Table of Contents

Introduction

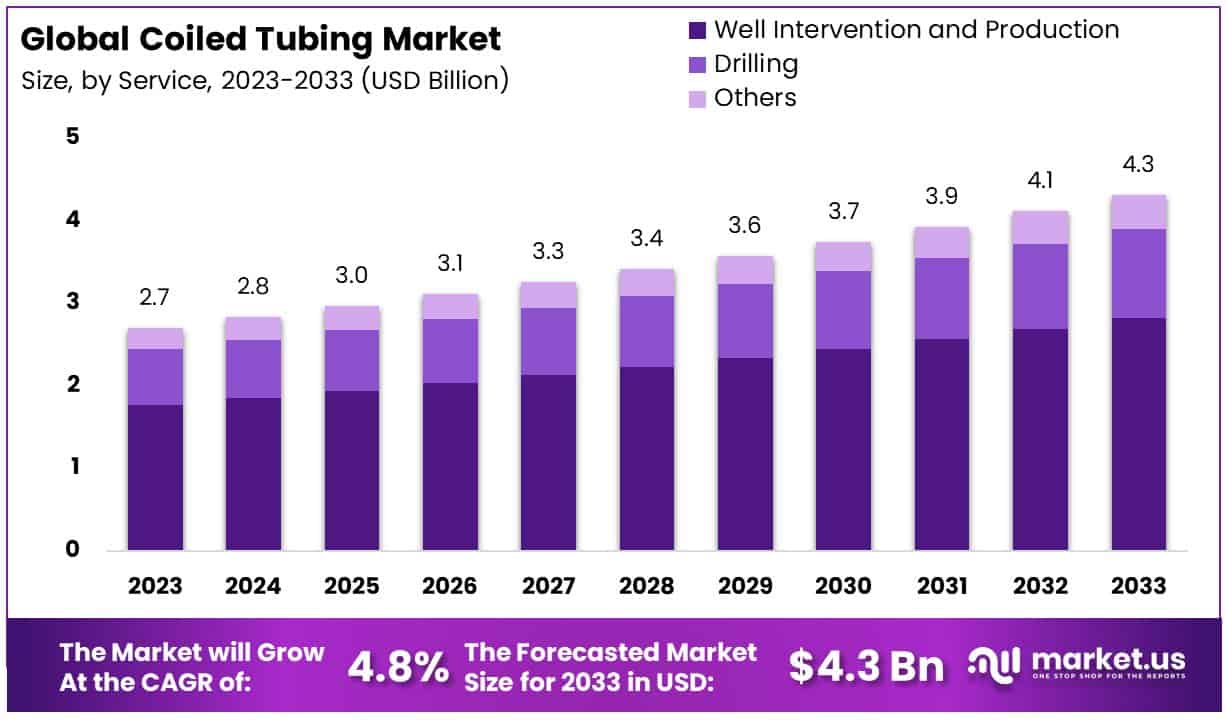

The Global Coiled Tubing Market is projected to reach a value of approximately USD 4.3 billion by 2033, up from an estimated USD 2.7 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 4.80% during the forecast period from 2024 to 2033.

Coiled tubing refers to a continuous length of steel or composite tubing that is wound onto a large reel for use in oil and gas exploration and production. It serves as a highly versatile tool for a range of well-intervention operations, including drilling, well cleaning, hydraulic fracturing, and cementing, among others. Its flexibility, combined with the ability to perform operations without shutting down production, has made coiled tubing a critical asset in the oilfield services sector.

The coiled tubing market encompasses the manufacturing, distribution, and deployment of coiled tubing equipment and related services for oil and gas exploration, development, and maintenance. This market caters primarily to upstream oilfield operations, offering solutions that enhance operational efficiency, reduce downtime, and lower costs. The scope of the market extends across applications in onshore and offshore fields, with increasing adoption in unconventional resource development, such as shale gas and tight oil.

