Table of Contents

Introduction

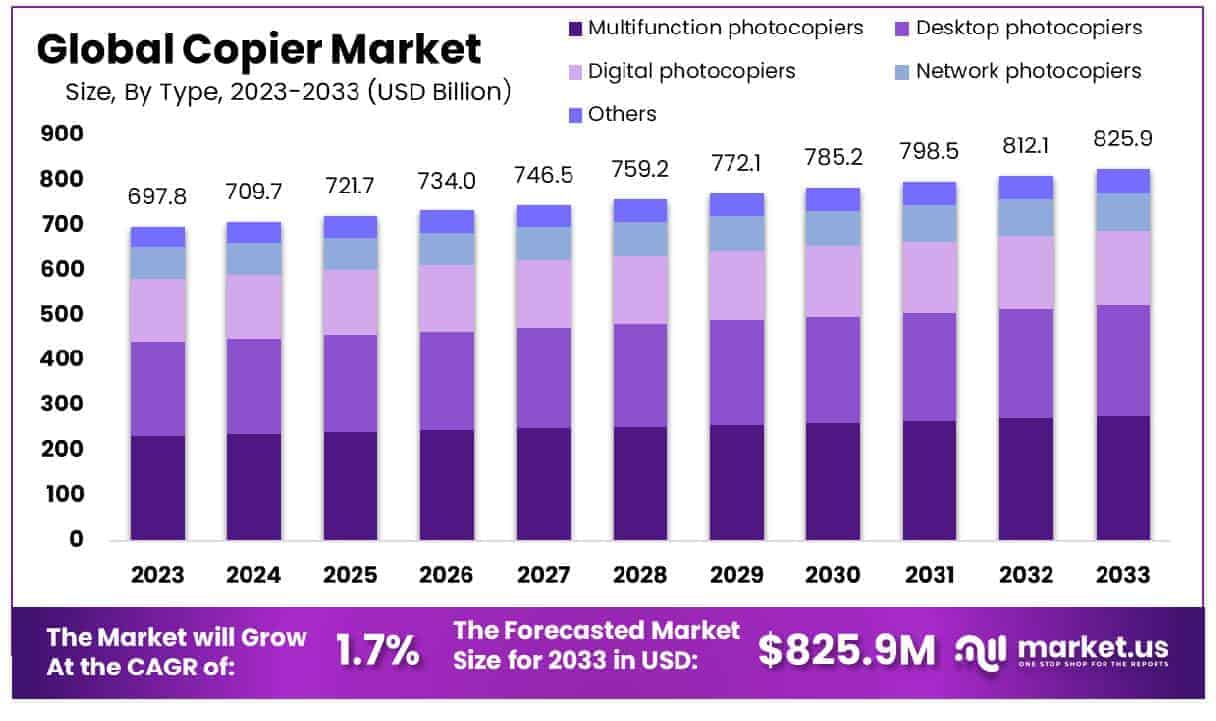

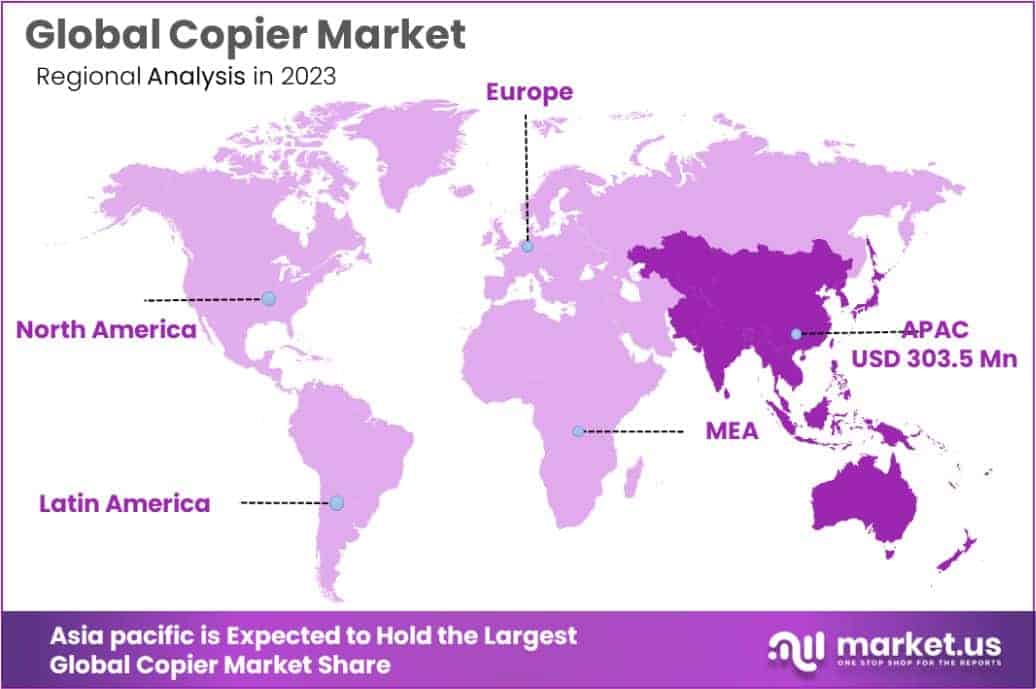

The Global Copier Market is projected to reach a value of approximately USD 825.9 million by 2033, up from USD 697.8 million in 2023, representing a compound annual growth rate (CAGR) of 1.7% during the forecast period from 2024 to 2033. In 2023, the Asia Pacific region led the market with a 43.5% share, generating revenue of USD 303.5 million from the copier market.

The copier market refers to the industry that manufactures, sells, and services copiers, which are machines designed for the purpose of making duplicates of documents, typically through photocopying or digital copying technologies. This market encompasses a wide range of devices, including traditional analog copiers, digital copiers, and multi-functional devices that combine printing, scanning, and faxing capabilities. The growth of the copier market can be attributed to the increasing demand for efficient document management solutions across industries such as healthcare, education, and corporate sectors.

Advancements in digital technologies and the integration of cloud-based services have further propelled market expansion. Additionally, the rising need for cost-effective, eco-friendly printing solutions and the adoption of energy-efficient devices are driving the demand for modern copiers. The market is poised for growth opportunities in emerging economies, where digitization efforts are increasing, creating demand for both low-cost and high-performance copying solutions. Furthermore, the rise of remote work and hybrid office models is expected to fuel future market growth.

Core Findings

- The Global Copier Market is projected to reach USD 825.9 Million by 2033, growing from USD 697.8 Million in 2023, reflecting a CAGR of 1.7% during the forecast period from 2024 to 2033.

- In 2023, Multifunction Photocopiers held a dominant position in the By Type segment, accounting for 33.4% of the market share.

- The Office segment led the By Application category in 2023, holding a 40.3% share of the market.

- Color Copiers maintained a dominant position in the By Copier Colour segment in 2023, with a 66.1% market share.

- Asia Pacific dominated the Copier Market in 2023, capturing 43.5% of the global market share, with a revenue of USD 303.5 Million.

Key Segments Analysis

