Table of Contents

- Introduction

- Editor’s Choice

- Global Cosmetics Market Statistics

- Number of Subscribers Analysis in YouTube Beauty Channels of Global Cosmetics Market Statistics

- Top 10 Global Cosmetics Exporting Nations Statistics

- Top Cosmetics Importing Nations Statistics

- Consumer Behavior Trends in Cosmetics Statistics

- Regulations for Cosmetics in Different Countries

- Recent Developments

- Conclusion

- FAQs

Introduction

Cosmetics Statistics: The cosmetics industry, integral to personal care, offers products that enhance appearance and foster self-confidence, serving diverse consumer needs through innovation and inclusivity.

These products, ranging from skincare to makeup, provide benefits such as skin protection and aesthetic enhancement.

However, the industry faces criticism for potential health risks associated with chemical ingredients and environmental impact due to packaging waste.

Despite these drawbacks, the benefits, including improved self-esteem and social perception, drive its popularity.

Furthermore, advancements in sustainable and organic formulations are addressing concerns. Making the cosmetics industry a complex blend of challenges and opportunities for enhancing personal well-being.

Editor’s Choice

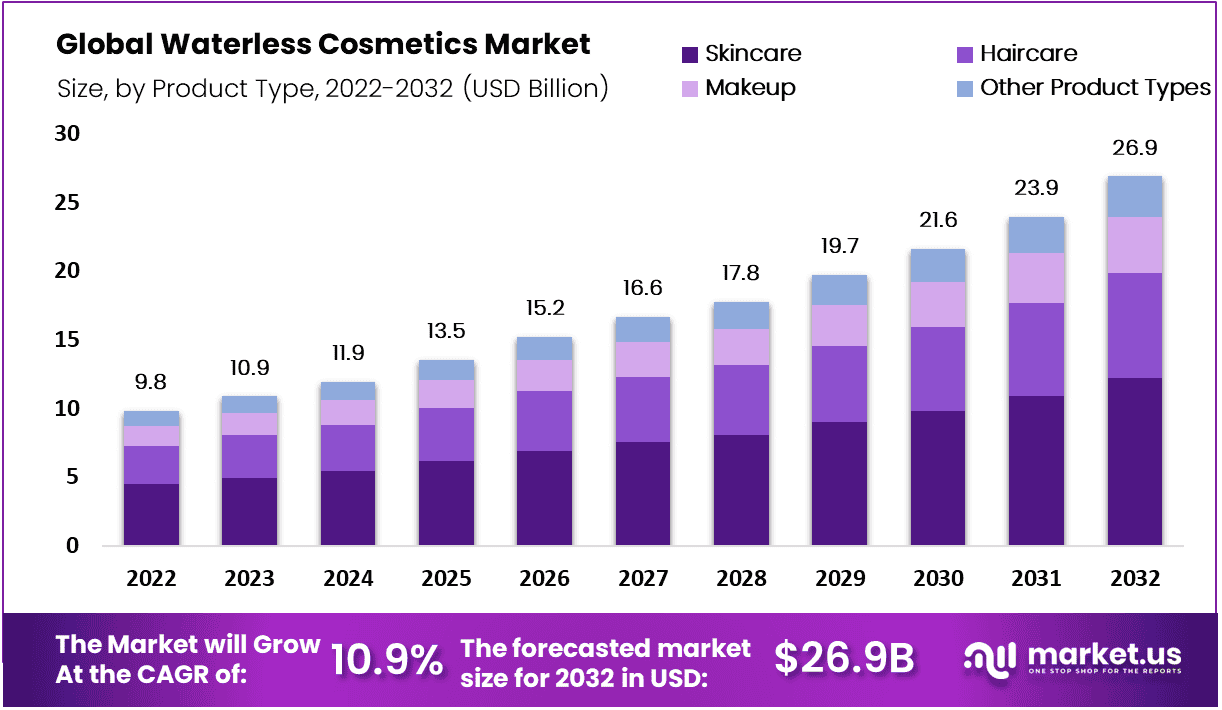

- In 2022, the global waterless cosmetics market was worth US$ 9.8 billion. It is anticipated to grow a CAGR of 10.9% between 2023-2032. It will reach US$ 26.9 billion by 2032.

- L’Oréal Paris is the leading cosmetic brand with an impressive value of USD 12.03 billion.

- The Face category dominates the cosmetics market with the highest revenue, reaching USD 31.14 billion in 2023.

- Sandra Cires Art tops the list as the most subscribed beauty content creator on YouTube with 16.4 million subscribers as of February 2023.

