Table of Contents

Introduction

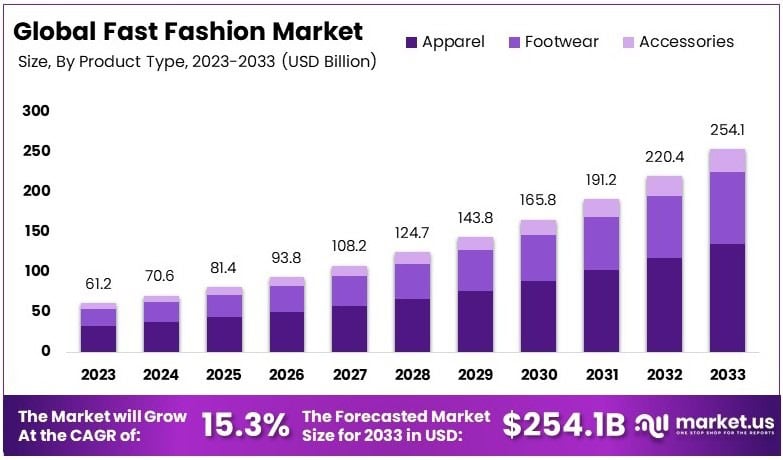

Impact of U.S. Tariffs on The Global Fast Fashion Market is projected to reach approximately USD 254.1 billion by 2033, rising from USD 61.2 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 15.3% during the forecast period spanning from 2024 to 2033.

The fast fashion market refers to the rapid production of trendy, affordable apparel that allows retailers to quickly respond to the latest fashion trends. This business model focuses on designing, manufacturing, and delivering garments in a matter of weeks, ensuring that stores are stocked with the newest styles at competitive prices. The fast fashion market has gained significant traction globally due to its ability to offer fashionable clothing at lower costs, attracting a broad consumer base, particularly among young and price-conscious shoppers.

The growth of e-commerce platforms has further fueled the fast fashion market by providing easy access to these products, making it convenient for consumers to shop from anywhere at any time. Several factors contribute to the rapid expansion of the market, including advancements in supply chain technology, improved manufacturing processes, and increased consumer demand for frequent new clothing. The demand is largely driven by shifting consumer preferences for constantly evolving trends, with the younger demographic being the primary market driver, seeking affordable yet stylish options.

Additionally, the market benefits from the ability to quickly reproduce designs seen on fashion runways or through social media, further intensifying its appeal. Opportunities in the fast fashion market are abundant, particularly in emerging economies where the demand for inexpensive, trendy clothing is increasing. Furthermore, companies that embrace sustainability practices or offer eco-friendly alternatives have the potential to attract a growing segment of environmentally conscious consumers, positioning themselves for long-term success amidst increasing scrutiny of the environmental impact of fast fashion.

Key Takeaways

- The Fast Fashion Market was valued at USD 61.2 Billion in 2023 and is projected to grow to USD 254.1 Billion by 2033, reflecting a robust CAGR of 15.3%.

- In 2023, the Apparel segment led the Product Type category, accounting for 53.4%, highlighting the strong demand for affordable clothing options.

- Women made up 64.8% of the Consumer Demographics segment in 2023, underscoring their significant preference for trendy and affordable fashion.

- Low-priced items dominated the Price Range segment in 2023, representing 57.9%, emphasizing the affordability aspect of fast fashion.

- Online Sales comprised 68.2% of the Distribution Channel in 2023, driven by the increasing convenience of online shopping.

- Asia Pacific maintained its position as the leading region in 2023, owing to its strong manufacturing infrastructure and expanding consumer base.

Tariffs and trade policy uncertainty could Imapct on, Request A Sample Copy Of This Report at https://market.us/report/fast-fashion-market/request-sample/

Fast Fashion Statistics

- The garment industry employs 1 in 6 global workers.

- Each year, $500 billion in value is lost due to underutilized or unrecycled clothing.

- 60% of garments produced annually are disposed of in landfills.

- Fashion manufacturing contributes 10% of global carbon emissions.

- Polyester makes up 60% of garments produced each year and is three times more carbon-intensive than cotton.

- 35% of microplastics in the oceans come from fashion production, with polyester accounting for 73%.

- It takes 1,800 gallons of water to produce and clean one pair of trousers.

- The clothing industry contributes 20% of global wastewater, primarily from textile dyeing.

