Table of Contents

Introduction

The Global Compact Loader Market is projected to reach approximately USD 41.4 billion by 2034, up from an estimated USD 26.9 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 4.4% during the forecast period from 2025 to 2034.

A compact loader, also known as a small or mini loader, is a versatile and compact construction machine designed primarily for material handling, excavation, and earthmoving tasks in confined spaces. These machines are engineered for enhanced maneuverability, productivity, and ease of use, making them suitable for a wide range of applications including landscaping, agriculture, municipal maintenance, and light construction work. The compact loader market refers to the global industry surrounding the production, distribution, and utilization of these machines.

This market encompasses various types of compact loaders such as skid steer loaders, track loaders, and articulated loaders, each offering unique performance characteristics tailored to specific operational requirements. Growth in this market is being driven by increasing urbanization and infrastructure development, particularly in emerging economies where space constraints necessitate the use of smaller, agile machinery. Additionally, heightened investments in public infrastructure and residential construction projects are contributing significantly to the demand.

The demand for compact loaders is further supported by their ability to accommodate a wide variety of attachments, enhancing their utility across multiple sectors. Furthermore, technological advancements such as telematics integration and electric-powered models are opening new avenues for innovation and sustainability, aligning with global trends toward low-emission construction equipment. The growing emphasis on operational efficiency, coupled with rising labor costs, has prompted contractors and operators to favor compact loaders for their cost-effectiveness and high performance in limited workspaces. Consequently, the compact loader market presents strong opportunities for manufacturers to expand their product portfolios, cater to niche applications, and tap into the increasing preference for multipurpose equipment across developed and developing markets alike.

Key Takeaways

- The Compact Loader Market was valued at USD 26.9 Billion in 2024 and is projected to reach USD 41.4 Billion by 2034, growing at a CAGR of 4.4% during the forecast period.

- Skid Steer Loaders accounted for the largest share in 2024, holding 38% of the product type segment. Their high maneuverability supports a wide range of construction and agricultural applications.

- Loaders with an operating capacity of 1,200–2,000 lbs led the market in 2024 with a 40% share, offering versatility for diverse job site conditions and functional tasks.

- The 50–75 HP engine power segment dominated the market with a 55% share in 2024, delivering an efficient power-to-performance ratio ideal for small to medium-scale operations.

- The construction sector remained the leading application area, contributing 45% of the market share in 2024. Compact loaders are vital for excavation, grading, and material transport in construction activities.

- Asia Pacific emerged as the dominant regional market in 2024. The growth is primarily driven by large-scale infrastructure development, increasing construction activities, and rapid agricultural mechanization across emerging economies in the region.

Delve into Sector-Wise Impact Assessments of US Trade Tariffs at https://market.us/report/compact-loader-market/request-sample/

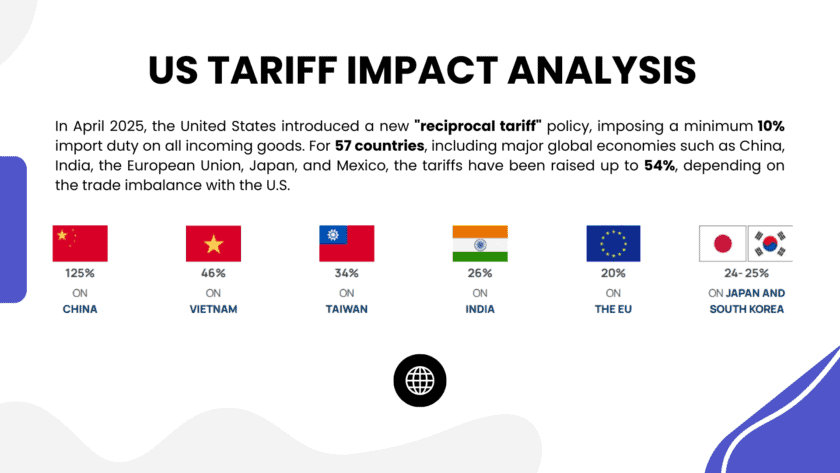

Impact of U.S. Tariffs on the Compact Loader Market

The imposition of new U.S. tariffs in 2025 has introduced significant challenges to the compact loader market, influencing both cost structures and strategic operations. Tariffs on imported steel and aluminum have escalated raw material expenses, thereby increasing production costs for compact loaders. Additionally, tariffs on imported machinery components have disrupted supply chains, leading to longer lead times and potential production delays.

These factors have compelled manufacturers to reassess their sourcing strategies and consider localizing production to mitigate tariff impacts. Furthermore, the uncertainty surrounding tariff policies has affected investment decisions, with some companies postponing capital expenditures and expansion plans. In the rental market, increased acquisition costs may translate to higher rental rates, potentially affecting demand. Overall, while the compact loader market continues to grow, the current tariff environment necessitates strategic adjustments by industry stakeholders to navigate the evolving economic landscape

Emerging Trends

- Adoption of Electric and Hybrid Models: The shift towards environmentally friendly machinery has led to increased demand for electric and hybrid compact loaders. These models offer reduced emissions and operational costs, aligning with global sustainability goals.

- Integration of Advanced Technologies: Incorporation of telematics, automation, and Internet of Things (IoT) solutions enhances equipment efficiency, reduces downtime, and provides real-time data for better decision-making.

- Growth in Rental Services: The rise of equipment rental services has made compact loaders more accessible to small and medium enterprises, promoting flexibility and cost-effectiveness in operations.

- Customization and Versatility: Manufacturers are offering customizable compact loaders with various attachments, catering to specific industry needs and enhancing machine versatility.

