Table of Contents

Introduction

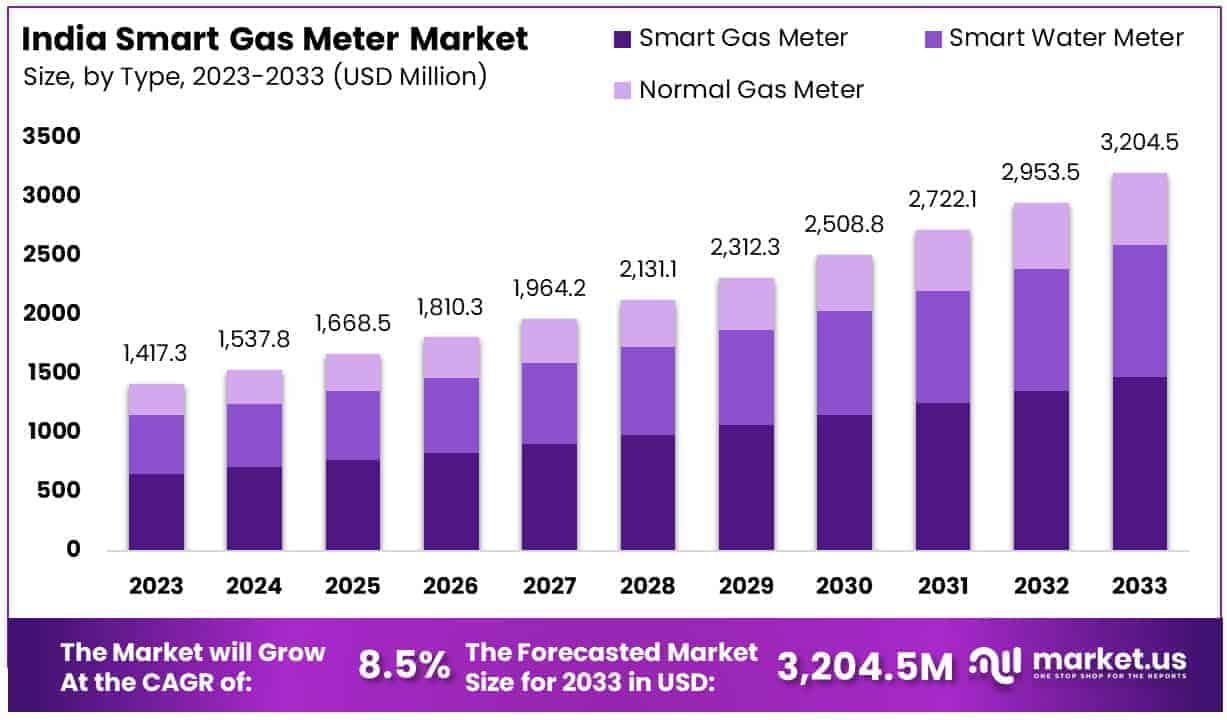

The India Gas and Water Meters Market is projected to reach approximately USD 3,204.53 million by 2033, up from USD 1,417.31 million in 2023, reflecting a compound annual growth rate (CAGR) of 8.5% during the forecast period from 2024 to 2033.

Gas and water meters are essential devices used to measure and monitor the consumption of gas and water in residential, commercial, and industrial settings. These meters play a critical role in accurately recording the amount of energy (gas) or water used, enabling utilities to bill consumers appropriately, ensure efficient resource management, and facilitate the monitoring of infrastructure performance.

Gas meters typically measure the flow of natural gas or LPG, while water meters track the amount of water used by households, businesses, and industries. Both types of meters are integral components of utility systems, providing data that supports operational efficiency, regulatory compliance, and customer engagement.

The gas and water meters market encompasses the production, distribution, and installation of metering devices used by utilities and consumers worldwide. This market is characterized by a variety of meter technologies, including traditional mechanical meters and advanced digital (smart) meters that provide real-time data and remote monitoring capabilities. The market is driven by the need for more accurate billing, greater resource efficiency, and the integration of advanced metering infrastructure (AMI) for smarter utility management.

