Table of Contents

Introduction

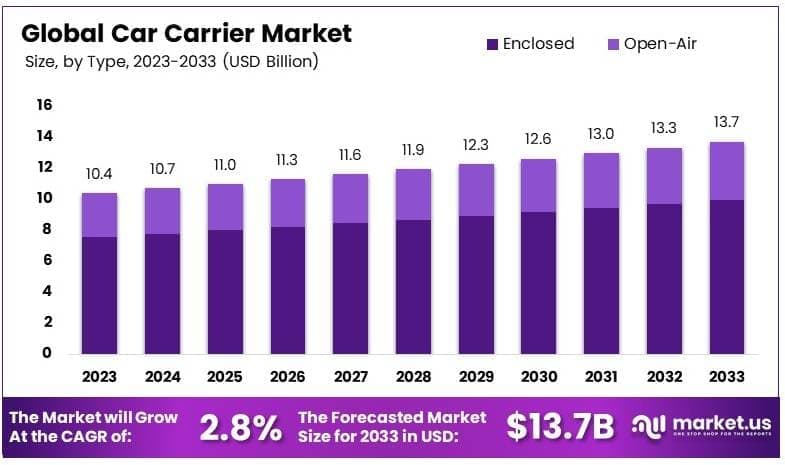

The Global Car Carrier Market is projected to reach approximately USD 13.7 billion by 2033, increasing from USD 10.4 billion in 2023. This represents a compound annual growth rate (CAGR) of 2.8% during the forecast period from 2024 to 2033.

The Car Carrier Market refers to the transportation industry segment responsible for the shipping of vehicles, including cars, trucks, and motorcycles, from manufacturers or dealerships to consumers, as well as to international markets. This market involves various logistics methods, primarily focused on specialized transport vehicles like roll-on/roll-off (RoRo) ships, multi-deck trailers, and enclosed carriers. The growth of the car carrier market can be attributed to the rising global demand for automobiles, particularly in emerging economies where vehicle ownership is on the rise.

Increasing cross-border trade, as well as expansion in the e-commerce sector for vehicle deliveries, are also contributing factors to market expansion. Additionally, technological advancements in logistics, such as real-time tracking and improved fuel efficiency, are helping to streamline operations. The market is also witnessing opportunities in the growth of electric vehicle (EV) transportation, where specialized carriers are needed to safely transport EVs. With sustainable transport gaining traction, further market opportunities lie in developing eco-friendly car carrier solutions.

Key Takeaways

- The Car Carrier Market was valued at USD 10.4 billion in 2023 and is projected to reach USD 13.7 billion by 2033, growing at a CAGR of 2.8%.

- Enclosed Car Carriers held the largest share of the type segment in 2023, accounting for 72.6%, due to their ability to provide enhanced protection during vehicle transportation.

- The Automobile Sales Service segment dominated the application category in 2023, representing 69.5% of the market, underscoring its critical role in transporting new vehicles.

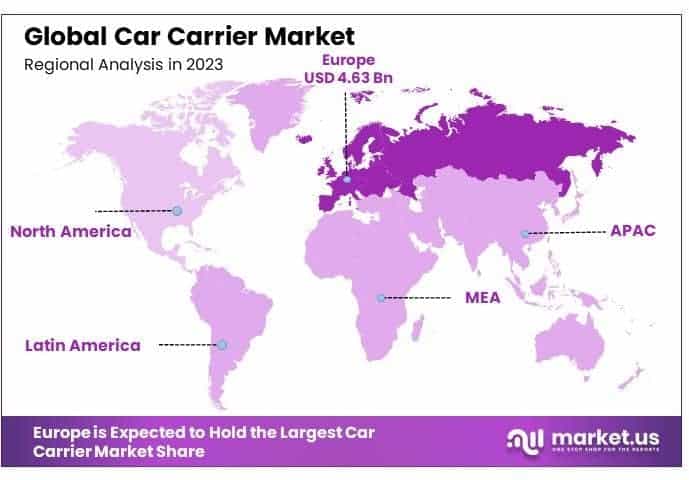

- Europe led the Car Carrier Market in 2023, with a market share of 44.5%, driven by the region’s strong automotive industry.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 10.4 Billion |

| Forecast Revenue (2033) | USD 13.7 Billion |

| CAGR (2024-2033) | 2.8% |

| Segments Covered | By Type (Open-Air, Enclosed), By Application (Automobile Sales Service, Terminals, Other Applications) |

| Competitive Landscape | Mitsui & Co. Ltd., Nippon Yusen KK, K Line, EUKOR Car Carriers Inc., Dongfeng Trucks, Miller Industries Inc., Tec Equipment Inc., Boydstun Equipment Manufacturing, Landoll Corporation, Wally-Mo Trailers, Cottrell Trailers, Kässbohrer Transport Technik GmbH, Lohr Industrie |