Several key drivers are shaping the growth of the coiled tubing market. The ongoing expansion of oil and gas exploration activities, particularly in unconventional reservoirs, is a significant factor. Increased focus on extending the life of mature oilfields is also fueling demand for well-intervention services, where coiled tubing plays a central role. Furthermore, the industry’s shift toward cost-efficient and time-saving technologies has driven the adoption of coiled tubing, which allows operators to conduct interventions without halting production. Advances in coiled tubing materials and designs, such as enhanced fatigue resistance and higher pressure capabilities, are also contributing to the market’s growth trajectory.

The demand for coiled tubing services is directly tied to upstream oil and gas activities. Fluctuations in oil prices play a critical role, influencing exploration budgets and, by extension, investments in coiled tubing operations. Additionally, regions with a high concentration of aging oilfields, such as North America and the Middle East, exhibit robust demand for coiled tubing services due to the need for regular maintenance and enhanced oil recovery. With the global energy transition underway, demand is also emerging from operators looking to optimize traditional hydrocarbons while exploring synergies with geothermal well applications, which are gaining attention in certain regions.

The coiled tubing market is poised to benefit from technological advancements, such as automation and digitalization, which are making operations more efficient and cost-effective. Growth opportunities are particularly notable in unconventional oil and gas resources, where coiled tubing is instrumental in horizontal well interventions and hydraulic fracturing operations. Additionally, offshore exploration projects, driven by increasing investments in deepwater and ultra-deepwater fields, present a lucrative avenue for market expansion.

Companies can also explore opportunities in emerging markets, where energy demand is rising, and infrastructure development is spurring upstream activity. Integrating coiled tubing with renewable energy projects, such as geothermal wells, further enhances its potential in a diversifying energy landscape.

Key Takeaways

- The Global Coiled Tubing Market is projected to grow from USD 2.7 billion in 2023 to USD 4.3 billion by 2033 at a 4.80% CAGR.

- Well Intervention & Production leads with 65.4%, focusing on extending the life of aging wells and boosting production. Other services like Well Completion, Cleaning, and Drilling also play important roles.

- Logging Operations hold 21.6%, offering essential reservoir data. Circulation, Pumping, and Perforation also support efficient oil and gas extraction.

- Onshore dominates with 66.2%, reflecting the importance of land-based oil and gas operations.

