Table of Contents

Introduction

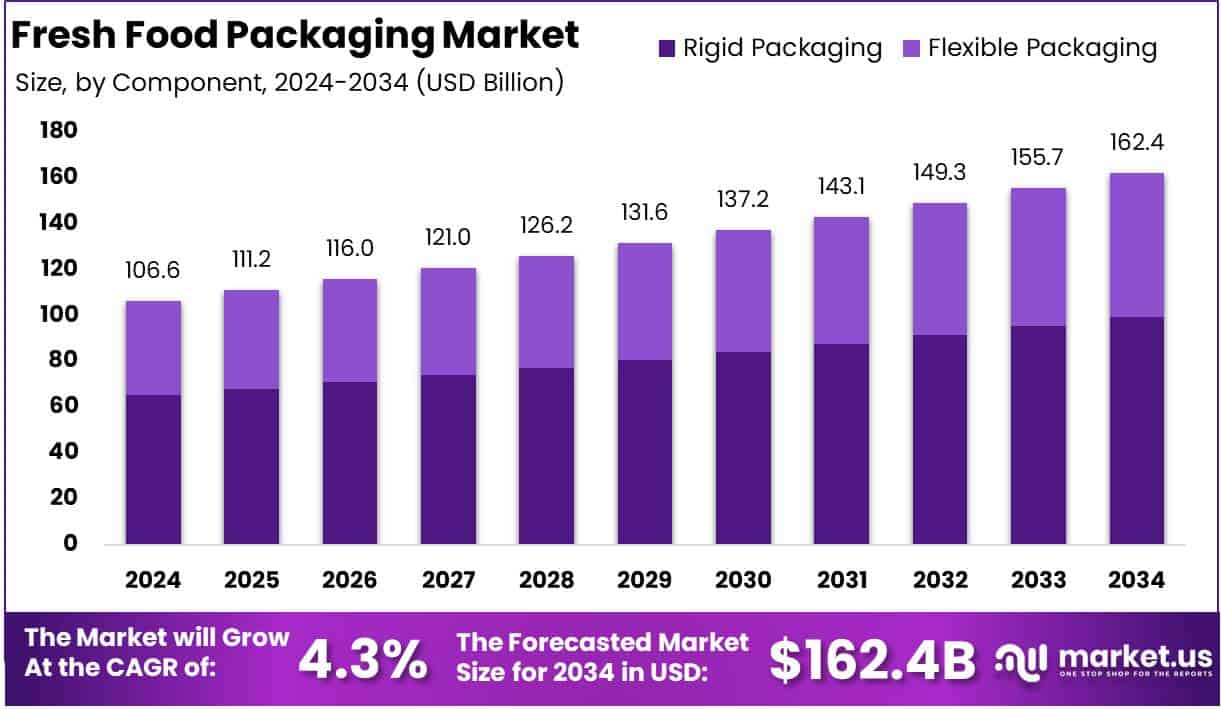

New York, NY – March 05, 2025- The Global Fresh Food Packaging Market is projected to reach approximately USD 162.4 billion by 2034, up from USD 106.6 billion in 2024, reflecting a compound annual growth rate (CAGR) of 4.3% over the forecast period from 2025 to 2034.

The Fresh Food Packaging Market is a dynamic segment within the broader packaging industry, driven by the need to preserve food quality, extend shelf life, and ensure safety from contamination. Fresh food packaging refers to the materials and techniques used to package perishable products such as fruits, vegetables, meat, seafood, and dairy, employing solutions like modified atmosphere packaging (MAP), vacuum packaging, and biodegradable materials.

The market is witnessing significant growth, fueled by increasing consumer awareness of food hygiene, stringent government regulations on food safety, and the rising demand for sustainable and eco-friendly packaging solutions. The expansion of e-commerce, particularly in online grocery retail, has further accelerated the demand for durable and flexible packaging solutions that maintain product integrity during transit.

Additionally, the growing preference for convenience foods and ready-to-eat products is propelling innovation in active and intelligent packaging technologies that enhance freshness and track food quality. The demand is particularly strong in emerging economies, where rising disposable incomes and urbanization are reshaping food consumption patterns.

However, challenges such as fluctuating raw material costs and environmental concerns regarding plastic waste are compelling manufacturers to invest in biodegradable and recyclable alternatives. Opportunities lie in the development of smart packaging solutions integrating QR codes and IoT-enabled sensors for real-time freshness monitoring, as well as increased adoption of plant-based packaging materials. With continuous advancements in packaging technology and the shift towards sustainability, the fresh food packaging market is poised for robust expansion, presenting lucrative opportunities for manufacturers and investors in the coming years.

