Table of Contents

- Introduction

- Editor’s Choice

- Global Breakfast Cereals Market Overview

- History of Breakfast Cereals

- The Volume of Breakfast Cereals Consumed Globally

- Price of Breakfast Cereal Statistics

- Nutritional Value of Different Types of Breakfast Cereal Statistics

- The Leading Countries in Exporting Breakfast Cereal Statistics

- The Leading Countries in Importing Breakfast Cereal Statistics

- Consumer Preferences and Trends

- Recent Developments

- Conclusion

- FAQs

Introduction

Breakfast Cereal Statistics: Breakfast cereals are a diverse category of convenient and nutritious foods available in various forms, such as cold cereals, hot porridge, and granola.

Typically grain-based and often fortified with vitamins and minerals. They offer quick energy from carbohydrates and can contribute to daily nutrient intake.

Commonly served with milk and topped with fruits or nuts, breakfast cereals cater to different tastes and dietary preferences.

However, the market trends reflect a growing demand for healthier options. Including whole grain and low-sugar varieties, as well as natural and organic choices.

Hence, With their convenience and versatility, breakfast cereals remain a popular choice for starting the day.

Editor’s Choice

- By 2033, the global breakfast cereals market is expected to achieve revenues of $108.7 billion.

- As of 2024, online platforms continued to gain traction, securing a 6.6% share. While offline channels saw a slight decline to 93.4%.

- The United States is leading the breakfast cereals market revenue with a substantial revenue of $22.53 billion.

- By 2028, the volume of breakfast cereals consumed is anticipated to reach 14.80 billion kilograms.

- Breakfast cereal exports are dominated by India, with a significant lead in shipments totaling 15,750 million units.

- In the global import market for breakfast cereals, Sri Lanka emerges as the leading destination, importing 5,359 million units.

- Moreover, cereal maintains its stronghold as the preferred choice for breakfast. With a substantial 79% of consumers worldwide opting for it in the morning.