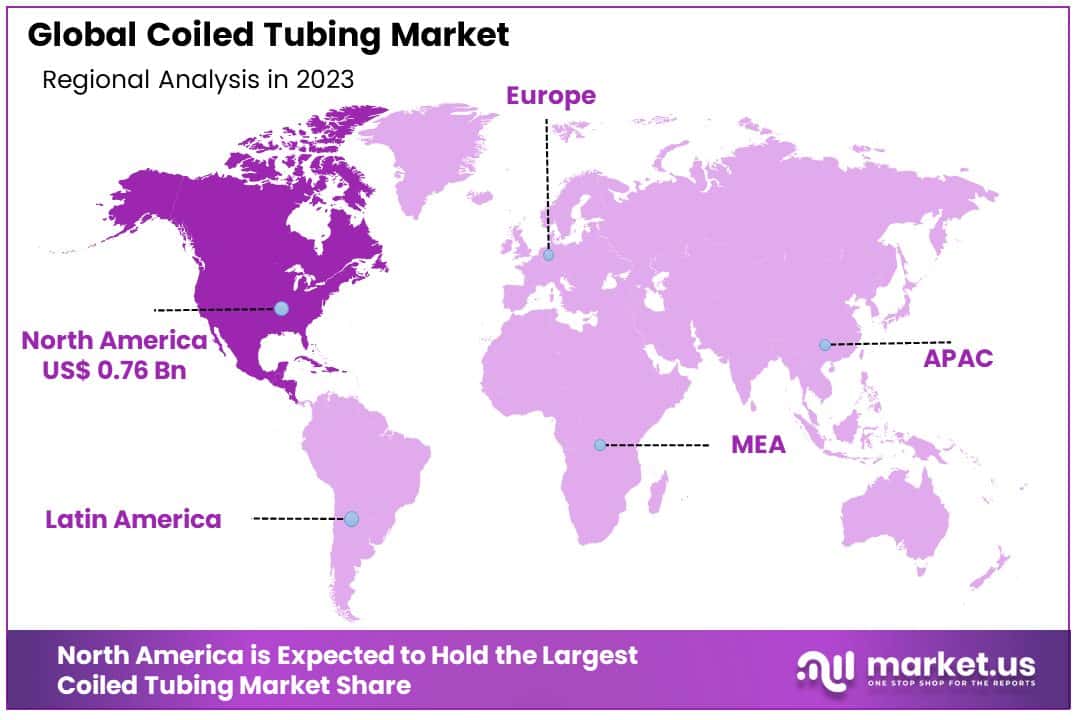

- North America Leads the market with a 28.4% share, driven by advanced technologies and strong oil and gas activities.

- Europe Holds 21.3% market share, supported by mature North Sea oil fields and strict environmental regulations.

Coiled Tubing Statistics

- Advanced coiled tubing systems now operate at pressures up to 15,000 PSI under extreme conditions.

- Coiled tubing reduces well intervention time by as much as 60% compared to rigid pipe methods.

- Typical coiled tubing depths range from 5,000 to over 20,000 feet, depending on the use case.

- By 2023, around 9,000 unused but approved permits for U.S. federal land production suggest potential growth in coiled tubing demand.

- Approximately 70% of oil wells require interventions during their lifecycle, driving demand for coiled tubing.

- As of 2024, coiled tubing is used in about 30% of global well interventions due to its operational efficiency.

- Global energy demand is expected to grow by over 25% by 2040, encouraging adoption of efficient technologies like coiled tubing.

- Over 55% of new wells globally now implement advanced completion methods, including coiled tubing technologies.

Emerging Trends

- Shift Towards Advanced Material Development: Innovations in coiled tubing materials are driving better performance and durability. High-strength, corrosion-resistant alloys, such as duplex stainless steel, are increasingly being used to extend tubing lifespan in harsh environments like deepwater and high-temperature wells. These advancements are enhancing operational efficiency and reducing downtime.

- Automation and Digitalization: The adoption of automation technologies, such as smart sensors and digital twins, is growing in the coiled tubing sector. These technologies allow real-time monitoring of tubing operations, enabling operators to predict failures, optimize performance, and reduce risks. Digitalization is anticipated to significantly improve decision-making across well interventions.

- Rising Application in Unconventional Resources: Coiled tubing is gaining traction in the exploitation of unconventional oil and gas reservoirs, such as shale and tight formations. Its versatility in horizontal drilling and fracturing operations has made it indispensable, especially in the U.S. shale revolution. The global focus on unconventional energy sources is expected to further boost its demand.

- Growing Demand for Multilateral Wells: Coiled tubing is increasingly being used in multilateral well operations to maximize reservoir contact. As operators aim to improve production efficiency while reducing the environmental footprint, coiled tubing offers a cost-effective and versatile solution for such complex well structures.

- Integration of Green Technologies: Environmental concerns are shaping coiled tubing applications. The use of greener chemicals, biodegradable fluids, and energy-efficient equipment in coiled tubing operations is becoming a major trend. This aligns with industry goals to minimize carbon emissions and comply with stricter environmental regulations.

Top Use Cases

- Well Cleaning and Maintenance: Coiled tubing is extensively used for removing blockages, such as sand, debris, or paraffin buildup, that restrict oil or gas flow in wells. Its ability to operate under pressure and without stopping production makes it a cost-effective solution. For example, using coiled tubing for well cleaning can reduce non-productive time by up to 40%.

- Hydraulic Fracturing: In unconventional reservoirs, coiled tubing plays a critical role in hydraulic fracturing by enabling precise delivery of fracturing fluids into the formation. It is particularly advantageous for multi-stage fracking in horizontal wells, improving operational efficiency and reducing downtime.

- Drilling Operations: Coiled tubing is frequently used for slim-hole drilling and re-entry drilling in mature wells. Its continuous and flexible design enables drilling without the need for joints, resulting in faster operations and lower drilling costs. Studies show that coiled tubing drilling can cut well development time by 20-30%.

