Table of Contents

Introduction

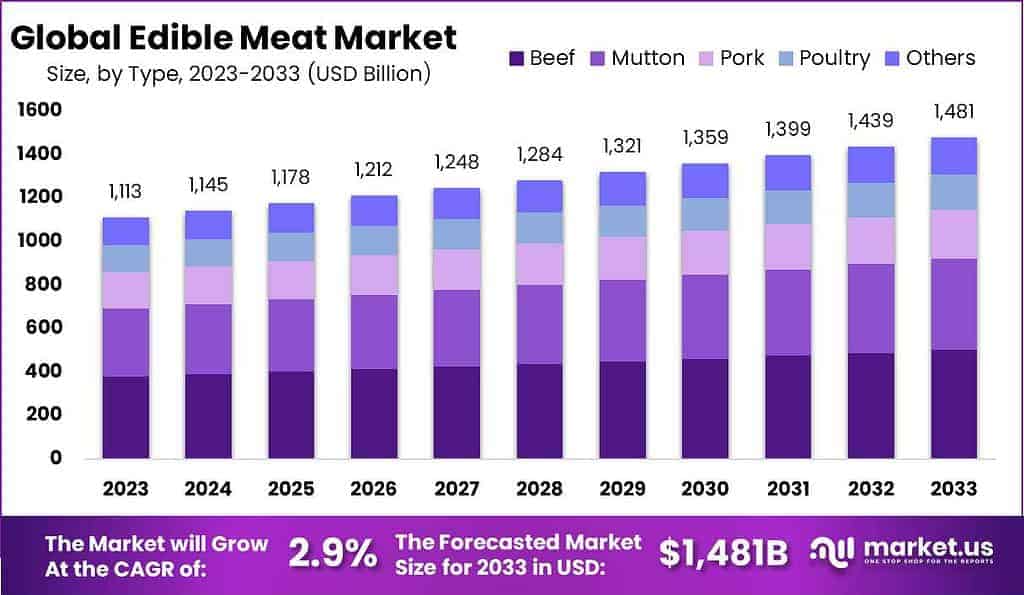

The global Edible Meat Market is poised for steady growth, projected to expand from USD 1113 billion in 2023 to USD 1481.0 billion by 2033, at a CAGR of 2.9%. This market is driven by robust demand across various regions, with significant consumption patterns and investment trends shaping its trajectory.

In North America, particularly the United States, the demand for beef remains strong despite rising prices, influenced by consumer preferences for high-quality meat products. The market is supported by substantial government investments and stringent food safety regulations which ensure consistent quality and safety of meat products.

Asia-Pacific stands out as a critical region for pork consumption, with a notable preference for fresh over frozen pork. This preference fuels the growth of local catering businesses, especially in countries like China, Japan, and Australia, thereby bolstering the regional market demand.

Africa is emerging as the fastest-growing market for edible meat, with significant investments forecasted across the entire value chain, from poultry and pork production facilities to transportation and feed production. This growth is driven by an increasing number of retail restaurant chains and a growing consumer base.

The Middle East also shows dynamic market expansion, with notable investments from major global meat producers aiming to strengthen their presence in the region. This includes investments in local meat processing facilities to cater to the increasing local demand.

Overall, the edible meat market is witnessing diverse growth factors from increased consumer demand for quality and convenience, significant investment in meat processing technologies, and strategic market expansions by key players. These factors collectively contribute to the ongoing popularity and expected expansion of the market globally.

Key Takeaways

- The Global Edible Meat Market is expected to be worth around USD 1481.0 billion by 2033, up from USD 1112.8 billion in 2023, and grow at a CAGR of 2.9% during the forecast period from 2024 to 2033.

- Beef dominated the Edible Meat Market with a substantial 33.4% share.

- Fresh/Chilled led the Edible Meat Market forms with a dominant 37.4% share.

- Fresh meat dominated the Edible Meat Market’s process segment with a 42.4% share.

- Commercial sources led the Edible Meat Market by source with a 51.3% share.

- Supermarkets and Hypermarkets led meat distribution with a dominant 53.4% market share.

- APAC dominates the global Edible Meat Market with a 39.6% share, totaling $475.1 billion.

Edible Meat Statistics

Global Meat Consumption Trends and Preferences

- India’s per capita consumption of poultry meat is forecast at 2.2 kg per annum in 2014.

- Chicken is India’s preferred non-vegetarian protein source, with local production increasing by an estimated 10 percent annually.

- In 2011, meat from registered slaughterhouses in India increased to 8.05 lakh tonnes.

- India became the largest exporter of beef in May 2012, surpassing Australia and New Zealand.

- A study projects India’s meat consumption (mostly poultry meat) rising to 18 kg in 2050.