Global Breakfast Cereals Market Overview

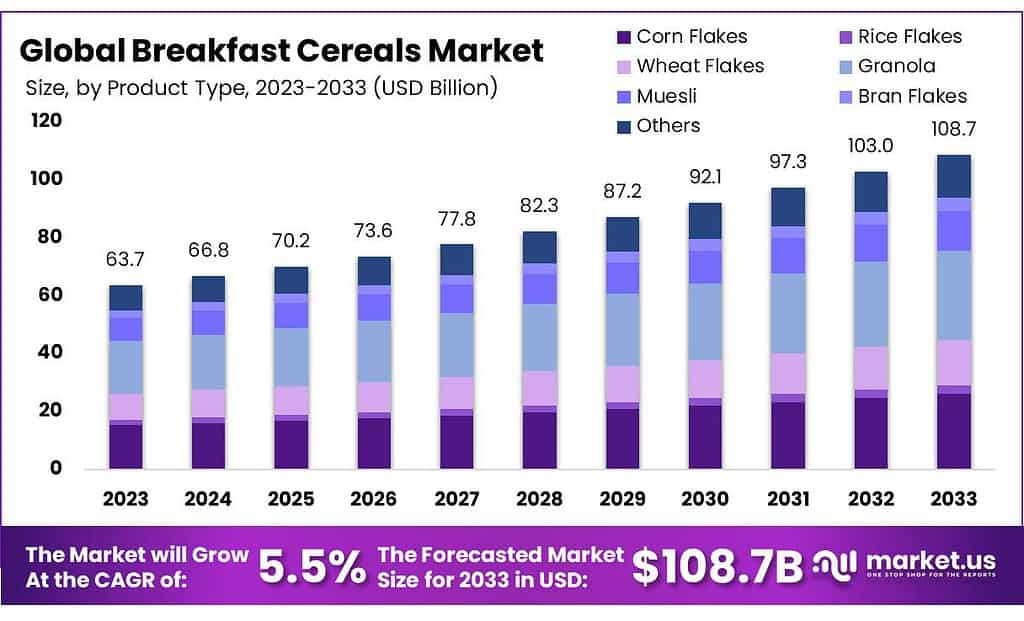

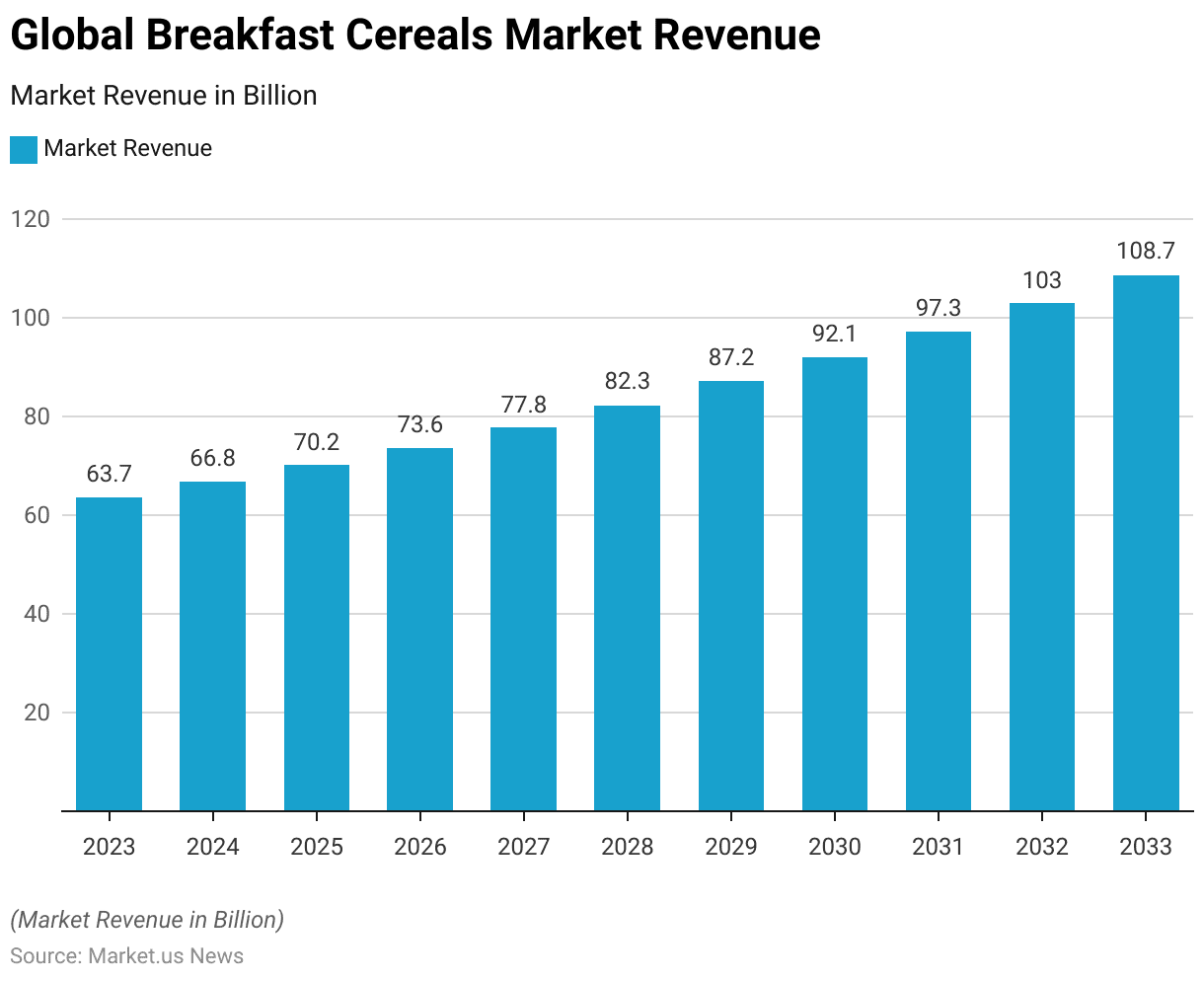

Global Breakfast Cereal Market Size Statistics

- The global breakfast cereals market has demonstrated steady growth over the past decade at a CAGR of 5.5%, with revenues increasing consistently.

- In 2023, the market revenue stood at $63.7 billion, followed by a rise to $66.8 billion in 2024.

- Projections indicate a further escalation in the coming years. With anticipated revenues of $70.2 billion in 2025, $73.6 billion in 2026, and $77.8 billion in 2027.

- By 2028, the market is expected to reach $82.3 billion, marking a significant milestone.

- The upward trajectory continues, with forecasted revenues of $87.2 billion in 2029 and $92.1 billion in 2030.

- As we move into the early 2030s, the market is anticipated to surpass the $100 billion mark. With projections reaching $97.3 billion in 2031 and $103.0 billion in 2032.

- By 2033, the global breakfast cereals market is expected to achieve revenues of $108.7 billion, reflecting sustained growth and promising opportunities within the industry.

(Source: Market.us)

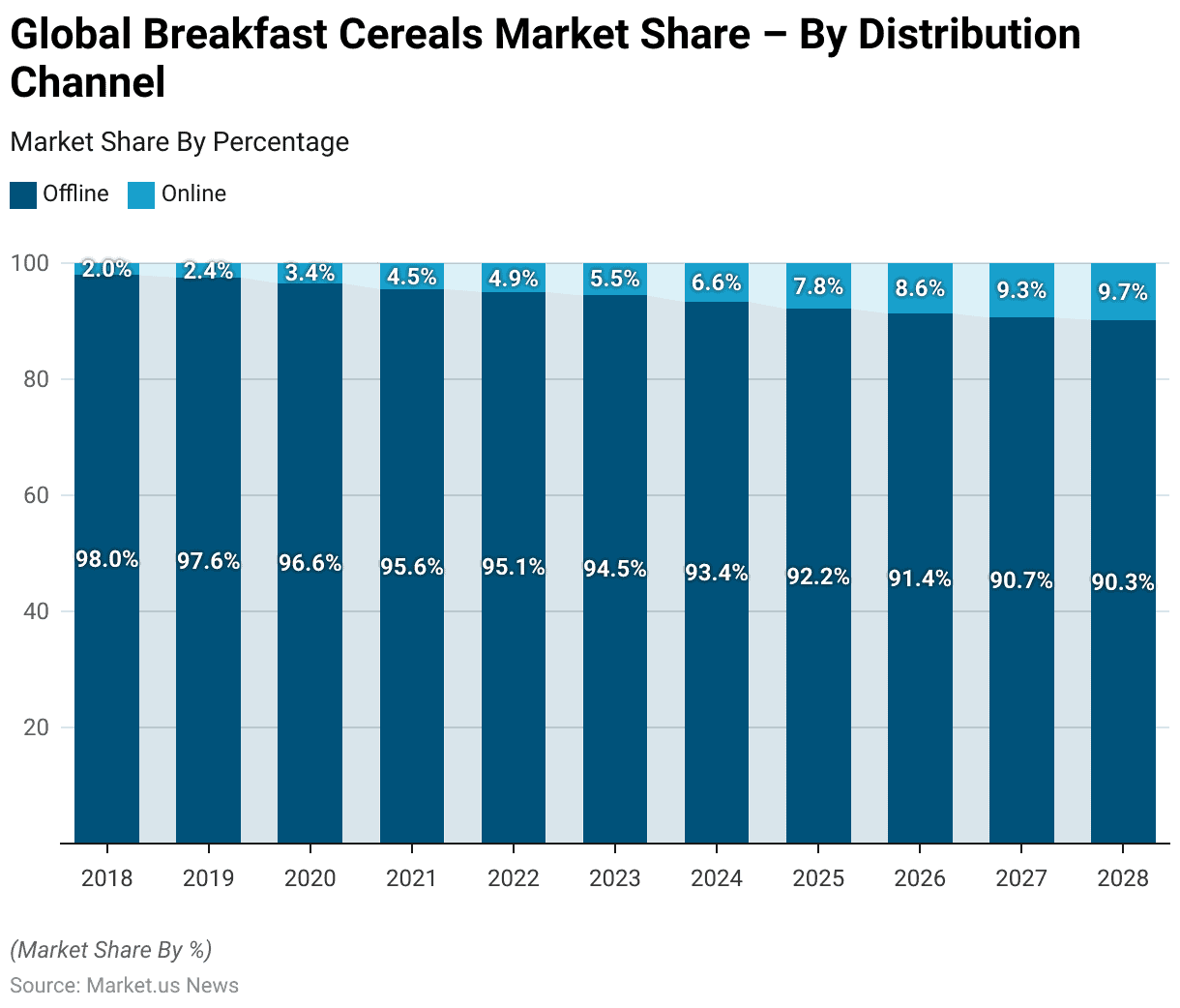

Global Breakfast Cereal Market Share – By Distribution Channel Statistics

- The distribution of global breakfast cereals has undergone a notable shift over the years. With online channels steadily gaining ground alongside traditional offline avenues.

