Table of Contents

Introduction

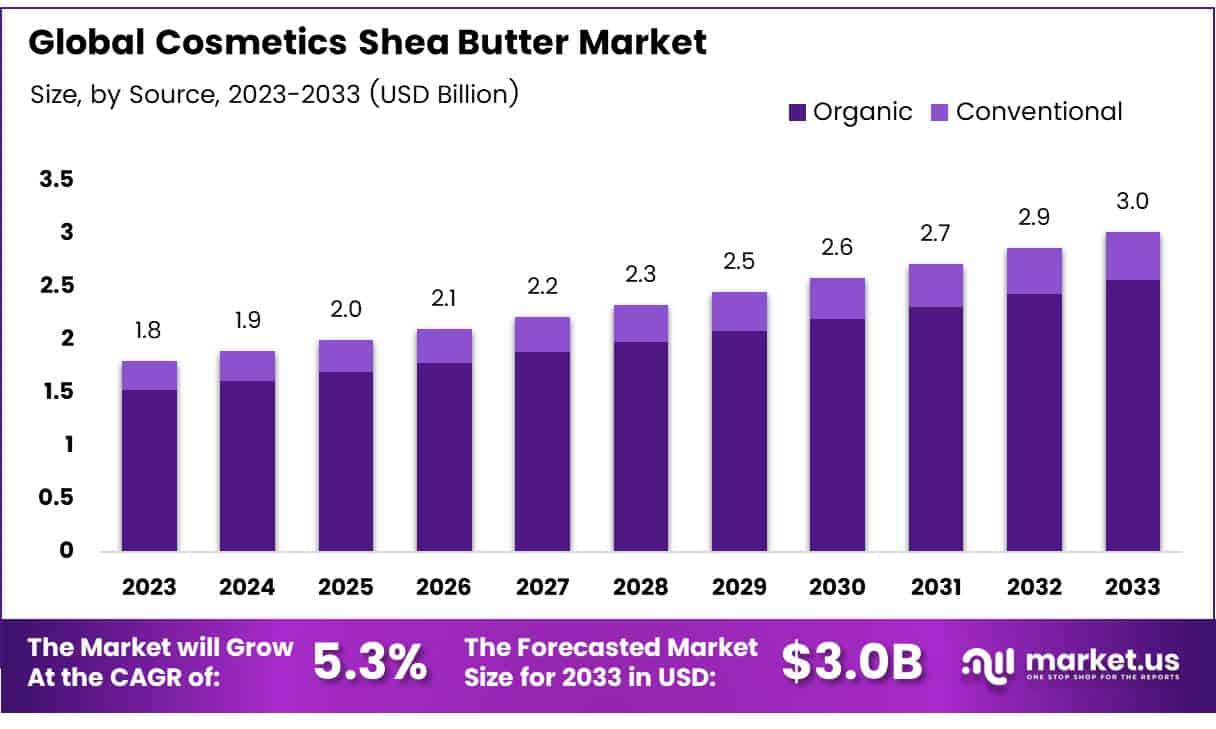

The Global Cosmetics Shea Butter Market is projected to reach approximately USD 3.0 billion by 2033, rising from an estimated value of USD 1.8 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 5.3% over the forecast period spanning from 2024 to 2033.

Cosmetics shea butter refers to the refined or unrefined fat extracted from the nuts of the Vitellaria paradoxa tree, predominantly grown in Africa, and is widely used in skincare and haircare formulations for its emollient, anti-inflammatory, and moisturizing properties. The cosmetics shea butter market represents the segment within the broader cosmetic ingredients industry focused on supplying shea butter as a key component in personal care products such as lotions, creams, balms, shampoos, and conditioners.

This market is witnessing steady expansion due to growing consumer inclination toward natural and organic personal care ingredients. The growth of the cosmetics shea butter market can be attributed to heightened awareness regarding the health benefits of shea butter, including its richness in vitamins A and E, as well as its ability to support skin elasticity and reduce signs of aging. Moreover, increasing demand for clean-label and sustainable beauty products is propelling the usage of shea butter as a preferred natural alternative to synthetic emollients.

Global demand is further driven by the rising disposable incomes in emerging economies and the expanding presence of global cosmetic brands in Asia-Pacific and Latin America. The market also benefits from the premiumization trend in skincare and the surge in DIY beauty products, which utilize raw or semi-processed shea butter. Significant opportunities lie in product innovation, such as incorporating ethically sourced, fair-trade certified shea butter, and expanding into men’s grooming and baby care categories.

Additionally, partnerships with African cooperatives and investments in sustainable sourcing practices are expected to enhance supply chain transparency and meet the evolving preferences of ethically conscious consumers.

