Table of Contents

Introduction

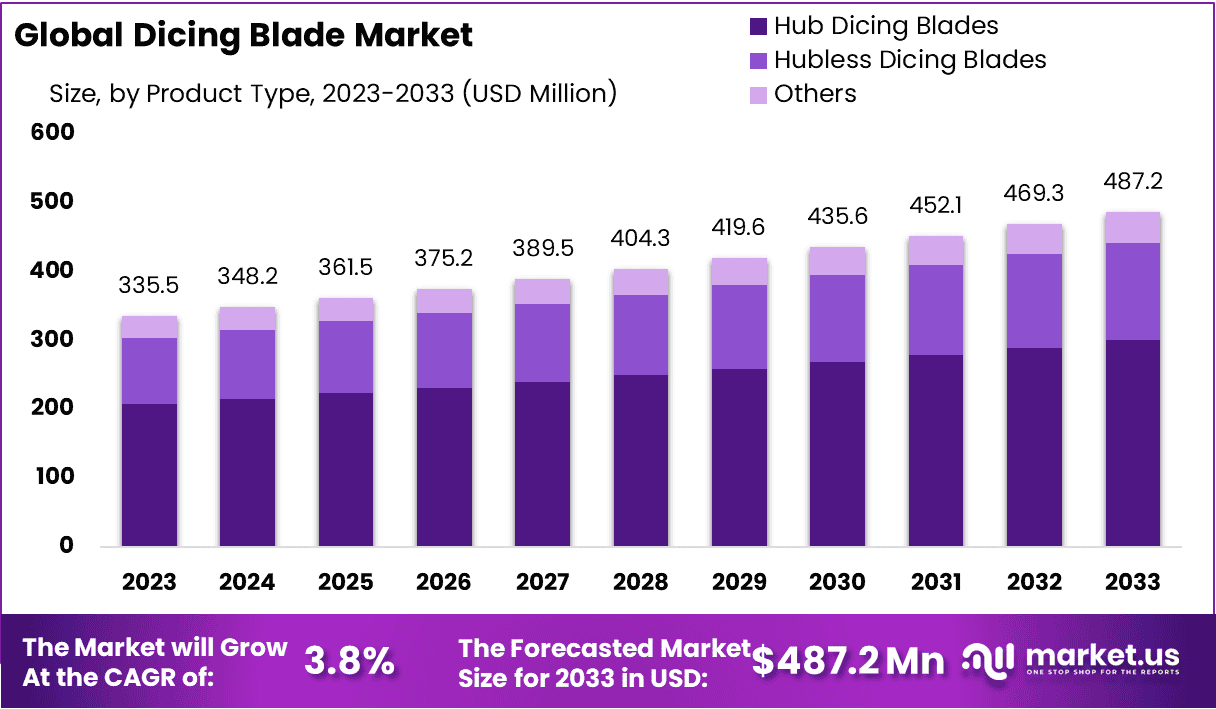

The Global Dicing Blade Market is projected to reach USD 487.2 million by 2033, up from USD 335.5 million in 2023, reflecting a compound annual growth rate (CAGR) of 3.80% over the forecast period from 2024 to 2033.

The dicing blade is a precision cutting tool primarily used in the semiconductor and electronics industries for slicing or dicing wafers, substrates, and other materials with high accuracy and minimal kerf loss. These blades, made from diamond or tungsten carbide, are essential in applications requiring fine, precise cuts, such as in the production of microchips, solar panels, and other microelectronics components. The dicing blade market refers to the global market that encompasses the manufacturing, distribution, and utilization of these cutting tools across various industries, including electronics, automotive, and healthcare.

The market is driven by the increasing demand for miniaturized and high-performance electronic devices, which necessitate more precise and efficient cutting tools. Several growth factors are contributing to the market’s expansion, including the proliferation of semiconductor manufacturing, advancements in the automotive sector with the rise of electric vehicles (EVs), and the growing adoption of renewable energy solutions that rely on dicing technology for solar panel production.

Furthermore, the rapid technological advancements in microelectronics, coupled with the demand for more energy-efficient and compact devices, are expected to further propel market growth. In terms of demand, there is a notable increase from industries such as semiconductor fabrication, consumer electronics, and photovoltaics, which require high-precision dicing for component production.

