Table of Contents

Introduction

The Global Department Stores Market is projected to reach USD 220.5 billion by 2033, up from USD 139.3 billion in 2023, representing a compound annual growth rate (CAGR) of 4.7% from 2024 to 2033.

Department stores are large retail establishments that offer a wide variety of products across multiple categories, such as apparel, electronics, home goods, and beauty products, under one roof. These stores typically operate in a multi-level format and provide a one-stop shopping experience to consumers. The department store market refers to the sector of the retail industry that encompasses these types of stores, which often focus on providing a broad selection of goods, competitive pricing, and a convenient shopping environment.

Key growth factors in the department stores market include rising disposable incomes, increasing urbanization, and the expansion of retail networks in emerging markets. Additionally, evolving consumer preferences toward convenience and variety continue to drive demand. The ongoing integration of online and offline retail channels presents significant opportunities for department stores to enhance customer experience, streamline operations, and reach a broader consumer base. This omnichannel approach, alongside a focus on customer-centric services, is poised to reshape market dynamics

Key Takeaways

- The Department Stores Market was valued at USD 139.3 billion in 2023 and is projected to reach USD 220.5 billion by 2033, growing at a CAGR of 4.7%.

- Hardline and Softline products dominate the market in 2023, accounting for 47.5% of the segment.

- Apparel and Accessories are the fastest-growing product category in 2023, reflecting changing fashion trends.

- Large department stores lead the market in 2023, representing 67.7% of total sales, showing a consumer preference for expansive shopping experiences.

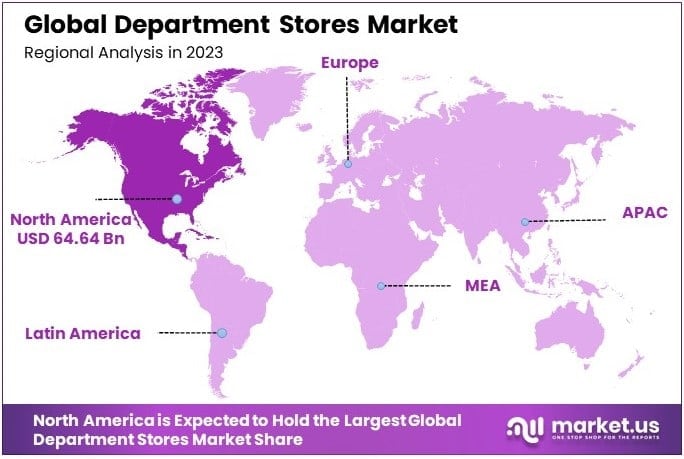

- North America holds the largest market share in 2023, with 46.4% of the market, driven by well-established retail infrastructure.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 139.3 Billion |

| Forecast Revenue (2033) | USD 220.5 Billion |

| CAGR (2024-2033) | 4.7% |

| Segments Covered | By Type (Hardline and Softline, Apparel and Accessories, FMCG), By Size (Large, Small) |

| Competitive Landscape | Marks and Spencer Group Plc., Macy’s Inc., Sears Holdings Corp., Target Corporation, Nordstrom Inc., Walmart Inc., Isetan Mitsukoshi Holdings Ltd., Kohl’s Corporation, Chongqing Department Store Co. Ltd, Lotte Department Store, Other Key Players |

Key Segments Analysis

Hardline and softline products dominate the market with a 47.5% share, driven by a diverse range of essentials like electronics, furniture, and home decor that attract steady consumer demand. Apparel and accessories, while not the largest segment, are the fastest-growing, fueled by shifting fashion trends and the need for in-store fitting. FMCG products, including food and beverages, play a key role in driving foot traffic to stores, supporting sales across other categories.

Large department stores dominate the market with a 67.7% share, thanks to their broad product offerings and strategic locations in urban centers and malls, providing a convenient and diverse shopping experience. Meanwhile, smaller department stores, while holding a smaller market share, are growing at a CAGR of 5.3%. These stores cater to niche markets and local communities, offering specialized products and personalized customer service, which contributes to their growth and helps maintain diversity within the market.

Emerging Trends

- Integration of E-commerce and In-store Experience: Department stores are increasingly blending online and offline experiences to cater to customers’ changing preferences. As more consumers shop online, physical department stores are enhancing their digital presence with services like click-and-collect, virtual shopping assistants, and AR-powered store displays. This trend is expanding as retailers invest in omnichannel strategies to enhance customer convenience.

- Sustainability and Eco-friendly Products: There is a rising demand for sustainable products in department stores. Shoppers are becoming more conscious of environmental impact, pushing retailers to introduce eco-friendly product lines and sustainable packaging options. This trend is reflected in increased availability of green products such as recycled materials, plant-based items, and low-carbon-footprint brands.