- Cementing and Plugging: Coiled tubing is widely applied in cementing operations for sealing wellbores or plugging abandoned wells. Its ability to accurately place cement at the required depth ensures better well integrity and reduces the risk of environmental contamination.

- Fishing Operations: Coiled tubing is used in fishing operations to retrieve lost or stuck tools, pipes, or other equipment from the wellbore. Its flexibility and strength allow for efficient recovery, minimizing operational downtime and the associated costs of well intervention.

Major Challenges

- Material Fatigue and Failures: Coiled tubing is subjected to repeated bending and unbending during operations, leading to fatigue and material degradation. Studies indicate that fatigue-related failures account for over 30% of coiled tubing malfunctions, particularly in high-pressure and high-temperature wells.

- High Operational Costs: The deployment of coiled tubing involves significant costs related to equipment, skilled personnel, and maintenance. For instance, deepwater operations can cost millions of dollars per project, making it challenging for smaller operators to adopt these technologies.

- Environmental Regulations: Stricter environmental standards are impacting the coiled tubing market. Disposal of waste fluids, emissions during operations, and the use of chemical additives are coming under increased scrutiny, driving up compliance costs for operators.

- Limited Lifespan in Harsh Environments: Coiled tubing often experiences accelerated wear and tear in extreme conditions, such as corrosive environments or wells with high levels of hydrogen sulfide (H2S). This shortens its operational life, increasing replacement frequency and overall costs.

- Shortage of Skilled Workforce: Operating coiled tubing equipment requires specialized skills. A global shortage of experienced personnel is posing challenges for the industry, especially in regions with emerging oil and gas markets, such as Africa and Southeast Asia.

Top Opportunities

- Expansion in Mature Oilfields: With approximately 70% of global oilfields reaching maturity, the need for enhanced oil recovery (EOR) techniques is growing. Coiled tubing offers a cost-efficient solution for interventions in aging wells, creating significant opportunities for service providers.

- Rising Investment in Deepwater Exploration: The global focus on deepwater oil and gas reserves, particularly in regions like Brazil and West Africa, is creating a demand for robust coiled tubing technologies. These environments require advanced tubing capable of handling extreme pressures and temperatures.

- Growing Adoption in Renewable Energy Geothermal Wells: Coiled tubing is finding new applications in the renewable energy sector, particularly in geothermal wells. Its ability to drill and intervene in high-temperature conditions is opening opportunities for coiled tubing services as geothermal energy projects expand globally.

- Technological Advancements in Equipment: Innovations in coiled tubing units, such as modular designs and compact systems, are enabling deployment in remote and space-constrained locations. These advancements are expected to boost adoption in offshore platforms and unconventional resources.

- Market Growth in Emerging Economies: Regions such as the Middle East, Africa, and Asia-Pacific are witnessing rapid development in their oil and gas sectors. Increasing investments in exploration and production activities are driving demand for coiled tubing solutions, particularly in unconventional and marginal fields. For instance, Asia-Pacific alone is projected to account for a significant share of global oil demand growth over the next decade.

North America Coiled Tubing Market

North America Leads the Coiled Tubing Market with Largest Market Share of 28.4%

North America dominates the coiled tubing market, holding the largest regional market share of 28.4% in 2023, translating to an estimated market value of USD 0.76 billion. This leadership position is driven by the region’s robust oil and gas exploration activities, particularly in the United States and Canada, where shale gas extraction and offshore drilling are prominent. The U.S. continues to be a significant growth driver, supported by technological advancements in well intervention services and the increasing focus on enhancing production efficiency in aging oil fields.

Furthermore, the presence of major oilfield service providers and favorable regulatory frameworks for energy production bolster the adoption of coiled tubing solutions in this region. North America’s strong energy infrastructure and its position as a leading oil and gas producer globally further solidify its dominance in the coiled tubing market.

Key Player Analysis

- Tenaris: Tenaris is a global leader in steel pipe manufacturing, offering high-performance coiled tubing products designed for enhanced durability and operational efficiency. The company’s advanced manufacturing processes, such as seamless tube technology, support the oil and gas sector’s growing demand for reliable and corrosion-resistant solutions. Tenaris has invested significantly in R&D and operates in over 25 countries, generating annual revenues of approximately $12 billion (2022).