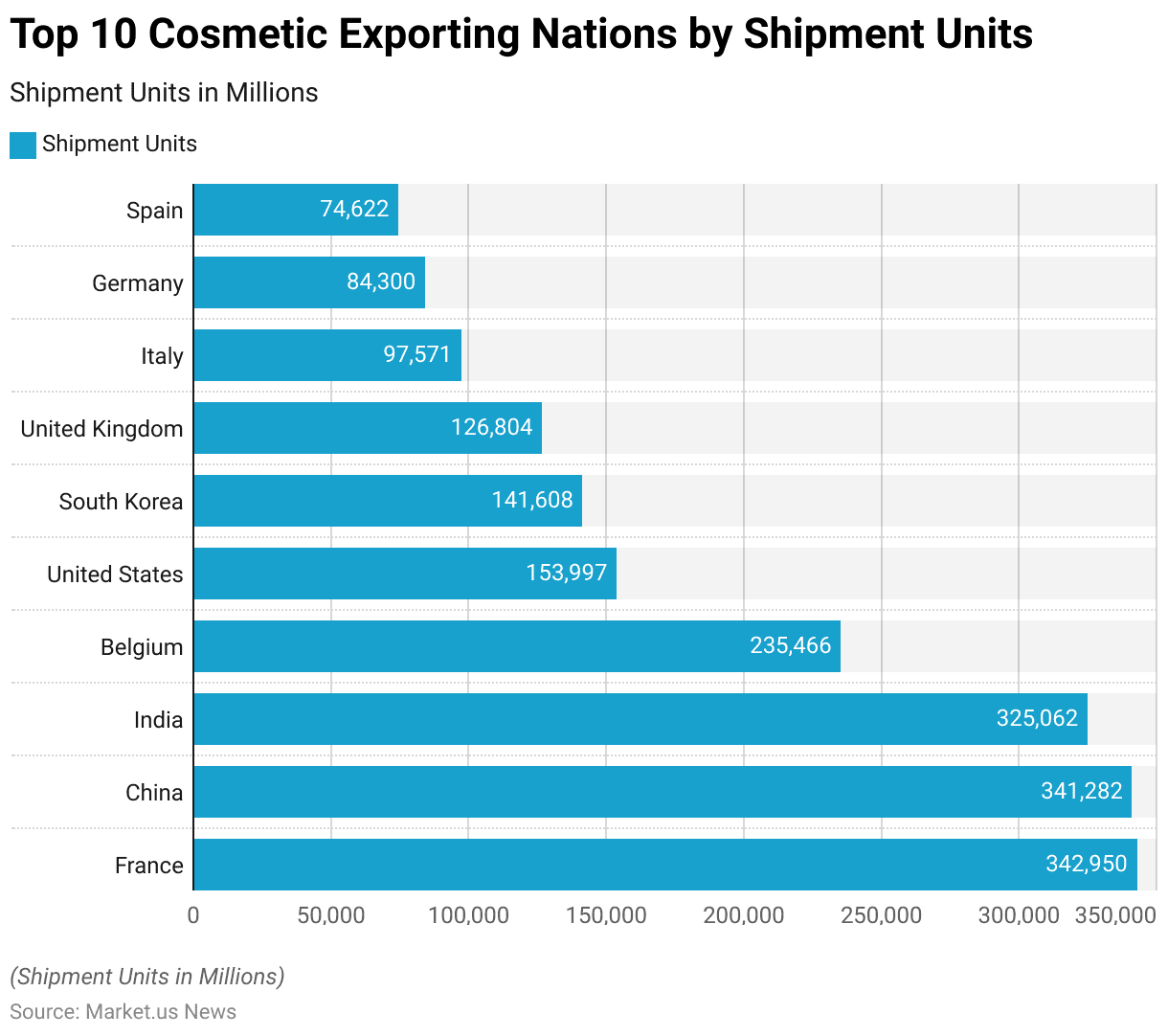

- France leads global exports with a robust volume of 342,950 million units. Showcasing its diverse range from luxury goods to advanced manufacturing.