Key Segments Analysis

Enclosed car carriers hold a dominant market share of 72.6% due to their superior protection against weather, road debris, and theft, making them the preferred option for transporting high-value, luxury, or vintage cars. While more expensive, their added security justifies the cost, especially for dealerships and owners seeking the best care for their vehicles. In contrast, open-air carriers, which are more cost-effective and can transport more vehicles at once, are commonly used for standard vehicles in short-distance shipments, particularly by dealerships managing high volumes of less expensive cars.

Automobile sales services dominate the car carrier application segment, accounting for 69.5% of the market, driven by the high demand for efficient vehicle transport from manufacturers to dealerships. Car carriers are vital in ensuring timely delivery and maintaining vehicle condition, which is essential for brand reputation and customer satisfaction. Terminals also play a significant role in the distribution network, requiring robust transport solutions for vehicle storage and redistribution. Additional applications include corporate fleets and rental services, where car carriers facilitate vehicle relocation based on demand. The continuous growth of the automotive sales sector, alongside evolving trends in sustainability and logistics efficiency, is expected to drive further expansion in the car carrier market.

Emerging Trends

- Shift to Electric and Autonomous Vehicle Transportation: The demand for electric vehicles (EVs) is driving changes in the car carrier industry. As the number of EVs on the road increases, car carriers are adapting by introducing specialized vehicles designed to transport EVs safely. These carriers are equipped with features that reduce the risk of damaging the sensitive batteries and electronics of EVs. Additionally, autonomous vehicles may soon require carriers that are capable of safely transporting them without manual oversight.

- Increased Demand for Multi-Modal Transport Solutions: There has been a growing trend towards the integration of multi-modal transport solutions in the car carrier industry. Carriers are increasingly adopting a combination of road, rail, and sea transport methods to improve cost efficiency, flexibility, and speed. This integration provides enhanced coverage and meets the needs of customers who require transportation of vehicles over long distances or across borders.

- Focus on Sustainability and Eco-Friendly Practices: Sustainability has become a key driver in the car carrier market. To reduce the carbon footprint of vehicle transportation, companies are investing in energy-efficient and low-emission vehicles for car carrier fleets. Hybrid and fully electric car carriers are being developed to comply with stricter environmental regulations and meet the growing demand for green logistics solutions.

- Advanced Tracking and Monitoring Systems: The introduction of advanced telematics and tracking technologies has transformed the car carrier industry. These systems provide real-time visibility of the vehicle’s location, condition, and estimated arrival time, enhancing security and customer satisfaction. The adoption of IoT (Internet of Things) technology is streamlining operations, allowing for better management and timely updates to clients.

- Customization of Car Carrier Fleets: As the variety of vehicles being transported increases, the demand for customized car carriers is rising. Specialized carriers are being designed to accommodate a wide range of vehicles, including luxury cars, oversized vehicles, and high-performance models. This trend is expected to continue as vehicle diversity grows globally.

Top Use Cases

- Automotive Industry Logistics: Car carriers are essential in the automotive supply chain, enabling the efficient transport of new cars from manufacturers to dealerships. This use case accounts for a significant portion of car carrier operations globally, ensuring timely deliveries to meet market demand. It is estimated that around 70% of the vehicles sold globally rely on car carriers for delivery from production sites.

- Vehicle Relocation Services: Individuals moving between cities or states often utilize car carriers for vehicle transportation. Whether for relocating a personal vehicle, shipping a vehicle purchased from an online auction, or transferring a luxury car, car carriers are used to safely transport cars over long distances. This use case is particularly common in countries with large land masses, such as the United States and Australia.

- Car Export and Import Services: Car carriers are widely used in global car trade, enabling the international transport of vehicles from manufacturers to importers and buyers. The growing export of used cars, particularly to emerging markets, fuels the demand for this service. In 2021, around 12 million used cars were exported globally, with a significant portion of this volume transported by car carriers.

- Leasing and Fleet Management: Fleet management companies, including car rental services, frequently use car carriers to transport vehicles between rental locations or to new markets. The demand for such services is growing, as more businesses rely on leasing and fleet management solutions to meet customer needs, with the fleet market estimated to grow at an annual rate of 3% in several regions.

