Table of Contents

Introduction

The Global Diverter Valves Market is projected to reach a value of approximately USD 419.9 million by 2033, up from USD 223.7 million in 2023. This represents a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2024 to 2033.

Diverter valves are critical components used in fluid control systems, designed to direct the flow of fluids or gases to different pathways based on operational requirements. These valves are extensively used in various industries, including oil and gas, chemical processing, water treatment, food and beverage, and pharmaceuticals, where precise control over flow direction and efficient system operation is essential.

The diverter valves market, therefore, encompasses the manufacturing, supply, and demand dynamics of these components, driven by their ability to improve process efficiency and ensure operational safety in fluid handling systems. Over the past few years, the market has witnessed significant growth, attributed to the rising demand for automation and system optimization across industries. The increasing complexity of industrial operations and the growing focus on energy efficiency have also contributed to the heightened adoption of diverter valves.

Moreover, technological advancements, such as the integration of smart technologies for real-time monitoring and predictive maintenance, are driving the innovation in the market, offering new opportunities for growth. The rising demand for diverter valves is particularly evident in emerging economies, where industrialization and infrastructure development are accelerating.

Additionally, regulatory pressures regarding environmental sustainability are creating opportunities for the market, as companies seek more efficient systems to reduce waste and energy consumption. The market is expected to continue expanding, driven by the growing need for versatile, high-performance valve systems and an increasing focus on industrial automation, which will provide a strong foundation for future investments and product development.

Key Takeaways

- The global Diverter Valves market is anticipated to grow from USD 223.7 million in 2023 to USD 419.9 million by 2033, expanding at a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2024 to 2033.

- In 2023, Hydraulic Diverter Valves held the largest share in the market’s by-type segment, accounting for 46.2% of the total market share.

- Blow-Through Diverter Valves dominated the operation segment of the Diverter Valves market in 2023, capturing a significant 65.3% share.

- Cast Iron emerged as the leading material type in the Diverter Valves market in 2023, holding a 36.1% share of the market.

- In 2023, the Oil & Gas industry was the largest end-user of Diverter Valves, representing 30.3% of the total market share.