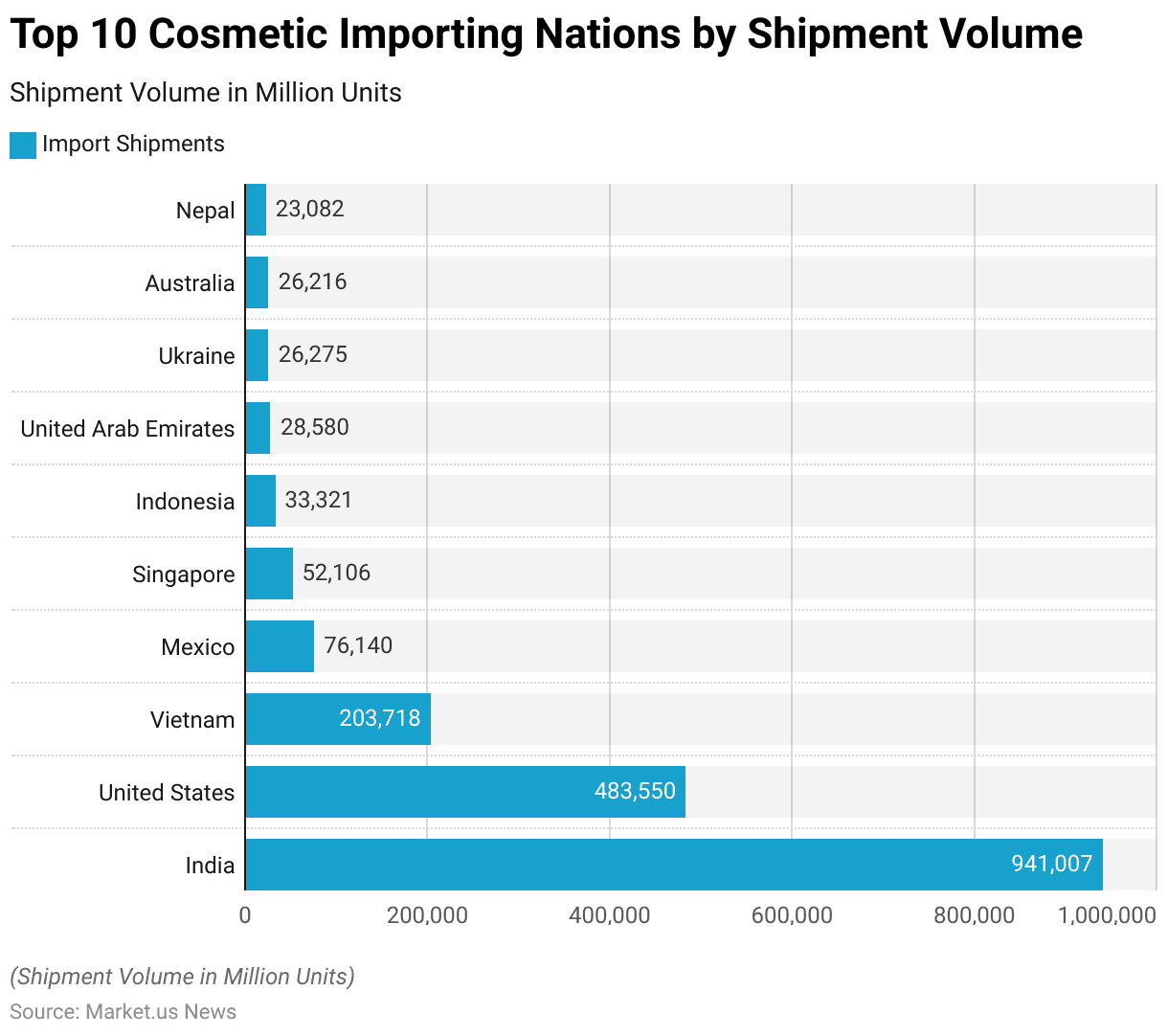

- India leads global imports with an impressive shipment volume of 941,007 million units. Showcasing its diverse export portfolio and significant global trade presence.