Key Takeaways

- Global Fresh Food Packaging Market is projected to reach USD 162.4 billion by 2034, growing at a CAGR of 4.3% from USD 106.6 billion in 2024.

- Plastic remains the dominant packaging material, accounting for 43.3% of the market share in 2024.

- Rigid packaging leads the segment, representing 61.2% of the total market share in 2024.

- Gusseted bags hold the largest market share at 32.2% in 2024.

- Fruits & vegetables continue to be the primary application, securing 41.2% of the market share in 2024.

- The Asia Pacific region holds the largest market share at 36.2%, with a market valuation of USD 38.5 billion in 2024.

Fresh Food Packaging Statistics

Food Waste

- The direct economic cost of food waste (excluding fish and seafood) is $750 billion annually.

- The global value of wasted food reaches $1 trillion, with a total weight of 1.3 billion tonnes.

- Europe wastes 29 million tonnes of dairy products each year.

- Over 20% of the 263 million tonnes of meat produced globally is lost or discarded.

- 22% of global oilseeds and pulses production is lost or wasted annually.

- The United States leads in food waste, discarding nearly 40 million tonnes per year.

- 8% of fish caught globally are thrown back into the sea, often damaged or dead.

Plastic and Packaging Waste

- Packaging accounts for 40% of global plastic waste.

- The world produces 141 million tonnes of plastic packaging annually.

- EU nations generate 84 million tonnes of packaging waste, averaging 7kg per person.

- The EU’s main packaging waste materials:

- Paper and cardboard: 34 million tonnes

- Plastic: 16.1 million tonnes

- Glass: 15.6 million tonnes

- The EU recycles 84.2% of its packaging waste.

- In the USA, 2 million tonnes of municipal solid waste (MSW) come from packaging.

- 63% of MSW in the USA is from packaging materials.

- UK households discard 83% of their plastic waste from food and drink packaging.

Environmental Impact

- Fast food packaging makes up 88% of the world’s coastline litter.

- Ten plastic products, including coffee cup lids, contribute to 75% of ocean waste.

- Straws, stirrers, and lolly sticks account for 2.5% of marine litter.

Emerging Trends

- Sustainable Packaging Solutions: There is a significant shift towards eco-friendly materials, such as biodegradable plastics and recyclable paper, to reduce environmental impact.

- Active and Intelligent Packaging: Innovations like antimicrobial agents and biosensors are incorporated into packaging to extend shelf life and monitor food quality.

- Edible Packaging: Development of packaging materials that can be safely consumed along with the product, minimizing waste.

- Nanotechnology Applications: Utilization of nanomaterials enhances barrier properties and provides antimicrobial effects, improving food preservation.

- Modified Atmosphere Packaging (MAP): Use of specific gas mixtures inside packaging slows down the metabolic process of food products, thus prolonging shelf-life.

Top Use Cases

- Prolonging Shelf Life: Advanced packaging technologies, such as vacuum-sealed packs and modified atmosphere packaging, are employed to extend the freshness of perishable items.

- Ensuring Food Safety: Packaging with antimicrobial properties helps in reducing the risk of contamination and foodborne illnesses.

- Enhancing Convenience: Single-serve and resealable packaging formats cater to on-the-go consumption and portion control.

- Reducing Food Waste: Intelligent packaging that monitors freshness can alert consumers about the quality of the product, thereby minimizing waste.

- Improving Sustainability: The adoption of biodegradable and recyclable materials in packaging addresses environmental concerns and meets consumer demand for sustainable options.

Major Challenges

- Managing Packaging Waste: The industry generates a substantial amount of waste, particularly from plastic packaging, posing environmental challenges.

- Transitioning to Sustainable Materials: Shifting from traditional plastics to compostable or recyclable materials presents technical and economic hurdles.

- Maintaining Food Quality: Ensuring that new packaging materials do not compromise the taste, texture, or safety of fresh food products is a critical concern.

- Regulatory Compliance: Adhering to varying global regulations regarding packaging materials and food safety standards adds complexity to packaging design and implementation.

- Cost Implications: Developing and adopting new packaging technologies can be costly, impacting pricing strategies and profit margins.

Top Opportunities

- Development of Edible Packaging: Creating packaging that can be safely consumed offers a novel solution to reduce waste and appeal to environmentally conscious consumers.

- Advancements in Active Packaging: Incorporating substances that interact with food to extend shelf life or enhance safety presents significant growth potential.

- Application of Nanotechnology: Leveraging nanotechnology can lead to improved packaging materials with superior barrier properties and functionalities.

- Implementation of Modified Atmosphere Packaging: Utilizing MAP technology can effectively prolong the freshness of produce, reducing spoilage and waste.

