Table of Contents

Overview

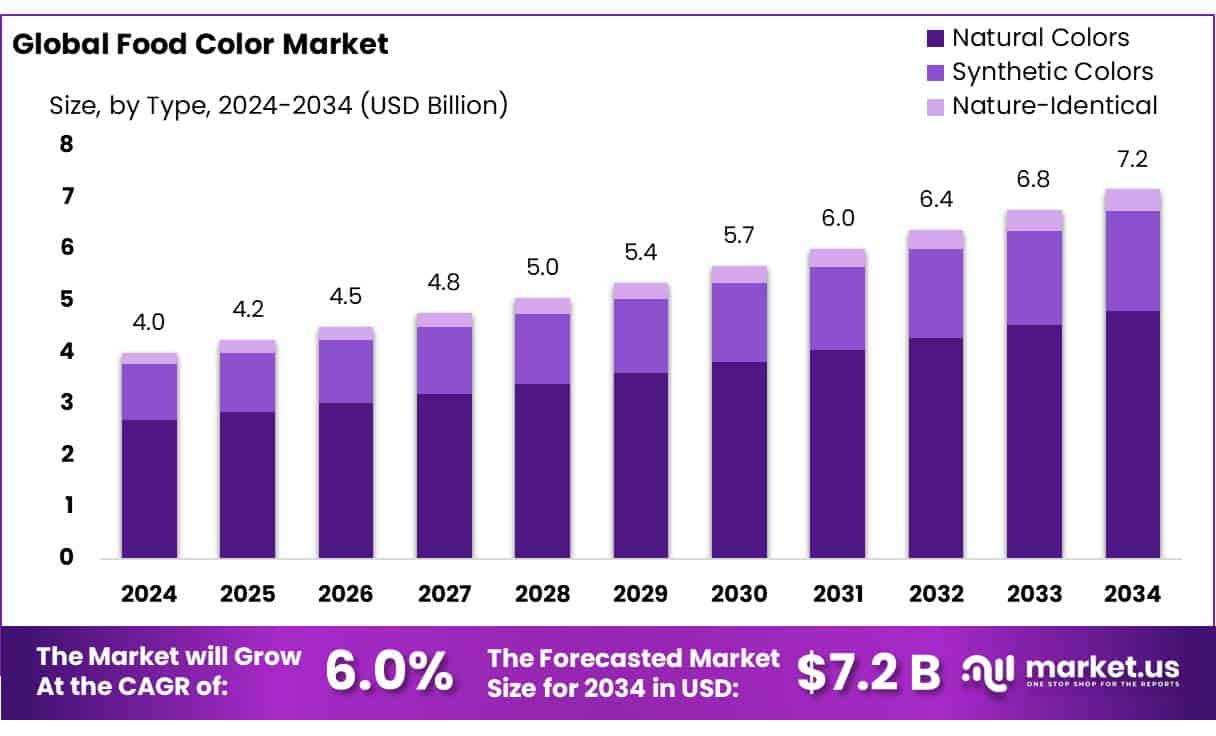

New York, NY – May 14, 2025 – The global Food Color Market is experiencing strong growth, driven by increasing demand for visually appealing and natural food products. Valued at USD 4.0 billion in 2024, the market is projected to reach USD 7.2 billion by 2034, expanding at a steady CAGR of 6.0% from 2025 to 2034.

In 2024, Natural Colors commanded a 67.2% share of the global food color market, fueled by consumer preference for healthier, transparent food options. Plants & Animals accounted for 43.6% of the food color market by source, driven by the rising demand for natural, recognizable ingredients.

Powder captured a 58.4% share of the global food color market by form, favored for its long shelf life, ease of storage, and compatibility with dry food applications. Dyes held a 66.9% share of the food color market by solubility, driven by their vibrant, consistent colors and excellent water solubility. Food Products accounted for 73.1% of the global food color market by application, reflecting the critical role of colors in enhancing the appeal of processed and packaged foods.

US Tariff Impact on Market

About 15% of the U.S. food supply is imported, with 32% of fresh vegetables, 55% of fresh fruit, and 94% of seafood coming from abroad, per the Consumer Federation of America, citing FDA data. Certain items, such as coffee and bananas, are almost entirely sourced internationally. Tariffs are creating uncertainty for households managing grocery budgets and businesses importing food.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/food-color-market/request-sample/

Key Takeaways

- Food Color Market size is expected to be worth around USD 7.2 billion by 2034, from USD 4.0 billion in 2024, growing at a CAGR of 6.0%.

- Natural Colors held a dominant market position, capturing more than a 67.2% share in the global food color market.

- Plants & Animals held a dominant market position, capturing more than a 43.6% share in the food color market.

- Powder held a dominant market position, capturing more than a 58.4% share.

- Dyes held a dominant market position, capturing more than a 66.9% share in the food color market.

- Food Products held a dominant market position, capturing more than a 73.1% share in the global food color market.

- Europe held a dominant position in the global food color market, capturing approximately 37.2% of the market share, equivalent to a valuation of around USD 1.4 billion.

Report Scope

| Market Value (2024) | USD 4.0 Billion |

| Forecast Revenue (2034) | USD 7.2 Billion |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (Natural Colors, Synthetic Colors, Nature-Identical), By Source (Plants and Animals, Minerals and Chemicals, Microorganisms), By Form (Liquid, Powder), By Solubility (Dyes, Lakes), By Application (Food Products, Beverages) |

| Competitive Landscape | Archer-Daniels-Midland Co., BASF, Cargill, Dohler Group, DSM, Ingredion, Inc., Kalsec, Inc., Koninklijke, Lycored Ltd., Naturex, Oterra, SAN-EI GEN F.F.I. INC, Symrise AG |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147642

Key Market Segments

By Type

- In 2024, Natural Colors commanded a 67.2% share of the global food color market, fueled by consumer preference for healthier, transparent food options. Derived from sources like turmeric, beetroot, and spirulina, natural colorants are favored over synthetic dyes due to heightened awareness of food safety and chemical-free ingredients.