- In 2018, offline distribution dominated, commanding 98%, while online platforms held a mere 2% share. However, the subsequent years witnessed a gradual but consistent rise in online presence, reaching 2.4% in 2019 and climbing to 3.4% in 2020.

- This trend continued, with online channels capturing 4.5% of the market in 2021 and growing to 4.9% in 2022. By 2023, online distribution expanded to 5.5%, marking a significant milestone.

- As of 2024, online platforms continued to gain traction, securing a 6.6% share. While offline channels saw a slight decline to 93.4%.

- Looking ahead, projections suggest a continued upward trajectory for online distribution. With forecasts indicating a rise to 7.8% in 2025 and further to 8.6% in 2026.

- By 2027, online channels are anticipated to claim 9.3% of the market, with offline distribution decreasing to 90.7%.

- This trend is expected to persist, with online platforms projected to hold 9.7% of the market share in 2028. Signaling a continued evolution in consumer preferences and shopping behavior within the breakfast cereals industry.

(Source: Statista)

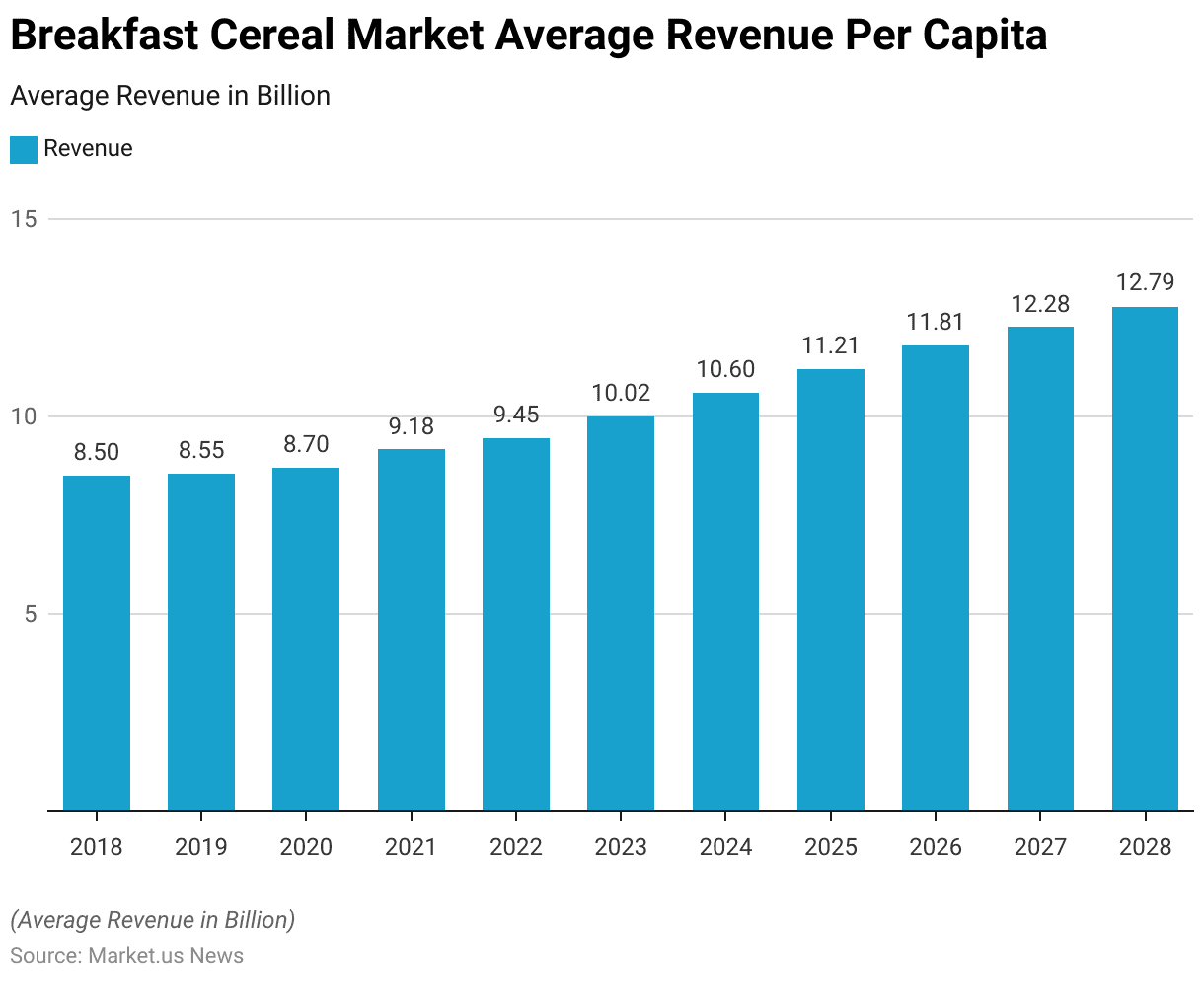

Breakfast Cereal Average Revenue Per Capita Statistics

- The average revenue per capita in the global breakfast cereals market has exhibited a consistent upward trend from 2018 to 2028.

- Beginning at $8.50 billion in 2018, the revenue per capita experienced gradual but steady growth, reaching $8.55 billion in 2019 and $8.70 billion in 2020.

- Notably, the pace of increase accelerated in subsequent years. With revenues climbing to $9.18 billion in 2021 and $9.45 billion in 2022.

- This upward trajectory continued robustly into the mid-2020s. With revenues reaching $10.02 billion in 2023 and $10.60 billion in 2024.

- The trend of growth persisted, with the average revenue per capita projected to rise to $11.21 billion in 2025 and further to $11.81 billion in 2026.

- By 2027, the average revenue per capita is forecasted to reach $12.28 billion. Followed by a subsequent increase to $12.79 billion in 2028.

- This consistent escalation reflects not only the market’s resilience but also the increasing consumer demand and spending within the breakfast cereals sector.

