Table of Contents

Introduction

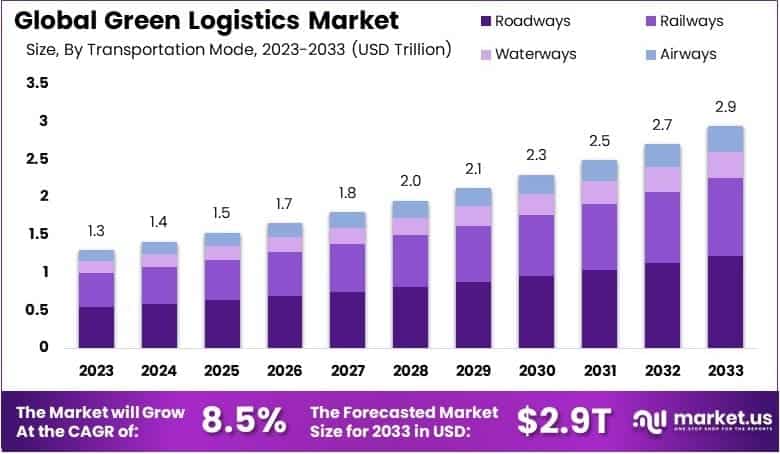

The Global Green Logistics Market is anticipated to grow from USD 1.3 trillion in 2023 to approximately USD 2.9 trillion by 2033, registering a compound annual growth rate (CAGR) of 8.5% during the forecast period from 2024 to 2033.

Green logistics refers to the sustainable practices implemented within the supply chain management process to minimize the environmental impact of logistics activities. This concept emphasizes the adoption of eco-friendly methods such as using renewable energy sources, optimizing routes to reduce fuel consumption, and employing biodegradable packaging materials.

The Green Logistics Market encompasses all activities and services that aim to achieve these sustainable logistics objectives. It includes solutions and technologies that facilitate efficient transportation, warehousing, distribution, and waste management while adhering to environmental standards.

The growth of the Green Logistics Market can be attributed to several key factors. Increasing regulatory pressures and environmental awareness among consumers are driving companies to adopt green logistics practices. Governments worldwide are implementing stricter emissions regulations, which compel businesses to rethink their supply chain operations to include sustainable practices. Additionally, the rising cost of traditional fuel sources and advancements in green technologies, such as electric and hybrid vehicles, further bolster the market’s expansion.

The demand for green logistics is on the rise, fueled by the growing need to reduce carbon footprints and mitigate environmental degradation. Companies are increasingly recognizing that integrating green practices into their logistics operations not only complies with regulations but also enhances brand reputation and customer loyalty. The market is seeing a surge in demand for services such as sustainable transportation management, eco-friendly packaging solutions, and energy-efficient warehousing.

Opportunities within the Green Logistics Market are vast and varied. Innovations in IoT and AI are playing a pivotal role in optimizing logistics operations, making them more sustainable. There is significant potential for growth in developing regions where awareness and adoption of green logistics are still evolving.

Moreover, the push towards circular economies creates new avenues for companies specializing in reverse logistics, which is integral to recycling and reusing resources. As the global economy moves towards sustainability, the Green Logistics Market is poised for substantial growth, offering numerous opportunities for industry stakeholders to innovate and expand their green initiatives.

Key Takeaways

- The global Green Logistics Market was valued at USD 1.3 trillion in 2023 and is projected to grow to USD 2.9 trillion by 2033, registering a CAGR of 8.5%.

- In 2023, the Roadways transportation segment dominated the market with a share of 41.6%, primarily driven by increased demand for environmentally sustainable road transportation.

- The Solutions component segment accounted for the largest market share of 62.3% in 2023, reflecting strong demand for efficient logistics management solutions.

- Manufacturing emerged as the leading industry vertical in 2023, supported by the growing emphasis on sustainable and environmentally friendly supply chain practices.

- The Distribution segment led among business types in 2023, fueled by significant investment in developing sustainable distribution networks.