Opportunities for growth are evident in emerging economies, where the expansion of electronic and semiconductor industries presents untapped market potential. Additionally, the rise of automation in manufacturing processes is likely to open new avenues for innovation and market development.

Key Takeaways

- The Dicing Blade Market is projected to experience steady growth, with its value increasing from USD 335.5 million in 2023 to USD 487.20 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 3.80%.

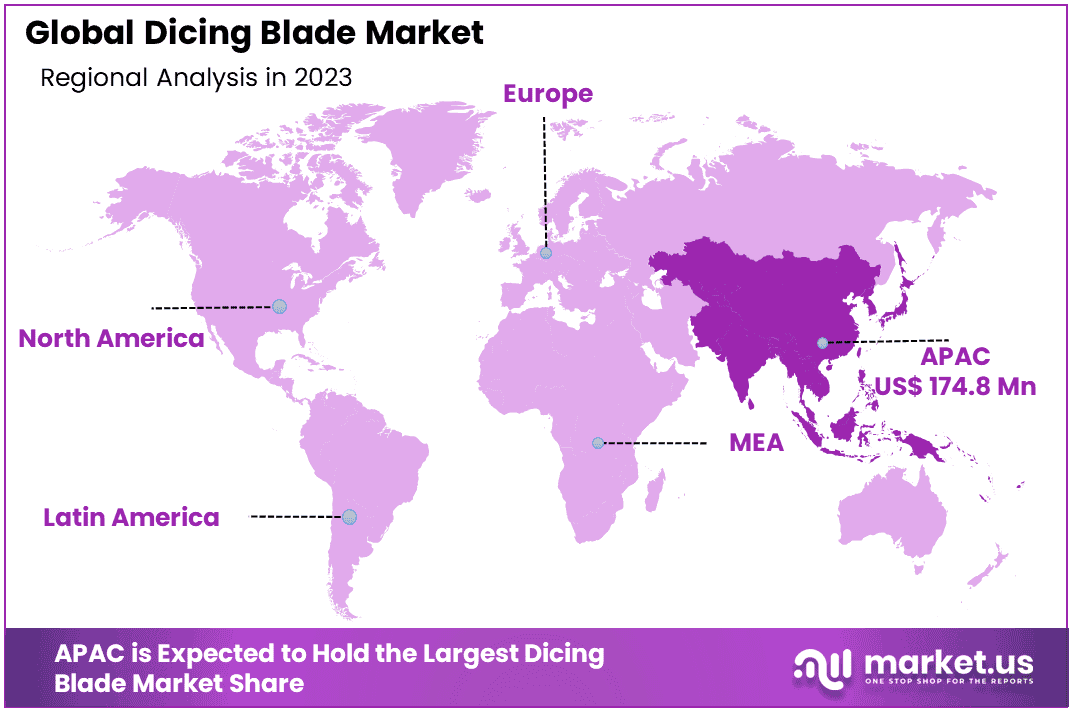

- The Asia-Pacific (APAC) region holds a dominant market share of 52.1%, underlining its significant role as a semiconductor manufacturing hub and highlighting the substantial demand for dicing blades within the region.

- Hubless Dicing Blades lead the market with a substantial 61.7% share, demonstrating their popularity and effectiveness in precision cutting applications.

- The semiconductor industry represents a significant portion of the market, accounting for 42.6% of the total share, which underscores the critical role dicing blades play in semiconductor manufacturing and precision cutting processes.

Report Scope:

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 335.5 Million |

| Forecast Revenue (2032) | USD 487.20 Million |

| CAGR (2023-2032) | 3.80% |

| Segments Covered | By Product Type(Hub Dicing Blades, Hubless Dicing Blades, Other Products), By Application(Semiconductors, Ceramics, Glass, Other Applications) |

| Competitive Landscape | Disco Corporation, Advanced Dicing Technologies, Kulicke & Soffa Industries, Inc., Load point Bearings, Engis Corporation, Meyer Burger Technology AG, Beijing Technol Science, Shanghai Sinyang Semiconductor Materials Co., Ltd., Kasco Abrasives, South Bay Technology, Inc., Kinik Company, Asahi Diamond Industrial Co., Ltd. |

Emerging Trends

- Technological Advancements in Material Science: The market for dicing blades is seeing an increasing adoption of advanced materials such as polycrystalline diamond (PCD) and ceramic-based blades, which offer enhanced durability and precision. These innovations are helping to meet the growing demand for higher cutting accuracy in semiconductor manufacturing.