- Sports and Luxury Car Transport: High-value vehicles, including luxury cars and sports cars, require specialized transportation due to their high cost and delicate construction. Car carriers that offer secure, enclosed transport are increasingly used for this purpose. The global luxury car market, valued at over $500 billion, contributes significantly to the demand for premium car transportation services.

Major Challenges

- Fuel Price Volatility: The fluctuating cost of fuel remains a critical challenge for car carrier operators. As fuel prices continue to rise and fall unpredictably, companies must navigate these costs while maintaining competitive pricing. In 2023, the average cost of diesel fuel in North America was around $4.50 per gallon, significantly impacting operating expenses.

- Regulatory Compliance: The car carrier industry faces increasing pressure to comply with stringent environmental and safety regulations, which vary by region. These regulations often require investment in upgraded fleets or changes in operational procedures. For example, in Europe, stricter emissions standards are pushing companies to transition to lower-emission vehicle fleets, which can involve high upfront costs.

- Vehicle Damage During Transport: Despite technological advancements, vehicle damage during transport remains a persistent issue. The challenge of securing a wide range of vehicles, particularly oversized or modified cars, requires specialized equipment and procedures. Claims related to damaged goods account for approximately 5-10% of the industry’s total annual revenues, depending on the region.

- Capacity Constraints: A limited number of car carriers available for certain routes, especially in emerging markets or less-served regions, can result in capacity shortages. This is particularly challenging during peak seasons when the volume of vehicles to be transported increases. Industry reports indicate that up to 15% of car shipments can be delayed due to capacity issues during high-demand periods.

- Labor Shortages: The car carrier sector faces labor shortages, particularly among drivers and technicians. The aging workforce in many developed countries and the high turnover rate in logistics-related jobs are contributing factors. The U.S. alone has seen a decline in the number of licensed truck drivers, with estimates suggesting a shortfall of over 60,000 drivers in 2022.

Top Opportunities

- Expanding into Emerging Markets: The growing automotive industry in emerging markets, particularly in Asia and Africa, presents significant opportunities for car carrier companies. Increased demand for new vehicles in these regions, along with the expansion of local production facilities, will drive the need for transportation services. The Asia-Pacific region is expected to see a rise in car shipments by over 25% in the next five years.

- Integration of Automation Technologies: The integration of automated driving technology into car carriers offers a growth opportunity by improving operational efficiency and reducing costs associated with manual labor. This trend is especially relevant as the logistics sector as a whole is moving toward greater automation. It is projected that automation in the logistics industry could reduce costs by up to 15% by 2028.

- Growing Demand for Eco-Friendly Solutions: With sustainability becoming a key focus in transportation, there is an opportunity for car carriers to invest in electric or hybrid fleets to meet the increasing demand for environmentally conscious services. Carriers that offer green transport solutions may attract new clients seeking to reduce their carbon footprints, a trend supported by tightening environmental regulations globally.

- Enhanced Digitalization and Data Analytics: The adoption of digital platforms and big data analytics in the car carrier industry presents an opportunity to streamline operations and improve decision-making. By utilizing predictive analytics, companies can optimize routes, monitor vehicle conditions, and enhance customer service, leading to operational cost savings and improved client satisfaction.

- Vehicle Customization and Specialty Transport Services: As the variety of vehicles being transported increases, there is an opportunity for car carriers to offer more specialized services, including custom-built carriers for specific types of vehicles. The demand for specialty transport, such as for oversized vehicles or luxury cars, is projected to grow as the automotive market continues to diversify.

Key Player Analysis

- Mitsui & Co. Ltd: Mitsui & Co. Ltd, a major player in the global car carrier market, has established itself as a prominent provider of transportation solutions, including car carriers. The company’s portfolio includes investments in automotive logistics, contributing significantly to the development of the car carrier sector. With operations across various global regions, Mitsui’s logistics division offers comprehensive solutions that cater to the growing demand for automotive shipping. As of recent financial reports, Mitsui & Co. Ltd’s net sales were estimated at $51.7 billion, reflecting a robust position in global trade and transportation services.

- Nippon Yusen KK: Nippon Yusen KK (NYK Line), one of the world’s leading shipping companies, is a prominent entity in the car carrier industry. NYK Line has a dedicated fleet for the transportation of vehicles, offering services to major automotive manufacturers. The company is known for its state-of-the-art vessels designed specifically for vehicle transportation. In recent years, Nippon Yusen KK has been expanding its fleet and services to meet the increasing demand for automotive logistics.

