Table of Contents

Introduction

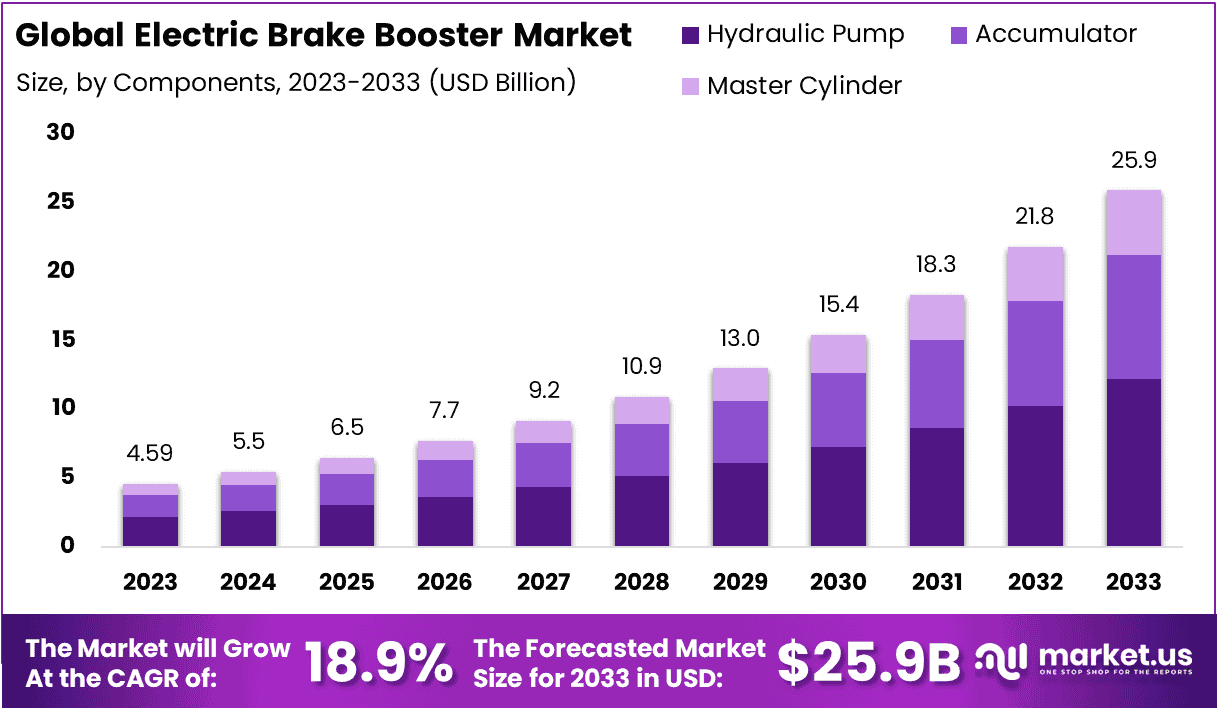

New York, NY – Feb 27, 2025- The Global Electric Brake Booster Market is projected to reach approximately USD 25.95 billion by 2033, up from USD 4.59 billion in 2023, reflecting a compound annual growth rate (CAGR) of 18.90% over the forecast period from 2024 to 2033.

The Electric Brake Booster (EBB) is an advanced braking system that utilizes electric motors to assist with brake force application, replacing the traditional hydraulic-based booster system. This technology offers precise, responsive braking performance by electronically controlling the braking pressure, resulting in improved safety and fuel efficiency, especially in electric and hybrid vehicles.

The Electric Brake Booster Market refers to the industry encompassing the manufacturing, distribution, and adoption of EBB systems in both original equipment (OE) and aftermarket applications. The market has been experiencing significant growth driven by the increasing adoption of electric vehicles (EVs) and the automotive industry’s shift towards advanced driver-assistance systems (ADAS).

The demand for EBBs is primarily fueled by the need for more efficient and environmentally friendly braking systems, particularly in hybrid and fully electric vehicles, which require compact, lightweight, and energy-efficient components. Moreover, government regulations on vehicle emissions and fuel economy are prompting automakers to adopt technologies that reduce energy consumption, further boosting the market.

Opportunities for market expansion are also supported by the rising awareness of road safety and the integration of next-generation braking technologies. The development of autonomous vehicles and the growing emphasis on smart vehicle systems offer additional growth avenues. As automakers continue to invest in the electrification of their fleets, the Electric Brake Booster Market is poised for steady growth, driven by technological advancements and an increasing shift toward sustainable mobility solutions.

Key Takeaways

- The Global Electric Brake Booster Market is projected to reach USD 25.95 billion by 2033, expanding from USD 4.59 billion in 2023, reflecting a robust CAGR of 18.90% from 2024 to 2033.

- The Hydraulic Pump segment holds a significant 47.3% market share, owing to its crucial role in improving vehicle braking performance and reliability.

- The Vacuum Booster leads the segment with a 61.3% market share, driven by its long-established reliability and widespread integration in both traditional and modern vehicle designs.