(Source: Statista)

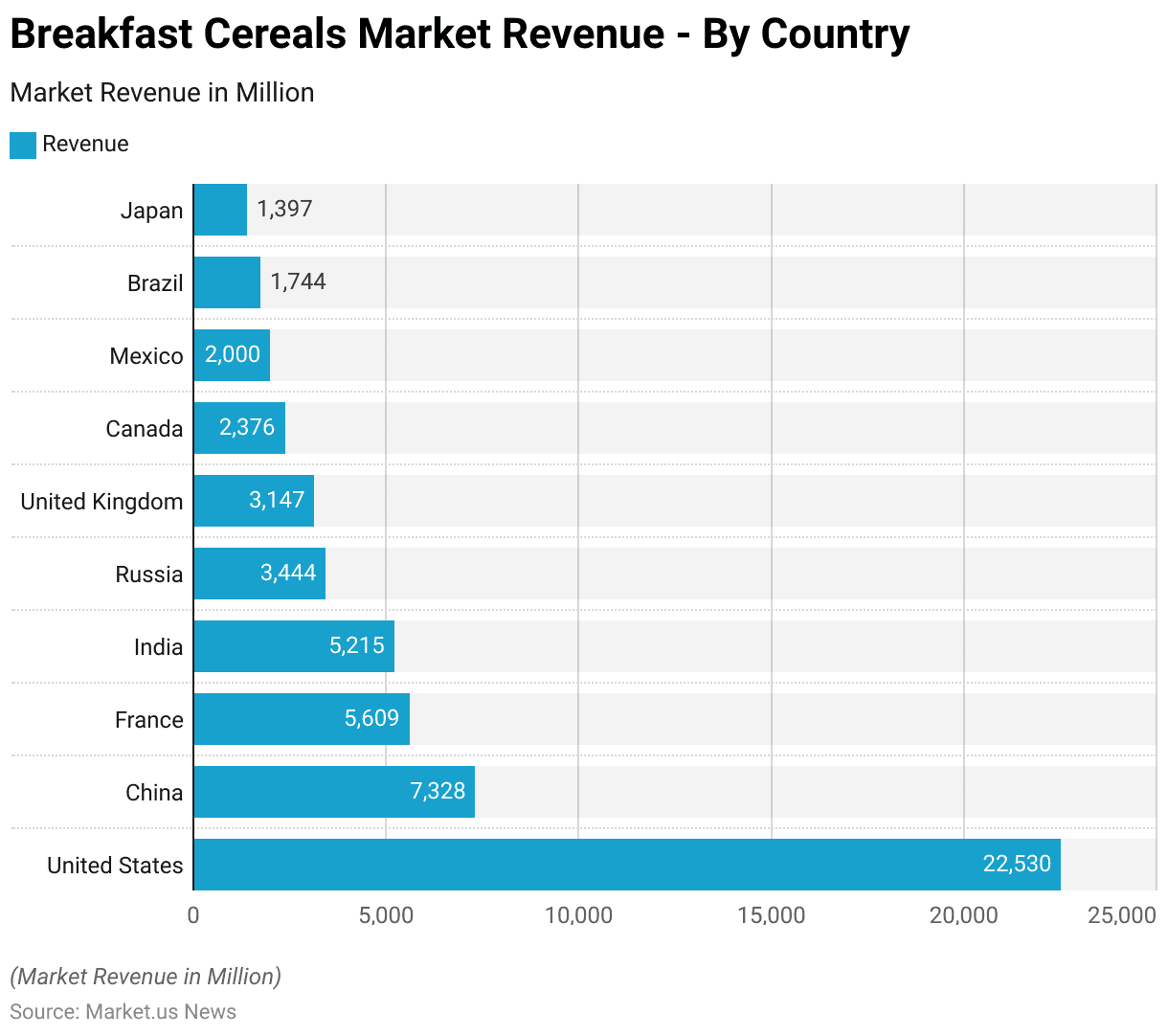

Global Breakfast Cereal Market Revenue – By Country Statistics

- The breakfast cereals market revenue varies significantly across different countries, reflecting varying consumer preferences, dietary habits, and market dynamics.

- Leading the pack is the United States, with a substantial revenue of $22.53 billion. Showcasing the nation’s significant appetite for breakfast cereals.

- China follows closely behind with a market revenue of $7.328 billion. Highlighting the growing popularity of breakfast cereals in the Chinese market.

- France and India also command noteworthy shares, generating revenues of $5.609 billion and $5.215 billion, respectively. Emphasizing the global appeal of breakfast cereals across diverse cultures.

- Meanwhile, Russia, the United Kingdom, Canada, Mexico, Brazil, and Japan contribute to the market with revenues ranging from $3.444 billion to $1.397 billion. Indicating a widespread presence of breakfast cereals across various regions.

- These figures underscore the importance of understanding regional preferences and market dynamics in crafting effective strategies for the breakfast cereals industry.

(Source: Statista)

History of Breakfast Cereals

- The history of breakfast cereals traces back to the late 19th century when convenient alternatives to cooked breakfasts emerged.

- In 1863, Dr. James Caleb Jackson introduced Granula, followed by Dr. John Harvey Kellogg’s creation of Corn Flakes in 1894.

- The commercialization of breakfast cereals began in the early 20th century with Kellogg’s Corn Flakes and the introduction of Wheaties in 1921.

- Throughout the mid to late 20th century, the industry witnessed expansion and innovation. Including the introduction of sugar-coated cereals in the 1950s and the diversification of flavors and shapes in the 1960s.

- The late 20th century and early 21st century saw a shift towards healthier options and the introduction of organic and whole-grain cereals.

- Despite challenges from alternative breakfast choices, such as yogurt and protein bars. The breakfast cereal industry remains resilient, focusing on innovation, sustainability, and personalized offerings to meet the evolving needs of consumers.

(Source: Mashed)