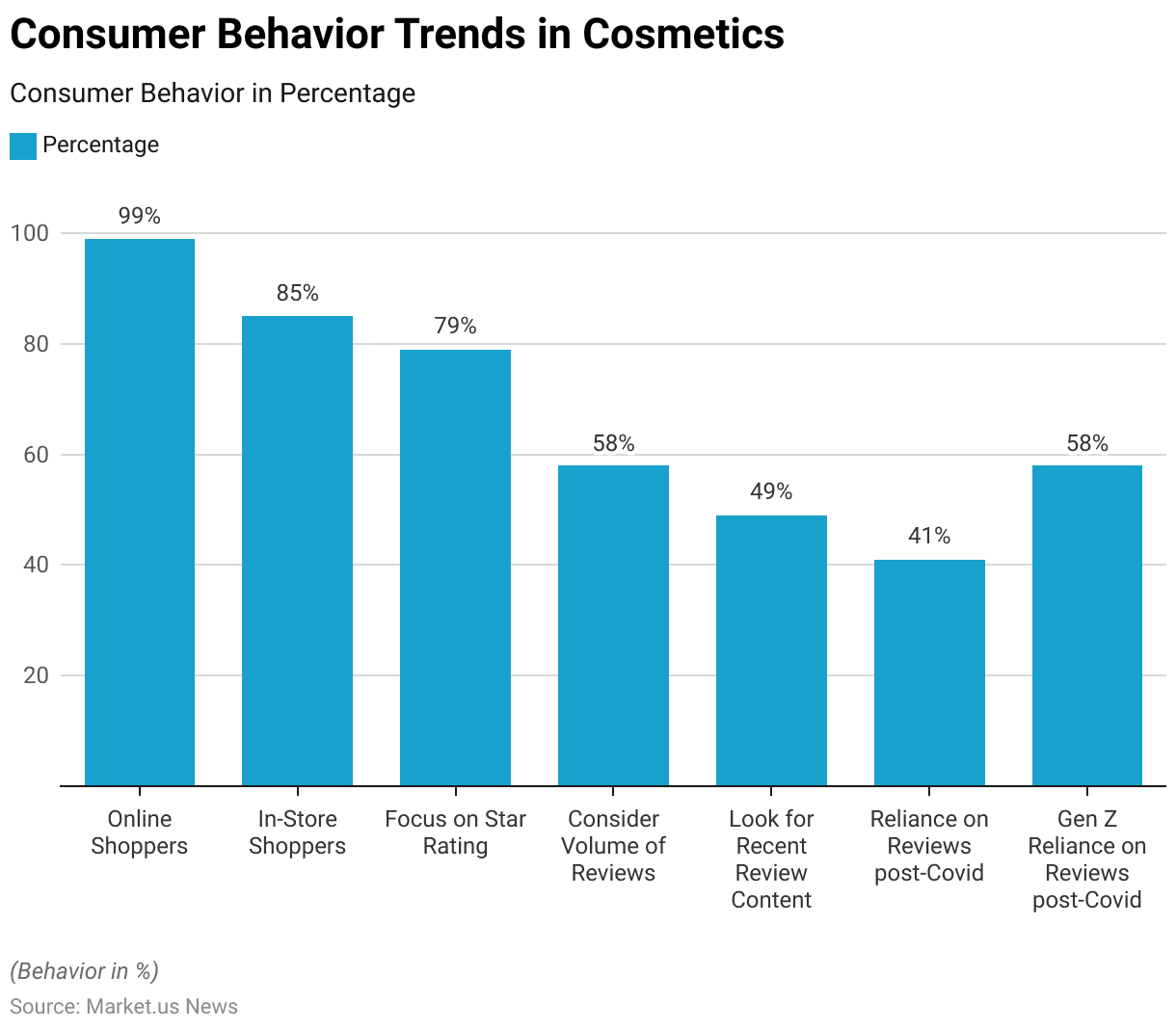

- A staggering 99% of online shoppers indicate that they always or sometimes read ratings and reviews when shopping for beauty products on the internet.

- The 2022 Modernization of Cosmetics Regulation Act (MoCRA) brings forth revised guidelines for cosmetic items. Modifying Chapter VI dedicated to Cosmetics in the Federal Food, Drug, and Cosmetic Act (FD&C Act).

Global Cosmetics Market Statistics

Top 10 Brand Value Analysis of the Global Cosmetics Market Statistics

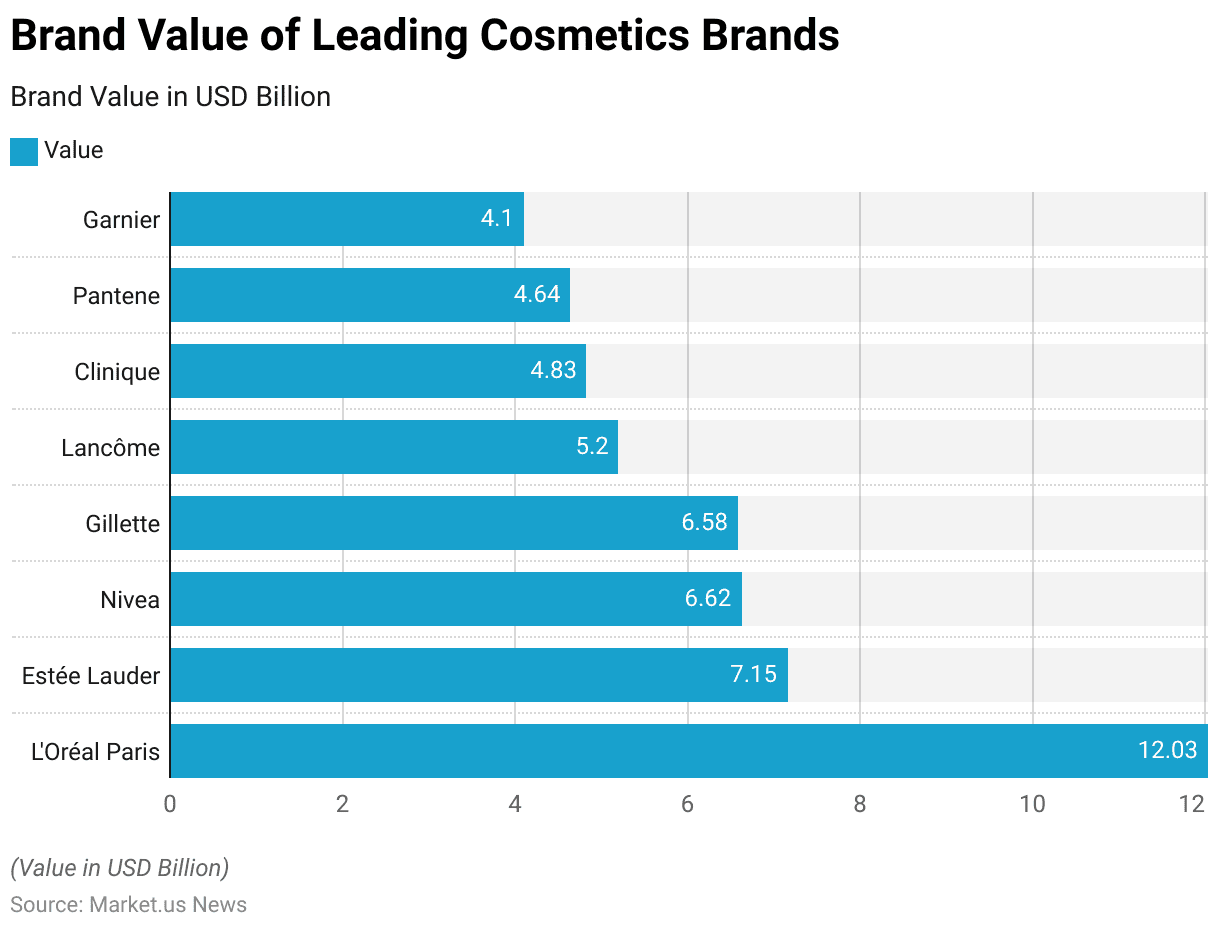

- In the year 2023, the cosmetic industry’s leading brands have been valued, with L’Oréal Paris taking the forefront at an impressive USD 12.03 billion.