By Source

- In 2024, Plants & Animals accounted for 43.6% of the food color market by source, driven by the rising demand for natural, recognizable ingredients. Colors sourced from beetroot, spirulina, turmeric, and cochineal insects align with clean-label trends and reduce reliance on synthetic additives. These sources deliver vibrant hues while meeting consumer demands for transparency and sustainability. Regulatory bodies like FSSAI and FDA are tightening controls on synthetic additives, further promoting plant- and animal-based colors in beverages, dairy, confectionery, and frozen foods.

By Form

- In 2024, Powder captured a 58.4% share of the global food color market by form, favored for its long shelf life, ease of storage, and compatibility with dry food applications. Manufacturers prefer powders for snacks, baked goods, and instant noodles due to their seamless blending and stability under heat and light.

By Solubility

- In 2024, Dyes held a 66.9% share of the food color market by solubility, driven by their vibrant, consistent colors and excellent water solubility. Widely used in beverages, candies, and syrups, dyes deliver strong visual appeal with minimal quantities and blend smoothly without residue. Their cost-efficiency and scalability make them a staple in industrial food production.

By Application

- In 2024, Food Products accounted for 73.1% of the global food color market by application, reflecting the critical role of colors in enhancing the appeal of processed and packaged foods. From bakery and confectionery to snacks and dairy, colors ensure visual consistency and align with flavor expectations.

Regional Analysis

- Europe led the global food color market in 2024, securing a 37.2% share valued at approximately USD 1.4 billion. This dominance stems from strict regulations, a strong preference for natural ingredients, and a well-established food processing sector. The European Food Safety Authority (EFSA) tightly regulates food additives, including colorants, approving only thoroughly vetted substances.

- This stringent oversight builds consumer confidence and pushes manufacturers toward safer, natural coloring options. European consumers increasingly favor health-focused products, driving a shift from synthetic to natural food colors. Ingredients like beetroot, spirulina, and turmeric are in demand, aligning with the clean-label trend that prioritizes transparency and minimal processing. Advances in technology have further enhanced the stability and vibrancy of natural colors, expanding their use across various food products.

Top Use Cases

- Enhancing Visual Appeal in Beverages: Food colors make drinks like sodas, juices, and energy drinks look vibrant and inviting. Bright hues attract consumers, align with flavor expectations, and boost brand recognition. Natural colors like spirulina and beetroot are popular for clean-label products, meeting the demand for healthier, visually appealing beverages in competitive markets.

- Improving Bakery Product Attractiveness: Food colors add vibrant shades to cakes, cookies, and pastries, making them more appealing. Natural options like turmeric and annatto enhance visual charm while meeting clean-label trends. Consistent coloring ensures product uniformity, driving consumer preference in retail and artisanal bakery sectors, especially for festive or themed baked goods.

- Boosting Confectionery Market Sales: Vibrant food colors in candies, gummies, and chocolates grab attention and enhance fun appeal. Synthetic dyes offer bold hues, while natural colors like cochineal cater to health-conscious buyers. Eye-catching colors drive impulse purchases, especially among kids, making confectionery a key segment for food color innovation and sales growth.

- Supporting Dairy Product Differentiation: Food colors create appealing shades in yogurts, ice creams, and flavored milk, setting products apart on shelves. Natural colors like saffron or beetroot align with health trends, while vibrant hues attract younger consumers. Consistent coloring builds brand identity, helping dairy products stand out in a crowded, competitive market.

- Enhancing Frozen Food Presentation: Food colors improve the look of frozen desserts, pizzas, and ready meals, making them more appetizing. Natural colorants like spinach or carrot extracts maintain appeal while meeting clean-label demands. Stable colors that withstand freezing processes ensure consistent quality, boosting consumer trust and sales in the growing frozen food sector.

Recent Developments

1. Archer-Daniels-Midland Co. (ADM)

- ADM has expanded its natural food color offerings by introducing new plant-based solutions, including vibrant shades from spirulina and beetroot. The company focuses on clean-label trends, catering to demand for sustainable and allergen-free colorants. ADM also invested in fermentation technology to enhance natural pigment production.

2. BASF

- BASF has been advancing in synthetic and natural food colors, with innovations in stable, heat-resistant pigments for beverages and confectionery. The company emphasizes sustainability, reducing synthetic dye usage, and promoting eco-friendly alternatives. BASF also collaborates with food brands to develop customized color solutions.

3. Cargill

- Cargill launched new natural color ranges, including CarmeLized Vegetable Juice for rich brown hues in snacks and bakery. The company focuses on clean-label, non-GMO, and organic-certified options. Cargill also invested in microbial fermentation for sustainable pigment production.

5. Döhler Group

- Döhler expanded its Terra range, offering plant-derived food colors with improved solubility and shelf life. The company focuses on organic and natural solutions, partnering with food brands for customized applications in beverages and desserts.

Conclusion

The Food Color Market is booming, fueled by growing demand for natural, clean-label products. Consumers increasingly value health and transparency, boosting the use of plant-based colors like beetroot and turmeric. Supported by strict regulations and innovations improving color stability, the market is poised for continued expansion, particularly in beverages, snacks, and plant-based foods.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)