In 2023, multifunction photocopiers dominated the market with a 33.4% share, owing to their versatile integration of printing, scanning, and copying functions, which make them ideal for high-productivity environments. Desktop photocopiers, designed for compact spaces, followed closely, catering to small offices and home environments. Digital photocopiers, recognized for their high-quality outputs and digital connectivity, also captured a notable share, particularly in settings requiring high-speed, high-resolution copying.

Network photocopiers, with their remote access capabilities, were increasingly adopted by large organizations for seamless multi-user functionality across departments and locations. Other copier types, including high-capacity and specialized models, catered to niche needs, such as high-volume or security-focused document handling.

The office segment led the market in 2023 with a 40.3% share, driven by the constant need for reliable and efficient copying solutions in business settings. Offices, spanning from small businesses to large corporations, rely on copiers for daily administrative and operational tasks. The government sector followed closely, utilizing copiers for managing extensive documentation in areas like public administration and legal records, requiring durable, high-volume machines.

The school segment represented a smaller share, reflecting the demand for copiers in educational environments for producing teaching materials and administrative documents. Other sectors, including healthcare, legal firms, and retail, also contributed to the market by requiring copiers for specialized purposes such as compliance or high-speed reproduction.

Color copiers commanded the largest share in 2023, holding 66.1% of the market, reflecting the growing demand for high-quality, vibrant prints, particularly for marketing and presentation materials. Modern color copiers are highly versatile, able to handle a variety of media types and sizes, making them a preferred choice in dynamic business environments. Monochrome copiers accounted for the remaining market share, with their cost-effectiveness making them a go-to option for standard black-and-white document reproduction, particularly in sectors such as legal and administrative offices. Advances in color copier technology, enhancing speed, efficiency, and connectivity, have contributed to their increasing dominance in the market.

Emerging Trends

- Transition to Cloud-Based Solutions: The adoption of cloud computing in the copier industry is increasingly influencing how copiers are used in offices. Many modern copiers are now integrated with cloud services, allowing users to store and access documents remotely, increasing flexibility and collaboration. This shift is also driving demand for multifunction devices capable of managing both physical and digital workflows.

