Table of Contents

Introduction

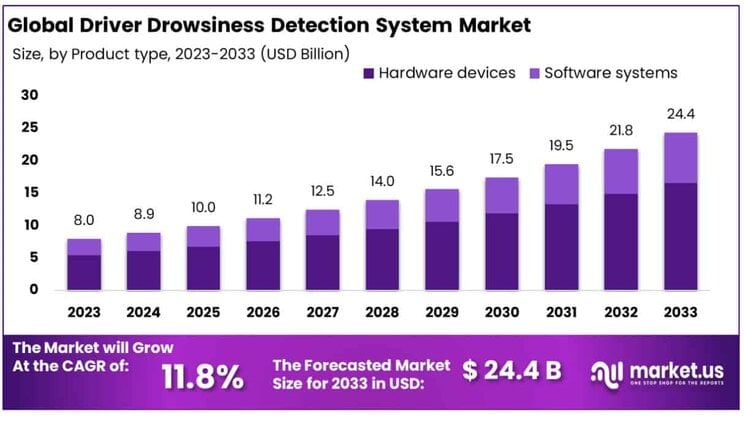

The Global Driver Drowsiness Detection System market is projected to reach approximately USD 24.4 billion by 2033, up from USD 8.0 billion in 2023. This represents a compound annual growth rate (CAGR) of 11.8% over the forecast period from 2024 to 2033.

The Driver Drowsiness Detection System (DDDS) is an advanced safety technology designed to monitor and detect signs of driver fatigue or drowsiness, using sensors and algorithms to assess factors such as eye movement, head position, and steering behavior. By identifying early signs of drowsiness, the system can alert the driver with visual, auditory, or tactile warnings to prevent accidents caused by fatigue.

The Driver Drowsiness Detection System Market refers to the industry segment focused on the development, manufacturing, and deployment of these technologies, which are increasingly integrated into both commercial and personal vehicles. This market is experiencing significant growth, driven by several key factors.

Increasing concerns regarding road safety and accident prevention have heightened the demand for advanced driver assistance systems (ADAS). Moreover, rising consumer awareness about the risks of driving while fatigued and the implementation of stricter government regulations on road safety standards are further accelerating market demand.

Additionally, advancements in sensor technologies, artificial intelligence, and machine learning are enhancing the accuracy and efficiency of these systems, thus driving their adoption across various automotive segments.

Opportunities in the market are also expanding with the growing trend of autonomous and semi-autonomous vehicles, where drowsiness detection systems will play a critical role in ensuring safety. The rising demand for electric vehicles (EVs) and smart cars is expected to provide significant growth prospects for DDDS, as these vehicles are increasingly being equipped with sophisticated driver assistance systems to enhance safety, contributing to the market’s robust growth trajectory.

Key Takeaways

- The Driver Drowsiness Detection System Market is expected to grow from USD 8.0 billion in 2023 to USD 24.4 billion by 2033, at a CAGR of 11.8%.

- Hardware devices dominate the market, accounting for 68.2% of the market share.

- Passenger cars represent the largest application segment, comprising 58% of the Driver Drowsiness Detection System Market.

- The Lane Departure Warning (LDW) system leads the market usage, contributing 42.2% of the overall market share.

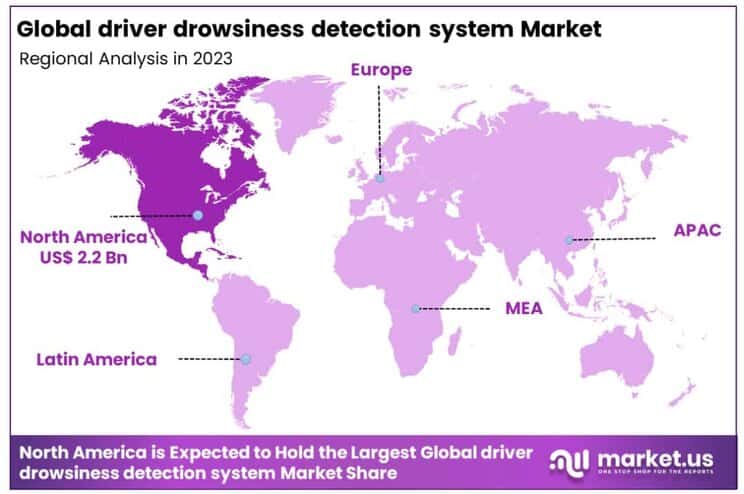

- North America holds the largest regional share, commanding 27.6% of the Driver Drowsiness Detection System Market.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 24.4 Billion |