- Schlumberger Limited: As one of the largest oilfield service providers worldwide, Schlumberger delivers a comprehensive range of coiled tubing solutions for well intervention and stimulation. Its proprietary ACTive technology enables real-time downhole monitoring, enhancing operational efficiency and precision. In 2022, Schlumberger reported revenues of $28.1 billion, reflecting its dominant market position and extensive global footprint.

- Baker Hughes Company: Baker Hughes provides innovative coiled tubing systems and services tailored for challenging environments, including deepwater and high-pressure wells. With its advanced equipment and integrated digital platforms, Baker Hughes ensures optimal performance in well operations. The company’s revenue for 2022 stood at approximately $21.2 billion, underscoring its significant contribution to the oilfield services market.

- Halliburton Company: Halliburton is a key player in the coiled tubing market, offering cutting-edge solutions for wellbore intervention and remediation. Its advanced service portfolio includes friction-reducing systems and real-time monitoring tools, which enhance productivity and minimize operational risks. Halliburton recorded revenues of $20.3 billion in 2022, further cementing its position as a market leader.

- Weatherford International PLC: Weatherford specializes in high-performance coiled tubing tools and services that optimize well lifecycle management. With a focus on innovative designs such as mechanized injector heads, the company addresses the industry’s growing demand for operational efficiency. Weatherford generated revenues of $4.3 billion in 2022, highlighting its role as a key contributor to the sector.

Recent Developments

- In May 27, 2024, Halliburton (NYSE: HAL) showcased its groundbreaking coiled tubing intervention system at its New Iberia, Louisiana, Training Facility. This system features the industry’s largest and strongest components, including the V135HP coiled tubing injector, a reel capable of handling 36,000 feet of coiled tubing, and a 750-ton capacity tension lift frame. The coiled tubing, made from 120,000-pound yield strength alloy steel, is the strongest and longest ever built, while the lift frame is twice the size of standard designs.

- In Aug. 01, 2024, Calfrac Well Services Ltd. (“Calfrac”) (TSX: CFW) released its financial and operating results for the second quarter ending June 30, 2024. Detailed financial statements and management’s analysis accompanied the release, with disclosures on forward-looking statements and non-GAAP measures provided in the advisory section.

- In 2024, Venture Builder VC and NOV Inc. (NYSE: NOV) launched the NOV Supernova Accelerator, a program aimed at accelerating digital transformation in the upstream oil and gas sector. This five-month initiative supports startups focused on innovative energy solutions, leveraging Venture Builder VC’s expertise to scale emerging technologies.

- In Oct. 15, 2024, Nabors Industries Ltd. (NYSE: NBR) and Parker Wellbore announced a definitive agreement for Nabors to acquire Parker in exchange for 4.8 million shares of Nabors stock, subject to pricing conditions. Parker, a key player in drilling services and tubular rentals, operates across global markets, with notable offerings in the U.S., the Middle East, and Asia. Its portfolio includes 17 drilling rigs and Operations & Maintenance services in regions such as Canada and Alaska.

- In 2024, Nine Energy Service, Inc. (NYSE: NINE) reported second quarter revenues of $132.4 million, with a net loss of $14.0 million or $(0.40) per share, aligning with prior revenue guidance of $130.0 to $140.0 million. Adjusted EBITDA for the quarter reached $9.7 million.

Conclusion

The coiled tubing market is on a steady growth trajectory, driven by rising demand for efficient well intervention and production optimization in both conventional and unconventional oil and gas operations. Its versatility, cost-effectiveness, and ability to minimize downtime have positioned it as an indispensable tool in upstream operations. As the industry embraces technological advancements like automation, digital monitoring, and high-performance materials, coiled tubing solutions are becoming more resilient and adaptable to challenging environments, including deepwater and high-temperature wells.

Emerging opportunities in geothermal energy and enhanced oil recovery in aging fields further underscore its expanding role in the global energy landscape. However, addressing challenges such as material fatigue, operational costs, and workforce shortages will be key to unlocking the full potential of this market in the years ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)