of beers. Breweries often offer growlers for event attendees to take home their favorite brews, enabling them to enjoy the beer later while promoting the brewery’s brand.

- Cost-Effective and Reusable Packaging: Consumers who drink beer regularly often use growlers as an economical option for purchasing beer in bulk, as growlers can be refilled at a lower cost compared to buying individual bottles or cans. This practice is growing in popularity due to the savings and environmental benefits it provides.

- Home Brewing and Beer Gifting: Growlers are commonly used by homebrewers to share their own beer creations with friends and family. Additionally, they are increasingly being given as gifts, with custom designs and labels that make them a unique and personal present.

Major Challenges

- Regulatory Restrictions on Refill Practices: In some regions, laws and regulations around growler refills limit the market’s growth potential. For instance, certain countries or states require special licenses for breweries to refill growlers, and these laws may change frequently, creating uncertainty for businesses.

- Logistical Issues with Distribution: Growlers are often large and fragile, making them difficult to ship and store efficiently. The cost of distribution, particularly for smaller breweries, can be prohibitive, limiting their ability to expand the growler model beyond local markets.

- Quality Control and Shelf Life: Ensuring the beer remains fresh during transit is a significant challenge. Growlers, although designed to preserve beer, have a limited shelf life. If a growler isn’t consumed soon after purchase, the beer can lose its quality, including carbonation and flavor.

- Consumer Awareness and Education: Not all consumers understand the proper care and use of growlers, such as how to store them at the right temperature or how to clean and maintain them for reuse. This lack of education can lead to poor product experience and potentially limit the adoption of growlers.

- Competition with Traditional Packaging: Despite the growing trend toward sustainable packaging, traditional bottles and cans continue to dominate the market due to their ease of use, lower cost, and longer shelf life. As a result, growlers face stiff competition in the beer packaging market, particularly from larger, more established breweries.

Top Opportunities

- Expanding the Craft Beer Market: As the craft beer segment continues to grow globally, there is an opportunity to further promote growlers as a way for craft beer drinkers to enjoy fresh, locally brewed beers at home. Increased interest in artisanal and small-batch beers provides a unique opportunity for growler suppliers to expand their customer base.

- Strategic Partnerships with Breweries: Growler suppliers can partner with more breweries and taprooms to offer branded growlers, increasing the visibility of their products and driving sales. Collaborations that feature exclusive growler designs for limited-edition beers could attract more customers seeking unique, branded beer experiences.

- Expanding Online Sales and Delivery: As e-commerce and home delivery services grow, there’s a major opportunity for companies to sell growlers online, with customers able to purchase and receive freshly filled growlers at home. Establishing a robust online platform for growler sales can capitalize on the increasing demand for convenience.

- Increase in Sustainable Packaging Demand: With growing consumer interest in sustainability, there is an opportunity for the growler market to thrive by offering eco-friendly products. Providing reusable and recyclable options such as glass and stainless steel growlers can attract environmentally-conscious consumers.

- Innovation in Growler Technology: As consumers become more tech-savvy, the integration of innovative features such as temperature-sensitive smart growlers or apps that help track the freshness of beer could open up new avenues for growth. These features appeal to tech-oriented consumers and can enhance the overall customer experience.

Key Player Analysis

- DrinkTanks: DrinkTanks is a prominent player known for its high-quality, vacuum-insulated growlers designed to keep beverages cold for extended periods. Their product range includes a variety of sizes, and their flagship item, the 64oz growler, is particularly popular. DrinkTanks’ focus on quality and innovation, such as the patented “Double Wall Insulation,” has helped it stand out.

- Hydro Flask: Hydro Flask, well-regarded for its durable and insulated drinkware, has expanded into the growler market. Their 64oz growlers are highly favored for their ability to maintain temperatures for up to 24 hours. Hydro Flask’s strong brand recognition and commitment to sustainability have contributed to its success.

- Klean Kanteen: Klean Kanteen, a key player in the sustainable beverage container market, offers a range of insulated growlers made from high-quality stainless steel. Their 64oz Classic Growler is one of the most popular choices. Klean Kanteen’s emphasis on eco-friendly products has made it a favorite among environmentally-conscious consumers.

- uKeg by GrowlerWerks: GrowlerWerks is known for its uKeg line of pressurized growlers, which allow for carbonation control, ensuring that beverages like beer stay fresh longer. Their uKeg 64oz model is especially popular for craft beer enthusiasts.

- Miir: Miir offers a range of insulated products, including growlers that are highly durable and designed for on-the-go use. Their products, such as the Miir 64oz growler, focus on both functionality and aesthetics. Miir’s business model also incorporates a focus on social responsibility, pledging a portion of their sales to global clean water initiatives.

Regional Analysis

North America – Dominating Region with the Largest Market Share (32.2%) in the Growlers Market

North America holds the largest share of the global Growlers Market, commanding a significant 32.2% share in 2023, valued at approximately USD 177.1 million. The dominance of this region can be attributed to several key factors, including the high consumer demand for craft beer and specialty beverages, along with the increasing trend of sustainable packaging options. Growlers, which are reusable glass containers typically used for transporting draft beer, have gained popularity in North America due to their convenience and environmental appeal.

The U.S. and Canada are at the forefront of this trend, with the U.S. particularly experiencing a boom in the craft beer segment, which fuels the demand for growlers. Moreover, several state-level regulations and favorable distribution systems have contributed to this market’s growth. As a result, North America is expected to continue leading the market, with its strong consumer base and thriving craft beer industry being key drivers of its growth.

Recent Developments

- In 2024, Tilray Brands, Inc. finalized its acquisition of several craft breweries, including Hop Valley Brewing, Terrapin Beer Co., and Revolver Brewing, from Molson Coors. This strategic purchase aims to enhance Tilray’s growth in the craft beer sector and expand its market reach while boosting brand development.

- In 2024, Performance Food Group (PFG) announced it would acquire Cheney Bros. for $2.1 billion. This acquisition strengthens PFG’s presence in the Southeast and adds significant distribution capacity, with Cheney Bros. generating $3.2 billion in annual revenue.

- In 2023, Mars Inc. agreed to acquire Kellanova for $36 billion. The deal will combine two major food industry players, with Mars paying a premium of 33% per share to expand its portfolio in response to industry challenges.

Conclusion

The global growlers market is poised for steady growth, driven by the increasing popularity of craft beer, sustainability trends, and the shift towards reusable packaging. As more consumers seek eco-friendly alternatives to traditional packaging, growlers, particularly those made of stainless steel and glass, offer an attractive solution for preserving beverage freshness while reducing waste. North America remains the dominant market, fueled by a strong craft beer culture and a growing preference for sustainable packaging options. With continued innovation and partnerships between breweries and growler manufacturers, the market is likely to expand further, offering more convenient and specialized products to meet consumer demands. As the industry evolves, challenges such as regulatory restrictions and logistical issues will need to be addressed, but the overall outlook remains positive with significant opportunities for growth across various regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)