| Forecast Revenue (2033) | USD 8 Billion |

| CAGR (2024-2033) | 11.8% |

| Segments Covered | By Product Type(Hardware devices, Software systems), By Vehicle type(Passenger cars, Commercial vehicles), By System type(Lane Departure warning, Driver fatigue monitoring, Driver distraction monitoring) |

| Competitive Landscape | Continental, Delphi Automotive, Robert Bosch, Hella Gmbh and Co, Autoliv Inc, Denso Corporation, Magna International Inc, Aisin Seiki Co, ltd, TRW Automotive, Valco, Seeing machines ltd, Smart eye AB |

Emerging Trends

- Advanced Sensor Technologies: With the integration of advanced sensors, such as infrared cameras and EEG headbands, the driver drowsiness detection systems are becoming more precise in monitoring driver alertness.

- Increased Demand for Autonomous Vehicles: As autonomous vehicle technology advances, driver assistance systems like drowsiness detection are being incorporated to enhance safety and provide full-spectrum support in semi-autonomous driving modes.

- AI & Machine Learning Integration: Artificial intelligence (AI) is increasingly being used to enhance the accuracy and predictive capabilities of drowsiness detection systems, adapting to driver behavior and improving over time.

- Government Regulations: Many countries are introducing stricter vehicle safety regulations, which is driving the adoption of drowsiness detection systems, particularly for commercial fleets and public transport.

- Wearable Devices Integration: The trend towards wearable technologies such as smartwatches and headbands is creating opportunities for integrating drowsiness detection with personal monitoring systems, improving real-time awareness.

Top Use Cases

- Commercial Fleet Management: Drowsiness detection is essential for long-haul truck drivers to reduce the risk of accidents caused by fatigue and improve driver safety.

- Passenger Vehicles: In consumer vehicles, these systems are being implemented as part of overall advanced driver-assistance systems (ADAS) to prevent accidents and improve road safety.

- Public Transportation: Buses, trains, and other forms of public transport utilize drowsiness detection systems to ensure that drivers remain alert, especially during late-night shifts.

- Driver Rehabilitation: In rehabilitation centers, drowsiness detection systems can help monitor the progress of drivers recovering from sleep disorders or other fatigue-related issues.

- Fleet Monitoring & Insurance: Insurers are adopting these systems to assess the risk profiles of drivers and provide incentive-based discounts to commercial fleet operators who use drowsiness detection technologies.

Major Challenges

- High Cost of Implementation: Despite the growing adoption, the cost of integrating advanced drowsiness detection systems with existing vehicle infrastructures remains a significant challenge.

- Privacy Concerns: Some drivers may feel uncomfortable with constant monitoring of their behavior, leading to concerns about data privacy and surveillance.

- Inconsistent Performance Across Environments: External factors like lighting conditions, weather, and road types can affect the performance of these systems, making it difficult to ensure consistent accuracy.

- Lack of Standardization: The absence of global standards for drowsiness detection technology makes it difficult to create universally accepted systems or regulations.

- Driver Resistance: Some drivers may not be receptive to the idea of automated monitoring of their alertness, leading to resistance to adopting these systems in consumer vehicles.

Top Opportunities

- Integration with IoT Ecosystem: The integration of drowsiness detection systems into the broader Internet of Things (IoT) ecosystem presents an opportunity to create more comprehensive, data-driven vehicle safety solutions.

- Expansion in Emerging Markets: As vehicle ownership grows in developing countries, the adoption of safety technologies, including drowsiness detection systems, presents a significant market opportunity.

- Collaborations with Health & Wellness Companies: Partnerships with health and wellness tech companies to integrate biometric monitoring and drowsiness detection could create new markets for personalized vehicle safety solutions.

- Customization for Fleet Operators: Fleet operators can benefit from customizable drowsiness detection systems tailored to the specific needs of their drivers, offering a competitive edge in fleet management solutions.

- Autonomous Vehicle Safety: As the autonomous vehicle market expands, there will be greater demand for advanced safety features, including drowsiness detection systems, which will be critical in ensuring safe transition times between human and machine control.