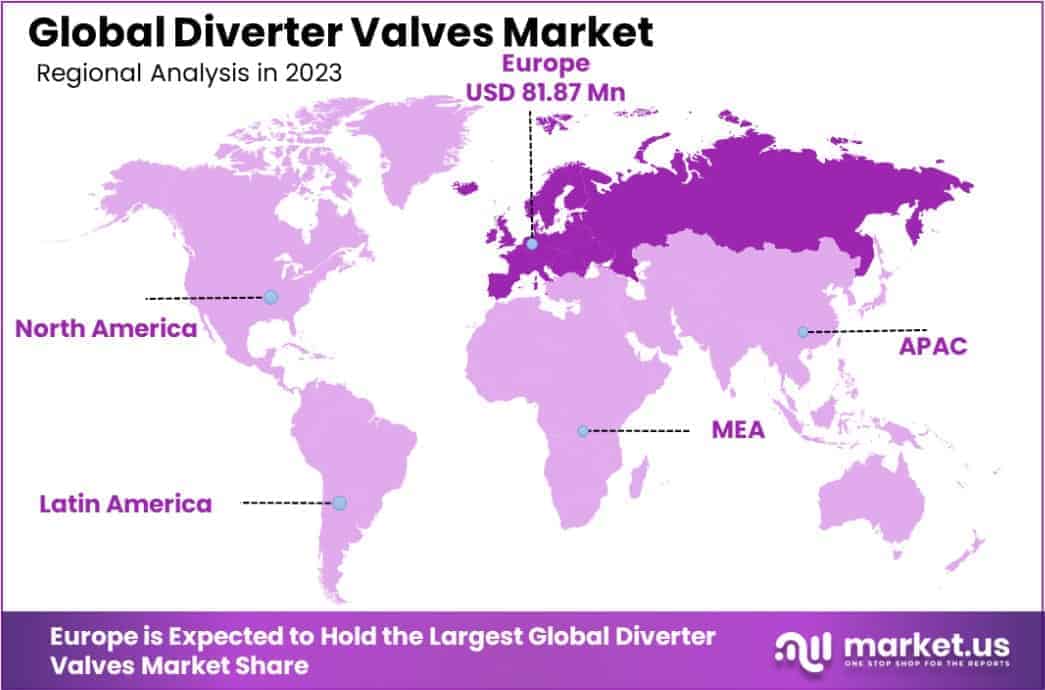

- Europe dominated the Diverter Valves market in 2023, accounting for 36.6% of the global market share, with a revenue of USD 81.87 million.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 223.7 Million |

| Forecast Revenue (2033) | USD 419.9 Million |

| CAGR (2024-2033) | 6.5% |

| Segments Covered | By Type (Hydraulic Diverter Valves, Electric Diverter Valves, Manual Diverter Valves), By Operation (Blow-Through Diverter Valves, Fall-Through Diverter Valves), By Material (Cast Iron, Stainless Steel, Brass/Bronze, Acetal, Ductile Iron), By End-User Industry (Oil & Gas, Chemical & Petrochemical, Pharmaceuticals, Food & Beverage, Other End-User Industries) |

| Competitive Landscape | Emerson Electric Co., Flowserve Corporation, Weir Group PLC, Cameron International Corporation, Rotork plc, GEA Group AG, Pentair plc, Mueller Water Products, Inc., IMI plc, ITT Inc., Alfa Laval AB, Spirax-Sarco Engineering plc, Other Key Players |

Emerging Trends

- Automation Integration: The demand for diverter valves is increasing with the rise of automation in industries such as oil and gas, pharmaceuticals, and food processing. The automation of valve operations helps improve efficiency, reduce human error, and maintain consistent production quality.

- Advances in Materials: The use of advanced materials, such as corrosion-resistant alloys and composites, is growing. These materials extend the life of diverter valves, reduce maintenance costs, and improve performance under high pressure and temperature conditions.

- Energy Efficiency Focus: Companies are prioritizing energy-efficient solutions in their operations. Diverter valves with low pressure drops and minimal energy consumption are becoming increasingly popular, aligning with the broader push for sustainability in industrial sectors.

- Smart Valve Technology: The integration of IoT-enabled sensors and actuators into diverter valves is a growing trend. These smart valves enable remote monitoring and predictive maintenance, which reduces downtime and ensures optimal valve performance.

- Customization and Adaptability: The demand for customizable diverter valves, capable of handling specific materials or operating conditions, is rising. Industries like food processing and pharmaceuticals require valves tailored to their unique needs, leading to an increase in the adoption of custom solutions.

Top Use Cases

- Petrochemical Industry: Diverter valves are widely used in the petrochemical sector for controlling the flow of various fluids through pipelines. They ensure the safe and efficient transportation of chemicals, oils, and gases in processing plants.

- Food and Beverage Processing: In food processing, diverter valves are crucial for directing the flow of ingredients between different production lines. They help maintain hygiene standards, as well as prevent cross-contamination of raw materials.

- Water Treatment Facilities: Diverter valves are used in water and wastewater treatment plants to manage the flow of water and chemicals across various filtration and treatment systems. Their role in directing flows ensures effective treatment processes.

- Power Generation: In power plants, diverter valves play a key role in controlling steam and gas flow through turbines and boilers. Their precise control is critical to maintaining plant efficiency and preventing operational failures.

- Pharmaceutical Manufacturing: The pharmaceutical industry relies on diverter valves for handling raw materials and active pharmaceutical ingredients (APIs) in strict compliance with hygiene and safety standards. These valves help in maintaining the purity and safety of the final product.

Major Challenges

- High Maintenance Costs: Diverter valves, especially those exposed to harsh environments, require regular maintenance and part replacements, leading to increased operational costs for companies.