- Europe accounted for the largest regional share, holding 36.3% of the market, valued at USD 0.47 trillion in 2023, due largely to stringent environmental regulations in the region.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 1.3 Trillion |

| Forecast Revenue (2033) | USD 2.9 Trilliion |

| CAGR (2024-2033) | 8.5% |

| Segments Covered | By Transportation Mode (Roadways, Railways, Waterways, Airways), By Component (Solutions: Transportation, Warehousing, Packaging, Distribution, Inventory Management; Service: Reverse Logistics, Carbon Emission Monitoring, Carbon Footprint Reduction, Waste Management, Eco-Friendly Packaging), By Industry Vertical (Manufacturing, Retail & E-commerce, Automotive, Food & Beverages, Pharmaceuticals & Healthcare, Electronics, Chemicals, Agriculture), By Business Type (Value Added Services, Warehousing, Distribution, Freight Forwarding) |

| Competitive Landscape | UPS, FedEx, DHL Supply Chain, Maersk Line, C.H. Robinson, XPO Logistics, J.B. Hunt Transport Services, Werner Enterprises, Ceva Logistics, Kuehne + Nagel |

Emerging Trends

- Adoption of Alternative Fuels: Logistics companies are increasingly investing in vehicles powered by alternative fuels, such as electric and hydrogen, to reduce carbon emissions. For example, Amazon has placed the UK’s largest-ever order for electric heavy goods vehicles (HGVs), including over 140 electric trucks, as part of its £300 million green transport investment aimed at achieving net-zero carbon emissions by 2040.

- Integration of Autonomous Vehicles: The development of driverless trucks is poised to revolutionize freight transport. Companies like Aurora Innovation are planning to deploy autonomous trucks for freight haulage between Dallas and Houston, aiming to address driver shortages and enhance delivery efficiency.

- High-Speed Rail Freight Services: The introduction of high-speed rail freight services offers a cleaner alternative to traditional trucking. In the UK, Varamis Rail has launched a service converting old passenger trains to transport goods at speeds up to 100 mph, reducing reliance on road transport.

- Circular Supply Chain Practices: Companies are adopting circular economy principles, focusing on recycling and reusing materials to minimize waste. This approach not only reduces environmental impact but also enhances resource efficiency.

- Green Shipping Initiatives: Major corporations are collaborating to promote the use of near-zero emissions fuels in maritime shipping. For instance, Amazon and IKEA, among others, are part of the Zero Emissions Maritime Buyers Alliance, seeking to accelerate the transition to sustainable ocean freight.

Top Use Cases

- Electric Delivery Vehicles: Deploying electric vans and trucks for last-mile delivery reduces greenhouse gas emissions in urban areas. Amazon’s initiative to add over 140 electric HGVs to its UK fleet exemplifies this application.

- Autonomous Freight Transport: Utilizing driverless trucks for long-haul routes enhances efficiency and safety in freight transport. Aurora Innovation’s plans to operate autonomous trucks between major Texan cities highlight this use case.

- High-Speed Rail Logistics: Implementing high-speed trains for freight offers a faster and more sustainable alternative to road transport. Varamis Rail’s service between Birmingham and Glasgow demonstrates this approach.

- Reverse Logistics for Recycling: Establishing systems to return and recycle products at the end of their lifecycle supports sustainability goals. This practice aligns with circular economy principles, reducing waste and conserving resources.

- Green Warehousing: Operating warehouses powered by renewable energy and utilizing energy-efficient technologies minimizes the environmental footprint of storage facilities. Sustainable practices in warehousing contribute significantly to overall green logistics efforts.

Major Challenges

- High Initial Investment: Transitioning to sustainable technologies, such as electric vehicles and renewable energy infrastructure, requires substantial upfront capital, which can be a barrier for many companies.

- Technological Uncertainty: The lack of consensus on which green technologies will become standard poses risks for companies investing in specific solutions, potentially leading to stranded assets.

- Regulatory Variability: Inconsistent environmental regulations across regions create compliance challenges for logistics companies operating globally, complicating the implementation of uniform green practices.

- Infrastructure Limitations: Insufficient infrastructure, such as charging stations for electric vehicles and facilities for alternative fuels, hampers the widespread adoption of green logistics solutions.

- Supply Chain Complexity: Managing sustainability across complex, multi-tiered supply chains is challenging, particularly when suppliers have varying capabilities and commitments to green practices.

Top Opportunities

- Development of Green Technologies: Investing in research and development of sustainable technologies, such as advanced biofuels and energy-efficient logistics solutions, presents significant growth potential.

- Collaboration for Sustainability: Forming alliances among stakeholders to share best practices and resources can accelerate the adoption of green logistics, as demonstrated by the Zero Emissions Maritime Buyers Alliance.

- Policy Advocacy: Engaging with policymakers to develop supportive regulations and incentives can facilitate the transition to sustainable logistics practices, creating a more favorable operating environment.

- Consumer Engagement: Educating consumers about the environmental benefits of green logistics can drive demand for sustainable practices, encouraging companies to adopt eco-friendly operations.

