Table of Contents

Introduction

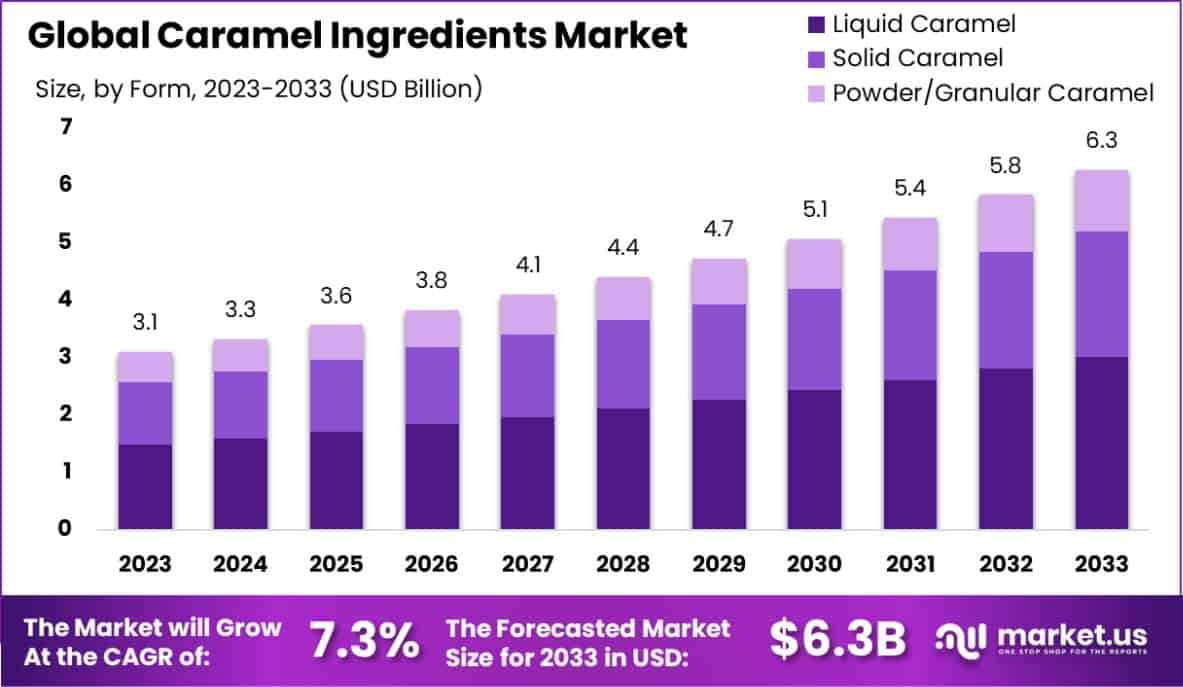

New York, NY – February 13, 2025 – The global Caramel Ingredients Market is poised for significant growth, with its size projected to reach approximately USD 6.3 billion by 2033, up from USD 3.1 billion in 2023. This growth represents a strong compound annual growth rate (CAGR) of 7.3% during the forecast period from 2024 to 2033.

The demand for caramel ingredients is being driven by a rising preference for sweeteners and flavor enhancers in the food and beverage industry. As consumers increasingly seek indulgent and natural flavors in their products, the market is experiencing a surge in popularity. Key growth factors include the expanding confectionery sector, demand for caramel-based sauces, and the growing trend of flavored beverages.

Additionally, market opportunities are emerging in the baking and dairy segments, where caramel ingredients are being widely used for product innovation. Furthermore, the increasing adoption of caramel ingredients in processed foods and snacks is contributing to market expansion. With advancements in production technologies and the availability of innovative caramel products, the market is expected to see continued demand from various applications, including food manufacturing, catering, and even non-food sectors like cosmetics.

Key Takeaways

- The Global Caramel Ingredients Market is expected to be worth around USD 6.3 Billion by 2033, up from USD 3.1 Billion in 2023, and grow at a CAGR of 7.3% from 2024 to 2033.

- Liquid caramel dominates, accounting for 48.3% market share globally.

- Caramel as a color leads with a 45.5% application share

- The bakery sector claims a 39.1% share in caramel ingredients usage.

- North America Holds 46.1% Share of Caramel Ingredients Market at USD 1.4 Billion

Report Scope

| Market Value (2024) | USD 3.1 Billion |

| Forecast Revenue (2034) | USD 6.3 Billion |

| CAGR (2025-2034) | 7.3% |

| Segments Covered | By Form (Liquid Caramel, Solid Caramel, Powder, and Granular Caramel), By Application (Colors, Flavors, Inclusions, Fillings and Toppings, Others), By End Use (Bakery, Confectionery, Beverages, Dairy, and Frozen Desserts, Others) |

| Competitive Landscape | ADM (Archer Daniels Midland Company), Bakels Worldwide, Cargill Incorporated, D.D. Williamson Caramel, DuPont de Nemours, Inc., Ferrero, Firmenich SA, Givaudan, Hansen Holding A/S, Ingredion Incorporated, Kerry Group plc, Koninklijke DSM N.V., Mars Inc., Martin Braun KG, Martin Braun-Gruppe, Metarom USA, Nestle, Nigay, Puratos, Puratos Group, Roquette Freres, Sensient Technologies Corporation, Sethness Roquette, Sudzucker AG, Tate & Lyle PLC |

Emerging Trends

- Natural and Clean-Label Ingredients: Consumers are increasingly demanding natural and clean-label products, prompting manufacturers to shift towards natural caramel ingredients. This trend is driven by a growing awareness of health and wellness, with consumers preferring products without artificial additives, colors, or preservatives. As a result, natural caramel alternatives are gaining popularity in the market.