- BEVs dominate the market with a 50.1% share, underscoring the growing adoption of zero-emission vehicles worldwide.

- The Original Equipment Manufacturer (OEM) channel commands a 63% market share, propelled by manufacturers’ focus on integrating advanced safety features into vehicles.

- The Asia-Pacific (APAC) region holds the largest market share at 43.1%, driven by increasing automotive demand and technological advancements in the region.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 4.59 Billion |

| Forecast Revenue (2033) | USD 25.95 Billion |

| CAGR (2024-2033) | 18.90% |

| Segments Covered | By Components (Hydraulic Pump, Accumulator, Master Cylinder), By Type (Vacuum Booster, Hydraulic Booster), By Vehicle Type (Two Wheeler, Passenger Vehicle, Commercial Vehicle), By Propulsion (Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Hybrid Electric Vehicle), By Sales Channel (OEM, Aftermarket) |

| Competitive Landscape | Aisin Seiki Co. Ltd., Robert Bosch GmbH, TRW Automotive, Hyundai Mobis, Continental AG, Mando Corporation, Hitachi, Nissin Kogyo, Jilin Dongguang Aowei Brake System Co. Ltd., Zhejiang VIE Science & Technology Co., Wanxiang Group Corporation, BWI Group, FTE automotive Group, APG, Liuzhou Wuling Automobile Industry Co. Ltd, Wuhu Bethel, CARDONE |

Emerging Trends

- Shift Toward Electrification in Vehicles: The growing adoption of electric vehicles (EVs) is influencing the electric brake booster market, with an increasing preference for lightweight and efficient braking systems in electric powertrains.

- Integration of Advanced Driver Assistance Systems (ADAS): There is a rising trend toward integrating electric brake boosters with ADAS features. These systems enhance vehicle safety by improving braking control and enabling semi-automated or fully automated driving functions.

- Focus on Sustainability and Fuel Efficiency: Automakers are prioritizing the development of energy-efficient braking systems that minimize energy loss. Electric brake boosters are gaining traction as they contribute to overall fuel efficiency by reducing power consumption in braking operations.

- Adoption of Regenerative Braking Systems: Regenerative braking technology, which recovers energy during braking, is increasingly being combined with electric brake boosters. This trend is significant in the context of electric and hybrid vehicles, where energy efficiency is a priority.

- Technological Advancements in Electric Actuation: Continuous innovation in electric actuation mechanisms is enabling more precise and faster brake responses. The shift toward electro-hydraulic and purely electric solutions is expected to further enhance the performance of electric brake boosters.

Top Use Cases

- Electric and Hybrid Vehicles: As the automotive industry moves towards greener transportation, electric brake boosters are becoming essential components in electric and hybrid vehicles for efficient energy use and braking control.

- Autonomous Vehicles: In autonomous driving, electric brake boosters are integrated into braking systems to ensure precise, reliable, and responsive stopping capabilities required for self-driving functionalities.

- Heavy Commercial Vehicles: Electric brake boosters are being increasingly utilized in trucks and buses, where enhanced braking power and reduced maintenance needs offer significant operational advantages in the heavy commercial sector.

- Motorcycles and Two-Wheelers: Electric brake boosters are finding application in motorcycles and two-wheelers, where space constraints and lightweight solutions are critical for overall vehicle performance and safety.

- Military and Defense Applications: In defense vehicles, electric brake boosters contribute to enhanced vehicle maneuverability and braking performance, which is crucial for military operations that require rapid, precise movements.

Major Challenges

- High Initial Development Costs: The development of electric brake booster systems requires significant investment in advanced technology and research, making initial costs a challenge for many manufacturers, particularly in the mass-market segment.

- Integration with Existing Vehicle Platforms: Retrofitting existing vehicle platforms with electric brake boosters can present significant challenges in terms of compatibility, space requirements, and system integration.

- Limited Consumer Awareness: While electric brake boosters offer numerous benefits, consumer awareness regarding their advantages over traditional braking systems remains limited, potentially hindering broader adoption.

- Power Supply and Battery Management: Electric brake boosters depend on the vehicle’s battery for operation, posing challenges related to power supply management. In particular, maintaining sufficient battery charge for reliable booster performance in electric and hybrid vehicles remains a key concern.

- High Complexity in Manufacturing: The manufacturing process of electric brake boosters involves precision engineering and high-level integration of multiple components, which can increase the complexity and cost of production.

Top Opportunities

- Rising Demand for Electric and Hybrid Vehicles: With increasing environmental regulations and consumer demand for eco-friendly alternatives, there is a growing opportunity for the electric brake booster market to expand as the adoption of electric and hybrid vehicles rises.

- Technological Advancements in Brake Booster Efficiency: The development of more efficient, cost-effective electric brake boosters presents an opportunity for manufacturers to meet the evolving demands for high-performance braking systems, particularly in electric vehicles.