- Increased Focus on Operator Comfort and Safety: Modern compact loaders are being designed with improved ergonomics, safety features, and user-friendly controls to enhance operator comfort and reduce fatigue.

Top Use Cases

- Construction Industry: Compact loaders are extensively used for material handling, excavation, and site preparation in residential and commercial construction projects, especially in urban areas with space constraints.

- Agricultural Operations: In agriculture, compact loaders assist in tasks such as plowing, harvesting, and transporting materials, contributing to increased productivity and efficiency.

- Landscaping and Gardening: Their maneuverability makes compact loaders ideal for landscaping tasks, including soil movement, grading, and debris removal in confined spaces.

- Waste Management: Compact loaders are employed in waste collection and disposal operations, aiding in efficient handling and transportation of waste materials.

- Snow Removal: In regions experiencing snowfall, compact loaders are utilized for clearing snow from roads, driveways, and public spaces, ensuring accessibility and safety.

Major Challenges

- High Initial Investment: The substantial upfront cost of compact loaders can be a barrier for small businesses and individual operators, limiting market penetration.

- Maintenance and Operational Costs: Regular maintenance and potential repair costs can add to the total cost of ownership, affecting profitability for end-users.

- Skilled Operator Shortage: A lack of trained and experienced operators can hinder the effective utilization of compact loaders, impacting operational efficiency.

- Regulatory Compliance: Adhering to varying environmental and safety regulations across regions can pose challenges for manufacturers and users alike.

- Technological Adaptation: Integrating advanced technologies requires significant investment and training, which may be challenging for smaller enterprises.

Top Opportunities

- Urban Infrastructure Development: Ongoing urbanization and infrastructure projects, particularly in Asia-Pacific countries like India and China, are creating substantial demand for compact loaders.

- Agricultural Mechanization: The push towards modernizing agriculture in developing nations presents opportunities for compact loader adoption in farming activities.

- Expansion of Rental Markets: The growing preference for equipment rental over ownership opens avenues for rental companies to expand their compact loader fleets.

- Technological Innovations: Advancements in electric and hybrid technologies offer prospects for developing eco-friendly compact loaders, meeting the rising demand for sustainable equipment.

- Diversification into New Applications: Exploring new applications in sectors like mining, forestry, and logistics can drive market growth and diversification.

Key Player Analysis

In the 2024 global compact loader market, competition among key players remains intense, driven by innovation, regional expansion, and product diversification. Caterpillar Inc. and Deere & Company continue to hold dominant positions through expansive dealer networks and robust R&D capabilities. Bobcat Company maintains a strong foothold owing to its specialized compact equipment portfolio and continuous enhancements in operator comfort and machine versatility.

Komatsu Ltd. and CNH Industrial N.V. (CASE Construction Equipment) leverage their global manufacturing infrastructure and integrated technology solutions to remain competitive. JCB Ltd. emphasizes rapid model upgrades and cost-effective designs tailored for emerging markets. Hitachi Construction Machinery Co., Ltd. and Volvo Construction Equipment focus on fuel-efficient, low-emission compact loaders aligned with sustainability goals. Meanwhile, Kubota Corporation and Takeuchi Manufacturing Co., Ltd. capitalize on niche market demands and compact design excellence, especially in urban construction projects. Overall, strategic collaborations and the integration of automation and telematics are reshaping the competitive dynamics across the segment.

Top Companies in the Market

- Caterpillar Inc.

- Deere & Company

- Bobcat Company

- Komatsu Ltd.

- CNH Industrial N.V. (CASE Construction Equipment)

- JCB Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- Kubota Corporation

- Takeuchi Manufacturing Co., Ltd.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=138116

Recent Developments

- In 2024, Yanmar Compact Equipment introduced its first compact track loader models, the TL100VS, specifically for the North American market. This milestone comes after four years of development efforts and the strategic use of a U.S.-based production site acquired earlier. The launch reflects Yanmar’s intention to broaden its presence in compact machinery and deliver advanced solutions for various applications.

- In 2024, Yuchai Heavy Industry is preparing to introduce multiple electric models on April 9, aimed at transforming compact construction equipment. The new releases include several electric skid steer loaders such as the S150, S35MAX, and X35 MAX, alongside the Z25 Mini Loader. These machines are expected to offer quiet operation and high energy efficiency, targeting modern job site needs.

- In 2023, JCB took a step toward zero-carbon goals by revealing hydrogen-powered engines. The company, known for its innovation in construction machinery, committed £100 million to this clean energy initiative. Its hydrogen combustion engine aims to significantly reduce emissions without compromising on equipment power or reliability.

- In 2024, CNH Industrial plans to increase its footprint in India with an investment of up to $50 million. As part of this strategy, CNH will launch a 105HP tractor in May. This initiative is part of the company’s broader commitment to support agricultural growth and bring modern farming solutions to Indian markets.

Conclusion

The global compact loader market is poised for sustained expansion, driven by increasing urbanization, infrastructure development, and the growing demand for versatile machinery across various sectors. The integration of advanced technologies, such as telematics and electric powertrains, is enhancing equipment efficiency and aligning with global sustainability goals. Furthermore, the rise of equipment rental services is making compact loaders more accessible to small and medium enterprises, promoting flexibility and cost-effectiveness in operations. Manufacturers are also focusing on customization and operator comfort to meet specific industry needs and improve user experience. However, challenges such as high initial investment costs and the need for skilled operators persist. Overall, the market presents significant opportunities for growth, particularly in emerging economies where construction and agricultural activities are on the rise.