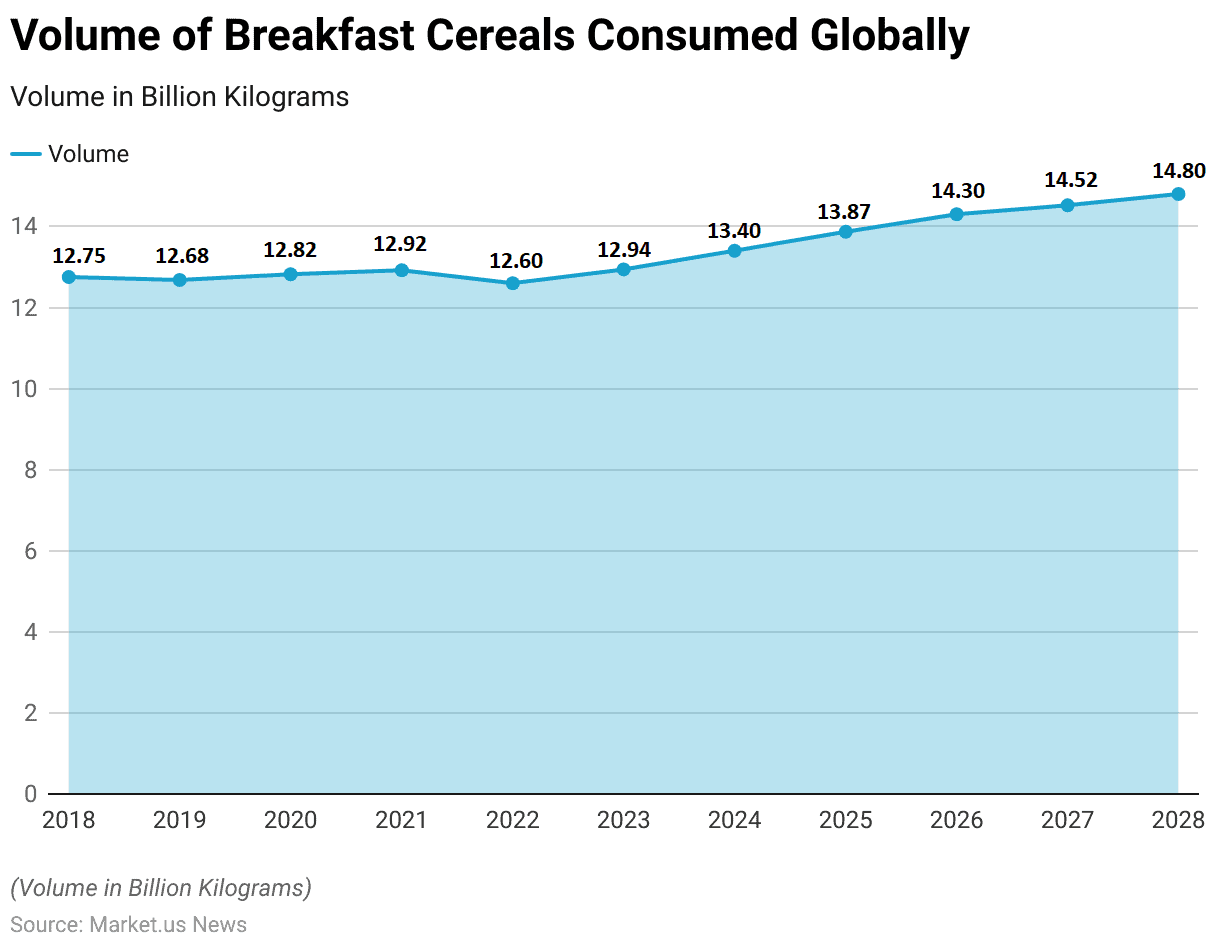

The Volume of Breakfast Cereals Consumed Globally

- The volume of breakfast cereals consumed globally has experienced fluctuations over the years, reflecting changing consumer preferences and market dynamics.

- In 2018, the volume stood at 12.75 billion kilograms, slightly declining to 12.68 billion kilograms in 2019.

- However, the subsequent years saw a modest increase, with volumes reaching 12.82 billion kilograms in 2020 and further rising to 12.92 billion kilograms in 2021.

- Despite a slight dip to 12.60 billion kilograms in 2022, the trend rebounded. With volumes surging to 12.94 billion kilograms in 2023.

- Notably, 2024 witnessed a significant uptick, with the volume increasing to 13.40 billion kilograms, marking a notable growth trajectory.

- Hence, this momentum continued into the forecasted years, with volumes projected to rise to 13.87 billion kilograms in 2025, 14.30 billion kilograms in 2026, and 14.52 billion kilograms in 2027, respectively.

- By 2028, the volume is anticipated to reach 14.80 billion kilograms. Indicating a steady expansion in the global consumption of breakfast cereals.

(Source: Statista)