- Following as a close second is Estée Lauder, which has a brand value of USD 7.15 billion.

- Nivea stands third, with a valuation of USD 6.62 billion.

- Gillette closely follows with a value of USD 6.58 billion.

- The renowned Lancôme is valued at USD 5.2 billion.

- Clinique has secured a brand value of USD 4.83 billion.

- Pantene, recognized for hair care, is valued at USD 4.64 billion.

- Garnier rounds out the list with a brand value of USD 4.1 billion.

- These valuations reflect the substantial brand equity amassed by these cosmetic giants within a competitive market landscape.

(Source: Statista)

Category-Wise Revenue of Global Cosmetics Market Statistics

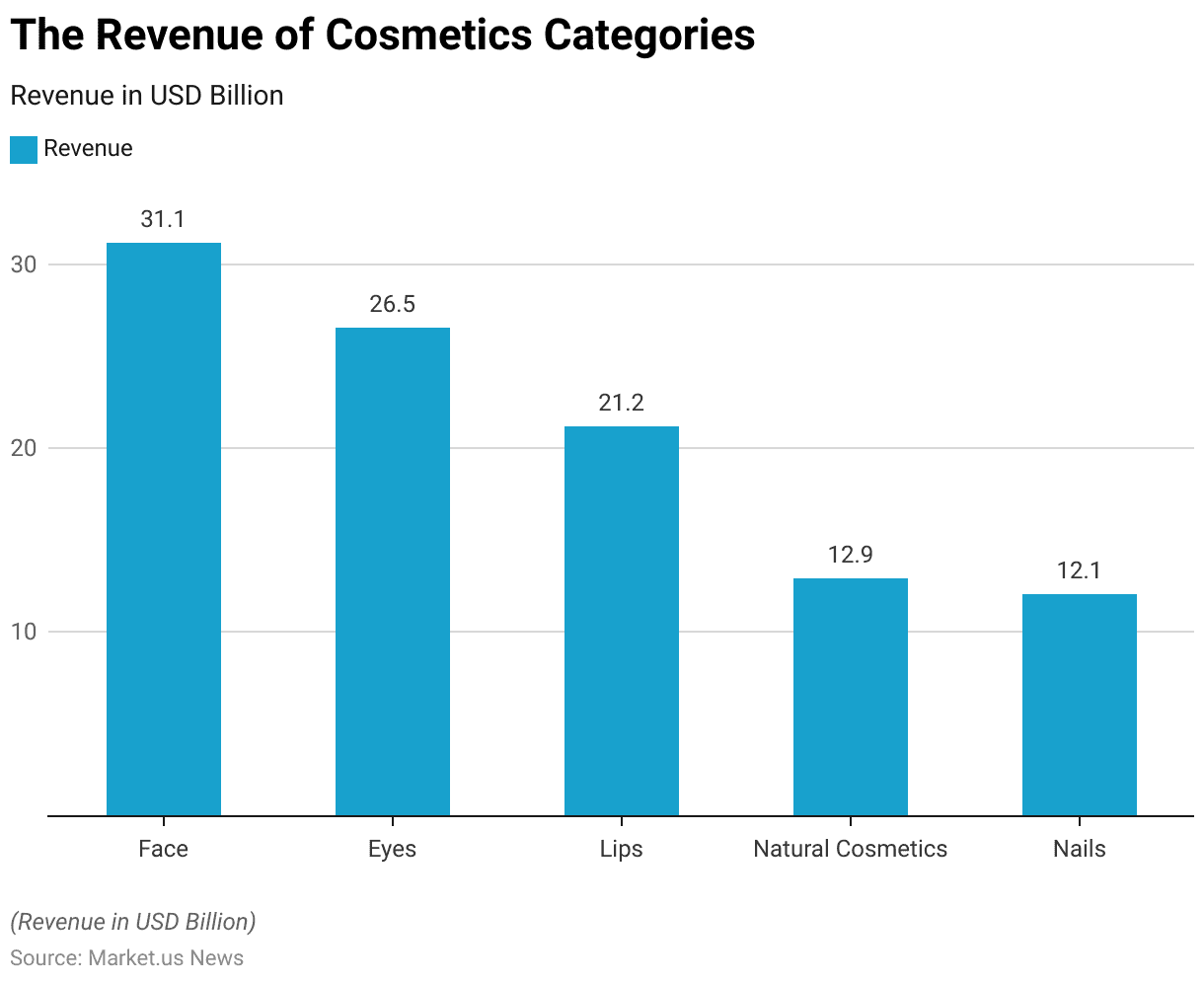

- The Face category dominates the cosmetics market with the highest revenue, reaching USD 31.14 billion in 2023.