- Plant-Based and Vegan Caramel Products: The rise of plant-based and vegan diets has led to an increase in demand for vegan-friendly caramel ingredients. Manufacturers are focusing on creating plant-derived caramel options to cater to the growing vegan and plant-based food sectors. This shift is opening new opportunities for plant-based caramel sauces, candies, and flavorings.

- Customization and Innovation in Flavors: Consumers are looking for unique and diverse flavor experiences, which has led to the development of customized caramel ingredients. Companies are experimenting with different caramel variations, combining them with exotic flavors like sea salt, vanilla, and spice blends to meet the demand for more innovative and exciting food options.

- Caramel in Health-Conscious Products: As health-conscious consumers become more prevalent, there is a rising demand for caramel ingredients that cater to lower sugar, low-calorie, and functional foods. Manufacturers are incorporating reduced-sugar and sugar-free caramel options in snacks, dairy products, and beverages to meet the demand for healthier indulgence.

- Sustainability and Ethical Sourcing: Sustainability has become a key focus in the caramel ingredients market. Consumers are increasingly prioritizing ethically sourced and environmentally friendly ingredients. Companies are working on sustainable sourcing practices for raw materials like sugar and corn, as well as reducing their carbon footprint in the production of caramel ingredients.

Use Cases

- Confectionery Production: Caramel ingredients are widely used in the production of candies, chocolates, and toffees. Their sweet, rich flavor enhances the overall taste profile of confections. Caramel is also used in coating or filling chocolates and creating a smooth texture, making it a staple in the confectionery industry for both mass-market and premium products.

- Beverages and Sauces: In the beverage sector, caramel ingredients are commonly added to coffee, sodas, and alcoholic drinks like cocktails for flavor enhancement. Caramel syrup and caramelized sugar are often used in crafting indulgent sauces, especially in ice creams, desserts, and pastries, offering a sweet, complex flavor that complements other ingredients.

- Baking and Desserts: Caramel ingredients are key in bakery items such as cakes, pies, and cookies, where they provide a rich, sweet taste and texture. Caramel is also used in creating dessert toppings, fillings, and glazes, contributing to both visual appeal and flavor complexity, especially in items like caramel custards and puddings.

- Dairy Products: Caramel is a popular ingredient in dairy-based products such as flavored yogurts, ice creams, and puddings. Its sweet, rich taste enhances the sensory experience of these products. Caramel is often used in swirl forms, mixed into ice cream bases, or as a topping for dairy desserts, providing indulgence in everyday snacks.

- Snacks and Ready-to-Eat Foods: Caramel ingredients are increasingly used in snacks such as granola bars, popcorn, and trail mixes. They provide both flavor and texture, balancing sweetness with a crunchy or chewy texture. This versatility has made caramel a popular choice in ready-to-eat products, offering a satisfying treat for on-the-go consumers.

Major Challenges

- Rising Raw Material Costs: The increasing costs of key raw materials like sugar, corn syrup, and dairy products pose a significant challenge for manufacturers of caramel ingredients. Fluctuations in the price of these inputs can lead to higher production costs, which may be passed on to consumers, affecting the overall affordability and pricing strategy of caramel-based products.

- Health and Nutritional Concerns: As consumers become more health-conscious, there is growing concern over the high sugar content in caramel ingredients. Excessive consumption of sugary products can contribute to obesity, diabetes, and other health issues. This has prompted a demand for sugar-free or reduced-sugar alternatives, but reformulating products to meet these demands without compromising on taste is a challenge for manufacturers.

- Sustainability Issues: The caramel ingredients market faces challenges related to sustainability, particularly in sourcing raw materials like sugar and corn. The environmental impact of farming practices, such as water use and soil depletion, as well as issues surrounding labor conditions in agricultural sectors, are increasingly scrutinized. Manufacturers must balance production needs with environmental responsibility.

- Consumer Preference Shifts: Changing consumer preferences towards clean-label, organic, or plant-based products can challenge the traditional caramel ingredients market. As more people seek healthier or ethical alternatives, manufacturers must adapt their offerings to meet new demands, often requiring reformulations or sourcing new ingredients that align with evolving consumer trends.

- Supply Chain Disruptions: The caramel ingredients market is also vulnerable to supply chain disruptions, particularly during times of global economic uncertainty, such as natural disasters or geopolitical tensions. These disruptions can lead to delays in raw material availability, higher costs, and production inefficiencies, which affect product pricing and consistency in the market.