- Pork is the most widely consumed meat globally, accounting for 36% of total consumption, followed by poultry (33%), beef (24%), and goat/sheep (5%)

Meat Market Size and Growth Projections

- The Global Edible Meat Market is expected to be worth around USD 1481.0 billion by 2033, up from USD 1112.8 billion in 2023.

- Beef dominated the Edible Meat Market with a substantial 33.4% share.

- Fresh/Chilled led the Edible Meat Market forms with a dominant 37.4% share.

- Commercial sources led the Edible Meat Market by source with a 51.3% share.

- In 2021, global meat production reached 340 million tons, driven by increasing wealth and dietary shifts

Regional Meat Market Dynamics

- APAC dominates the global Edible Meat Market with a 39.6% share, totaling $475.1 billion.

- China produced approximately 93.28 million metric tons of meat in 2022, marking a notable increase of around 3%.

- In the developing economies, beef demand is expected to grow by 17% in 2028 compared to 2019.

- Supermarkets and Hypermarkets led meat distribution with a dominant 53.4% market share.

- Ground beef cooking yields vary by fat content: <12%, 12–22%, and >22%, with moisture and fat changes analyzed during preparation

Meat Consumption Patterns and Health Considerations

- Edible beef 24% is the third most consumed meat in the world after pork 36% and poultry 33% in terms of volume.

- Edible beefs contain 26 grams of protein per 100-gram serving, while pork has 24 grams of protein per 100-gram meat.

- In 2023, the rural population in India consumed 0.137 kg of meat per capita, while the urban population consumed 0.218 kg.

- The average annual per capita meat supply (in carcass weight) remains below 5 kg in India.

- Milk demand in India may grow at about 10.6% per year, egg demand at 7.4%, and meat demand at 8.4%.

- Clean and plant-based meats are gaining higher acceptance in India (56.3%) and China (59.3%) compared to the USA (29.8%).

Emerging Trends

- Shift Toward Plant-Based Alternatives: As consumers become more health-conscious and environmentally aware, the demand for plant-based meat alternatives is rising. Products made from soy, pea protein, and other plant ingredients are gaining popularity as sustainable substitutes to traditional edible meat, offering similar taste and texture.

- Cultured Meat Technology: Lab-grown or cultured meat is an emerging trend in the edible meat industry. Using cellular agriculture techniques, companies are producing meat without the need for animal slaughter. This method is seen as a potential solution to environmental concerns and ethical issues surrounding traditional meat production.

- Sustainability and Ethical Consumption: With growing concerns about the environmental impact of livestock farming, many consumers are opting for meats produced with sustainable practices. This includes grass-fed, free-range, and hormone-free meat products that align with ethical and eco-friendly production methods.

- Increased Focus on Healthier Meat Options: Consumers are seeking leaner, healthier meat choices that offer lower fat content, fewer preservatives, and enhanced nutritional benefits. Products like grass-fed beef, organic poultry, and antibiotic-free pork are gaining traction as people prioritize health-conscious eating.

- Customized Meat Products: Advances in technology are enabling the creation of personalized meat products tailored to specific dietary needs, such as low-sodium, low-fat, or high-protein options. This customization trend caters to consumers with unique health requirements or specific nutritional goals.

Use Cases

- Health-Conscious Diets: Edible meat, particularly lean cuts or products with reduced fat, serves as a high-protein option for health-conscious consumers. Athletes and fitness enthusiasts often include meat in their diets for muscle building and recovery, while those on weight-loss journeys opt for lower-fat, higher-protein alternatives.

- Catering to Ethical Consumers: With an increasing number of consumers concerned about animal welfare, sustainable and ethically sourced meat products are gaining popularity. These include free-range, grass-fed, or cruelty-free meat options, providing consumers with choices that align with their ethical values and environmental concerns.

- Foodservice Industry Demand: Edible meat is a staple in the food service industry, from restaurants to catering services. As consumers continue to seek diverse and high-quality meat options, chefs are incorporating premium cuts, specialty meats, and plant-based substitutes to meet a wide range of dietary preferences.

- Meal Kits and Ready-to-Cook Products: With the rise of meal kit delivery services, edible meat products are being packaged and marketed as part of ready-to-cook solutions. These offerings cater to busy consumers who seek convenience without sacrificing the quality and nutritional value of their meals.

- Cultural and Regional Preferences: Edible meat plays a key role in various traditional dishes around the world. From beef tacos in Mexico to lamb skewers in the Middle East, meat remains central to diverse culinary experiences. Customizing products to meet these cultural preferences helps brands expand their reach in global markets.