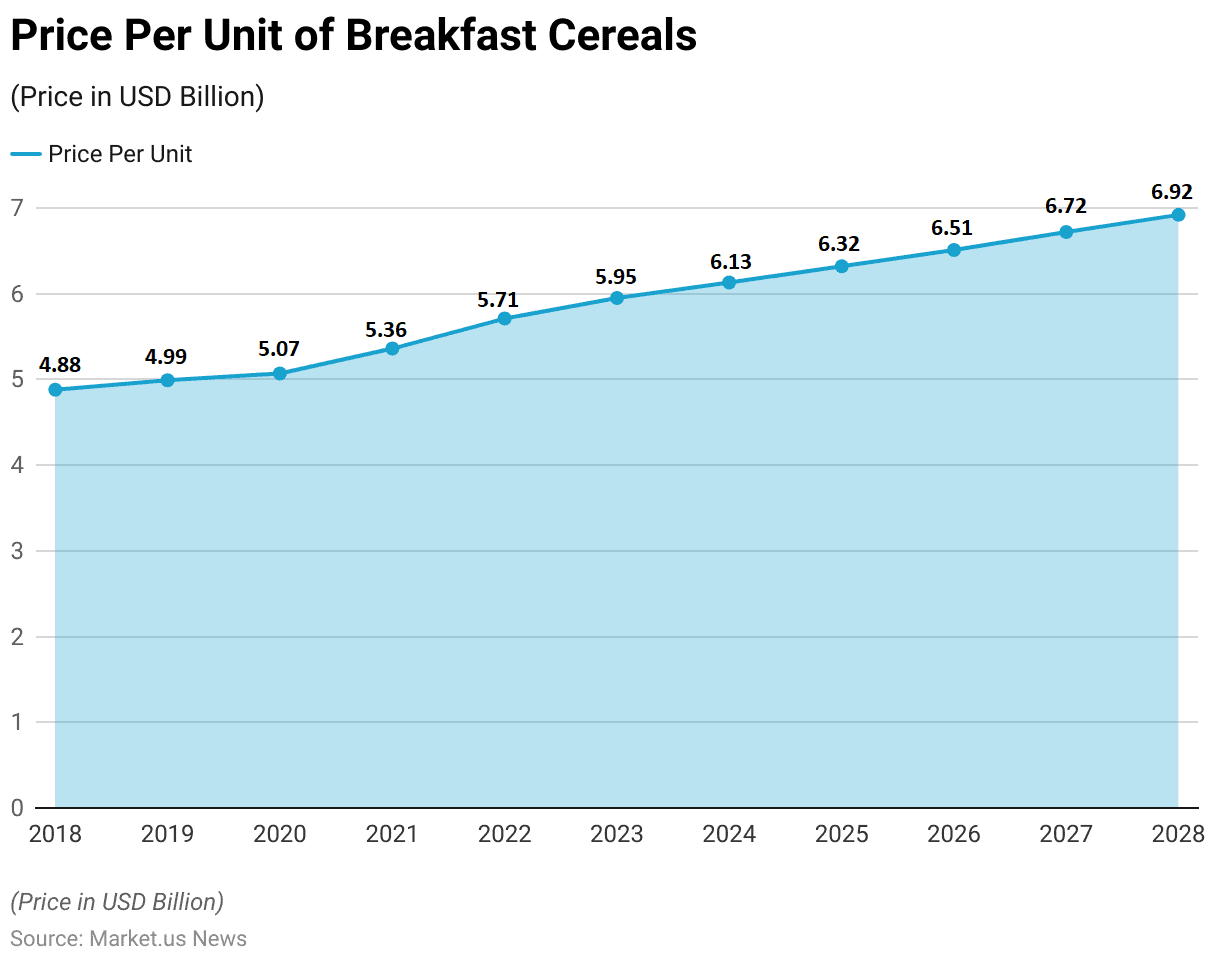

Price of Breakfast Cereal Statistics

- The price per unit of breakfast cereals has exhibited a consistent upward trend over the years, reflecting factors such as inflation, production costs, and market demand.

- In 2018, the price stood at $4.88 per unit, gradually increasing to $4.99 in 2019 and $5.07 in 2020.

- The following years saw more significant escalations, with prices rising to $5.36 in 2021 and $5.71 in 2022, respectively.

- As demand persisted and production costs continued to influence pricing dynamics, prices continued to climb, reaching $5.95 per unit in 2023 and $6.13 in 2024.

- This trend of incremental increases persisted into the forecasted years, with prices projected to reach $6.32 per unit in 2025, $6.51 in 2026, $6.72 in 2027, and $6.92 in 2028, indicating a steady trajectory of price growth within the breakfast cereals market.

(Source: Statista)

Nutritional Value of Different Types of Breakfast Cereal Statistics

Bran Flakes

- Bran flakes, with a serving size of 3/4 cup, provide a moderate energy content of 402 kilojoules (kJ) or approximately 96 kilocalories (kcal).

- In terms of macronutrients, they are low in fat, with 0.66 grams per serving, of which only 0.12 grams are saturated fat. The majority of the fat content consists of polyunsaturated fats (0.308 grams) and a smaller amount of monounsaturated fat (0.088 grams).

- These flakes are primarily composed of carbohydrates, providing 24.12 grams per serving, including 5.67 grams of sugar and a notable 5.3 grams of dietary fiber, contributing to digestive health and satiety. Additionally, each serving contains 2.82 grams of protein, contributing to overall nutritional balance.

- In terms of minerals, bran flakes are relatively moderate in sodium, with 220 milligrams per serving, and contain no cholesterol.

- They also provide a source of potassium, with 185 milligrams per serving, which is essential for various bodily functions, including muscle function and electrolyte balance.

- Overall, bran flakes offer a balanced nutritional profile, making them a suitable choice for a healthy breakfast option.

(Source: FatSecret)

Chocolate Flavoured Rings Cereal (Presweetened)

- The chocolate-flavored rings cereal, pre-sweetened, offers a serving size of 3/4 cup, providing a slightly higher energy content compared to bran flakes, with 469 kilojoules (kJ) or approximately 112 kilocalories (kcal) per serving.

- In terms of macronutrients, this cereal contains a higher fat content, with 2.38 grams per serving, including 0.432 grams of saturated fat, along with monounsaturated fat (0.903 grams) and polyunsaturated fat (0.892 grams).

- Carbohydrates contribute significantly to the cereal’s composition, providing 22.11 grams per serving, including 12.69 grams of sugar and a modest 1.5 grams of dietary fiber.

- This cereal offers a lower protein content compared to bran flakes, with 1.3 grams per serving. In terms of minerals, it contains 128 milligrams of sodium per serving and no cholesterol. Additionally, the cereal provides a small amount of potassium, with 49 milligrams per serving.

- While chocolate-flavored rings cereal may be a tasty treat, its higher sugar and fat content should be considered when incorporating it into a balanced diet.

(Source: FatSecret)

Corn Flakes

- Corn flakes, with a serving size of 1 cup, provide a moderate energy content of 422 kilojoules (kJ) or approximately 101 kilocalories (kcal) per serving.

- These flakes are notably low in fat, containing only 0.03 grams per serving, with no saturated fat. The fat content primarily consists of small amounts of monounsaturated fat (0.008 grams) and polyunsaturated fat (0.014 grams).

- Carbohydrates form the majority of the cereal’s composition, offering 24.28 grams per serving, with a relatively low sugar content of 1.82 grams and a modest 1.3 grams of dietary fiber.

- Each serving also provides 1.88 grams of protein, contributing to overall nutritional balance. In terms of minerals, cornflakes contain 266 milligrams of sodium per serving and no cholesterol. They offer a small amount of potassium, with 33 milligrams per serving.

- Corn flakes present a nutritious option for breakfast or snacks, particularly for those seeking a low-fat, carbohydrate-rich option.

(Source: FatSecret)