- Wear and Tear Under Extreme Conditions: The constant flow of aggressive fluids, such as chemicals and high-pressure gases, can lead to premature wear of valve components, impacting performance and requiring frequent replacements.

- Technical Complexity: Designing and implementing diverter valves that can handle complex operational conditions—such as extreme temperatures, pressure variations, and corrosive substances—requires advanced engineering, which can be a significant challenge.

- Limited Standardization: There is a lack of uniform standards for diverter valves, especially in specialized industries. This can result in difficulties when sourcing replacements or ensuring compatibility across different systems and setups.

- Regulatory Compliance: Diverter valves used in critical applications, such as pharmaceuticals and food processing, must comply with stringent regulations and standards. Adhering to these requirements can lead to increased development and testing costs.

Top Opportunities

- Growing Demand in Emerging Markets: Rapid industrialization in regions such as Asia-Pacific and Latin America presents a significant opportunity for growth in the diverter valve market. As these economies expand, the demand for efficient and reliable flow control solutions increases.

- Investment in Infrastructure: As global infrastructure projects ramp up, particularly in water treatment, energy, and manufacturing sectors, the demand for diverter valves to manage and direct fluid flows is expected to increase, creating new market opportunities.

- Development of Eco-friendly Solutions: As environmental concerns rise, there is a growing opportunity for manufacturers to innovate and provide environmentally-friendly diverter valves. These valves could focus on minimizing leakage, reducing energy consumption, and improving sustainability.

- Technological Advancements in Smart Valves: The increasing adoption of smart valve technology presents an opportunity to introduce advanced features such as remote monitoring, real-time diagnostics, and predictive maintenance. These advancements are expected to boost the demand for smart diverter valves.

- Custom Solutions for Niche Industries: As industries such as biotechnology, pharmaceuticals, and food processing require highly specialized flow control solutions, there is a significant opportunity for manufacturers to design custom diverter valves that meet the unique needs of these markets.

Key Player Analysis

The Global Diverter Valves Market is characterized by a strong presence of key industry players, each contributing to the expansion and innovation within the sector. Emerson Electric Co., with its vast technological expertise and robust product portfolio, remains a dominant force in the market, driving advancements in valve automation. Flowserve Corporation and Weir Group PLC leverage their global distribution networks to cater to diverse end-use industries, including oil & gas, chemicals, and water treatment.

Meanwhile, Cameron International Corporation, now part of Baker Hughes, continues to enhance its market position through its specialized valve solutions for critical applications. Rotork plc and GEA Group AG are recognized for their focus on automation and control technologies, adding significant value to end-users through operational efficiency. Pentair plc and Mueller Water Products, Inc. are prominent players in the water treatment segment, contributing to sustainable solutions. The market also benefits from the innovative efforts of IMI plc, ITT Inc., Alfa Laval AB, and Spirax-Sarco Engineering plc, all of which emphasize performance reliability, energy efficiency, and enhanced operational safety. Collectively, these players are shaping the competitive landscape and driving the market towards further growth and technological advancements in 2024.

Top Key Players in the Market

- Emerson Electric Co.

- Flowserve Corporation

- Weir Group PLC

- Cameron International Corporation

- Rotork plc

- GEA Group AG

- Pentair plc

- Mueller Water Products, Inc.

- IMI plc

- ITT Inc.

- Alfa Laval AB

- Spirax-Sarco Engineering plc

- Other Key Players

Regional Analysis

Europe Diverter Valves Market with Largest Market Share of 36.6% in 2024

The Diverter Valves market in Europe is expected to hold a dominant position, accounting for 36.6% of the global market share in 2024, valued at approximately USD 81.87 million. The region’s growth can be attributed to the increasing demand for advanced valve solutions across a range of industries, including chemical processing, oil and gas, and pharmaceuticals. Europe’s well-established industrial infrastructure, along with significant investments in automation and industrial optimization, are driving this market expansion.