- Eyes cosmetics also show strong performance with revenues of USD 26.53 billion.

- Lip products contribute significantly as well, with a total revenue of USD 21.16 billion.

- Natural Cosmetics indicates a growing market segment, amassing USD 12.93 billion in revenue.

- The Nails segment, while the smallest among the listed categories, still accounts for USD 12.05 billion in revenue.

(Source: Statista)

Number of Subscribers Analysis in YouTube Beauty Channels of Global Cosmetics Market Statistics

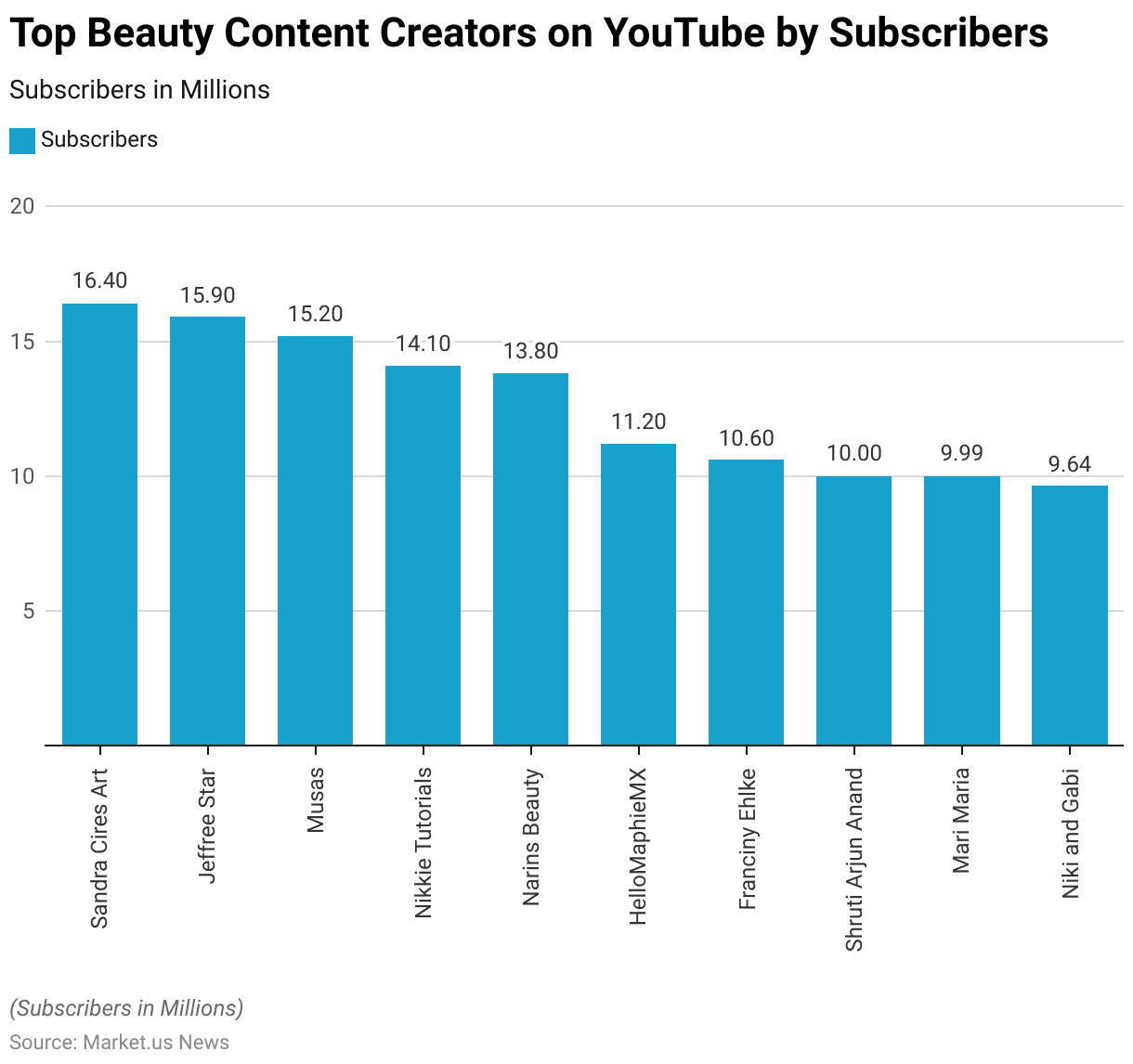

- Sandra Cires Art tops the list as the most subscribed beauty content creator on YouTube with 16.4 million subscribers as of February 2023.

- Jeffree Star maintains a strong following, ranking second with 15.9 million subscribers.

- Musas holds third place in the ranking with 15.2 million subscribers.