- Sustainability and Eco-Friendly Features: As environmental concerns become more prevalent, copiers with eco-friendly features are gaining popularity. The focus is on energy-efficient machines, reduced use of consumables, and the development of copiers with a lower carbon footprint. Additionally, many copiers now feature recycling programs for toner cartridges and other parts, contributing to a circular economy.

- Integration of Artificial Intelligence (AI) and Automation: The integration of AI in copiers is revolutionizing document management. Intelligent copiers can now automatically sort, categorize, and optimize prints and scans. AI-powered solutions are streamlining workflows by recognizing patterns in document usage, reducing manual input and improving overall efficiency.

- Growth of Managed Print Services (MPS): Managed Print Services (MPS) are becoming more common in organizations looking to optimize their printing infrastructure. MPS providers analyze an organization’s printing needs, provide tailored solutions, and manage the entire copier fleet. This trend is growing as businesses seek to reduce costs and enhance productivity.

- Enhanced Security Features: With the increasing threat of cyber-attacks and data breaches, the copier industry is witnessing a rise in demand for enhanced security features. Modern copiers are now equipped with secure print, data encryption, and user authentication protocols to prevent unauthorized access to sensitive documents.

Top Use Cases

- Office Printing and Documentation: One of the primary uses for copiers remains in traditional office settings where employees require high-volume, cost-effective printing. According to industry estimates, businesses use copiers to produce millions of pages annually, ranging from basic text documents to complex color prints, making them essential for daily office tasks.

- Legal and Financial Sector Applications: In the legal and financial industries, copiers play a crucial role in document management, whether for printing contracts, reports, or compliance documents. Legal offices often rely on copiers that can handle high-volume output and provide clear, accurate reproduction for confidential and critical documents.

- Educational Institutions: Copiers are widely used in educational environments, from primary schools to universities, for copying learning materials, assignments, and administrative documents. In the education sector, copiers must be capable of managing large print runs and various document sizes to meet the diverse needs of students and faculty.

- Healthcare Document Management: In healthcare settings, copiers are indispensable for producing patient records, medical forms, and other critical documentation. These copiers are often integrated with secure document management systems to ensure compliance with privacy laws, such as HIPAA in the United States. Healthcare professionals require copiers that offer high-speed printing and enhanced security features.

- Retail and Customer Service Applications: Retailers and customer service providers use copiers for a range of tasks, including printing receipts, customer forms, and promotional materials. Multi-functional copiers that combine printing, scanning, and faxing capabilities are particularly useful for these environments, where quick, efficient document handling is critical to maintaining smooth operations.

Major Challenges

- High Operational Costs: Despite technological advancements, many businesses still face high operational costs associated with copier usage. The cost of consumables, such as toner and paper, as well as maintenance fees, can add up quickly. Companies are often looking for ways to optimize usage and reduce overall printing expenditures.

- Security Vulnerabilities: As copiers become more interconnected and networked, they present potential security risks. Many copiers are vulnerable to hacking, unauthorized access, and data breaches, particularly when handling sensitive documents. The need for continuous updates to security protocols and compliance with data protection regulations presents a significant challenge.

- Environmental Impact: Although there has been an increase in eco-friendly copier models, the overall environmental impact remains a challenge. The production and disposal of copiers and their consumables (like toner cartridges and paper) contribute to electronic waste. Efforts to promote sustainability are still limited, as not all organizations can afford or implement green alternatives.

- Lack of Integration with Other Systems: Many copiers, especially older models, are not fully integrated with other enterprise software or digital workflows. This lack of integration can hinder productivity and increase manual intervention, as employees are forced to handle documents in separate, non-automated systems. Overcoming this challenge requires investing in advanced multifunction devices that seamlessly connect with existing business systems.

- Complexity in Device Management: As companies expand their copier fleets, managing a large number of devices can become increasingly complex. Monitoring usage, maintaining devices, and ensuring consistent performance across multiple locations can be challenging. Organizations often struggle with the logistics and time required for efficient fleet management, resulting in downtime and underutilization.

Top Opportunities

- Rising Demand for Cloud-Based Solutions: With the growing trend toward digital transformation, there is significant opportunity in offering cloud-based copier solutions. Cloud integration allows businesses to store, manage, and access documents remotely, creating a new avenue for copier vendors to provide innovative services and enhance workflow efficiency.