Additionally, regulatory standards and the push for sustainability have prompted utilities to adopt more efficient and technologically advanced metering solutions. As of recent years, digitalization, IoT (Internet of Things), and the move towards smart cities have significantly influenced the market, with a growing shift towards smart gas and water meters that enable real-time monitoring, data analytics, and predictive maintenance.

Several key factors are driving the growth of the gas and water meters market. First, the increasing adoption of smart meters is a major catalyst, as they offer enhanced accuracy, better monitoring, and the ability to collect and analyze usage data in real time. The shift towards more efficient and sustainable resource management is another driving factor, as governments and regulatory bodies worldwide push for innovations that reduce wastage and optimize the use of gas and water.

Smart cities initiatives are also playing a pivotal role in expanding the demand for advanced metering systems that integrate seamlessly into city-wide infrastructure. Moreover, the growing awareness of the need for water conservation and energy efficiency is fueling the need for advanced meters capable of providing more granular data to consumers and utilities alike.

The demand for gas and water meters is largely influenced by the expansion of urban populations, the need for more efficient utility management, and increasing regulatory pressure on utilities to reduce water and energy waste. In developed markets, the ongoing transition from legacy mechanical meters to smart meters is spurring demand, as utilities seek to improve billing accuracy, reduce operational costs, and enhance customer experience.

In emerging economies, the growth in infrastructure development and increasing access to utilities is driving the demand for both gas and water metering solutions. Furthermore, the rise in environmental concerns and the growing need for sustainable practices in resource management are prompting greater adoption of smart metering technologies across various regions.

The gas and water meters market presents numerous opportunities for growth and innovation. The growing shift towards smart meters represents a significant opportunity for technology providers and manufacturers to expand their product offerings.

With IoT integration, smart meters can provide real-time data, predictive analytics, and remote monitoring capabilities, which enhances the utility’s ability to detect leaks, prevent wastage, and improve maintenance schedules. Another opportunity lies in the rising trend of retrofitting legacy infrastructure, particularly in older urban centers, where utilities are upgrading their metering systems to meet modern efficiency and data requirements.

Moreover, the increasing emphasis on sustainability, water conservation, and energy efficiency presents an opportunity for market players to develop and deploy advanced metering solutions that cater to the growing demand for precision and environmental responsibility. Lastly, emerging markets in regions such as Asia-Pacific and Latin America, where urbanization and industrialization are rapidly increasing, represent substantial growth potential for both gas and water meter manufacturers.

Key Takeaways

- The India gas and water meters market is projected to grow from USD 1,417.31 million in 2023 to USD 3,204.53 million by 2033, at a CAGR of 8.5% during 2024-2033.

- Smart gas meters lead the market with 45.1% share, thanks to their accurate billing and efficiency benefits.

- Hardware components dominate with 64.3% share, as they are essential for the operation of metering systems.

- The residential sector holds the largest share at 64%, due to high demand for utility management in homes.

- North India is the largest regional market with 38.5% share, driven by urbanization and population growth.

Gas and Water Meters Statistics

- 95.5% of smart meters globally provide accurate energy readings.

- India aims to install 250 million smart meters by 2026, one of the most ambitious global targets.

- India’s government supports smart meter deployment with $40 billion in grants and performance-based payments.

- Conventional meters require manual readings, and billing takes up to 15 days to process.

- India’s Revamped Distribution Sector Scheme (RDSS) accelerated installations, with 50 million tenders expected in 2023.

- 68% of electricity meters in North America are now smart meters.

- By February 2022, India had installed 3.9 million smart power meters through government initiatives.

- Uttar Pradesh leads in India’s smart meter installations with over 1.15 million, followed by Bihar with 560,049 meters.

- 7.34 million smart meters are currently being installed in India.

- Newly installed smart meters in India improved billing efficiency by 21% and increased revenue by ₹2.64 billion annually.

- India’s electricity demand is projected to exceed 950,000 MW by 2030.

- Globally, India ranks 5th in electricity generation and is the 6th largest energy consumer.

- The average household uses approximately 22,000 liters of water monthly.

- Utility service providers worldwide installed over 1.06 billion smart meters by the end of 2023.