- Nikkie Tutorials is also among the top with 14.1 million subscribers.

- Narins Beauty has a substantial audience with 13.8 million subscribers.

- HelloMaphieMX stands with 11.2 million subscribers.

- Franciny Ehlke has garnered 10.6 million subscribers.

- Shruti Arjun Anand is not far behind, with a subscriber count of 10 million.

- Mari Maria has a significant following of 9.99 million subscribers.

- Niki and Gabi round out the list with 9.64 million subscribers, highlighting their impact in the beauty segment on YouTube.

(Source: Statista)

Top 10 Global Cosmetics Exporting Nations Statistics

- France leads global exports with a robust volume of 342,950 million units. Showcasing its diverse range from luxury goods to advanced manufacturing.

- China closely follows with 341,282 million units, driven by its manufacturing capabilities and expansive trade networks.

- India emerges as a significant exporter with 325,062 million units. Benefiting from its varied exports in textiles, pharmaceuticals, and IT services.

- Belgium stands out with 235,466 million units, utilizing its strategic location and advanced logistics for trade facilitation.

- The United States maintains its key exporter status, recording 153,997 million units due to technological innovation and a diverse export portfolio.

- South Korea and the United Kingdom exhibit strengths in technology, automotive, and financial services exports. With volumes of 141,608 million units and 126,804 million units, respectively.

- Italy demonstrates expertise in luxury goods, machinery, and automotive exports, contributing 97,571 million units.

- Germany, renowned for engineering excellence, adds significantly to exports with 84,300 million units.

- Spain’s export volume of 74,622 million units leverages strengths in agriculture, tourism, and renewable energy.

(Source: Volza)

Top Cosmetics Importing Nations Statistics

- India leads global imports with an impressive shipment volume of 941,007 million units. Showcasing its diverse export portfolio and significant global trade presence.

- The United States closely follows with a substantial shipment volume of 483,550 million units. Driven by its strong manufacturing sector and extensive trade networks.

- Vietnam secures a notable position as a key export region, highlighting its rapid industrialization and growing international trade presence with a shipment volume of 203,718 million units.

- Mexico demonstrates its importance in global trade with a shipment volume of 76,140 million units. Benefiting from its strategic location and robust manufacturing capabilities.

- Singapore stands out as a significant export region leveraging its status as a major trade and commerce hub in Southeast Asia, recording a shipment volume of 52,106 million units.

- Indonesia shows a growing influence in international trade with a shipment volume of 33,321 million units. Driven by its expanding manufacturing sector and diverse export base.

- The United Arab Emirates solidified its position as a key export region with a shipment volume of 28,580 million units. Driven by its strategic location and vibrant trade ecosystem.

- Ukraine contributes significantly to global exports with a shipment volume of 26,275 million units. Reflecting strengths in agriculture, manufacturing, and natural resources.

- Australia showcases export prowess with a shipment volume of 26,216 million units, driven by abundant natural resources. Agricultural products, and advanced manufacturing.

- Nepal concludes the top 10 export regions with a shipment volume of 23,082 million units. Demonstrating increasing participation in global trade and economic development efforts.

(Source: Volza)

Consumer Behavior Trends in Cosmetics Statistics

- Online Shoppers: A staggering 99% of online shoppers indicate that they always or sometimes read ratings and reviews when shopping for beauty products on the internet.

- In-Store Shoppers: 85% of in-store shoppers also engage with ratings and reviews, showcasing the significant influence of consumer feedback across both online and offline channels.

- Focus on Star Rating: Nearly 4 out of 5 consumers (79%) prioritize the average star rating when evaluating beauty products, emphasizing the importance of overall product satisfaction.

- Consider Volume of Reviews: More than half of consumers (58%) take into account the volume of reviews, suggesting that a higher number of reviews may influence their purchasing decisions.

- Look for Recent Review Content: Close to half of consumers (49%) actively seek out recent review content, indicating a preference for up-to-date and relevant feedback.

- Reliance on Reviews post-Covid: 41% of consumers state that they rely on reviews more than they did before the COVID-19 pandemic, indicating a heightened importance of peer recommendations in uncertain times.

- Gen Z Reliance on Reviews post-Covid: Among younger generations, particularly Gen Z, 58% claim to rely more on reviews post-Covid, reflecting a trend of increased reliance on online feedback channels for purchasing decisions.

(Source: PowerReviews)

Regulations for Cosmetics in Different Countries

India

- In India, the regulation of cosmetics falls under the jurisdiction of the Drugs and Cosmetics Act of 1940 and the Cosmetic Rules of 2020.

- The Central Drugs Standard Control Organization (CDSCO), operating within the Ministry of Health and Family Welfare, acts as the primary regulatory body. Compliance with CDSCO registration requirements is mandatory for all cosmetics produced or imported into the country.

(Source: Artixio)

United States

- The Modernization of Cosmetics Regulation Act of 2022 (MoCRA) introduces fresh regulations for cosmetic items, modifying Chapter VI: Cosmetics within the Federal Food, Drug, and Cosmetic Act (FD&C Act).