Key players in the European market are focused on enhancing product offerings with improved efficiency, durability, and compliance with stringent regulatory standards, which further boosts market demand. Countries such as Germany, the United Kingdom, and France are expected to be at the forefront of growth, with substantial contributions from both established manufacturers and new entrants aiming to capture market share in these high-demand sectors.

Recent Developments

- In 2024, DXP Enterprises, Inc. announced the completion of acquisitions of Burt Gurney & Associates (BGA) and MaxVac Inc. The deal was funded through the company’s cash reserves. BGA, based in Omaha, Nebraska, is recognized as a leading manufacturer’s representative in the municipal water and wastewater treatment sector. MaxVac, located in California’s Central Valley and San Francisco, specializes in vacuum pump sales, maintenance, and repair for industries such as electronics, semiconductor, food and beverage, and pharmaceuticals.

- In 2024, ABB acquired Real Tech, a Canadian company known for its innovative optical sensor technology, aimed at enhancing smart water management systems. This acquisition expands ABB’s presence in the water sector and complements its portfolio with real-time water monitoring capabilities. The financial terms of the deal, expected to close in Q1 2024, were not disclosed.

- On January 19, 2024, ITT Inc. finalized the acquisition of Svanehøj Group A/S, a supplier of pumps and aftermarket services focused on cryogenic applications in the marine sector. This acquisition, first announced in November 2023, was funded primarily through a €300 million term loan. The business will be integrated into ITT’s Industrial Process segment, known for its engineered pumps, valves, and aftermarket services.

- In 2024, Wilo UK expanded its pump servicing capabilities by acquiring Arfon Rewinds Limited, trading as Arfon Engineering Services. This acquisition enhances Wilo UK’s ability to offer comprehensive water management services, including pump installation, repair, and maintenance. Arfon operates from two facilities in the UK and serves industries and water utilities across the North West of England.

- In 2024, Workdry International acquired Vanderkamp Group, a Netherlands-based temporary pumping solutions provider. The acquisition is intended to support Workdry’s international growth and strengthen its offerings in water and wastewater treatment rental solutions.

- On February 27, 2024, ChampionX Corporation (NASDAQ: CHX) announced the acquisition of Artificial Lift Performance Limited (ALP), a specialist in advanced analytics for optimizing oil and gas production. Based in Edinburgh, Scotland, ALP develops software designed to enhance artificial lift operations and extend equipment lifespan.

- In 2024, Metso signed an agreement to acquire Jindex Pty Ltd, an Australian company known for its valves and process flow control solutions. The acquisition will enhance Metso’s slurry handling capabilities, strengthening its position in the mining industry by integrating Jindex’s valve solutions with its existing portfolio.

- In 2024, Idex Corp entered into an agreement to acquire Mott Corporation for US$1 billion. Mott is a leading microfiltration business specializing in sintered porous metal components used in fluidic applications. This acquisition expands Idex’s capabilities in precision filtration and engineered solutions.

- In 2024, Flowserve Corporation (NYSE: FLS) acquired intellectual property and R&D related to cryogenic LNG submerged pump technology from NexGen Cryo. This acquisition is a strategic move to support Flowserve’s growth in LNG infrastructure and decarbonization technologies.

Conclusion

The Diverter Valves market is poised for steady growth, driven by increasing industrial automation, advancements in valve technologies, and the rising demand for efficient flow control systems across diverse sectors. The market’s expansion is further supported by the growing need for customized solutions tailored to the specific requirements of industries such as oil and gas, pharmaceuticals, and food processing. As environmental regulations become more stringent, there is an increasing emphasis on sustainability and energy efficiency, which is likely to propel the demand for innovative valve solutions. With key industry players focusing on automation, smart technologies, and performance optimization, the Diverter Valves market is expected to witness sustained development, providing opportunities for manufacturers and end-users alike to enhance operational efficiency and system reliability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)