Major Challenges

- Environmental Impact: Traditional meat production, particularly beef and pork, has a significant environmental footprint, contributing to deforestation, water usage, and greenhouse gas emissions. As consumers and governments push for sustainability, the meat industry faces pressure to adopt more eco-friendly production methods.

- Health Concerns: High consumption of red and processed meats has been linked to health issues like heart disease, cancer, and obesity. This has led to increasing scrutiny of meat consumption, with many consumers opting for plant-based or leaner alternatives in response to health concerns.

- Ethical and Animal Welfare Issues: As more people become concerned about animal welfare, ethical considerations regarding factory farming and meat production practices pose challenges to the edible meat sector. Brands are under pressure to ensure more humane practices and transparent sourcing to meet consumer expectations.

- Regulatory and Trade Barriers: The edible meat industry faces challenges related to regulatory requirements, including food safety standards, labeling laws, and animal welfare regulations. Trade barriers, tariffs, and supply chain disruptions can also impact the global meat trade, making it difficult for companies to expand internationally.

- Rising Costs of Production: The rising cost of feed, transportation, and labor is increasing the overall cost of meat production. These higher costs can result in higher retail prices for consumers, which could limit demand, especially in price-sensitive markets or among lower-income demographics.

Market Growth Opportunities

- Expansion of Plant-Based Meat Alternatives: As demand for plant-based diets grows, there is a significant market opportunity for companies to develop and expand plant-based meat alternatives. These products cater to health-conscious, environmentally aware consumers and provide a sustainable solution to traditional meat consumption.

- Global Demand in Emerging Markets: The rising middle class in emerging markets, particularly in Asia and Africa, is driving increased demand for meat products. As disposable incomes rise, consumers in these regions are seeking higher-quality protein sources, offering growth opportunities for meat producers to expand their reach.

- Health-Conscious Product Innovation: There is a growing demand for healthier meat options, such as leaner cuts, and antibiotic-free, and hormone-free products. Companies can tap into this opportunity by developing products that cater to health-conscious consumers, offering meat options with fewer preservatives, lower fat content, and enhanced nutritional profiles.

- Sustainability and Ethical Meat Production: With increasing consumer focus on sustainability, meat producers have an opportunity to develop and market products that are sustainably sourced, such as grass-fed, free-range, and organic meats. These options appeal to ethical consumers looking for meats produced with less environmental impact and greater animal welfare standards.

- Integration of Technology in Production: Advances in food technology, such as lab-grown meat and precision fermentation, are opening up new growth avenues in the edible meat sector. These innovations can lead to more efficient, cost-effective, and sustainable production methods, catering to consumers who are concerned about both environmental and ethical issues in traditional meat production.

Key Players Analysis

- Al Aali Exports Pvt. Ltd: Al Aali Exports specializes in the export of halal meat products, catering to global markets with a strong focus on quality and ethical sourcing. The company offers a variety of meats, including beef, mutton, and poultry, ensuring compliance with strict halal guidelines for international consumers.

- Allanasons Private Limited: Allanasons is one of India’s leading exporters of frozen meat products, specializing in high-quality buffalo meat and other processed meat products. The company is known for its significant presence in global markets, including the Middle East, Southeast Asia, and Africa, focusing on premium export-grade meat.

- BRF S.A: BRF S.A is a multinational food company based in Brazil, involved in the production and export of a wide range of meat products, including poultry and pork. The company’s brands are known for quality, and BRF has a strong presence in both the retail and food service sectors globally.

- Cargill: Cargill is a major player in the global edible meat sector, supplying a broad range of beef, pork, and poultry products. The company focuses on sustainable sourcing and animal welfare, with operations spanning North America, South America, and beyond, supplying both fresh and processed meat products to diverse markets.

- Cloverdale Foods: Cloverdale Foods is a leading provider of quality meat products in the U.S., offering a wide range of fresh, frozen, and prepared meat options. Their products, including bacon, sausage, and deli meats, are known for consistency and quality, making them popular among retailers and food service providers.

- Danone: Danone, a global leader in dairy, also plays a role in the meat sector through its investments in plant-based and sustainable food products. With a growing focus on health and sustainability, Danone is expanding its offerings in the alternative protein market, including plant-based meat products.

- Farm Suzanne Pvt Limited: Farm Suzanne focuses on producing high-quality poultry and meat products for both domestic and international markets. The company is known for its commitment to hygiene, ethical farming practices, and premium-quality chicken, positioning itself as a trusted name in the Indian meat industry.

- HMA Agro Industries Limited: HMA Agro Industries is a leading exporter of frozen meat products, particularly focusing on buffalo and goat meat. The company serves markets in the Middle East, Southeast Asia, and Europe, known for its high-quality processing standards and efficient supply chain management.