- K Line: K Line, officially known as Kawasaki Kisen Kaisha Ltd., operates one of the largest fleets of car carriers globally. The company specializes in the transportation of automobiles, offering tailored solutions to automotive manufacturers worldwide. K Line’s fleet comprises eco-friendly car carriers designed to meet stringent environmental regulations. Significant contributions from its car carrier services, marking a stable position in the market.

- EUKOR Car Carriers Inc.: EUKOR Car Carriers Inc. is a leading provider of roll-on/roll-off (RoRo) services, specializing in the global transportation of automobiles. The company operates a large fleet of car carriers serving major ports across the world, supporting a wide range of automotive manufacturers. EUKOR is known for its efficient and innovative transportation solutions, which have enabled the company to maintain a dominant position in the market.

- Dongfeng Trucks, a division of Dongfeng Motor Corporation, has become an essential player in the car carrier market, particularly in the manufacture of truck-based transport solutions. The company offers a wide range of vehicles used in car carrier operations, from specialized car transport trucks to heavy-duty haulers. Dongfeng’s market presence has been strengthened by its reputation for high-quality manufacturing and cost-effective logistics solutions.

Regional Analysis

Europe: Dominating Car Carrier Market with Largest Market Share of 44.5%

The European car carrier market is the largest in terms of revenue, accounting for a dominant share of 44.5% in 2023, with an estimated value of USD 4.63 billion. This significant market share can be attributed to the region’s robust automotive manufacturing industry, well-established logistics infrastructure, and high demand for both domestic and international vehicle transportation. Europe’s extensive network of ports and highways, coupled with the increasing import and export of vehicles, further fuels the market’s growth. Major automotive hubs, including Germany, France, and the United Kingdom, continue to drive demand for car carriers, facilitating the movement of both finished vehicles and automotive components.

The presence of global automotive manufacturers and the region’s strong focus on sustainability, particularly in transitioning to electric vehicles, is expected to influence the demand for specialized car carrier solutions. The expansion of automotive trade agreements within the European Union and with external partners is also contributing to the growth. As the market for car carriers in Europe continues to grow, advancements in eco-friendly technologies and fleet optimization are likely to shape the future of vehicle transportation.

Recent Developments

- In 2025, CMA CGM announced the addition of a new LNG-powered vessel, the CMA CGM Esculiar, to its fleet. The ship was delivered on January 7, 2025, and began its service in the CNC CV8 route, connecting Shanghai to Ho Chi Minh City. The vessel had departed Ulsan on December 24, 2024, and reached Shanghai by December 28, 2024. This follows the delivery of other LNG-powered vessels like the CMA CGM Mermaid and CMA CGM Tivoli, reinforcing the company’s commitment to sustainable shipping.

- In 2023, Stellantis N.V. confirmed a €1.5 billion investment in Leapmotor, acquiring a 20% stake. This partnership established Leapmotor International, a joint venture aimed at expanding the sales and manufacturing of Leapmotor vehicles outside China, marking a significant step in global electric vehicle development.

- In 2024, Honeywell completed the acquisition of Carrier Global Corporation’s Global Access Solutions business for $4.95 billion. This deal expands Honeywell’s presence in the digital security sector, particularly within cloud-based services, and supports its broader strategic focus on automation and megatrends in building technologies.

- In 2023, Carlyle and Stellex Capital Management finalized the sale of Titan Acquisition Holdings to an affiliate of Lone Star Funds. Titan, a leader in ship repair and marine fabrication services, was acquired by Lone Star Funds to expand its portfolio in the maritime industry.

- In 2024, Hapag-Lloyd and Maersk launched the “Gemini Cooperation,” a long-term collaboration set to begin in February 2025. The partnership aims to enhance ocean network efficiency, offering a robust fleet of 340 vessels and increasing capacity to 3.7 million TEUs. This new operational alliance is designed to improve global shipping connectivity while incorporating cleaner fuel solutions.

Conclusion

The Car Carrier Market is poised for steady growth, driven by increasing demand for automotive transportation, particularly in emerging markets and regions with strong automotive industries. The market’s expansion is underpinned by factors such as the rise in vehicle ownership, the integration of advanced technologies like real-time tracking, and a growing focus on sustainability. As logistics solutions evolve to meet the needs of diverse vehicle types, including electric and luxury cars, new opportunities will emerge for operators to enhance their services. Despite challenges such as fuel price volatility and regulatory compliance, the car carrier sector remains positioned to adapt and capitalize on the evolving global automotive landscape, ensuring continued relevance in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)