- Government Regulations and Incentives: Governments worldwide are implementing stricter safety and environmental regulations, which are likely to drive the adoption of advanced braking systems like electric brake boosters in both consumer and commercial vehicle segments.

- Potential for Aftermarket Installations: As more vehicles on the road adopt electric and hybrid powertrains, there is an opportunity to expand into the aftermarket sector, offering retrofitting services to enhance the braking systems of existing vehicles.

- Global Expansion of Electric Vehicle Infrastructure: As global infrastructure for electric vehicles expands, the need for advanced, energy-efficient braking systems such as electric brake boosters will increase, creating growth opportunities for manufacturers in emerging markets.

Key Player Analysis

In the global electric brake booster market for 2024, key players are expected to maintain a competitive stance through strategic technological innovations and geographical expansions. Aisin Seiki Co. Ltd., Robert Bosch GmbH, and TRW Automotive lead the market, leveraging their strong R&D capabilities to advance electric braking technologies. These companies are well-positioned to capitalize on the increasing demand for fuel-efficient, lightweight, and high-performance braking systems, particularly in electric and hybrid vehicles.

Hyundai Mobis and Continental AG are also significant contributors, with a focus on enhancing vehicle safety and automation through advanced electric brake systems. Mando Corporation and Hitachi strengthen their market presence through strategic partnerships and technological advancements. Regional players such as Jilin Dongguang Aowei Brake System Co. Ltd. and Zhejiang VIE Science & Technology Co. contribute to the market’s growth by meeting the localized needs of the automotive industry in Asia. The competitive dynamics are shaped by technological innovation, cost optimization, and an evolving regulatory landscape.

Market Key Players

- Aisin Seiki Co. Ltd.

- Robert Bosch GmbH

- TRW Automotive

- Hyundai Mobis

- Continental AG

- Mando Corporation

- Hitachi

- Nissin Kogyo

- Jilin Dongguang Aowei Brake System Co. Ltd.

- Zhejiang VIE Science & Technology Co.

- Wanxiang Group Corporation

- BWI Group

- FTE automotive Group

- APG

- Liuzhou Wuling Automobile Industry Co. Ltd

- Wuhu Bethel

- CARDONE

Regional Analysis

Asia Pacific Electric Brake Booster Market with Largest Market Share (43.1%) in 2024

The Electric Brake Booster market in the Asia Pacific region is poised for significant growth, holding a dominant market share of 43.1% in 2024, valued at approximately USD 1.98 billion.

This substantial market share can be attributed to the region’s rapid automotive industry expansion, particularly in countries like China, Japan, and India, which are major hubs for automotive manufacturing and innovation. With increasing demand for electric vehicles (EVs) and advancements in vehicle safety systems, the Asia Pacific region is positioned as the primary driver of growth in the global Electric Brake Booster market.

Furthermore, the region’s strong automotive production capabilities, coupled with stringent safety regulations and a growing preference for fuel-efficient vehicles, further support the adoption of electric brake boosters. Additionally, rising disposable incomes and urbanization in countries like India and China contribute to the rising demand for advanced automotive technologies, ensuring the continued dominance of this region in the market. The Asia Pacific market is expected to maintain its leading position throughout the forecast period, driven by technological advancements and the shift towards electrification in the automotive sector.

Recent Developments

- In 2023, BorgWarner Inc. (NYSE: BWA) and Eldor Corporation S.p.A. announced an agreement for BorgWarner to acquire Eldor’s Electric Hybrid Systems (EHS) business. The deal, valued at €75 million at closing, includes the potential for additional payments based on future performance milestones.

- In 2025, ZF, a global leader in automotive technology, secured a significant business deal in the brake-by-wire technology sector. The agreement underscores ZF’s dominance in the automotive chassis components market, with the company’s Chassis Solutions Division playing a pivotal role in enabling Software Defined Vehicles. This win includes the planned mass production of brake-by-wire technology and advanced steering systems for a prominent global manufacturer.

- In 2024, Brembo continued its push for innovation in the automotive industry, expanding its product offerings for the aftermarket. At Automechanika 2024, Brembo showcased a comprehensive range of replacement solutions. This strategic move aims to meet the growing demands of modern vehicles, offering high-quality, performance-driven products to satisfy diverse customer requirements.

Conclusion

The Electric Brake Booster market is poised for significant growth, driven by the rising adoption of electric and hybrid vehicles, advancements in vehicle safety technologies, and the increasing emphasis on energy efficiency and sustainability. The shift towards electrification in the automotive industry, coupled with stricter environmental regulations and the integration of advanced driver-assistance systems (ADAS), is positioning electric brake boosters as a critical component in modern vehicle design. As automakers continue to innovate and respond to consumer demand for safer, more efficient vehicles, the market is expected to expand rapidly, with key players focusing on technological advancements and regional expansions to meet evolving needs. The future of the electric brake booster industry remains promising, underpinned by the continued growth of the global automotive sector and the ongoing transition to greener, more energy-efficient transportation solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)