Table of Contents

Introduction

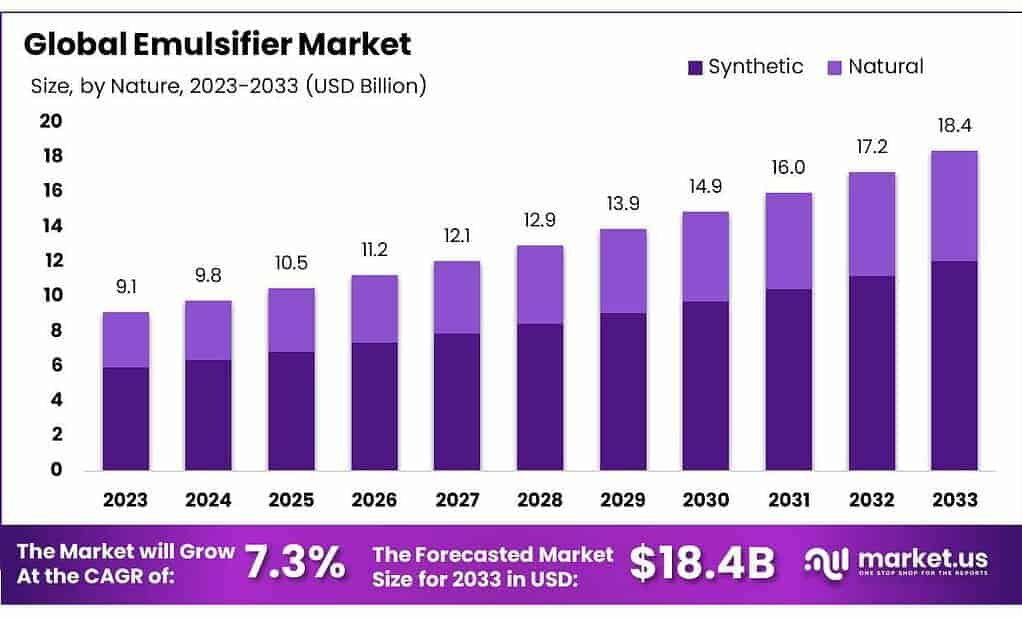

New York, NY – January 17, 2025 – The global Emulsifier Market is experiencing significant growth, with the market size projected to reach USD 18.4 billion by 2033, up from USD 9.1 billion in 2023, growing at a compound annual growth rate (CAGR) of 7.3% during the forecast period from 2024 to 2033.

Emulsifiers play a vital role in a wide range of industries, including food and beverages, personal care, pharmaceuticals, and chemicals, due to their ability to stabilize mixtures and improve product quality. The rising demand for processed and convenience foods, coupled with increasing awareness of health and wellness, is fueling market expansion.

Additionally, the growing use of emulsifiers in the cosmetic and pharmaceutical sectors, driven by trends toward natural and organic products, is contributing to the market’s popularity. Key growth factors include the increasing adoption of clean-label products, rising disposable incomes, and ongoing technological innovations in emulsifier production. With opportunities for market players to tap into emerging markets, particularly in Asia-Pacific, the emulsifier market is poised for substantial growth and offers substantial expansion potential for businesses.

Key Takeaways

- In 2023, the market for emulsifiers generated a revenue of USD 9.1 billion, with a CAGR of 7.3%, and is expected to reach USD 18.4 billion by the year 2033.

- The nature segment held a major share of the market, with the synthetics segment taking the lead in 2023 with a market share of 65.4% due to the cost affordability of the synthetic emulsifiers.

- By product type, the mono & di-glycerides of the fatty acid segment accounted for a significant share of 48.2% owing to the rapid expansion of bakery and confectionery industries worldwide.

- By function segment, the emulsification segment among the other sub-segments held a significant share of the market with 42.6% of the emulsifiers market due to the increasing consumption of packaged foods worldwide.

- By application, the food segment accounted for the largest market share of 58.2%.

- North America led the market by securing a market share of 45.6% in 2023.

Emerging Trends

- Clean Label Demand: Consumers are increasingly seeking products with simple, natural ingredients. This trend has led to a rise in the demand for clean-label emulsifiers, which are free from artificial additives and preservatives. Manufacturers are responding by developing plant-based and natural emulsifiers to meet the growing preference for transparency and health-conscious choices.

- Rise of Plant-Based Emulsifiers: With the growing trend of plant-based and vegan diets, plant-derived emulsifiers are gaining popularity. Ingredients like sunflower lecithin, soy lecithin, and other plant-based sources are being incorporated into a variety of products to replace animal-derived emulsifiers. This shift is driven by consumer demand for sustainable, cruelty-free, and allergen-free options.

- Health-Conscious Product Development: As consumers focus on health and wellness, emulsifiers are being used to create healthier alternatives in food and beverages. Products with reduced sugar, fat, or calorie content, as well as those with enhanced nutritional value, rely on emulsifiers to maintain taste, texture, and product stability.

- Personal Care and Cosmetics Growth: Emulsifiers are increasingly used in the personal care and cosmetics industries to formulate creams, lotions, and serums that provide smooth textures and enhanced skin absorption. With the rise of natural and organic beauty products, there is a growing demand for natural emulsifiers that align with consumers’ preferences for safe, non-toxic ingredients.

- Technological Advancements: The development of advanced emulsification technologies is boosting the efficiency and performance of emulsifiers. Innovations like high-pressure homogenization and microfluidization are allowing for better control over particle size, leading to improved product stability and performance.