Key Takeaways

- The global cosmetics shea butter market is projected to reach USD 3.0 billion by 2033, expanding at a CAGR of 5.3% during the forecast period from 2024 to 2033.

- The organic segment dominated the market in 2023, supported by growing consumer preference for natural and sustainable cosmetic products.

- Grade A (Unrefined) shea butter accounted for the largest market share in 2023, attributed to its high demand as a natural ingredient in skincare formulations.

- Lotions and creams emerged as the leading application segment in 2023, driven by increasing consumer focus on moisturization and clean beauty trends.

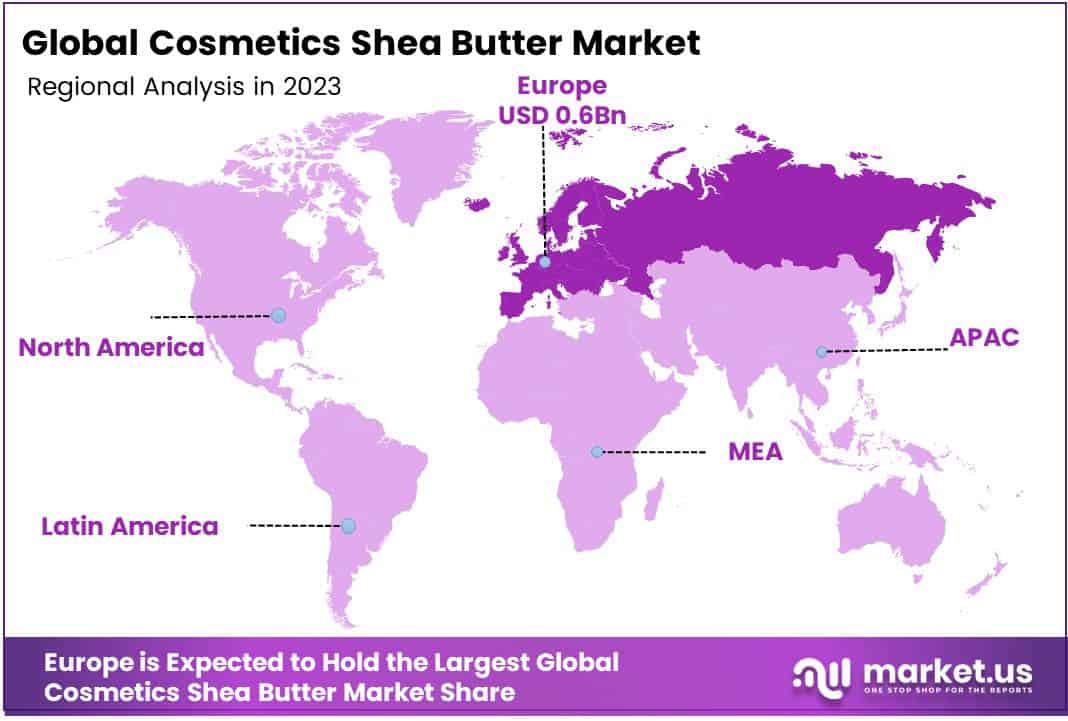

- Europe held the largest regional market share at 31%, valued at approximately USD 0.6 billion in 2023, propelled by strong demand for organic personal care products.

Tariffs and trade policy uncertainty could Imapct on, Request A Sample Copy Of This Report at https://market.us/report/cosmetics-shea-butter-market/request-sample/

Cosmetics Shea Butter Statistics

- The cosmetics industry in the United States generates around $49.2 billion annually.

- Each month, Americans spend between $244 and $313 on cosmetics.

- Globally, the cosmetics market is valued at approximately $571.10 billion.

- This global industry is expanding steadily at an annual growth rate of 3.8%.

- Personal care products are the largest category, making up 44.4% of the total market.

- This segment alone is worth about $253.3 billion worldwide.

- Men are increasingly purchasing skincare and grooming products.

- Sales of men’s skincare rose by 7% in the past year.

- About 40% of U.S. adults show interest in gender-neutral cosmetic products.

- African American consumers spend roughly $1.2 trillion on beauty products each year.

- That spending is expected to rise to $1.5 trillion this year.

- Cosmetics have been used for over 7,000 years across many cultures.

- The global beauty sector is growing at 7% annually, faster than global GDP.

Impact of U.S. Tariffs on Cosmetics Shea Butter Market

- Increased Production Costs: The application of tariffs on imported raw materials, including shea butter, has led to heightened production expenses for cosmetic manufacturers. This escalation in costs is often transferred to consumers, resulting in higher prices for beauty products.

