Table of Contents

Introduction

The Global Die Attach Machine Market is projected to reach approximately USD 3.0 billion by 2033, up from USD 1.7 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.70% during the forecast period from 2024 to 2033.

The die attach machine market is a critical segment within the semiconductor manufacturing industry, driven by increasing demand for high-performance electronic components. A die attach machine is an advanced assembly equipment used for attaching semiconductor dies onto substrates, lead frames, or packages, ensuring precise bonding for optimal electrical and thermal conductivity.

The die attach machine market is expanding due to the rapid growth of consumer electronics, automotive electronics, and industrial automation. The proliferation of 5G technology, IoT devices, and AI-driven applications has intensified the need for compact, high-density semiconductor packaging, boosting demand for advanced die bonding solutions. The increasing adoption of automated and high-precision manufacturing techniques is further driving the transition from manual and semi-automated machines to fully automated, high-speed die attach solutions.

Moreover, the growing electric vehicle (EV) and renewable energy sectors present substantial opportunities, as power semiconductors and high-reliability chips require efficient die bonding processes. The market is witnessing innovation in flip-chip, eutectic, epoxy, and hybrid bonding techniques, catering to the evolving needs of miniaturization and enhanced thermal management in semiconductor devices.

Additionally, the rise in outsourced semiconductor assembly and testing (OSAT) services is contributing to market growth, particularly in Asia-Pacific, which dominates due to strong semiconductor manufacturing infrastructure in China, Taiwan, and South Korea.

However, high capital costs and technical complexities in advanced die attach technologies pose challenges for smaller players. Nevertheless, with the ongoing advancements in die bonding materials, AI-driven automation, and Industry 4.0 integration, the market is poised for sustained growth, making it a key enabler of next-generation electronic devices.

Key Takeaways

- The Global Die Attach Machine Market is expected to grow from USD 1.7 billion in 2023 to USD 3.0 billion by 2033, at a CAGR of 5.70% driven by rising demand in semiconductor packaging and automation.

- Asia-Pacific leads with a 38% market share due to strong semiconductor manufacturing.

- Die bonder machines hold a 63% market share, driven by high demand in electronics assembly.

- Epoxy bonding accounts for 34%, favored for its reliability in semiconductor packaging.

- LED applications contribute 29%, fueled by increasing demand for energy-efficient lighting solutions.

Die Attach Machine Facts and Statistics

Gold-Silicon Eutectic Alloy

- The gold-silicon (AuSi) eutectic alloy has a thermal conductivity of around 57 W/mK.

- It efficiently transfers heat away from the die, improving thermal management.

- The melting point of AuSi is 280°C, allowing for a strong bond without excessive heat.

- It is suitable for high-power applications requiring efficient heat dissipation.

Eutectic Alloy for High-Temperature Applications

- The eutectic alloy has a melting point of 363°C.

- It is higher than AuSn, making it ideal for high-temperature environments.

- The high thermal conductivity ensures effective heat removal.

Silver-Filled Glass Compounds

- These materials offer thermal conductivities between 3-4 W/mK.

- They can be processed at temperatures around 200°C.

- This makes them suitable for temperature-sensitive devices.

Epoxy-Based Thermal Interface Materials

- Pure epoxy resin has a low thermal conductivity of 0.2 W/mK.

- The addition of silver particles increases conductivity to 3-4 W/mK.

- Silver-filled epoxy provides both thermal efficiency and mechanical strength.

Laser Heating for Die Attachment

- A 980 nm diode laser with a 100 µm spot size enables localized heating.

- It reduces thermal damage to sensitive nearby components.

Flip-Chip Technology for GaN Devices

- GaN die attachment on a copper coin substrate reduces thermal resistance.

- A resistance as low as 0.1°C/W enhances heat dissipation.

Underfill Materials for Mechanical Stability

- Typical underfill materials have a CTE of 20–45 ppm/°C.

- This ensures compatibility with both the die and the substrate.

- They provide structural integrity and thermal reliability.

Emerging Trends

- Miniaturization of Electronic Devices: The continuous demand for smaller, lighter, and more portable consumer electronics necessitates advanced die attach machines capable of precise and reliable die bonding.

- Adoption of Flip Chip Technology: Flip chip bonding is gaining traction due to its suitability for high-frequency components and 2.5D/3D packaging, enhancing device performance and integration.

- Integration of Automation and AI: Incorporating automation and artificial intelligence into die attach equipment improves accuracy, reduces human error, and increases production efficiency.

- Development of Advanced Adhesive Materials: Innovations in adhesive materials, such as epoxy resins with superior thermal and mechanical properties, are enhancing the performance and reliability of die attach processes.

- Focus on Thermal Management Solutions: As electronic devices become more powerful, effective thermal management through advanced die attach techniques is becoming increasingly critical.

Top Use Cases

- Semiconductor Device Manufacturing: Die attach machines are essential in producing microprocessors, memory chips, and integrated circuits, forming the backbone of modern electronics.