- Hormel Foods: Hormel Foods is a well-established U.S.-based company that produces a wide range of edible meat products, including fresh meat, processed meats, and ready-to-eat meals. The company is recognized for brands like SPAM, Jennie-O, and Hormel, which have a strong market presence globally.

- JBS S.A.: JBS S.A., one of the largest meat processors in the world, offers beef, poultry, and pork products across multiple markets. The company has a robust supply chain and a reputation for sustainable practices, including efforts to reduce environmental impact in its global operations.

- Maple Leaf Foods: Maple Leaf Foods is a major Canadian food company specializing in premium meat products, including pork, poultry, and prepared meals. The company is committed to sustainability, animal welfare, and producing high-quality, responsibly sourced products for both retail and food service markets.

- Marfrig: Marfrig is one of the world’s leading beef producers, with operations in North and South America. The company focuses on high-quality beef and processed meat products, catering to both retail and food service sectors, and has a strong commitment to sustainable farming practices.

- Mark International Food Stuff Pvt. Ltd: Mark International Food Stuff Pvt. Ltd is an exporter of various meat products, including frozen chicken, beef, and mutton. Known for its quality and consistency, the company serves international markets, focusing on providing halal meat products to the Middle East and Southeast Asia.

- Mirha Exports Pvt. Ltd: Mirha Exports specializes in exporting frozen meat, particularly buffalo meat, to global markets. The company emphasizes premium quality, ensuring that its products meet international standards and are processed with strict hygiene and ethical practices.

- MK Overseas Private Limited: MK Overseas focuses on exporting high-quality frozen meat products, including buffalo meat, to regions like the Middle East, Africa, and Southeast Asia. The company’s strong supply chain and commitment to customer satisfaction make it a reliable player in the global meat market.

- Moy Park: Moy Park is a leading producer of poultry in the U.K. and Europe, offering a wide range of fresh, frozen, and value-added chicken products. The company places a strong emphasis on animal welfare and sustainability, ensuring high-quality poultry products for both retail and food service industries.

- Perdue Farms: Perdue Farms is one of the largest poultry companies in the U.S., offering a wide variety of fresh, frozen, and value-added chicken products. The company is committed to animal welfare and sustainability, with an increasing focus on organic and antibiotic-free poultry products.

- Pilgrim’s Pride: Pilgrim’s Pride is a major producer of chicken products in North America, offering fresh, frozen, and processed meats. Known for its commitment to quality and sustainability, Pilgrim’s Pride serves both retail and food service markets with a wide array of poultry products.

- Sanderson Farms: Sanderson Farms is a U.S.-based poultry producer known for its fresh and frozen chicken products. The company focuses on producing high-quality poultry while maintaining strict biosecurity and animal welfare practices to ensure the best products for consumers.

- Smithfield Foods: Smithfield Foods, a subsidiary of WH Group, is a leading global producer of pork and processed meats. The company offers a wide range of products, including bacon, sausages, and fresh cuts, and is committed to sustainable production practices and reducing its environmental impact.

- Suguna Foods Private Limited: Suguna Foods is one of India’s largest poultry producers, offering a range of fresh and frozen chicken products. Known for its high standards of hygiene and quality, Suguna is a trusted name in the Indian poultry industry and has expanded its reach to international markets.

- Tyson Foods: Tyson Foods is a global leader in the production of chicken, beef, and pork products. The company is known for its wide portfolio of meat products, from fresh cuts to value-added items, and is actively investing in sustainable practices and alternative protein sources.

- VH Group: VH Group is an Indian conglomerate that operates in the edible meat sector, focusing primarily on poultry and meat processing. The company is known for producing high-quality frozen meat products and has expanded its footprint in both domestic and international markets.

- Vion Food Group: Vion Food Group is a leading European meat producer, specializing in beef and pork products. The company focuses on providing sustainable and high-quality meat to both retail and food service markets, with an emphasis on animal welfare and environmental responsibility.

Conclusion

As the global Edible Meat Market continues to expand, several key factors underscore its dynamic growth trajectory. Expected to surge from USD 1113 billion in 2023 to USD 1481.0 billion by 2033, the market is driven by diverse consumer preferences and significant technological advancements in meat processing. Consumer demand for high-quality, convenient meat products is on the rise, influenced by an increasing emphasis on health and sustainability.

Innovations such as lab-grown meat and plant-based alternatives are revolutionizing the industry, offering environmentally friendly and ethical options that appeal to a broadening base of consumers. In conclusion, the edible meat market is poised for continued growth, supported by technological innovations, changing consumer preferences, and strategic market expansions. This dynamic sector offers substantial opportunities for stakeholders across the supply chain to innovate and adapt to the evolving demands of global consumers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)