- Supply Chain Disruptions: Tariffs have disrupted established supply chains, compelling companies to seek alternative sources or domestic production. Such adjustments can lead to supply shortages or increased costs, further straining the availability and affordability of shea butter in cosmetic formulations.

- Market Access Challenges: The imposition of tariffs has led to retaliatory measures from international trading partners. For instance, China imposed tariffs on U.S. beauty products, including ingredients like cocoa butter and coconut oil, which are essential in cosmetic formulations. Such actions restrict market access and adversely affect sales and revenue.

- Impact on International Trade Agreements: The introduction of tariffs has strained international trade relations, leading to disputes and the potential for further trade barriers. This environment of trade uncertainty hampers global business operations and affects the competitiveness of U.S. beauty products in international markets.

- Challenges for Small and Medium Enterprises (SMEs): SMEs in the beauty sector face significant hurdles due to tariffs, including increased operational costs and reduced competitiveness. Their limited resources make it challenging to absorb higher expenses or adapt to changing trade policies, potentially leading to market share loss.

Emerging Trends

- Rise in Demand for Clean Beauty Products: Consumers are increasingly seeking products free from synthetic chemicals, parabens, and artificial fragrances. Shea butter, being a natural ingredient, aligns with this demand, leading to its heightened incorporation in skincare lines.

- Ethical Sourcing and Fair Trade Practices: There’s a growing emphasis on sourcing shea butter through fair trade practices, ensuring fair wages and sustainable harvesting methods. This ethical approach resonates with socially conscious consumers.

- Technological Advancements in Extraction Methods: Innovations in extraction technologies, such as cold-pressing, have improved the quality and yield of shea butter, preserving its beneficial properties and meeting the rising demand.

- Integration into Multifunctional Beauty Products: Shea butter’s versatility has led to its inclusion in products that offer multiple benefits, such as moisturizing, anti-aging, and sun protection, catering to consumers seeking simplified skincare routines.

- Expansion in Online Retail Channels: The growth of e-commerce platforms has facilitated easier access to shea butter products, expanding their reach to a broader consumer base and boosting market growth.

Top Use Cases

- Moisturizing Lotions and Creams: Shea butter is widely used in lotions and creams for its hydrating properties, accounting for a significant portion of its application in the cosmetics industry.

- Hair Care Products: Its nourishing qualities make shea butter a popular ingredient in shampoos and conditioners, addressing issues like dryness and breakage.

- Lip Balms and Lipsticks: Shea butter’s emollient nature provides moisture and smoothness, making it ideal for lip care products.

- Body Butters and Massage Oils: Its rich texture and skin benefits have led to its use in body butters and massage oils, offering deep hydration and relaxation.

- Baby Care Products: Due to its gentle and soothing properties, shea butter is incorporated into baby lotions and creams to protect delicate skin.

Major Challenges

- Supply Chain and Sourcing Issues: The shea butter supply chain faces challenges due to its reliance on small-scale farmers and traditional processing methods, leading to potential inconsistencies in quality and supply.

- Climate Change Impact on Shea Nut Harvests: Environmental factors, such as unpredictable rainfall and rising temperatures, can affect shea nut yields, leading to supply shortages and price volatility.

- Competition from Alternative Natural Ingredients: Shea butter faces competition from other natural oils like coconut, argan, and almond oils, which offer similar skincare benefits, necessitating differentiation strategies.

- Regulatory Constraints: Evolving regulations related to the sourcing, production, and labeling of natural ingredients can pose challenges, especially for smaller companies striving to comply with stringent standards.

- Need for Consumer Education: In some regions, limited awareness about the benefits of shea butter can hinder its market potential, highlighting the need for educational initiatives to inform consumers.

Top Opportunities

- Expansion into Emerging Markets: Rising disposable incomes and increasing awareness of skincare benefits in regions like Asia Pacific and Latin America present significant growth opportunities for shea butter-based cosmetics.

- Development of Men’s Grooming Products: The growing trend of men’s grooming offers a new avenue for shea butter applications in products like beard oils and moisturizers.

- Innovation in Product Formulations: Combining shea butter with other natural ingredients can lead to innovative products that cater to specific consumer needs, enhancing market appeal.

- Emphasis on Ethical and Sustainable Practices: Brands that prioritize ethical sourcing and sustainability can differentiate themselves, attracting environmentally and socially conscious consumers.

- Leveraging Digital Marketing and E-commerce: Utilizing online platforms for marketing and sales can increase visibility and accessibility of shea butter products, driving consumer engagement and sales.