Use Cases

- Food and Beverage Industry: Emulsifiers are widely used in the food and beverage sector to create stable blends of oil and water in products like salad dressings, margarine, sauces, and dairy items. They help maintain consistency and texture while preventing separation, ensuring products remain fresh and appealing.

- Cosmetics and Personal Care: In the cosmetics industry, emulsifiers are essential in creating smooth, consistent formulations for lotions, creams, and moisturizers. They help blend oil-based and water-based ingredients, improving the texture and absorption of skincare products.

- Pharmaceuticals: Emulsifiers are crucial in the pharmaceutical industry for developing oral suspensions, creams, and ointments. They improve the stability and bioavailability of active ingredients, ensuring even distribution of the product.

- Paints and Coatings: Emulsifiers are used in the production of water-based paints and coatings, where they help achieve a uniform dispersion of pigments in the paint. This ensures smooth application and prevents clumping or settling.

- Agricultural Applications: In the agricultural industry, emulsifiers are used in the formulation of pesticides, herbicides, and fertilizers. They help ensure that active ingredients are effectively mixed with water and other components, leading to better application and performance.

Major Challenges

- Regulatory Compliance: Emulsifier manufacturers face strict regulations related to ingredient safety and labeling, particularly in regions with high consumer scrutiny. Navigating varying regulations across different markets can be challenging, as standards differ for natural, organic, and synthetic emulsifiers.

- Consumer Preference for Natural Ingredients: With the growing demand for clean-label products, emulsifier manufacturers are under pressure to replace synthetic emulsifiers with natural alternatives. While natural emulsifiers are gaining popularity, they can be more expensive and less effective, requiring innovation and additional investment to meet both performance and sustainability standards.

- Supply Chain Disruptions: The production of emulsifiers relies on a variety of raw materials, including plant-based sources. Supply chain disruptions, such as agricultural shortages or geopolitical issues, can lead to raw material shortages and price volatility. This impacts production costs and can lead to delays in product availability in the market.

- Sustainability Concerns: The environmental impact of emulsifier production is becoming a growing concern. There is increasing pressure on manufacturers to adopt more sustainable sourcing and production methods. The use of synthetic emulsifiers and non-renewable resources raises questions about the industry’s carbon footprint, prompting a shift toward eco-friendly alternatives.

- Formulation Challenges: Developing emulsifiers that work efficiently across a wide range of products and conditions remains challenging. Balancing factors such as texture, stability, and shelf life requires continuous innovation and testing.

Market Growth Opportunities

- Rising Demand for Clean Label Products: As consumers increasingly prefer transparency in food labeling, there is a growing opportunity for emulsifier manufacturers to develop clean-label solutions. Emulsifiers derived from natural and organic sources can cater to this demand, offering healthier, safer alternatives while maintaining product stability.

- Expansion of Plant-Based Products: The shift towards plant-based and vegan diets presents a major opportunity for emulsifiers derived from plant sources. As more consumers seek plant-based food products, emulsifiers made from sunflower lecithin, soy lecithin, and other plant-based materials will be in high demand.

- Growth in Health-Conscious Consumers: The increasing awareness of health and wellness among consumers is driving demand for functional and nutritionally enriched food and beverages. Emulsifiers play a crucial role in formulating low-fat, low-sugar, and reduced-calorie products while maintaining taste and texture.

- Technological Advancements in Emulsifier Production: Advancements in emulsification technology, such as high-pressure homogenization and microfluidization, offer opportunities for the development of more efficient and stable emulsifiers. These technologies allow for better control over particle size, leading to improved product performance.

- Emerging Markets in Asia-Pacific: The rapid urbanization and growing middle class in the Asia-Pacific region are creating new opportunities for emulsifier manufacturers. As consumers in these regions become more health-conscious and demand processed food products, the emulsifier market is expected to expand.

Recent Developments

- ADM: In January 2024, ADM announced a joint development agreement with Solugen to produce bio-based propylene glycol and other specialty chemicals using enzymatic technology. This could potentially impact emulsifier production.

- Corbion: In January 2024, Corbion and Kingswood Capital Management announced an agreement for Kingswood to acquire Corbion’s emulsifier business for €362 million. This divestment aligns with Corbion’s strategy to focus on its core competencies in fermentation.

- Cargill: In October 2023, Cargill opened a new $150 million pectin production facility in Brazil to meet the growing global demand for the label-friendly texturizing ingredient used in various food applications.

- Ingredion: In 2023, Ingredion expanded its range of clean-label emulsifiers derived from sunflower oil to meet increasing consumer demand for simpler ingredients.

- BASF: In March 2024, BASF and Evonik formed a joint venture to develop new manufacturing technologies for sodium laureth sulfate (SLES), an important emulsifier and surfactant. The goal is to improve sustainability and regional supply.

- Palsgaard: In 2023, Palsgaard invested in expanding production capacity for emulsifiers at its Mexican facility to meet growing demand in North and South America.

Conclusion

The Emulsifier Market is poised for robust growth, driven by increasing consumer demand for clean-label, plant-based, and healthier products across various industries. With applications spanning food and beverages, personal care, pharmaceuticals, and agriculture, emulsifiers play a vital role in improving product stability, texture, and performance.

Technological advancements, along with the growing trend for sustainable and natural ingredients, present significant opportunities for innovation. As emerging markets, especially in Asia-Pacific, continue to expand, there are ample prospects for market players to capitalize on evolving consumer preferences. Despite challenges such as regulatory hurdles and supply chain disruptions, the future of the emulsifier market remains promising, offering substantial growth potential for manufacturers who can adapt to changing demands and invest in innovative solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)