Table of Contents

Overview

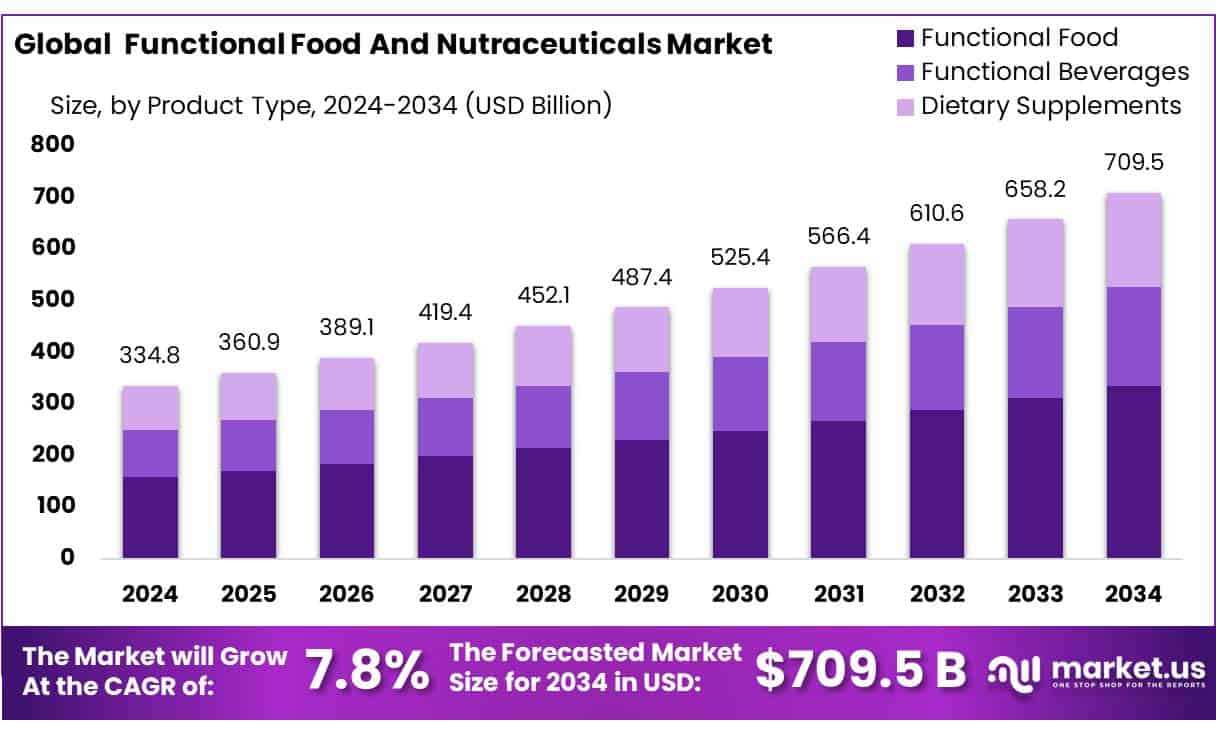

New York, NY – May 07, 2025 – The global Functional Food And Nutraceuticals Market is projected to grow significantly, reaching approximately USD 709.5 billion by 2034, up from USD 334.8 billion in 2024, reflecting a robust compound annual growth rate (CAGR) of 7.8% during the forecast period from 2025 to 2034.

Functional Food captured a commanding 47.3% market share, driven by rising demand for health-focused, clean-label products. Fortified cereals, probiotic yogurts, and omega-3 snacks are popular among millennials and older consumers seeking immunity and digestive benefits. Supermarkets and hypermarkets led with a 44.1% market share, offering diverse functional food and nutraceutical options at competitive prices.

Key Takeaways

- Functional Food and Nutraceuticals Market size is expected to be worth around USD 709.5 Bn by 2034, from USD 334.8 Bn in 2024, growing at a CAGR of 7.8%.

- Functional Food held a dominant market position, capturing more than a 47.3% share.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 44.1% share.

- North America dominated the Functional Food and Nutraceuticals Market, holding a substantial 34.2% share, which translated into a market value of approximately USD 114.5 billion.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-functional-food-and-nutraceuticals-market/request-sample/

Analyst Viewpoint

Investment opportunities lie in plant-based proteins, probiotics, and personalized nutrition, especially in North America, However, risks include high R&D costs and climate-related supply chain disruptions. Investors should target innovative startups focusing on sustainable, science-backed products to capitalize on this growth while staying mindful of volatile raw material costs.

Consumers are leaning hard into wellness, and Millennials are prioritizing functional foods for immunity, gut health, and mental clarity. They love clean-label products and are drawn to omega-3-fortified snacks and nootropic drinks, especially in Asia-Pacific, where the market share.

Technology is a game-changer. AI-driven formulation and nanoencapsulation are making products more effective and appealing. But the regulatory landscape is a tightrope. Strict FDA and EU labeling laws demand robust evidence for health claims, and non-compliance leads to product recalls. Investors can win by backing companies that embrace transparency and adapt to evolving rules, ensuring they meet consumer trust and regulatory standards.