- Integration of Intelligent Packaging Systems: Developing packaging that can monitor and communicate food quality in real-time offers opportunities to enhance consumer trust and reduce waste.

Key Player Analysis

The Global Fresh Food Packaging Market in 2024 is driven by key players leveraging innovation, sustainability, and advanced material technologies to meet evolving consumer and regulatory demands. Amcor plc and Mondi plc continue to dominate with their focus on recyclable and bio-based packaging solutions, aligning with global sustainability goals. Sealed Air Corporation and Sonoco Products Company are enhancing their portfolios with high-barrier films and active packaging technologies to extend food shelf life.

Bemis Company, Inc. and DS Smith plc emphasize lightweight and flexible packaging solutions to reduce carbon footprints. Huhtamaki Oyj and Smurfit Kappa Group plc capitalize on fiber-based alternatives amid increasing regulatory restrictions on plastic usage. Winpak Ltd. and Tetra Pak maintain leadership in aseptic and vacuum-sealed packaging innovations. UFlex Limited and WestRock Company focus on high-performance laminates and circular economy initiatives. Silgan Holdings Inc. and Constantia Flexibles Group GmbH strengthen their competitive edge with investments in smart packaging and food safety advancements.

Top Key Players in the Market

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Sonoco Products Company

- Bemis Company, Inc.

- DS Smith plc

- Huhtamaki Oyj

- Smurfit Kappa Group plc

- Winpak Ltd.

- Tetra Pak

- UFlex Limited

- WestRock Company

- Silgan Holdings Inc.

- Constantia Flexibles Group GmbH

Regional Analysis

Asia Pacific Leads Fresh Food Packaging Market with Largest Market Share of 36.2%

The Asia Pacific region dominates the fresh food packaging market, accounting for 36.2% of the global market share in 2024. The market in this region is valued at USD 38.5 billion, driven by rapid urbanization, a growing population, and increasing demand for packaged and convenient food products. Countries such as China, India, and Japan are witnessing significant investments in sustainable and advanced packaging solutions due to rising consumer awareness and regulatory emphasis on food safety and waste reduction.

Moreover, the expansion of retail chains and e-commerce platforms has further accelerated the demand for fresh food packaging solutions, particularly in flexible and rigid packaging formats. The region’s strong presence in agricultural production and food exports further strengthens its market position, making Asia Pacific the leading contributor to global fresh food packaging demand.

Recent Developments

- In September 12, 2023 – Smurfit Kappa, a FTSE 100 company, and WestRock, an S&P 500 company, have officially signed a definitive agreement to form Smurfit WestRock. This merger aims to establish a global leader in sustainable packaging, following the initial combination announcement made on September 7, 2023.

- In December 13, 2024 – Tetra Pak has been honored with the ‘Resource Efficiency’ Award at the Sustainable Packaging News Awards 2024. The award recognizes the company’s breakthrough in paper-based barrier material innovation, highlighting its contribution to advancements in sustainable packaging.

- In 2024 – Amcor has finalized the acquisition of Berry Global Group, Inc. in an all-stock transaction valued at approximately $8.4 billion. This merger brings together two major packaging industry players under the name Amcor plc, with global headquarters in Zurich, Switzerland, and a strong operational presence in Evansville, Indiana.

- In December 09, 2024 – Novolex® and Pactiv Evergreen Inc. (NASDAQ: PTVE) have announced a definitive merger agreement. This strategic combination is set to create a major manufacturer in food, beverage, and specialty packaging. By integrating complementary product lines and a broad manufacturing and distribution network, the combined company will better serve both major brands and small businesses.

- In February 24, 2025 – Lakeview Farms, backed by CapVest Partners LLP (“CapVest”), has successfully merged with noosa Holdings, Inc. The newly formed company, Novus Foods, reflects a strong vision to lead the consumer packaged goods sector, particularly within the refrigerated grocery segment.

- In 2025 – Macfarlane Group PLC has announced the acquisition of The Pitreavie Group Limited (“Pitreavie”) for up to £18.0 million. This includes an earn-out provision of up to £4.0 million over two years. The acquisition aligns with Macfarlane’s strategy to expand its protective packaging business through both organic growth and acquisitions.

Conclusion

The fresh food packaging market is set for strong growth, driven by increasing demand for convenience, sustainability, and food safety. Rising consumer awareness, urbanization, and regulatory focus on eco-friendly packaging are shaping industry trends. Innovations in biodegradable materials, active packaging, and smart technologies are transforming the market landscape. The Asia-Pacific region leads due to expanding retail and e-commerce sectors. Industry players are investing in advanced solutions to enhance food preservation and reduce environmental impact. With continuous technological advancements, the market offers significant opportunities for manufacturers and investors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)