Key Player Analysis

The key players in the Global Driver Drowsiness Detection System Market for 2024 are well-positioned to capitalize on the growing demand for advanced safety features in automotive technologies. Continental, Delphi Automotive, and Robert Bosch are leading the charge, leveraging their extensive experience in vehicle electronics and safety systems. These companies are actively integrating drowsiness detection technologies into their broader automotive safety solutions. Autoliv Inc. and Denso Corporation have also made significant strides, focusing on driver assistance systems that enhance overall vehicle safety.

Similarly, Hella GmbH and Magna International Inc. are investing heavily in sensor technologies to improve real-time monitoring of driver alertness. Companies like Seeing Machines Ltd and Smart Eye AB specialize in AI-based drowsiness detection systems, positioning themselves as pioneers in this niche but rapidly expanding segment. Aisin Seiki Co. Ltd and TRW Automotive continue to innovate, offering integrated solutions that enhance vehicle safety while reducing driver fatigue-related accidents. These companies are collectively contributing to the market’s expected growth in 2024.

Top Market Key Players

- Continental

- Delphi Automotive

- Robert Bosch

- Hella Gmbh and Co

- Autoliv Inc

- Denso Corporation

- Magna International Inc

- Aisin Seiki Co, ltd

- TRW Automotive

- Valco

- Seeing machines ltd

- Smart eye AB

Regional Analysis

North America Dominating Region with Largest Market Share in Drowsiness Detection System Market (27.6% in 2024)

The North American region is poised to maintain its leadership in the global Drowsiness Detection System market, contributing a significant market share of 27.6%, valued at USD 2.2 billion in 2024. This dominance can be attributed to the region’s advanced technological landscape, robust automotive sector, and heightened focus on safety innovations. The growing adoption of advanced driver-assistance systems (ADAS) and the increasing demand for in-vehicle safety technologies in countries such as the United States and Canada further fuel the market’s growth.

Additionally, the high rate of fatalities caused by driver fatigue in North America has led to a growing awareness and regulatory support for the development and integration of drowsiness detection systems. These factors collectively position North America as the leading regional market for drowsiness detection solutions, with a projected steady growth trajectory throughout the forecast period.

Recent Developments

- In December 2024, Continental will showcase its “Intelligent Vehicle Experience Car” at the CES 2025 in Las Vegas, offering a glimpse into the future of automotive technology. The vehicle will feature innovative solutions for driver-vehicle interaction, with potential for these technologies to be implemented in production models in the next three to five years.

- In January 2025, Seeing Machines Limited, a leader in advanced computer vision and AI-driven operator monitoring systems, will demonstrate its cutting-edge interior sensing technology at CES 2025 in Las Vegas. This technology aims to enhance safety by improving the interaction between drivers and vehicles through intelligent monitoring systems.

- In 2025, Motive, an AI-powered Integrated Operations Platform, unveiled its new AI-driven features to combat road safety concerns in Mexico, particularly distracted and drowsy driving. With its AI-powered Drowsiness Detection and Forward Collision Warning systems, Motive empowers fleet safety managers to address driver fatigue and other risky behaviors, enhancing overall safety.

- In September 2023, Autoliv China, a leader in automotive safety systems, announced a partnership with Great Wall Motor (GWM), a major vehicle manufacturer in China. This collaboration is designed to tackle emerging challenges in the global automotive market and strengthens Autoliv’s ties with Chinese original equipment manufacturers (OEMs).

- In 2024, Netradyne, an AI and edge computing SaaS provider, launched its third-generation Driver Drowsiness and Monitoring System (DMS) Sensor. The sensor, which builds upon extensive sleep research, is capable of detecting early signs of driver fatigue, enabling proactive safety measures to reduce the risk of accidents.

Conclusion

The Driver Drowsiness Detection System market is set for substantial growth as the automotive industry continues to prioritize safety through advanced technologies. The increasing awareness of the dangers associated with driver fatigue, coupled with rising regulatory pressures, is driving the demand for these systems. Technological advancements in sensors, AI, and machine learning are enhancing the accuracy and efficiency of drowsiness detection, making it an essential component of modern vehicles, particularly in the context of autonomous driving and electric vehicle integration. Despite challenges such as high implementation costs and privacy concerns, the market offers numerous opportunities, especially in emerging regions and through collaboration with health and wellness sectors. As the market evolves, key players are expected to continue innovating, ensuring that drowsiness detection systems play a critical role in reducing road accidents and improving overall driver safety.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)