- 99% of domestic smart meters in the UK are installed by large energy suppliers.

- 28% of non-domestic smart meters in the UK are installed by small energy suppliers.

- The number of non-smart meters in the UK decreased by 33% within a recent timeframe.

- By the end of 2023, 1.06 billion smart meters (electricity, water, and gas) were installed globally.

- Smart meter adoption in the UK grew from 1% in 2012 to 60% in 2023.

- By 2023, there were 33.9 million smart and advanced meters in UK homes.

- A survey revealed that 66% of UK households with smart meters were satisfied with their installation experience.

- Small energy suppliers installed 498,000 non-domestic smart meters in the UK, while 242,000 were installed for domestic properties.

- Around 2 billion people globally lack access to safe water at home.

- A city 300 kilometers southeast of Mumbai, with a population of 5,000, is the first in India to install ultrasonic water meters.

- The ultrasonic water meters track daily water consumption and detect events like leaks, tampering, and reverse flow for up to 460 days.

- These meters also record monthly water usage data for a duration of 36 months.

Emerging Trends

- Integration with Smart Home Systems: The rise of smart homes has significantly influenced the gas and water meter industry. Many modern meters are being designed to integrate seamlessly with smart home systems, allowing users to monitor usage remotely via mobile apps. This trend is spurred by consumer demand for greater control and visibility over their utility consumption. As of 2023, over 70% of new residential buildings in developed regions are now including smart utility meters as part of their standard infrastructure.

- Adoption of IoT-Enabled Meters: The Internet of Things (IoT) is transforming the functionality of gas and water meters. IoT-enabled meters can send real-time data to utility companies, providing them with accurate readings without the need for manual intervention. This data can help in predictive maintenance, reducing downtime and improving the efficiency of utilities. By 2025, it is expected that over 60% of gas and water meters globally will be IoT-enabled, providing better data for consumption analysis and demand forecasting.

- Focus on Energy and Water Conservation: With increasing global awareness of environmental sustainability, there is a growing trend toward designing gas and water meters that encourage conservation. These meters are often paired with systems that provide real-time feedback to consumers, helping them identify inefficiencies and reduce waste. According to industry trends, around 50% of households in developed markets are now using such conservation-focused smart meters.

- Advanced Metering Infrastructure (AMI) Rollouts: Utilities worldwide are rolling out advanced metering infrastructure (AMI), which includes not just the meters but also the network systems that support real-time data transmission. AMI systems provide detailed insights into consumption patterns, enabling dynamic pricing models and improved operational efficiencies. By the end of the decade, AMI adoption is expected to cover more than 85% of gas and water utilities across North America and Europe.

- Improved Security Features: As digital transformation accelerates, the security of gas and water meters is becoming a priority. Many new meters are being designed with enhanced cybersecurity features to prevent hacking, tampering, and fraud. This trend comes as part of a broader effort to protect sensitive data in an increasingly connected world. By 2025, it is expected that 75% of all digital meters will incorporate advanced encryption and cybersecurity measures to safeguard user data.

Top Use Cases

- Real-Time Consumption Monitoring for Consumers: Smart meters allow consumers to monitor their gas and water usage in real time via smartphone apps or web portals. This use case has grown significantly in both residential and commercial sectors, empowering users to adjust their consumption habits, reduce wastage, and manage utility costs more effectively. In some regions, this has led to a reduction in consumption by up to 15%.

- Leak Detection and Prevention: Advanced water and gas meters equipped with sensors can detect leaks early, helping prevent wastage and damage to infrastructure. With more than 1 trillion liters of water wasted annually due to leakage in the water supply system, this use case is gaining traction, especially in urban areas where water conservation is critical. Gas meters with leak detection are also helping avoid potential safety hazards, contributing to both economic and public safety benefits.

- Remote Meter Reading: Remote reading eliminates the need for manual meter readings, reducing human error and increasing operational efficiency. Gas and water utilities can access real-time data from meters, which improves billing accuracy and minimizes the need for on-site visits. In regions that have fully implemented remote meter reading, operational costs have been reduced by over 30% due to increased automation.