- Digitalization and Data Analytics: Leveraging digital technologies to optimize logistics operations can lead to significant efficiency gains and emission reductions, enhancing overall sustainability.

Key Player Analysis

the Global Green Logistics Market in 2024 indicates substantial competition and strategic innovation. UPS continues its leadership role, focusing significantly on electric vehicles and advanced route optimization, solidifying its commitment to carbon-neutral operations. FedEx is leveraging substantial investments in renewable energy and fleet electrification, enhancing its environmental sustainability profile.

DHL Supply Chain remains at the forefront through its aggressive sustainability initiatives, including extensive adoption of green warehousing and emission-reduction programs. Maersk Line maintains dominance in maritime logistics by intensifying efforts toward biofuels and sustainable shipping practices. C.H. Robinson expands its sustainable logistics solutions with tech-driven optimization platforms to improve operational efficiencies. XPO Logistics actively implements energy-efficient transportation solutions, supported by advanced data analytics.

J.B. Hunt Transport Services strengthens its market position through significant fleet electrification investments. Werner Enterprises focuses strategically on fuel efficiency improvements and technology integration. Ceva Logistics enhances its sustainability profile through green warehousing practices and innovative supply chain management solutions. Kuehne + Nagel demonstrates continued leadership in sustainability through robust carbon reduction initiatives and sustainable freight solutions.

Top Key Players

- UPS

- FedEx

- DHL Supply Chain

- Maersk Line

- C.H. Robinson

- XPO Logistics

- J.B. Hunt Transport Services

- Werner Enterprises

- Ceva Logistics

- Kuehne + Nagel

Regional Analysis

Europe Dominates Green Logistics Market with Largest Market Share of 36.3%

Europe is anticipated to dominate the green logistics market, accounting for approximately 36.3% of the global market share in 2024, with a market valuation estimated at USD 0.47 trillion. The substantial growth in this region can be attributed to stringent environmental regulations, increased consumer preference for sustainable solutions, and significant investments in green transportation infrastructure. The European Union’s Green Deal and targets set by regional governments to reduce carbon emissions further propel the adoption of eco-friendly logistics practices.

Moreover, the presence of major logistics providers actively transitioning to sustainable operations significantly contributes to the region’s leadership position in the global market. As companies prioritize sustainability in response to consumer demands and regulatory pressures, Europe’s dominance in green logistics is expected to strengthen further in the coming years.

Recent Developments

- In 2024, Ryder System acquired Cardinal Logistics, expanding its presence in North America’s dedicated transportation sector. Cardinal Logistics, headquartered in Concord, North Carolina, focuses mainly on managing dedicated driver fleets, freight brokerage, and limited last-mile and logistics operations across retail, automotive, grocery, consumer goods, and industrial markets.

- In 2025, Aegis Energy received £100 million funding from Quinbrook Infrastructure Partners to build the UK’s first clean multi-fuel refueling stations. These hubs will support electric, hydrogen, bio-CNG, and HVO fuels, targeting commercial fleet operators seeking cleaner energy options.

- In 2025, UPS acquired Frigo-Trans and BPL, specialized providers in healthcare cold-chain logistics. Frigo-Trans operates extensive temperature-controlled storage facilities and transportation networks across Europe, covering ultra-low to ambient temperatures, while BPL enhances UPS’s urgent freight forwarding services for healthcare products.

- In 2024, DSV reached an agreement to buy Schenker from Deutsche Bahn for EUR 14.3 billion. This significant deal enhances DSV’s global logistics capabilities, boosting service quality and competitive positioning internationally.

- In January 2025, GoBolt reported exceptional growth in electric deliveries through its GoBolt Parcel service, achieving a 562% increase compared to the previous year. The company successfully delivered 1.5 million EV-powered packages in 2024, strengthening its position as a leader in eco-friendly logistics in Canada and the U.S.

Conclusion

The Green Logistics Market is projected to experience significant growth, driven by increasing environmental regulations, technological advancements, and a global shift towards sustainability. Governments worldwide are implementing stricter policies to reduce carbon emissions, compelling businesses to adopt eco-friendly practices across their supply chains. Technological innovations, such as the integration of electric vehicles and renewable energy sources, are enhancing operational efficiency while minimizing environmental impact. Additionally, growing consumer demand for sustainable products is encouraging companies to invest in green logistics solutions. This convergence of regulatory pressure, technological progress, and consumer preference is expected to propel the Green Logistics Market’s expansion in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)