- Miniaturization of Electronic Devices: With the increasing trend of miniaturizing electronic components, there is a rising need for dicing blades capable of handling smaller wafers and thin materials. This has led to the development of specialized dicing blades that can operate effectively on high-precision cutting jobs.

- Rise of Automation in Dicing Processes: Automation in wafer processing is gaining traction, allowing for higher production efficiency and consistent quality. Dicing blades integrated with automated systems are expected to streamline processes in semiconductor and electronics manufacturing.

- Demand for Environmentally Friendly Materials: There is a growing preference for sustainable and eco-friendly materials in manufacturing processes. Dicing blades are now being designed with reduced environmental impact, focusing on non-toxic and recyclable materials without compromising performance.

- Integration with Smart Manufacturing: As the trend towards Industry 4.0 grows, there is an increased adoption of smart dicing blades that can be monitored and controlled via Internet of Things (IoT) devices. These smart blades improve process efficiency and reduce downtime by predicting wear and tear in real time.

Top Use Cases

- Semiconductor Manufacturing: Dicing blades are extensively used for slicing semiconductor wafers into individual chips. The precision offered by modern dicing blades is critical to ensure minimal damage and optimal chip yield.

- LED and Solar Panel Production: Dicing blades are used to cut substrates like sapphire and silicon in the production of LED lights and solar panels, ensuring clean, accurate cuts without compromising the integrity of the material.

- Medical Device Manufacturing: The medical industry, particularly for devices requiring high precision, employs dicing blades to cut small, intricate parts for applications like implantable devices and diagnostic equipment.

- Electronic Component Fabrication: As electronic components become smaller and more complex, dicing blades play a crucial role in manufacturing parts for mobile devices, circuit boards, and sensors.

- Packaging and Assembly in Electronics: Dicing blades are used for cutting packaging materials and components used in assembling electronic products, ensuring high accuracy in packaging lines, particularly in microelectronic industries.

Major Challenges

- Wear and Tear of Dicing Blades: As dicing blades are exposed to intense mechanical stress and heat during use, their longevity is often limited. Frequent replacement of blades adds to operational costs, posing a challenge for manufacturers to maintain efficiency.

- Material Compatibility Issues: Dicing blades must be specifically tailored to the material being cut. The increasing use of new, harder materials presents challenges in blade selection and performance optimization.

- Precision and Quality Control: Achieving the required precision levels in dicing operations remains a challenge. Even minor discrepancies can affect the overall yield and performance of the end product, which is critical in industries like semiconductor manufacturing.

- High Operational Costs: Despite technological advancements, the cost of acquiring high-precision dicing blades remains a barrier for some companies, particularly smaller manufacturers or those operating in emerging markets.

- Limited Availability of Skilled Operators: The specialized nature of dicing blade operation requires highly skilled workers. The shortage of trained personnel in some regions can lead to inefficiencies and increased operational costs.

Top Opportunities

- Growth in Semiconductor Demand: With the ever-expanding demand for semiconductors, the need for advanced dicing blades will continue to rise. New innovations in dicing technology could provide opportunities for better efficiency and cost reduction.

- Development of Blade Materials with Longer Lifespan: There is an opportunity to develop more durable dicing blades that can withstand longer operational cycles, thereby reducing replacement costs and improving overall productivity.

- Automation and Robotics Integration: The ongoing trend towards automation in manufacturing presents an opportunity for dicing blades integrated with robotic systems, offering greater precision and reducing manual labor costs.

- Expanding Applications in Emerging Industries: New applications of dicing blades in fields like biotechnology, automotive electronics, and flexible electronics offer growth potential. These industries require precision cutting tools for smaller, more intricate components.

- Enhanced Customization and Service Offerings: Offering more customized dicing blades tailored to specific customer needs or materials can present an opportunity for companies to differentiate themselves and capture niche markets in highly specialized sectors.

