Table of Contents

Introduction

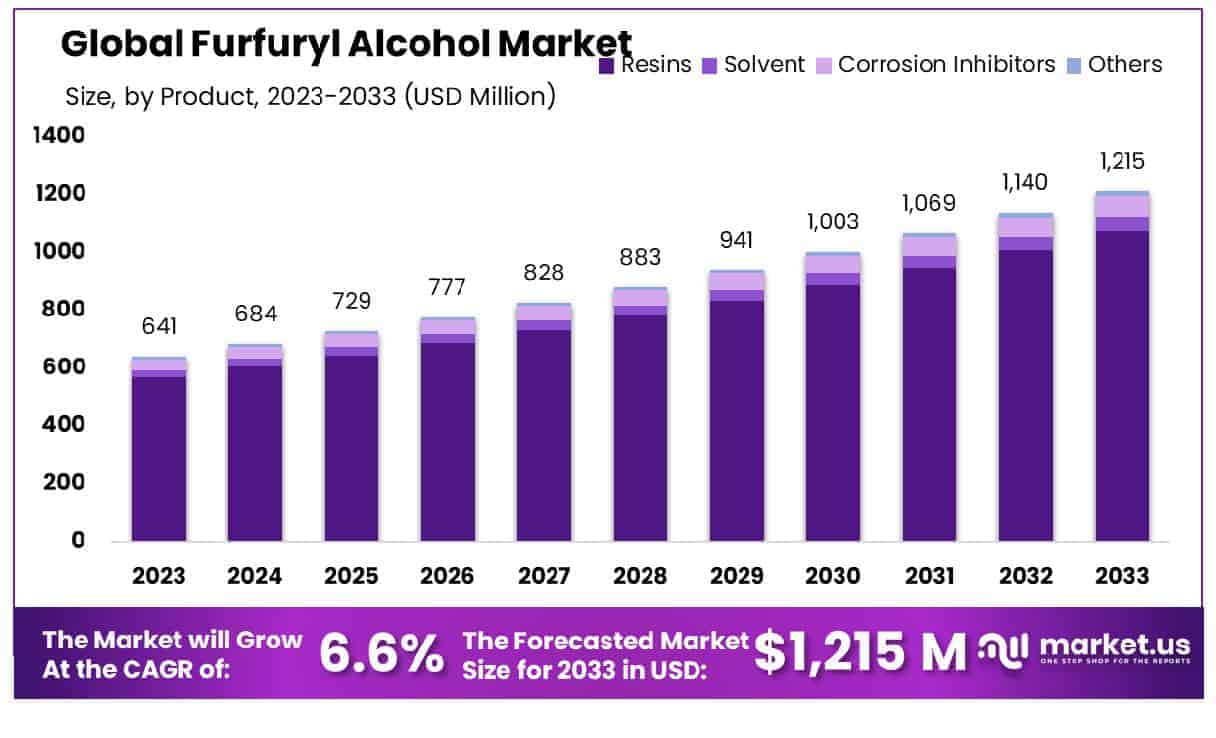

The Global Furfuryl Alcohol Market is projected to reach approximately USD 1,215 million by 2033, up from USD 641 million in 2023, expanding at a compound annual growth rate (CAGR) of 6.60% from 2024 to 2033.

Furfuryl alcohol is an organic compound derived from furan, typically produced from agricultural byproducts like corncobs, sugarcane bagasse, and oat hulls. It is a key intermediate in the production of resins, pharmaceuticals, and fragrances, playing a pivotal role in the manufacturing of thermosetting resins used in foundries, adhesives, and coatings. The global furfuryl alcohol market has witnessed steady growth due to its increasing demand across various industries, particularly in the production of furan resins for the automotive and construction sectors.

Growth factors driving the market include the rising need for bio-based chemicals, sustainability trends, and advancements in the manufacturing of furfuryl alcohol from renewable feedstocks. Additionally, the growth of the chemical, pharmaceutical, and agrochemical sectors presents ample opportunities for market expansion. With increasing awareness of environmental impacts and the shift towards renewable resources, the furfuryl alcohol market is expected to experience sustained demand, positioning it as a crucial player in the green chemicals segment.

Key Takeaways

- The global furfuryl alcohol market is projected to reach USD 1,215 million by 2033, growing from USD 641 million in 2023, at a compound annual growth rate (CAGR) of 6.60% from 2024 to 2033.

- Asia-Pacific leads the furfuryl alcohol market, holding a significant 67.1% share.

- Resins are the largest segment, accounting for 88.6% of the market share, highlighting their crucial role in the industry’s demand.

- Foundry applications are the primary end-use sector, capturing 81.4% of the market share, underscoring their key contribution to the market.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 641 Million |

| Forecast Revenue (2033) | USD 1,215 Million |

| CAGR (2024-2033) | 6.60% |

| Segments Covered | By Application(Resins, Solvent, Corrosion Inhibitors, Others), By End-Use(Foundry, Agriculture, Paints & Coatings, Pharmaceuticals, Food & Beverages, Others) |

| Competitive Landscape | KRBL Limited, China XLX Fertilizer Ltd., Aurus Specialty Company Limited, Hongye Holding Group Corporation Limited, Xingtai Chunlei Furfuryl Alcohol Co., Ltd., Zhucheng Taisheng Chemical Co., Ltd., Zibo Donghai Industrial Co., Ltd., DynaChem, Inc., International Furan Chemicals B.V. (IFC), Shijiazhuang Worldwide Furfural and Furfuryl Alcohol and Furan Resin Co., Ltd., Silvateam S.p.a., Illovo Sugar (Pty) Ltd., Zibo Huaao Chemical Co., Ltd. |

Top Use Cases

- Manufacture of Resins and Adhesives: Furfuryl alcohol is primarily used in the production of furan-based resins and adhesives. These resins are known for their high thermal stability and strength, making them suitable for applications in industries like automotive and construction. The global market for furan resins is expanding, with applications ranging from foundry cores to coatings, helping to drive the demand for furfuryl alcohol.

