Table of Contents

Overview

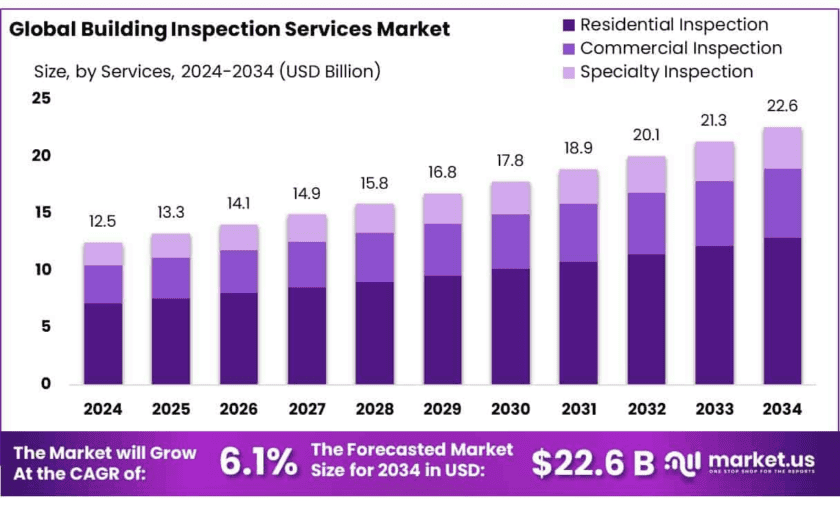

The Global Building Inspection Services Market is projected to expand significantly, reaching USD 22.6 billion by 2034, up from USD 12.5 billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034. This growth is primarily driven by heightened regulatory compliance requirements, technological advancements, and rising awareness of structural safety in residential, commercial, and industrial buildings.

The demand for building inspection services has surged, driven by stringent safety audits, smart city projects, and infrastructure expansion globally. The Asia-Pacific region dominates the market with a substantial 38.6% share, fueled by rapid urbanization and regulatory mandates in key countries such as China, India, and Japan. Residential inspection services captured a dominant share of 57.3% in 2024, fueled by heightened demand for property assessments and structural integrity checks.

Experts Review

Government incentives and technological innovations are shaping the building inspection services market. In India, the National Infrastructure Pipeline (NIP) allocated $1.5 trillion for infrastructure projects by 2025, creating substantial demand for inspection services. The adoption of AI and drones, observed in 37% of global construction sites, enhances inspection precision, mitigating risks and reducing costs. Investment opportunities are emerging in the digital inspection segment, while risks include regulatory complexities and bureaucratic delays, as seen in Andhra Pradesh’s LTP reforms. Increasing consumer awareness of safety and compliance drives demand for property inspections, particularly in residential and commercial sectors. The regulatory environment is evolving, with stricter standards for structural audits and fire safety assessments, pushing companies to adopt advanced inspection technologies.

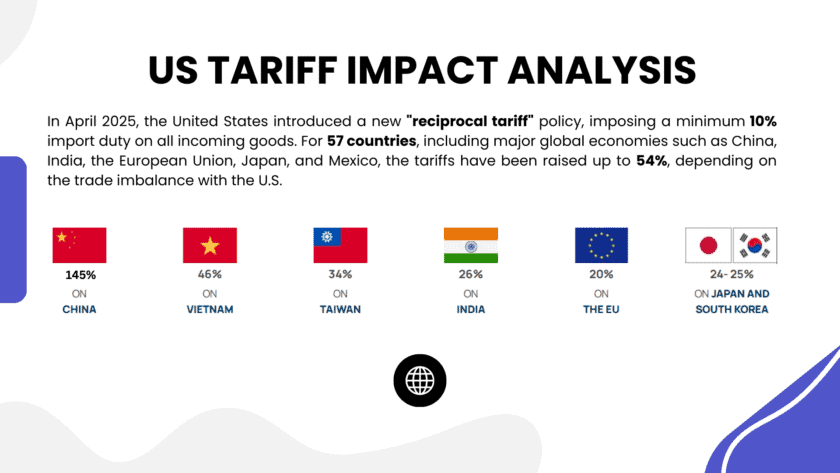

US Tariff Impact on Building Inspection Services Market

The U.S. building inspection services market may experience indirect impacts due to ongoing tariff uncertainties on imports from Canada and Mexico. On March 6, 2025, President Donald Trump announced a further postponement of tariffs, causing disruptions in the polymers sector. High-density polyethylene film FAS Houston remained at USD 992/mt on March 5, reflecting market stagnation amid tariff concerns.

Tariffs targeting Canada are expected to significantly affect the U.S. construction sector, potentially influencing demand for building inspection services, particularly in residential and commercial projects reliant on polymer-based construction materials. Additionally, European clients are reportedly facing uncertainty, potentially affecting international inspection service contracts and cross-border real estate investments.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/building-inspection-services-market/free-sample/

The building inspection services market is positioned for robust growth, driven by rising urbanization, regulatory mandates, and technological advancements. As governments emphasize structural safety and green building standards, the integration of AI, drones, and thermal imaging will redefine the inspection landscape. APAC remains the dominant region, propelled by infrastructure development in China and India, while North America and Europe focus on regulatory compliance and sustainable building assessments.

Key Takeaways

- Building Inspection Services Market size is expected to be worth around USD 22.6 Billion by 2034, from USD 12.5 Billion in 2024, growing at a CAGR of 6.1%.

- Residential Inspection held a dominant market position, capturing more than a 57.3% share in the Building Inspection Services market.

- In-House Services held a dominant market position, capturing more than a 58.5% share in the Building Inspection Services market.

- Traditional Inspection held a dominant market position, capturing more than a 63.9% share in the Building Inspection Services market.