Key Player Analysis

The competitive landscape of the global Cosmetics Shea Butter Market in 2024 is shaped by a mix of multinational corporations and specialized producers, each contributing uniquely to product innovation, supply chain robustness, and sustainability initiatives.

Major players such as Cargill, Incorporated, AAK AB, and Archer Daniels Midland Company are leveraging their extensive global sourcing networks and processing capabilities to ensure a steady supply of high-quality shea butter, which is critical for meeting rising cosmetic industry demand.

BASF SE, Croda International Plc, and Clariant AG are focusing on value-added formulations by integrating shea butter into advanced cosmetic ingredients, driven by consumer preference for natural and multifunctional products.

Regional and niche suppliers such as Ghana Nuts Company Ltd, Ojoba Collective, and The Savannah Fruits Company are gaining prominence by capitalizing on ethical sourcing, organic certification, and fair-trade practices. Meanwhile, companies like Sophim S.A., Olvea Group, and Agrobotanicals, LLC are actively investing in R&D to develop refined, eco-conscious shea derivatives.

Top Key Players in the Market

- Cargill, Incorporated

- Clariant AG

- AAK AB

- Olvea Group

- Croda International Plc

- Ghana Nuts Company Ltd

- Agrobotanicals, LLC

- Archer Daniels Midland Company

- Bunge Limited

- BASF SE

- Sophim S.A.

- AOS Products Private Limited

- The Savannah Fruits Company

- Ojoba Collective

- The HallStar Company

Tariff Risks And Trade Uncertainty May Hinder Growth, Purchase The Full Report Now at https://market.us/purchase-report/?report_id=135306

Regional Analysis

Europe Lead Region Cosmetics Shea Butter Market with Largest Market Share 31%

The European region remains the dominant market for cosmetics shea butter, capturing an impressive 31% market share by 2024, with a market value estimated at USD 0.6 billion. This segment is characterized by sustained growth bolstered by consumer preference for natural and ethically sourced ingredients, which has significantly impacted the cosmetics segment.

Detailed regional analysis indicates that the robust performance in Europe can be attributed to high consumer awareness regarding sustainable products as well as the increasing demand within personal care and skincare sectors. Additionally, market dynamics have been shaped by international trade policies; notably, U.S. tariffs on cosmetics shea butter have indirectly influenced the pricing and competitive landscape in Europe, reinforcing the region’s position as a key hub for premium cosmetic ingredients.

The regional growth trend, supported by favorable regulatory frameworks and extensive market penetration, underscores Europe’s pivotal role in driving innovation and market expansion in the cosmetics shea butter industry.

Recent Developments

- In 2024, SheaMoisture launched its first deodorant line, created especially for melanin-rich skin. The range includes six antiperspirants and two whole-body deodorants. These products are approved by Black dermatologists and aim to even out skin tone, offer moisture, and keep skin smooth while reducing sweat and odor.

- In 2024, Bunge Loders Croklaan introduced Karibon, a new shea-based Cocoa Butter Equivalent for chocolate makers. This innovation is fully plant-based and designed to support better nutrition and sustainability. Karibon helps maintain great taste while offering lower saturated fat and higher stearic acid content than traditional cocoa butter.

- In 2024, ClayCo Cosmetics secured $2 million funding from Unilever Ventures. This investment will support the brand’s growth by expanding its product range, improving marketing efforts, and strengthening working capital. ClayCo plans to use the funds to reach more customers and enhance its brand presence.

- In 2024, RENÉE Cosmetics raised ₹100 crore in a Series B funding round. This round was led by Evolvence India and Edelweiss Group. With the new capital, RENÉE aims to expand its product offerings and improve its reach across both online and offline platforms. The company is currently valued between ₹1200 and ₹1400 crore.

Conclusion

The global cosmetics shea butter market is poised for sustained growth, driven by increasing consumer demand for natural and sustainable skincare solutions. Shea butter’s rich composition of vitamins and fatty acids makes it a preferred ingredient in various cosmetic products, including lotions, creams, and hair care formulations. The market benefits from technological advancements in extraction methods, ensuring higher quality and yield, while ethical sourcing practices resonate with socially conscious consumers. Europe continues to lead in market share, reflecting strong regional preferences for organic personal care products. Emerging markets in Asia-Pacific and Latin America present significant opportunities, fueled by rising disposable incomes and growing awareness of skincare benefits. Challenges such as supply chain complexities and competition from alternative natural ingredients persist; however, strategic investments in sustainable sourcing and product innovation are expected to mitigate these issues. Overall, the cosmetics shea butter market is expected to maintain a positive trajectory, supported by evolving consumer preferences and industry advancements.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)