- Foundry Sand Binders: Furfuryl alcohol is used as a binder in sand casting processes, particularly in the production of metal castings. It binds sand particles together, creating molds that can withstand high temperatures during metal pouring. The demand for furfuryl alcohol in the foundry industry is expected to grow due to the increasing demand for precision metal castings across automotive and aerospace sectors.

- Pesticide Formulations: Furfuryl alcohol is used as an intermediate in the manufacture of pesticide formulations. It helps in the production of insecticides and fungicides, improving their effectiveness and stability. Furfuryl Alcohol Demand growing in response to agricultural industry needs for better-performing chemicals.

- Pharmaceutical and Agrochemical Intermediates: Furfuryl alcohol serves as a key building block in the synthesis of various pharmaceuticals and agrochemicals. Its derivatives are involved in producing anti-fungal agents, anti-cancer drugs, and herbicides. This makes it an essential component in the formulation of several life-saving medicines and agricultural chemicals, contributing to its growing importance in the chemical industry.

- Production of Solvents and Additives: Furfuryl alcohol is used as a solvent in various applications, including coatings, paints, and varnishes. It is valued for its ability to dissolve resins and other components, contributing to the stability and application properties of these products. Furfuryl Alcohol holding a niche role due to its effectiveness in various industrial processes.

Major Challenges

- Environmental Impact of Production: The production of furfuryl alcohol generates pollutants, including volatile organic compounds (VOCs), which can contribute to air pollution. Stringent environmental regulations in key markets like the European Union and North America push manufacturers to adopt greener technologies, which can be costly and technically challenging.

- Price Volatility of Raw Materials: Furfuryl alcohol is primarily derived from furfural, which is obtained from agricultural by-products like corncobs or sugarcane bagasse. The price of these raw materials is subject to seasonal fluctuations and changes in agricultural production. This price volatility can lead to unpredictable costs for manufacturers of furfuryl alcohol, impacting the stability of the market.

- Limited Production Capacity: The global production capacity for furfuryl alcohol is concentrated in a few regions, primarily in Asia and North America. This limited capacity can lead to supply shortages, especially in periods of high demand, and hinder the growth potential of markets that rely on consistent supply for applications like foundry resins and adhesives.

- Competition from Alternative Chemicals: The rise in demand for bio-based and sustainable chemicals has led to competition from alternative materials in several applications of furfuryl alcohol, such as resins and adhesives. Biochemicals and renewable-based resins are being developed to replace furfuryl alcohol in some sectors, which could limit future market growth if adoption increases.

- Health and Safety Concerns: Furfuryl alcohol is considered to have moderate toxicity and can pose risks during handling, especially in industrial settings. Safety measures, including protective equipment and proper ventilation, are required to reduce exposure. These health and safety concerns can lead to higher operational costs and limit the adoption of furfuryl alcohol in certain regions or industries.

Regional Analysis

Asia-Pacific: Furfuryl Alcohol Market with Largest Market Share of 67.1% in 2023

The Asia-Pacific region dominates the global furfuryl alcohol market, accounting for an impressive 67.1% market share in 2023, with a market value of approximately USD 430 million. This region’s market leadership is primarily driven by the robust industrial demand, particularly in countries like China, India, and Japan, which are significant consumers of furfuryl alcohol in the production of resins, chemicals, and various specialty products. The growing industrialization and increasing investment in manufacturing sectors across these countries have significantly boosted the demand for furfuryl alcohol, a key raw material for the production of furan resins and foundry sand binders.

The expanding construction and automotive industries in Asia-Pacific, which require high-performance resins, further propel the market growth. Additionally, the region benefits from low-cost production capabilities, favorable government policies, and access to a large consumer base. These factors contribute to Asia-Pacific’s continued dominance and steady growth trajectory in the furfuryl alcohol market. With an expected increase in industrial output and demand for eco-friendly chemical alternatives, Asia-Pacific is projected to maintain its leadership position in the global market for the foreseeable future.

Recent Developments

- In December 2024, Faraday Future Intelligent Electric Inc. (Nasdaq: FFIE), a California-based company specializing in AI-driven electric vehicles, revealed it secured $30 million in financing. This investment will help accelerate the growth of the company and the development of its Faraday X (FX) initiative, aimed at launching affordable, high-performance electric vehicles with advanced technology to meet market demands.

- In November 2024, Kraton Corporation, a global leader in sustainable specialty polymers and bio-based products, announced a price increase of $330 per metric ton for all of its SIS polymer products.

- In December 2024, Aemetis, Inc., a company focused on renewable fuels and natural gas, reported that its Universal Biofuels subsidiary in India completed the delivery of $103 million worth of biodiesel to three government-owned Oil Marketing Companies. This was part of a one-year supply agreement ending in September 2024.

Conclusion

The furfuryl alcohol market is poised for sustained growth driven by increasing industrial demand, particularly in the automotive, construction, and chemical sectors. The shift towards bio-based and sustainable chemicals, coupled with the ongoing expansion of manufacturing capabilities in key regions, supports the market’s long-term prospects.

However, challenges such as environmental concerns, raw material price volatility, and competition from alternative chemicals may pose hurdles. Despite these challenges, the market’s robust applications in resins, foundry products, and specialty chemicals position furfuryl alcohol as an essential component in a variety of industries. Moving forward, the market will likely benefit from advancements in green production technologies and the growing adoption of furfuryl alcohol in emerging applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)