- Around 1.1 billion people globally lack access to clean water.

- Only 2% of garment workers earn a living wage.

- 72% of Americans are aware of sustainability issues in the apparel industry.

- 55% of consumers are interested in purchasing sustainably sourced clothing, but 48% are unsure where to find it.

- 100 billion items of clothing are produced globally each year.

- On average, people wear only 20% of their clothes 80% of the time.

- Fast fashion primarily targets consumers aged 18 to 24.

- The fashion industry generates 92 million tonnes of textile waste annually.

- The fashion industry is responsible for 8-10% of global emissions.

- Each year, 92 million tons of textile waste are produced by the fashion industry.

- 73% of millennials are willing to pay more for sustainable products, a number expected to grow as their incomes increase.

Emerging Trends

- Digital Transformation: The fast fashion industry is increasingly integrating advanced technologies such as artificial intelligence (AI), augmented reality (AR), and 3D printing. AI is utilized for trend forecasting and inventory management, AR enhances online shopping experiences through virtual try-ons, and 3D printing allows for on-demand production, reducing waste and enabling customization .

- Sustainability Initiatives: There is a growing emphasis on sustainability within the fast fashion sector. Brands are adopting eco-friendly materials like organic cotton and recycled polyester, implementing circular fashion models that promote recycling and reuse, and enhancing supply chain transparency to ensure ethical sourcing .

- Shift Towards Resale and Vintage Markets: The resale and vintage fashion markets are experiencing significant growth, driven by consumer demand for unique, sustainable, and cost-effective alternatives to traditional fast fashion. This shift reflects a broader cultural movement towards sustainability and individuality in fashion choices .

- Expansion in Emerging Markets: Fast fashion brands are increasingly targeting emerging markets, particularly in Asia, Latin America, and Africa, where rising disposable incomes and a growing middle class present substantial growth opportunities. This expansion is facilitated by digital platforms and localized strategies tailored to regional preferences .

- Influence of Social Media and Influencers: Social media platforms, especially Instagram and TikTok, play a pivotal role in shaping fashion trends and consumer purchasing behaviors. Influencers and user-generated content drive brand visibility and consumer engagement, leading to increased sales and brand loyalty .

Top Use Cases

- On-Demand Production: Utilizing technologies like 3D printing, brands can produce garments on demand, minimizing overproduction and reducing waste. This approach aligns with sustainability goals and meets consumer demand for personalized products .

- Virtual Try-Ons: Augmented reality enables consumers to virtually try on clothing items, enhancing the online shopping experience and reducing return rates. This technology improves customer satisfaction and operational efficiency .

- Predictive Trend Analysis: AI-driven tools analyze consumer behavior and social media trends to forecast fashion demands accurately. This capability allows brands to align production with market needs, optimizing inventory and reducing unsold stock .

- Supply Chain Transparency: Blockchain technology is employed to provide transparent and traceable supply chains, ensuring ethical sourcing and building consumer trust. This practice addresses increasing demand for accountability in fashion production .

- Sustainable Packaging Solutions: Brands are adopting eco-friendly packaging materials and practices, such as biodegradable bags and minimalistic designs, to reduce environmental impact and appeal to environmentally conscious consumers .

Major Challenges

- Environmental Impact: The fast fashion industry is a significant contributor to environmental degradation, including high water usage, textile waste, and pollution. Addressing these issues requires substantial investment in sustainable practices and technologies .

- Labor Practices and Ethical Concerns: Reports of poor labor conditions, including long working hours and low wages, persist within the supply chains of some fast fashion brands. Ensuring fair labor practices and compliance with labor laws remains a critical challenge .

- Market Saturation: The proliferation of fast fashion brands has led to market saturation, making it challenging for new entrants to differentiate themselves and for existing brands to maintain profitability .

- Regulatory Compliance and Tariffs: Changes in trade policies and the imposition of tariffs, such as the removal of the “de minimis” rule in the U.S., affect the cost structure and competitiveness of fast fashion brands, particularly those relying on international supply chains .

- Consumer Awareness and Demand for Sustainability: Increasing consumer awareness regarding the environmental and social impacts of fast fashion is leading to a shift towards more sustainable and ethical purchasing decisions, challenging brands to adapt their practices accordingly.