- Residential held a dominant market position, capturing more than a 47.7% share in the Building Inspection Services market.

- Asia-Pacific (APAC) region emerged as the dominant force in the global building inspection services market, commanding a substantial 38.6% share, equivalent to approximately USD 4.6 billion.

Report Scope

| Market Value (2024) | USD 12.5 Billion |

| Forecast Revenue (2034) | USD 22.6 Billion |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Services (Residential Inspection, Commercial Inspection, Specialty Inspection), By Sourcing Type (In-House Services, Outsourced Services), By Technology (Traditional Inspection, Drone Inspection, Thermal Imaging Inspection), By End Use ( Residential, Commercial, Industrial, Government) |

| Competitive Landscape | SGS SA, RICS, Bureau Veritas, Intertek, WSP Global, AECOM, Huxley Associates, The Hartford, AtkinsonNolandand Associates, GHD Group, TUV Rheinland |

Report Segmentation

By services, the market is divided into Residential Inspection, Commercial Inspection, and Specialty Inspection. Residential Inspection holds a dominant 57.3% share, driven by rising awareness of property maintenance and regulatory compliance. Specialty Inspection includes Sewer and Septic System Inspections, Roof Inspections, and Yearly Maintenance Inspections.

By sourcing type, the market is segmented into In-House and Outsourced Services. In 2024, In-House Services captured 58.5% of the market due to businesses maintaining control over inspection processes. The growing emphasis on quality checks and real-time reporting using digital tools also supported this segment.

By technology, the market is segmented into Traditional Inspection, Drone Inspection, and Thermal Imaging Inspection. Traditional Inspection remains dominant with a 63.9% share in 2024, as cost-effective, hands-on assessments continue to be preferred in regions where digital adoption is slower. However, drone and thermal imaging technologies are gaining traction, particularly in complex infrastructure projects and hard-to-access areas.

By end use, the market is divided into Residential, Commercial, Industrial, and Government. The Residential segment leads with a 47.7% share, driven by increasing housing projects and a growing focus on property safety assessments. Commercial and Industrial segments also exhibit significant growth due to rising infrastructure development and regulatory mandates.

➤ Directly purchase a copy of the report: https://market.us/purchase-report/?report_id=148327

Key Market Segments

By Services

- Residential Inspection

- Pre-Listing Inspections

- Builder’s Warranty Inspections

- New Construction Inspections

- Pre-Closing Inspections

- Commercial Inspection

- Commercial Draw Inspections

- Retail or Office Space Inspections

- Special Purpose Facilities

- Others

- Specialty Inspection

- Sewer and Septic System Inspections

- Roof Inspections

- Lawn Irrigation Inspections

- Yearly Maintenance Inspection

- Others

By Sourcing Type

- In-House Services

- Outsourced Services

By Technology

- Traditional Inspection

- Drone Inspection

- Thermal Imaging Inspection

By End Use

- Residential

- Commercial

- Industrial

- Government

Recent Developments

SGS SA, headquartered in Geneva, Switzerland, is a global leader in inspection, verification, testing, and certification services. In 2023, the company reported sales of CHF 6,622 million, supported by strong organic growth of 8.1% across all business lines, including building inspection services. SGS’s comprehensive services ensure compliance with regulatory standards, minimizing risk and enhancing quality across various industries.

RICS is a leading professional body that accredits professionals within the land, property, construction, and infrastructure sectors. In 2023, RICS reported commercial and other income totaling £21.5 million, reflecting its role in setting and enforcing standards in building inspections and surveys. RICS-certified surveyors are recognized for their expertise in property valuation and structural assessments.

Bureau Veritas, based in France, offers testing, inspection, and certification services across various industries. In 2023, the company achieved revenue of €5,867.8 million, with an 8.5% organic growth, driven by strong performance in sectors including buildings and infrastructure. Bureau Veritas provides comprehensive building inspection services to ensure safety and compliance with regulatory standards.

Intertek is a UK-based company specializing in assurance, testing, inspection, and certification services. In 2023, Intertek reported revenue of £3,393 million, with its Industry and Infrastructure division, which includes building inspection services, accounting for 26% of total revenue. Intertek’s services help clients develop and maintain safe and sustainable infrastructure.

WSP Global, headquartered in Canada, is a leading engineering and professional services firm. In 2023, WSP reported revenues of $3.72 billion for the fourth quarter, marking a 4.6% increase compared to the previous year. The company offers a range of services, including building inspections, to support sustainable infrastructure development.

AECOM is a US-based multinational engineering firm providing design, consulting, construction, and management services. In fiscal year 2023, AECOM’s Professional Services business reported revenue of $14.4 billion. AECOM’s building inspection services are integral to its comprehensive infrastructure solutions.

Huxley Associates is a global recruitment consultancy specializing in placing professionals in the banking, finance, and engineering sectors. While specific revenue data for 2023 is not publicly available, Huxley plays a role in staffing skilled professionals for building inspection services, contributing to the sector’s talent pool.

The Hartford is a US-based investment and insurance company offering a range of services, including property and casualty insurance. In 2023, The Hartford reported core earnings of $2.8 billion. The company’s insurance services often involve building inspections to assess risk and ensure compliance with safety standards.

Top Key Players in the Market

- SGS SA

- RICS

- Bureau Veritas

- Intertek

- WSP Global

- AECOM

- Huxley Associates

- The Hartford

- AtkinsonNolandand Associates

- GHD Group

- TUV Rheinland

Conclusion

The Global Building Inspection Services Market is poised for substantial growth, driven by regulatory mandates, infrastructure development, and technological advancements. The rise in digital inspection tools, particularly drones and AI, offers lucrative investment opportunities. However, overcoming regulatory complexity and bureaucratic delays remains critical for sustained market expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)