Market Growth Opportunities

- Expansion in Emerging Markets: As middle-class populations grow in emerging markets, particularly in Asia-Pacific and Latin America, there is a rising demand for processed foods, snacks, and beverages. This trend presents significant growth opportunities for caramel ingredient manufacturers, as consumers in these regions increasingly seek indulgent flavors in food and drink products.

- Demand for Natural and Clean-Label Products: There is an increasing demand for natural and clean-label products across various food categories. Manufacturers can capitalize on this by offering caramel ingredients made with fewer additives and using natural sweeteners. This trend is particularly prominent among health-conscious consumers who prioritize transparency in product labels and ingredient sourcing.

- Plant-Based and Vegan Product Development: The growing popularity of plant-based diets provides a key opportunity for caramel ingredients in vegan products. Companies can explore new formulations that replace traditional dairy-based components with plant-based alternatives, catering to the expanding vegan and plant-based food market, especially in segments like dairy-free ice creams and vegan confectionery.

- Innovative Flavors and Product Customization: There is an increasing demand for unique and customized caramel flavors in various industries. By offering flavor innovation—such as sea salt caramel, caramel with spices, or caramel blends with fruits—companies can attract more consumers looking for novel experiences. This can lead to the creation of premium products and drive higher profit margins.

- Caramel in Functional Foods: The rise of functional foods, which offer health benefits beyond basic nutrition, provides new opportunities for caramel ingredients. Manufacturers can create caramel-based snacks and beverages that incorporate added nutritional benefits, such as protein, fiber, or probiotics, appealing to health-conscious consumers while maintaining a desirable flavor profile.

Recent Developments

1. ADM (Archer Daniels Midland Company)

- Recent Developments:

- Investment in Innovation: ADM has been investing heavily in sustainable and plant-based food solutions, including caramel ingredients. In 2023, ADM expanded its production capabilities for natural food colors, including caramel colors, to meet the growing demand for clean-label products.

- Partnerships: ADM partnered with Cargill in 2023 to develop a new line of sustainable, plant-based food ingredients, including caramel alternatives, to reduce the carbon footprint of food production.

- Acquisitions: In 2022, ADM acquired Deerland Probiotics and Enzymes, enhancing its portfolio of natural ingredients, including caramel-related products.

- Contribution to Caramel Ingredients Sector: ADM’s focus on clean-label and sustainable caramel colors has positioned it as a leader in the industry. Their innovations aim to reduce synthetic additives and improve the nutritional profile of caramel ingredients.

2. Bakels Worldwide

- Recent Developments:

- Innovation: Bakels will introduce a new range of low-sugar caramel ingredients in 2023, targeting the health-conscious consumer market.

- Partnerships: Bakels partnered with Tate & Lyle in 2022 to develop innovative sweetening solutions, including caramel flavors, for the bakery and confectionery sectors.

- Contribution to Caramel Ingredients Sector: Bakels’ focus on reducing sugar content in caramel ingredients aligns with global health trends and regulatory requirements for healthier food options.

3. Cargill Incorporated

- Recent Developments:

- Investment in Innovation: Cargill has invested in expanding its caramel color production facilities in Europe and Asia in 2023, focusing on sustainable and non-GMO ingredients.

- Partnerships: Cargill collaborated with ADM in 2023 to develop sustainable caramel ingredients for the food and beverage industry.

- Acquisitions: In 2022, Cargill acquired Leman Decoration Group, a leader in bakery decoration solutions, which includes caramel-based products.

- Contribution to Caramel Ingredients Sector: Cargill’s advancements in sustainable caramel colors and clean-label solutions have significantly impacted the industry, catering to the demand for environmentally friendly products.

4. D.D. Williamson (DDW)

- Recent Developments:

- Innovation: DDW launched a new line of organic-certified caramel colors in 2023, targeting the growing organic food market.

- Partnerships: DDW partnered with Sensient Technologies in 2022 to develop advanced caramel color solutions for the beverage industry.

- Contribution to Caramel Ingredients Sector: DDW’s focus on organic and natural caramel colors has helped the company cater to the increasing demand for clean-label and organic products.

5. DuPont de Nemours, Inc.

- Recent Developments:

- Innovation: DuPont has been working on developing enzyme-based solutions for caramel production, aiming to improve efficiency and reduce waste in the manufacturing process (2023).

- Partnerships: DuPont partnered with BASF in 2022 to create sustainable food ingredient solutions, including caramel flavors and colors.

- Contribution to Caramel Ingredients Sector: DuPont’s enzyme-based innovations have the potential to revolutionize the caramel ingredients industry by making production more sustainable and cost-effective.

Conclusion

The Caramel Ingredients Market is poised for strong growth driven by increasing consumer demand for indulgent flavors, natural ingredients, and innovative products. The sector presents numerous opportunities, particularly in emerging markets, plant-based products, and functional food segments. However, challenges such as rising raw material costs, health concerns, and sustainability demands require companies to adapt and innovate continuously. By focusing on clean-label ingredients, unique flavor offerings, and sustainable practices, manufacturers can capitalize on the evolving market landscape and meet the changing preferences of consumers, ensuring long-term success in this dynamic sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)