Top Opportunities

- Adoption of Sustainable Practices: Implementing sustainable production methods, such as using eco-friendly materials and adopting circular fashion models, presents an opportunity for brands to attract environmentally conscious consumers and comply with evolving regulations .

- Expansion into Emerging Markets: Targeting emerging markets with tailored products and localized strategies offers significant growth potential, driven by increasing disposable incomes and a young, fashion-forward population .

- Integration of Advanced Technologies: Leveraging technologies like AI, AR, and 3D printing can enhance operational efficiency, improve customer experiences, and reduce environmental impact, providing a competitive edge in the market .

- Growth of Resale and Vintage Markets: Capitalizing on the rising demand for resale and vintage clothing allows brands to tap into a growing segment of consumers seeking unique, sustainable, and affordable fashion options .

- Enhanced Consumer Engagement through Social Media: Utilizing social media platforms for marketing and customer engagement enables brands to reach a broader audience, influence purchasing decisions, and build brand loyalty among younger consumers

Key Player Analysis

The global fast fashion market in 2024 is characterized by intense competition, with several key players maintaining dominant positions through their distinctive business models and strategies. Zara, a flagship brand of Inditex, remains at the forefront with its agile supply chain and rapid response to emerging trends, enabling it to offer high-quality fashion at affordable prices.

H&M continues to lead in sustainability efforts, appealing to eco-conscious consumers while offering an extensive range of trendy apparel. Shein has made a significant impact, especially in the online space, by leveraging advanced data analytics to predict fashion trends and maintain low costs. Uniqlo’s global reach, coupled with its focus on technology-driven fabrics, has positioned it as a prominent player in casual and functional wear.

Other brands such as Forever 21, Boohoo, Fashion Nova, and Primark maintain strong market shares by catering to price-sensitive consumers and offering frequent product updates, ensuring they stay competitive in the fast-paced market.

Purchase The Full Report Now at – https://market.us/purchase-report/?report_id=136209

Top Companies in the Market

- Zara (Inditex)

- H&M

- Shein

- Uniqlo (Fast Retailing)

- Forever 21

- Boohoo

- Fashion Nova

- Primark

- Mango

- ASOS

- Topshop (ASOS)

- Missguided

- River Island

Recent Developments

- In 2023, Reliance Retail, the leading retail company in India, acquired the licenses and brand assets of UK-based Superdry in three Asian markets for 40 million pounds ($48 million). This strategic move will strengthen Reliance’s partnerships with international brands while providing Superdry with crucial financial support to aid its recovery. Following this deal, Superdry’s stock saw a rise of 18%, hitting its highest level in nearly two months, as the company plans to use the proceeds to address its liquidity needs and fund its turnaround efforts.

- In 2023, Authentic Brands Group Inc. secured $500 million in funding from General Atlantic, a growth-equity investor. This deal raises the valuation of the brand management company, which owns various fashion and celebrity rights, to over $20 billion. While specific valuation details were not disclosed, the transaction marks a significant boost to the company’s growth strategy, as sources familiar with the matter shared.

- In 2023, Walmart Inc. sold its Bonobos menswear brand to WHP Global and Express Inc. for $75 million, significantly less than the $310 million Walmart paid for the brand in 2017. WHP Global, known for owning brands like Anne Klein, acquired the Bonobos brand for $50 million, while Express, partially owned by WHP, took on the operational assets and liabilities for $25 million.

- In 2023, Frasers Group, owned by Mike Ashley, purchased a 5% stake in Boohoo, an online fashion retailer, for £22 million. This investment is part of Ashley’s broader strategy to strengthen his online retail portfolio, which already includes brands like Sports Direct and Flannels. Additionally, Frasers Group recently acquired a 9% stake in the electrical goods retailer Currys, continuing its focus on acquiring undervalued brands.

Conclusion

The global fast fashion market is poised for sustained expansion, driven by rapid technological advancements, the increasing influence of social media, and a growing appetite among younger consumers for affordable, trend-responsive apparel. Brands are increasingly integrating technologies such as artificial intelligence, augmented reality, and 3D printing to streamline production processes, enhance customer engagement, and reduce environmental impact. However, the industry faces mounting challenges related to environmental sustainability, labor practices, and regulatory compliance, necessitating a shift towards more ethical and transparent business models. Companies that can effectively balance speed, affordability, and sustainability are well-positioned to thrive in this evolving market landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)