Key Player Analysis

In 2024, the global dicing blade market continues to be dominated by key players who drive innovation and maintain strong market positions. Disco Corporation remains a leading player, recognized for its advanced dicing technologies that cater to the semiconductor industry. Similarly, Advanced Dicing Technologies and Kulicke & Soffa Industries, Inc. contribute significantly through their cutting-edge solutions that optimize precision and efficiency in the dicing process.

Companies like Engis Corporation and Meyer Burger Technology AG leverage robust R&D efforts to offer high-performance blades for varied applications, catering to growing demand in the electronics and renewable energy sectors. Regional players such as Beijing Technol Science and Shanghai Sinyang Semiconductor Materials Co., Ltd. have strengthened their foothold by tapping into the rapidly expanding markets in Asia. Meanwhile, established manufacturers like Kinik Company, Asahi Diamond Industrial Co., Ltd., and Kasco Abrasives continue to enhance product offerings, ensuring versatility and reliability in high-stakes dicing operations.

Key players in the market

- Disco Corporation

- Advanced Dicing Technologies

- Kulicke & Soffa Industries, Inc.

- Load point Bearings

- Engis Corporation

- Meyer Burger Technology AG

- Beijing Technol Science

- Shanghai Sinyang Semiconductor Materials Co., Ltd.

- Kasco Abrasives

- South Bay Technology, Inc.

- Kinik Company

- Asahi Diamond Industrial Co., Ltd.

Regional Analysis

Asia-Pacific Region with Largest Market Share in Dicing Blade Market (52.1% in 2024)

The Asia-Pacific region is expected to dominate the dicing blade market, holding a significant share of 52.1% in 2024, valued at approximately USD 174.8 million. This dominance is primarily driven by the rapid growth of the semiconductor and electronics industries in countries such as China, Japan, South Korea, and Taiwan, where a large number of semiconductor manufacturers and equipment suppliers are based. The region’s robust technological advancements and increasing demand for miniaturized electronic devices further fuel the need for precision cutting tools like dicing blades.

The widespread adoption of advanced manufacturing techniques in the region, coupled with the rising demand for consumer electronics, automotive electronics, and mobile devices, will continue to sustain the market’s upward trajectory. Additionally, the presence of leading dicing blade manufacturers in Asia-Pacific further strengthens the region’s position in the global market. The growth of the market is also supported by significant investments in research and development, as well as the expansion of production capacities by key players within the region.

Recent Developments

- In January 2025, NTT DATA, a global leader in digital business and IT services, unveiled its annual report, NTT DATA Technology Foresight 2025. The report highlights emerging technology trends, offering valuable insights through a thorough analysis of current business landscapes, with a focus on IT’s role in driving success.

- In November 2024, Kulicke & Soffa Industries, Inc. (K&S), a prominent provider of semiconductor equipment, announced a significant order from a leading foundry customer. The order includes multiple APTURA™ Fluxless TCB systems, aimed at supporting the growing demand for advanced semiconductor packaging solutions.

- In 2025, ROHM introduced the 650V GaN HEMT, designed in a compact, high-heat dissipation TOLL package. This new component, the GNP2070TD-Z, boasts high current capacity and exceptional switching performance, making it ideal for high-power applications in industrial and automotive systems. Manufacturing is outsourced to ATX SEMICONDUCTOR (WEIHAI) CO., LTD., an experienced provider of semiconductor assembly and testing services.

- In 2024, DISCO Corporation, a leader in semiconductor manufacturing equipment, launched two new dicing blades: the ZHSC25 Series for SiC and the Z25 Series for electronic components. These innovations will be showcased at SEMICON Japan 2024, reflecting the company’s commitment to advancing cutting-edge technology in the semiconductor industry.

Conclusion

The dicing blade market is poised for steady growth, driven by the increasing demand for precision cutting in industries such as semiconductors, electronics, and renewable energy. As technological advancements continue to evolve, the market will benefit from innovations in materials, automation, and smart manufacturing systems that enhance cutting accuracy and operational efficiency. Furthermore, emerging markets, particularly in the Asia-Pacific region, offer significant growth opportunities due to the expanding electronics and semiconductor industries. However, challenges such as blade wear, material compatibility, and high operational costs remain, requiring ongoing efforts to improve blade durability and reduce production costs. Despite these obstacles, the dicing blade industry is expected to thrive, driven by the need for high-performance, cost-effective cutting solutions in increasingly miniaturized and complex electronic devices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)