- Personalized Customer Experiences: With the help of AI and data analytics, department stores are focusing more on personalization. From customized product recommendations to targeted discounts, department stores are leveraging customer data to offer tailored shopping experiences. This helps improve customer engagement and loyalty while enhancing the overall shopping experience.

- Technological Innovation in Stores: Smart technology is being introduced into physical stores, with innovations like self-checkout kiosks, smart fitting rooms, and interactive product displays. These technologies aim to streamline the shopping process, improve operational efficiency, and provide customers with a more interactive and immersive shopping experience.

- Focus on Health and Wellness: Department stores are diversifying their product offerings to meet the growing demand for health and wellness products. This includes everything from fitness equipment to organic food and wellness supplements. This trend reflects the growing consumer awareness of mental and physical well-being, influencing department store inventories to adapt accordingly.

Top Use Cases

- Omnichannel Retail: A significant use case for department stores is the integration of both physical stores and online platforms. This allows consumers to shop via multiple channels, enhancing convenience. For example, a study showed that 50% of consumers prefer shopping with brands that offer both in-store and online purchase options.

- Personalized Shopping Experience: Department stores use customer data to create personalized shopping experiences. By analyzing purchasing behavior and preferences, retailers can offer tailored promotions, personalized product suggestions, and targeted marketing campaigns. For example, personalized offers can increase customer conversion rates by up to 20%.

- Click-and-Collect Services: Department stores have widely adopted click-and-collect services, where customers order online and pick up their items in-store. This use case has grown significantly, especially during the pandemic. As of 2023, over 40% of department store customers in North America have used click-and-collect services.

- In-store Digital Technology: The use of digital tools in-store, like self-checkouts and interactive kiosks, helps customers easily navigate and purchase products. Digital screens allow customers to view more product details and check stock availability in real-time, enhancing the customer experience and reducing wait times.

- Pop-up Stores and Experience Zones: Department stores are increasingly using pop-up stores or experience zones within their larger spaces to showcase limited-time products or special events. These zones offer customers a more immersive shopping experience, drawing in new customers and creating buzz around exclusive products.

Major Challenges

- Declining Foot Traffic: A major challenge for department stores is the continued decline in foot traffic to physical stores. As e-commerce continues to grow, fewer people are visiting physical retail spaces, and those who do are spending less time shopping in-store. According to recent reports, foot traffic to department stores has dropped by up to 15% over the last five years.

- Intense Price Competition: Department stores face fierce price competition, both from online retailers and discount stores. Customers now expect the best deals, and many department stores struggle to keep up with the aggressive pricing strategies of e-commerce giants. This is pressuring profit margins, as they often have to discount heavily to remain competitive.

- Changing Consumer Preferences: The shift in consumer preferences toward convenience, personalized experiences, and sustainability presents challenges for traditional department stores. Consumers are more inclined to shop at stores that cater to their specific needs or offer more sustainable options, which can be difficult for department stores to match.

- Rising Operational Costs: With inflation, rising wages, and increasing energy costs, department stores are facing higher operational expenses. The higher costs of maintaining large physical stores and managing supply chains are squeezing margins, forcing retailers to find ways to reduce expenses without compromising the customer experience.

- Supply Chain Disruptions: Department stores are dealing with ongoing supply chain disruptions, which have been exacerbated by global trade challenges. Delays in inventory shipments and stock shortages have affected product availability, leading to lost sales opportunities. Retailers are trying to find alternative suppliers and solutions to ensure they meet customer demand consistently.

Top Opportunities

- Expansion of Online and In-store Integration: There is a significant opportunity for department stores to further integrate their online and offline offerings. By expanding omnichannel capabilities, department stores can increase sales and customer loyalty. For example, leveraging more robust e-commerce platforms and offering seamless delivery options can drive higher conversion rates.

- Growth of Private Label Brands: Developing and promoting private label brands is a key growth opportunity for department stores. Offering exclusive in-house brands not only enhances product differentiation but also improves profit margins. Private label sales can account for up to 30% of total sales in some department stores, providing substantial growth potential.

- Sustainability-Focused Offerings: With rising consumer interest in sustainable products, department stores have a growth opportunity in promoting eco-friendly goods. By investing in green product lines and sustainable practices, they can attract a more environmentally-conscious customer base. In fact, nearly 60% of shoppers are willing to pay more for eco-friendly products.

- Collaborations with Niche Brands: Partnering with niche brands or local designers to offer exclusive products can create a unique selling proposition. Department stores can tap into emerging markets and attract younger, trend-savvy customers who are seeking unique items that reflect their personal style.