- Dynamic Pricing and Consumption Management: Smart meters are enabling utilities to implement dynamic pricing models based on peak and off-peak usage times. This helps balance demand, incentivizing consumers to reduce consumption during peak times and lower their utility bills. A growing number of utility companies are using these meters to integrate time-of-use (TOU) pricing, which can reduce overall consumption by approximately 10% in areas with high adoption.

- Data-Driven Operational Optimization for Utilities: Gas and water meters equipped with data analytics tools help utilities analyze trends in consumption and optimize infrastructure deployment. This use case is transforming how utilities predict demand and manage their resources. For instance, gas utilities can adjust supply schedules based on consumption patterns, leading to more efficient distribution and reduced operational costs by as much as 20%.

Major Challenges

- High Initial Installation Costs: The transition from traditional to smart gas and water meters can involve high upfront costs, both for consumers and utility companies. While these meters offer long-term savings and efficiency gains, the initial financial burden remains a significant barrier, particularly in developing markets where infrastructure investments are limited.

- Data Privacy and Security Concerns: With the growing reliance on digital and IoT-enabled meters, concerns over data privacy and cybersecurity are increasing. The risk of hacking or unauthorized access to sensitive consumption data is a challenge that utilities and consumers alike must navigate. The growing trend of cyberattacks on critical infrastructure further highlights the urgency of implementing robust security measures.

- Integration with Legacy Systems: Many utility providers still rely on legacy systems that are incompatible with newer smart meter technologies. Integrating advanced metering infrastructure (AMI) with these older systems often requires significant investment in software and hardware upgrades, leading to delays and increased costs. As many as 40% of utilities report challenges with this integration, hindering the adoption of newer technologies.

- Consumer Resistance to New Technologies: Despite the benefits of smart meters, some consumers are resistant to adopting new technology, either due to lack of understanding or skepticism about the accuracy of readings. In some regions, less than 30% of consumers are fully aware of the advantages offered by smart metering, limiting widespread adoption.

- Regulatory and Standardization Challenges: The gas and water metering industry faces regulatory hurdles that vary from region to region. A lack of standardized protocols for smart meters, especially in terms of data reporting, privacy protections, and technical specifications, can slow down market growth. In some areas, the absence of cohesive national policies has delayed the rollout of smart meters, despite their proven advantages.

Top Opportunities

- Expanding IoT-Enabled Smart Meter Installations: There is a significant opportunity in expanding the installation of IoT-enabled smart meters, particularly in developing regions. These meters provide real-time monitoring and efficient management, and as more infrastructure investments are made, they offer utility providers a pathway to optimize resource distribution and cut operational costs.

- Deployment of Advanced Data Analytics for Consumption Forecasting: With the rise of data-driven solutions, utilities can leverage advanced analytics to predict consumption patterns more accurately. By using historical consumption data, weather patterns, and consumer behavior insights, utilities can improve their forecasting capabilities, leading to better resource management and more efficient billing systems.

- Increased Government Support for Smart Metering Initiatives: Governments around the world are increasingly recognizing the value of smart metering as a tool for energy and water conservation. Many governments are providing incentives and subsidies to encourage the widespread adoption of smart meters, creating a significant growth opportunity for manufacturers and service providers in this space.

- Expansion into Commercial and Industrial Sectors: While residential adoption of smart meters is growing, there is a large untapped market in the commercial and industrial sectors. These sectors consume a substantial amount of gas and water, and the ability to monitor and control usage with advanced metering systems can lead to substantial savings. Manufacturers have a growing opportunity to target this segment with tailored solutions.

- Integration of Renewable Energy with Smart Metering: As the use of renewable energy sources grows, integrating renewable energy generation with smart meters presents an exciting opportunity. Smart meters can help track not only gas and water usage but also energy generation and consumption from solar or wind sources, promoting more sustainable resource management practices across various sectors.

Key Player Analysis

- Honeywell International Inc. is a global leader in industrial automation and metering systems. The company offers advanced gas and water metering solutions equipped with IoT capabilities, enabling utilities to monitor usage in real time. With operations in over 100 countries and annual utility-related revenues surpassing $34 billion in 2022, Honeywell is a key player in smart city projects. Its focus on sustainability and energy efficiency has positioned it as a preferred partner for governments and private utility companies worldwide.