- Automotive Electronics: The automotive industry utilizes die attach technology in manufacturing sensors, control modules, and advanced driver assistance systems, contributing to vehicle safety and performance.

- Medical Devices: Die attach processes are employed in assembling medical equipment such as pacemakers, insulin pumps, and diagnostic devices, ensuring precision and reliability.

- LED Production: The assembly of LED chips for lighting applications relies on die attach machines to ensure optimal performance and longevity.

- Telecommunications Equipment: Die attach technology is critical in producing components for communication devices, including RF modules and photonics, facilitating high-speed data transmission.

Major Challenges

- Void Formation in Adhesives: Trapped gases or moisture during the dispensing or curing stages can lead to voids within the adhesive material, impeding heat transfer and potentially causing device failure.

- Delamination Issues: Inadequate surface preparation or mismatched thermal expansion coefficients between materials can cause delamination, compromising device reliability.

- Material Compatibility: Ensuring compatibility between die attach materials and substrates is crucial to prevent chemical reactions that could degrade performance.

- Thermal Management: As devices become more powerful, managing the heat generated becomes challenging, requiring advanced die attach solutions to ensure efficient thermal dissipation.

- Cost Constraints: The development and implementation of advanced die attach technologies can be cost-prohibitive, especially for small and medium-sized enterprises.

Top Opportunities

- Expansion in Consumer Electronics: The growing demand for advanced consumer electronics presents opportunities for die attach machine manufacturers to supply equipment for high-volume production.

- Growth in Electric Vehicles (EVs): The rise of EVs increases the need for power electronics, where die attach machines play a vital role in assembling components like inverters and battery management systems.

- Advancements in 5G Technology: The rollout of 5G networks requires sophisticated semiconductor components, driving demand for precise die attach processes.

- Medical Technology Innovations: The development of new medical devices and wearable health monitors offers a growing market for die attach applications.

- Renewable Energy Systems: The expansion of renewable energy technologies, such as solar inverters and wind turbine controls, relies on power electronics that require reliable die attach solutions.

Key Player Analysis

The Global Die Attach Machine Market in 2024 is expected to witness significant competition among key players, driven by technological advancements, automation, and increasing demand from semiconductor packaging applications. Panasonic Industry Co., Ltd. and ASM Pacific Technology Limited continue to lead the market with their strong R&D capabilities and extensive product portfolios. Fasford Technology Co. Limited and BE Semiconductor Industries N.V. are focusing on high-precision die bonding solutions to cater to the growing need for miniaturization in electronic devices.

MicroAssembly Technologies Limited and Palomar Technologies leverage advanced automation to enhance production efficiency, particularly in high-reliability applications such as aerospace and medical electronics. Kulicke and Soffa Industries maintain a strong presence through strategic partnerships and innovations in hybrid bonding technologies. Companies like Inseto UK Limited, Shinkawa Limited, and Dr. Tresky AG are expanding their global footprint by catering to niche applications. Emerging players continue to intensify competition through cost-effective solutions and regional market penetration.

Top Market Key Players

- Panasonic Industry Co., Ltd.

- Fasford Technology Co. Limited

- ASM Pacific Technology Limited

- BE Semiconductor Industries N.V.