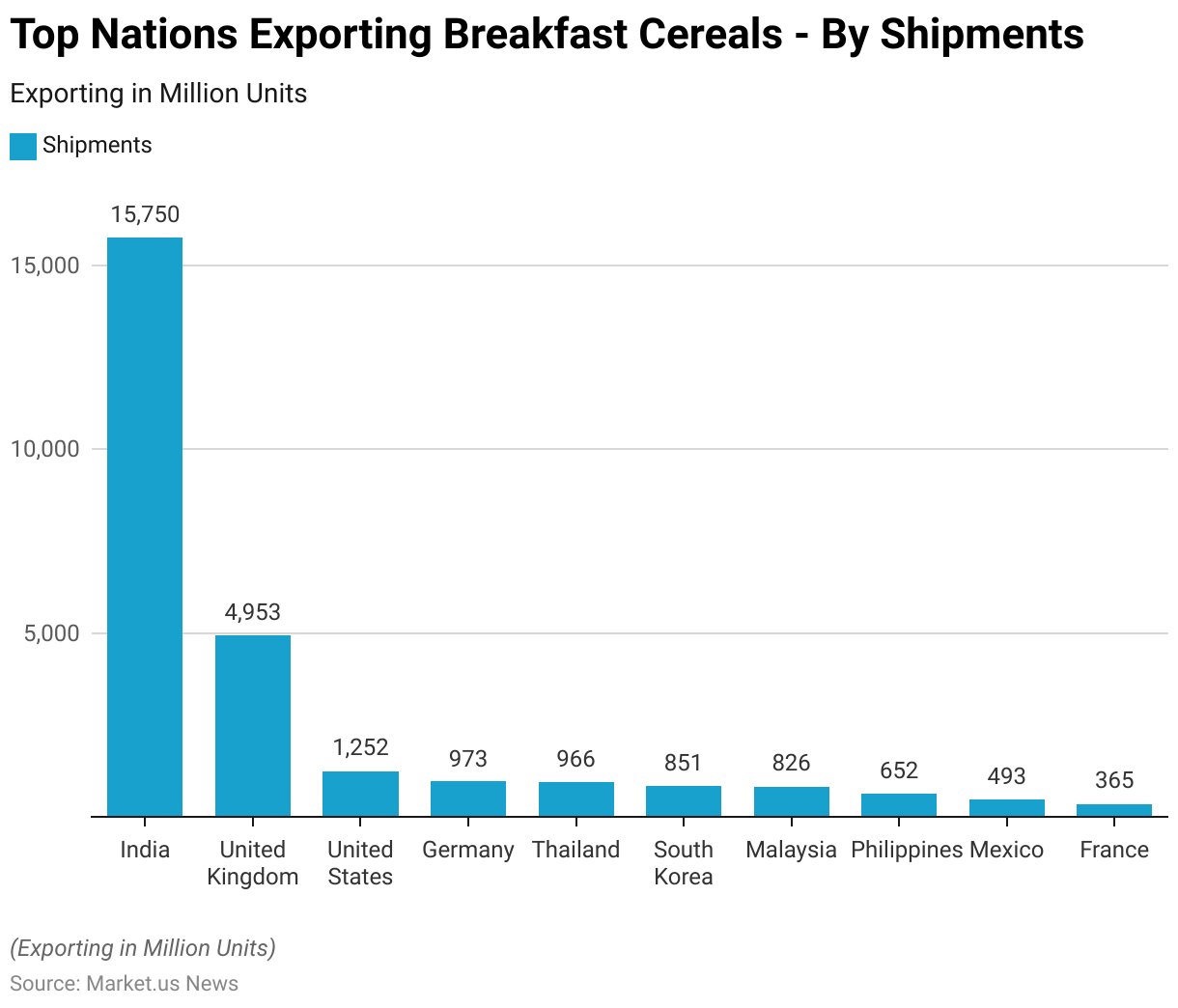

The Leading Countries in Exporting Breakfast Cereal Statistics

- Breakfast cereal exports are dominated by India, with a significant lead in shipments totaling 15,750 million units, followed by the United Kingdom with 4,953 million units.

- The United States ranks third, exporting 1,252 million units, while Germany and Thailand closely trail with 973 million units and 966 million units, respectively.

- South Korea, Malaysia, and the Philippines also contribute substantially to the market, each exporting over 800 million units.

- However, Mexico follows suit with 493 million units, and France completes the list of leading exporters with 365 million units.

- This data underscores India’s prominent position in the global breakfast cereal export market while also highlighting the diverse contributions of other key exporting nations.

(Source: Volza)