- Secure Meters Ltd., headquartered in India, provides a wide range of metering and energy management solutions. It has installed over 50 million meters globally and operates in more than 50 countries, generating annual revenues exceeding ₹2,500 crore. The company’s portfolio includes both conventional and smart meters, with a focus on user-centric solutions that empower customers to manage energy consumption effectively. Secure Meters is increasingly integrating AI-driven analytics into its systems to enhance utility performance and reduce operational costs for clients.

- Itron Inc., based in the United States, is a prominent player in the utility sector, specializing in innovative gas and water metering solutions. The company is known for its IoT-enabled meters and data analytics platforms that help utilities improve billing accuracy and resource efficiency. With revenues of approximately $1.8 billion in 2022 and operations in over 100 countries, Itron has a strong global presence. It is actively expanding into emerging markets and is focusing on smart grid technology to address water and energy challenges in developing regions.

- Xylem Water Solutions India Pvt Ltd, a subsidiary of Xylem Inc., is a leading provider of water management solutions, including advanced metering and analytics systems. The company generated global revenue of $5.52 billion in 2022, with India emerging as a key growth market. Xylem’s water meters are widely recognized for their precision and ability to support municipalities in addressing water scarcity through predictive analytics. Its integration of AI and machine learning into water distribution networks underscores its commitment to sustainable water resource management.

- Moschip Technologies Ltd. (Maven Systems Pvt. Ltd.) is an emerging leader in smart gas and water metering, leveraging its expertise in IoT and semiconductor technologies. The company is known for offering cost-effective, communication-enabled metering systems designed for efficiency and reliability. With consistent revenue growth of over 20% year-on-year, Moschip is rapidly expanding its footprint, particularly in India’s rural and semi-urban areas. Collaborating with government initiatives, it aims to enhance the adoption of smart metering technology to improve resource efficiency and utility management across diverse regions.

Recent Developments

- In 2023, Vikas Lifecare Limited secured a major supply order worth INR 49.5 crore for 40,000 gas meters from Gujarat Gas Limited, India’s largest city gas distributor. The order was executed through its subsidiary, Genesis Gas Solutions, which specializes in smart gas meters and power distribution solutions. Vikas Lifecare holds a 95% stake in Genesis, driving innovation in infrastructure technology.

- In 2023, Honeywell introduced the world’s first 100% hydrogen-capable diaphragm gas meter in Europe. The Honeywell EI5 smart gas meter, initially piloted in the Netherlands, aligns with the European Green Deal’s sustainability objectives by supporting clean energy transition efforts.

- On February 21, 2024, Itron, Inc. and Schneider Electric announced a partnership to enhance energy and grid management for utilities. The collaboration focuses on integrating intelligent grid and distributed energy resource (DER) management solutions, addressing the growing adoption of rooftop solar, battery storage, and microgrids. This initiative aims to digitalize electricity demand and supply at the grid edge.

- In 2024, smart city initiatives gained traction with the introduction of the Smart Metering Hub. Designed to create tailored IoT networks, this platform offers innovative solutions for seamless connectivity and interoperability. Experts provided guidance to build customized smart city infrastructures, addressing unique urban development needs.

Conclusion

The gas and water meters market is poised for significant growth, driven by advancements in smart metering technologies, increasing urbanization, and the growing emphasis on sustainable resource management. Smart meters, with their ability to provide real-time data and enable predictive analytics, are transforming utility operations, improving billing accuracy, and empowering consumers to make informed decisions about their consumption. The integration of IoT and advanced metering infrastructure is further accelerating market development, addressing challenges like leak detection, conservation, and operational inefficiencies.

While high installation costs and regulatory hurdles remain challenges, the push for digitalization, coupled with supportive government initiatives, is creating vast opportunities for innovation and expansion. As industries and households increasingly recognize the benefits of precise monitoring and efficient resource usage, the demand for modern metering solutions will continue to grow, shaping a more sustainable and connected future for utilities worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)