- MicroAssembly Technologies Limited

- Palomar Technologies

- Kulicke and Soffa Industries

- Inseto UK Limited

- Shinkawa Limited

- Dr. Tresky AG

- Other Key Players

Regional Analysis

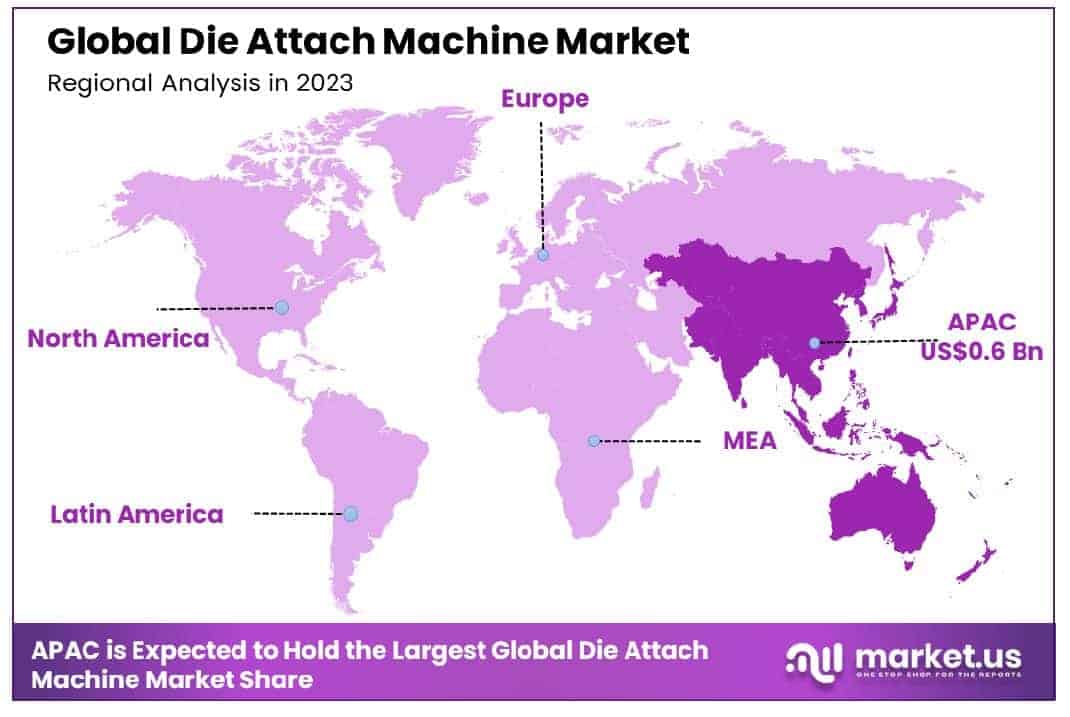

Asia-Pacific Dominates the Die Attach Machine Market with Largest Market Share of 38% in 2024

The Asia-Pacific region is the leading market for die attach machines, accounting for 38% of the global market share in 2024, driven by the strong presence of semiconductor manufacturing hubs in countries such as China, Taiwan, South Korea, and Japan. The region is projected to reach a market valuation of USD 0.6 billion, supported by increasing investments in electronics and semiconductor fabrication facilities.

The rising demand for consumer electronics, automotive semiconductors, and advancements in 5G technology is accelerating the adoption of die attach machines. Moreover, favorable government policies, significant R&D spending, and the presence of key industry players contribute to the region’s dominance.

China, as the largest contributor, continues to lead due to its robust semiconductor manufacturing ecosystem, followed by Taiwan and South Korea, which are home to major foundries and packaging companies. The region’s strategic advantages, including cost-effective labor and advanced technological infrastructure, further reinforce its leadership position in the die attach machine market.

Recent Developments

- In February 20, 2025 – Lam Research Corporation (NASDAQ: LRCX), a global supplier of semiconductor manufacturing equipment, announced a major expansion of its advanced packaging solutions to support the growing demand for high-performance computing and AI-driven applications. The company introduced new etch and deposition technologies designed to enhance chiplet integration and heterogeneous packaging, improving efficiency and performance for next-generation semiconductor devices.

- In January 15, 2025 – Synopsys, Inc. (NASDAQ: SNPS), a leader in electronic design automation (EDA) and semiconductor IP, secured a multi-year collaboration with a leading foundry to advance AI-optimized chip design. The agreement focuses on accelerating process-node transitions and delivering AI-powered design automation solutions to enhance power efficiency, performance, and scalability for semiconductor companies worldwide.

- In March 5, 2025 – ASML Holding N.V. (NASDAQ: ASML), a key supplier to the semiconductor industry, announced the shipment of its first high-NA EUV lithography system, enabling chipmakers to push Moore’s Law further. This advanced system is set to enhance transistor density and drive innovation in AI, 5G, and high-performance computing. ASML expects multiple customers to integrate high-NA EUV into production lines by 2026, marking a critical milestone in semiconductor manufacturing.

- In February 10, 2025 – NVIDIA Corporation (NASDAQ: NVDA), a leader in AI computing, revealed its next-generation GPU architecture designed for data center and edge AI workloads. The new architecture delivers significant performance gains, energy efficiency improvements, and enhanced AI acceleration, reinforcing NVIDIA’s leadership in AI infrastructure. Major cloud providers and enterprise customers are expected to deploy the new GPUs starting in Q3 2025.

- In January 8, 2025 – TSMC (NYSE: TSM), the world’s largest contract chip manufacturer, announced a $10 billion investment to expand its Arizona semiconductor fabrication facility. The expansion aims to boost advanced process technology production, supporting global supply chain resilience and the increasing demand for AI and high-performance computing chips. The additional capacity is expected to begin operations by 2027.

- In 2025, PDF Solutions, Inc. announced a definitive agreement to acquire secureWISE, LLC from Telit IoT Solutions Inc. for $130 million in cash. This strategic acquisition aims to strengthen PDF Solutions’ portfolio by enhancing its secure remote connectivity solutions for the semiconductor manufacturing industry.

Conclusion

The Global Die Attach Machine Market is set for steady growth, driven by rising demand for semiconductor packaging in consumer electronics, automotive, and industrial applications. Advancements in automation, miniaturization, and high-precision bonding technologies are shaping the market, with increasing adoption of AI and Industry 4.0 solutions enhancing efficiency. Asia-Pacific remains the dominant region, supported by a strong semiconductor manufacturing base and growing investments in advanced electronics. While challenges such as high capital costs and technical complexities persist, ongoing innovations in bonding materials, automation, and thermal management are expected to drive market expansion and technological advancements.