- Expansion into Emerging Markets: Emerging economies, particularly in Asia-Pacific and Africa, represent an important growth opportunity for the copier industry. As businesses and educational institutions expand in these regions, there will be an increasing demand for high-quality, cost-effective copiers to meet both printing and document management needs.

- Integration of Sustainable Technology: As more organizations adopt sustainability initiatives, there is a growing market for eco-friendly copiers. Companies are seeking devices that reduce waste, use less energy, and incorporate recyclable materials. Manufacturers that invest in developing more sustainable copier models will benefit from the increasing demand for green technology.

- Increased Adoption of Managed Print Services (MPS): The ongoing adoption of Managed Print Services (MPS) presents a significant growth opportunity for the copier industry. Organizations are increasingly looking for ways to optimize their document management infrastructure, reduce costs, and enhance productivity, making MPS an attractive option. The growing focus on cost control and efficiency is expected to drive the demand for MPS solutions.

- Advancements in Copier Automation and AI: As artificial intelligence and automation continue to evolve, there are considerable opportunities for copier manufacturers to develop intelligent devices. These copiers can optimize print jobs, reduce paper waste, and improve overall efficiency by automating tasks such as sorting, document categorization, and resource allocation. This technological evolution represents a key area for growth in the industry.

Asia Pacific Copier Market

The Asia Pacific region is expected to maintain its dominant position in the global copier market, commanding a significant share of 43.5% in 2023, valued at approximately USD 303.5 million. This region’s robust growth can be attributed to the rapid industrialization, increasing business activities, and a growing demand for office automation and document management solutions across countries such as China, Japan, India, and South Korea. Notably, China is one of the largest contributors to this market share, driven by the expansion of its corporate sector and a rising need for advanced printing solutions in both private and government sectors.

Additionally, Japan’s technological innovation and South Korea’s high penetration of office equipment play a pivotal role in bolstering the market in the region. The rapid adoption of advanced copier models, coupled with the increasing shift toward digital transformation in businesses, is further enhancing demand across key markets in Asia Pacific. As a result, this region continues to lead the copier market, both in terms of value and volume.

Recent Developments

- In October 2023, Sharp Imaging and Information Company of America (SIICA) launched two new A4 monochrome multifunction printers (MFPs), designed to provide businesses and educational institutions with the features of larger MFPs in a compact size. The BP-B540WR and BP-B550WD models offer faster printing speeds and improved user interfaces. The BP-B540WR prints up to 40 pages per minute, while the BP-B550WD offers speeds of up to 50 pages per minute. Both models feature a 7-inch touchscreen for an enhanced user experience and are compatible with Sharp OSA 6.0 for seamless integration into workflows.

- In March 2024, HP Inc. unveiled new services at the Amplify Partner Conference. The newly introduced HP Workforce Experience Platform, powered by AI, is designed to enhance digital experiences for businesses. HP also launched a new managed service for PCs, a print subscription model, and flexible support options, along with sustainability-focused initiatives to extend the lifecycle of devices.

- In August 2023, Ricoh Company, Ltd. announced a strategic share transfer involving five subsidiaries of Toshiba Tec Corporation to Ricoh Technologies. This transfer, part of an ongoing business integration process, will further strengthen Ricoh’s portfolio in the document solutions sector by forming a joint venture with Toshiba Tec.

- In February 2024, Xerox Holdings Corporation revealed a range of new solutions to help businesses accelerate digital transformation in hybrid work environments. These tools focus on boosting productivity, enhancing security, and improving user experiences across hardware and software, aimed at creating a secure, efficient, and sustainable workplace.

- In August 2023, Konica Minolta Business Solutions U.S.A., Inc. completed the acquisition of Muratec America, Inc., a well-known provider of MFP solutions and managed document services. The acquisition will help expand Konica Minolta’s market presence and further solidify its leadership in the document management industry. Muratec will continue to operate under its existing leadership and as a subsidiary of Konica Minolta.

Conclusion

The Global copier market is positioned for steady growth, driven by advancements in technology and evolving workplace demands. As businesses continue to seek efficient, cost-effective, and eco-friendly solutions for document management, multifunctional copiers and cloud-based integrations are gaining increasing traction. The demand for digital transformation, automation, and sustainability in copier systems is reshaping the industry, offering substantial opportunities for both established and emerging players.

While challenges such as high operational costs, security concerns, and environmental impact persist, ongoing innovations, particularly in artificial intelligence and managed print services, are likely to mitigate these issues. The copier market’s continued expansion in key regions, especially in emerging economies, presents a promising outlook, fostering the growth of both traditional and next-generation copying solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)