Report Scope

| Market Value (2024) | USD 334.8 Billion |

| Forecast Revenue (2034) | USD 709.5 Billion |

| CAGR (2025-2034) | 7.8% |

| Segments Covered | Product Type (Functional Food, Functional Beverages, Dietary Supplements), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Drug Stores/Pharmacies, Online Retail Stores, Other Distribution Channels) |

| Competitive Landscape | Nestlé S.A., PepsiCo, Inc., Kellogg Company, Herbalife International of, America, Inc., Danone S.A., Now Health Group, Inc. (NOW, Foods), Alticor Inc. (Amway Corporation), Red Bull GmbH, Abbott Laboratories, Bayer AG, Nu Skin Enterprises, Inc., Nature’s Sunshine Products, Inc., The Hain Celestial Group, Inc., Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145450

Key Market Segments

By Product Type

- In 2024, functional food captured a commanding 47.3% market share, driven by rising demand for health-focused, clean-label products. Fortified cereals, probiotic yogurts, and omega-3 snacks are popular among millennials and older consumers seeking immunity and digestive benefits. Plant-based innovations and personalized nutrition will further propel growth, especially in Asia-Pacific and North America.

By Distribution Channel

- In 2024, supermarkets and hypermarkets led with a 44.1% market share, offering diverse functional food and nutraceutical options at competitive prices. In-store health promotions and displays attract wellness-focused shoppers who value the ease of combining grocery and health purchases. Fueled by modern retail expansion in developing regions, loyalty programs, and enhanced in-store experiences.

Regional Analysis

- North America led the Functional Food and Nutraceuticals Market with a 34.2% share, valued at roughly USD 114.5 billion. This dominance reflects a strong wellness culture and widespread awareness of health and nutrition, particularly in the U.S., where an aging population and rising health concerns fuel demand for dietary supplements to address age-related issues.

- The region sees robust demand for omega-3-enriched foods, probiotic yogurts, and fortified beverages, driven by efforts to combat prevalent lifestyle diseases like obesity, diabetes, and heart conditions. Government and private sector initiatives, such as Canada’s plant-based food guide, further promote nutritious eating, boosting the popularity of functional foods.

- Technological advancements in food science, including nanoencapsulation and microencapsulation, enhance the effectiveness and appeal of functional foods by improving ingredient delivery. These innovations, combined with proactive health policies, solidify North America’s leadership in the market.

Top Use Cases

- Immune Health Support: Functional foods like probiotic yogurts and vitamin-enriched juices are popular for boosting immunity. Consumers, especially post-pandemic, prioritize products with immune-enhancing ingredients like zinc and vitamin C, driving demand in North America and Europe for convenient, health-focused snacks and beverages.

- Gut Health Promotion: Probiotic and prebiotic foods, such as fermented drinks and fiber-rich cereals, are in demand for improving digestion. Millennials and aging populations seek gut-friendly products to address issues like bloating, fueling innovation in dairy and plant-based options across global markets.

- Heart Health Benefits: Omega-3-fortified foods, like enriched eggs and spreads, target heart health. Consumers concerned about cardiovascular diseases favor these products for their cholesterol-lowering benefits, with strong growth in Asia-Pacific due to rising health awareness and disposable incomes.

- Weight Management Solutions: Functional foods like protein bars and meal replacement shakes appeal to weight-conscious consumers. These products offer satiety and nutrition, popular among Gen Z and fitness enthusiasts, driving sales in gyms and online platforms in urban markets.

- Cognitive Function Enhancement: Nootropic-infused beverages and snacks, containing ingredients like L-theanine, are gaining traction. Professionals and students use these to boost focus and memory, with growing popularity in the U.S. and Japan, supported by innovative marketing campaigns.

Recent Developments

1. Nestlé S.A.

- Nestlé has expanded its functional food portfolio with new probiotic-enriched products under the Garden of Life and Nature’s Bounty brands. They launched a gut-health-focused yogurt drink in Europe and plant-based protein shakes with added vitamins. Nestlé is also investing in personalized nutrition through its Nestlé Health Science division, developing tailored supplements for metabolic health.

2. PepsiCo, Inc.

- PepsiCo entered the functional beverage market with Propel Immune Support, a vitamin-infused water. Their Quaker Oats division introduced protein-enriched oatmeal, while Tropicana launched juices with added probiotics. PepsiCo is also partnering with biotech firms to explore bioactive ingredients for better-for-you snacks.

3. Kellogg Company

- Kellogg (now Kellanova) expanded its Special K and RXBAR lines with protein-packed, low-sugar functional snacks. They introduced a new Pringles Superfood variant with plant-based nutrients. Kellogg is focusing on clean-label, non-GMO functional foods to meet rising consumer demand.

4. Herbalife International

- Herbalife launched Adaptogen Herbal Beverages with stress-relieving herbs like ashwagandha. Their Formula 1 shakes now include immune-boosting vitamins. The company is also expanding into plant-based protein powders and gut-health supplements to align with global wellness trends.

Conclusion

The global Functional Food and Nutraceuticals Market is on a strong growth path, driven by rising health awareness, increasing chronic diseases, and demand for preventive healthcare. Consumers are actively seeking products that offer digestive, heart, immune, and cognitive benefits, leading to innovations in probiotics, protein-fortified foods, and herbal supplements. Major companies like Nestlé, PepsiCo, Kellogg, and Herbalife are expanding their portfolios with science-backed, clean-label products to meet these needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)