- Investment in Health and Wellness Sections: As consumers increasingly prioritize health and wellness, department stores have an opportunity to expand their product offerings in this area. By creating dedicated health and wellness sections that feature fitness equipment, organic foods, and wellness supplements, department stores can cater to the growing health-conscious market.

Key Player Analysis

- Marks and Spencer Group Plc.: Marks and Spencer (M&S), a prominent British retailer, operates both department stores and online retail operations, offering clothing, food, and home goods. The company has a strong presence in the UK and is expanding internationally. M&S aims to accelerate its omnichannel growth, focusing on digital integration to boost its e-commerce sales.

- Macy’s Inc.: Macy’s is a leading American department store chain, operating a vast network of stores across the U.S. In fiscal year 2023. The company has been adapting to changing consumer behavior by enhancing its digital offerings and promoting its loyalty program, which has grown significantly in recent years.

- Sears Holdings Corp.: Once a giant in American retail, Sears Holdings operates both Sears and Kmart stores, though its market share has dramatically decreased. Despite these challenges, Sears continues to operate in certain markets, attempting to revive its business through e-commerce and strategic partnerships.

- Target Corporation: Target is one of the largest retail chains in the U.S., known for its wide range of products from clothing to electronics and groceries. The company is known for its excellent customer service and competitive pricing strategy. Target has focused heavily on enhancing its supply chain and e-commerce capabilities to stay ahead of retail trends.

- Nordstrom Inc.: Nordstrom operates both physical department stores and an online platform, offering high-end fashion, beauty, and home goods. The company has been successful in integrating its online and in-store shopping experiences, offering services like curbside pickup and flexible return options.

Regional Analysis

North America – Department Stores Market with Largest Market Share of 46.4% in 2023

The North American department stores market is currently the largest and most dominant region, holding a substantial market share of 46.4%, equivalent to USD 64.64 billion in 2023. This commanding position is primarily driven by a well-established retail infrastructure, robust consumer spending, and high per capita income levels in the United States and Canada. The market is characterized by the widespread presence of large chains such as Macy’s, Nordstrom, and Kohl’s, which continue to capture significant portions of the consumer retail expenditure. Furthermore, North America benefits from advanced technological integration, with many department stores adopting e-commerce platforms, omnichannel strategies, and personalized customer experiences, which have significantly bolstered sales.

The region also boasts a strong consumer demand for premium products, home goods, and fashion apparel, contributing to its high market value. In addition, the growing trend of hybrid shopping models, which combine both in-store and online experiences, continues to fuel the market’s expansion. With a market size of USD 64.64 billion, North America remains a pivotal region, supported by strong economic fundamentals, a tech-savvy consumer base, and continuous retail innovations. As such, North America is projected to retain its dominant market share in the coming years, further solidifying its position as the largest market for department stores globally.

Recent Developments

- In 2025, Macy’s Inc. announced the closure of 66 underperforming store locations as part of its Bold New Chapter strategy. This initiative, unveiled in February 2024, aims to improve the company’s long-term profitability by reducing its store footprint and investing in its remaining 350 locations, with a goal to enhance overall sales growth by 2026.

- In 2023, Victoria’s Secret & Co. completed the acquisition of Adore Me, a digitally-native intimates brand. This acquisition is expected to drive significant growth, leveraging Adore Me’s technology and expertise to modernize the Victoria’s Secret and PINK customer experience, with Adore Me projected to generate $250 million in profitable sales.

- In 2024, Walmart continued to elevate its eCommerce experience, emphasizing its mission of helping customers save money and live better. By integrating technology and creating a more convenient shopping journey, Walmart is enhancing customer experiences across its omnichannel retail network.

- In 2024, Dillard’s reported its results for the 13 and 39 weeks ended November 2. Despite a 4% decline in retail sales, the company focused on maintaining strong margins, achieving a 44.5% gross margin. Dillard’s also reported over $1.1 billion in cash and investments, alongside $107 million in stock repurchases, with plans to focus on customer service during the holiday season.

Conclusion

The global department stores market is poised for steady growth, driven by the increasing demand for convenience, variety, and personalized shopping experiences. As consumer preferences evolve, department stores are adapting by integrating online and offline platforms, emphasizing sustainability, and leveraging advanced technologies to improve the shopping experience. While challenges such as declining foot traffic and price competition remain, opportunities abound for retailers who can innovate and meet changing market demands. The future of department stores will likely hinge on their ability to offer a seamless omnichannel experience, personalized services, and a strong focus on sustainability, which will help them maintain relevance and continue to capture a diverse consumer base.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)