- Moreover, MoCRA grants the U.S. Food & Drug Administration (FDA or Agency) the authority to enforce product recalls and halt facility registrations in cases of serious health risks.

- Furthermore, MoCRA contains a provision preventing states from enacting divergent laws or regulations about cosmetics, encompassing product listing, registration, good manufacturing practices (GMP), record-keeping, recalls, adverse event reporting, and safety justification.

(Source: blog.nkgabc.com)

Brazil

- The National Health Surveillance Agency of Brazil (ANVISA) has introduced new measures that impact the personal care industry.

- However, ANVISA’s Resolution RDC 806/2023 has come into effect, ushering in changes to the list of substances that are prohibited in personal hygiene products, cosmetics, and perfumes.

- The updated resolution RDC 806/2023 is an evolution of a 2021 regulation, and it also incorporates the Mercosur technical regulation GMC 35/22.

(Source: gpc gateway)

Canada

- Cosmetic products sold in Canada must meet the criteria established in the Food and Drugs Act and the Cosmetic Regulations.

- These regulations mandate that cosmetics must undergo production, preparation, preservation, packaging, and storage in sanitary environments.

- Furthermore, compliance with additional applicable laws, such as the Canadian Environmental Protection Act, 1999 (CEPA), the Consumer Packaging and Labelling Act (CPLA), and the Cannabis Act, is compulsory.

(Source: Canada.ca)

China

- China’s revised Cosmetic Supervision and Administration Regulation (CSAR) in 2021 has resulted in notable changes in the cosmetics sector.

- New guidelines for cosmetic ingredient research were issued by the National Institute for Food and Drug Control (NIFDC) under the National Medical Products Administration (NMPA) on December 1, 2023.

(Source: Cisema, Chemilinked)

Recent Developments

Acquisitions and Mergers:

- L’Oréal acquired a prominent skincare brand, expanding its portfolio and market share in the cosmetics industry.

- Estée Lauder merged with a luxury fragrance company, creating synergies and diversifying its product offerings to cater to a broader consumer base.

New Product Launches:

- Cosmetic companies introduced innovative makeup and skincare products, such as foundations with built-in skincare benefits and serums targeting specific skin concerns.

- Beauty brands launched inclusive makeup lines with diverse shade ranges to cater to a wider range of skin tones and ethnicities.

Investment and Funding:

- Venture capital firms and private equity investors injected significant funding into emerging beauty startups, supporting product development and brand expansion.

- Crowdfunding campaigns enabled independent beauty brands to raise capital for new product launches and marketing initiatives.

Expansion into Digital Channels:

- Cosmetic companies expanded their presence in e-commerce and social media platforms, leveraging digital marketing strategies to reach and engage with consumers.

- Virtual try-on tools and augmented reality experiences were introduced to enhance the online shopping experience and facilitate product discovery.

Sustainability and Clean Beauty:

- Beauty brands emphasized sustainability and clean beauty initiatives, launching eco-friendly packaging and formulations free from harmful ingredients.

- Consumer demand for ethical and sustainable cosmetics drove the adoption of cruelty-free and vegan beauty products, prompting brands to prioritize ethical sourcing and production practices.

Celebrity Collaborations and Influencer Partnerships:

- Celebrity-endorsed makeup collections and influencer collaborations gained traction, driving sales and brand awareness among followers and fans.

- Beauty influencers and content creators played a significant role in product promotion and brand advocacy through sponsored content and product reviews.

Market Trends and Consumer Preferences:

- Market research reports highlighted emerging trends in skincare, such as the rise of clean skincare and the growing demand for anti-pollution and anti-aging products.

- Consumer surveys revealed a shift towards minimalistic makeup looks and multifunctional beauty products that offer convenience and versatility.

Conclusion

Cosmetics Statistics – The cosmetics industry stands as a beacon of continuous evolution and resilience, marked by its ability to adapt to consumer needs and leverage technological advancements.

Recent developments, particularly in natural and sustainable product offerings, underscore a shift toward environmentally conscious beauty solutions.

These innovations not only respond to growing ethical consumerism but also stimulate market expansion. As the industry harnesses digitalization, personalized beauty experiences are becoming the new norm, further driving consumer engagement and market growth.

The sector’s significant economic footprint and its intersection with wellness and lifestyle trends suggest a promising trajectory for future growth and influence.

FAQs

Current trends include a shift towards natural and organic ingredients, an emphasis on sustainability and eco-friendly packaging, and the rise of personalized beauty aided by digital technology.

Growth is being driven by increasing consumer awareness of self-care, advancements in beauty tech, and a surge in e-commerce, especially post-COVID-19.

Yes, there are concerns regarding the use of synthetic chemicals, the environmental impact of cosmetic packaging, and the ethical sourcing of ingredients.

Consumers are demanding more transparency, eco-friendly practices, and inclusivity in product ranges, which is leading brands to adapt and cater to these needs.

Regulations ensure product safety and quality, with authorities like the FDA setting guidelines for manufacturing and labeling, thus affecting market dynamics and consumer trust.