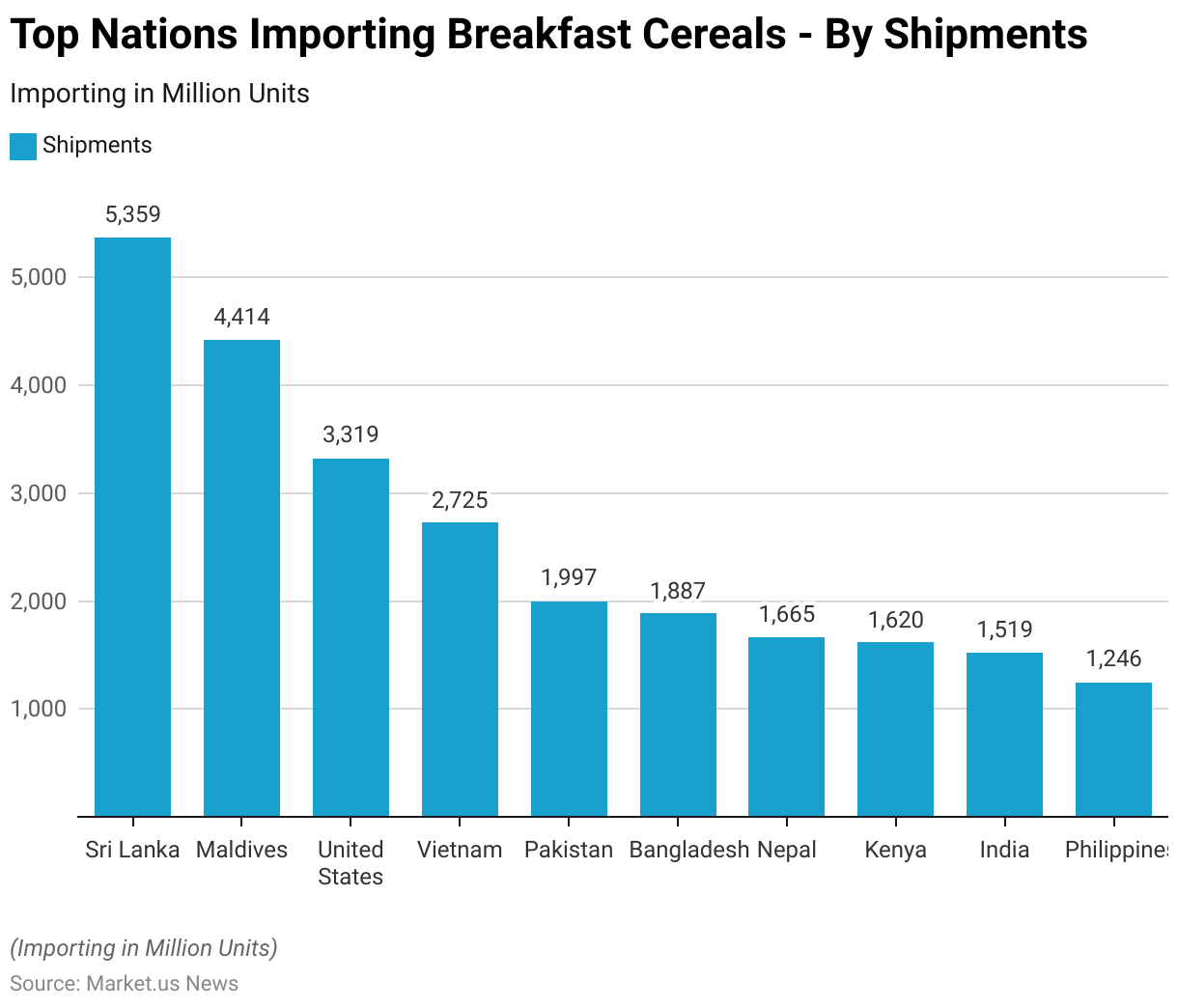

The Leading Countries in Importing Breakfast Cereal Statistics

- In the global import market for breakfast cereals, Sri Lanka emerges as the leading destination, importing 5,359 million units, closely followed by the Maldives with 4,414 million units.

- The United States ranks third among importers, receiving 3,319 million units of breakfast cereals, while Vietnam and Pakistan follow suit with 2,725 million units and 1,997 million units, respectively.

- Bangladesh and Nepal also constitute significant import markets, with 1,887 million units and 1,665 million units, respectively.

- Kenya follows closely behind, with imports totaling 1,620 million units.

- Despite being a significant exporter, India imports 1,519 million units of breakfast cereals, indicating a dynamic domestic market.

- Lastly, the Philippines concludes the list of leading importers with 1,246 million units, reflecting a diverse global demand for breakfast cereal products.

(Source: Volza)

Consumer Preferences and Trends

- Cereal maintains its stronghold as the preferred choice for breakfast, with a substantial 79% of consumers worldwide opting for it in the morning. Yet, the evolving trend of cereal as a snack presents manufacturers with lucrative prospects to tailor their messaging, flavors, and packaging to cater to this emerging occasion.

- Notably, consumers are incorporating cereal into their routines not only for breakfast but also as a snack throughout the day. Including morning (28%), afternoon (25%), and evening (19%) timeslots, as well as during lunch and dinner.

- On a global scale, there’s been a notable uptick in breakfast cereal consumption. With 23% of consumers reporting an increase over the past year, with health considerations driving over half of these decisions.

- Among the countries experiencing significant consumption growth—Vietnam (47%), India (39%), Saudi Arabia (36%), and Thailand (35%). The majority are situated in Asia, suggesting a burgeoning opportunity within this region.

- Oats/oatmeal emerge as the most frequently consumed cereal variant. With 44% of consumers enjoying it at least twice a week, followed closely by cornflakes and sweet cereals.

- Breakfast cereal holds a strong association with health among modern consumers. According to a survey conducted by Innova across 37 countries, the primary reason cited for consuming cereal is its perceived healthfulness. Half of the respondents (50%) selected this option, surpassing reasons such as taste (47%) and convenience (44%). Notably, in countries like India, Indonesia, and Brazil, as many as two out of three consumers identified health as a key motivator.

- For individuals who have recently increased their cereal intake, health emerges as the predominant driver. While, on average, 53% of global consumers attribute health considerations to their increased cereal consumption. This percentage is significantly higher in specific regions, including Argentina and Brazil (64%), Peru (66%), and China (70%).

(Source: Glanbia Nutritionals)

Recent Developments

Acquisitions and Mergers:

- Kellogg’s acquisition of RXBAR: In a strategic move to expand its product portfolio, Kellogg Company acquired RXBAR, a protein bar manufacturer, for approximately $600 million.

- This acquisition aims to tap into the growing demand for healthy snack options and diversify Kellogg’s offerings beyond traditional breakfast cereals.

New Product Launches:

- General Mills’ launch of Nature Valley Granola Cereal: In response to consumer demand for nutritious and convenient breakfast options, General Mills introduced Nature Valley Granola Cereal.

- This product combines the popularity of granola with the convenience of cereal, catering to health-conscious consumers seeking whole-grain breakfast alternatives.

Funding and Investments:

- Magic Spoon’s successful funding round: Magic Spoon, a direct-to-consumer cereal brand offering high-protein, low-carb options, secured $40 million in Series B funding.

- Thus investment underscores the growing interest in innovative, health-focused cereal brands and reflects confidence in Magic Spoon’s growth potential.

Market Expansion Strategies:

- Expansion into the Asia-Pacific region: Leading breakfast cereal manufacturers are increasingly targeting the Asia-Pacific market due to rising disposable incomes and changing dietary preferences.

- Thus, companies like Kellogg’s and General Mills are investing in marketing campaigns and distribution networks to capitalize on this lucrative market opportunity.

Health and Wellness Trends:

- Growing demand for natural and organic cereals: With consumers becoming more health-conscious, there is a rising preference for breakfast cereals made from natural and organic ingredients.

- Thus, companies are responding by reformulating their products to remove artificial flavors and preservatives and introducing organic variants to meet evolving consumer preferences.

Conclusion

Breakfast Cereal Statistics – In summary, the breakfast cereal industry demonstrates resilience and adaptability amidst changing consumer preferences and market dynamics.

Moreover, fueled by health and wellness trends, innovation, and convenience, the market continues to expand.

Manufacturers are diversifying products to meet varied consumer needs while leveraging digital platforms for growth.

Emerging markets offer substantial expansion opportunities. Despite challenges, including competition and sustainability concerns, proactive strategies can sustain growth.

Overall, the industry’s future remains promising, driven by consumer demand for nutritious and convenient breakfast options.

FAQs

Breakfast cereals are processed grains typically consumed as breakfast food. They come in various forms, such as flakes, puffs, granola, and shapes, and may be fortified with vitamins and minerals.

It depends on the specific cereal and its ingredients. Some breakfast cereals are high in sugar and low in nutritional value, while others are fortified with vitamins, minerals, and whole grains, offering a healthier option.

Breakfast cereals can provide essential nutrients, fiber, and energy to start the day. They are convenient and versatile, allowing for quick and easy meal preparation.

Breakfast cereals should be stored in a cool, dry place in airtight containers to maintain freshness and prevent moisture absorption. Avoid storing them near heat sources or in direct sunlight to preserve their quality.

Yes, breakfast cereals have a shelf life and may expire over time, especially if not stored properly. It’s essential to check the expiration date on the packaging and consume them before the indicated date for optimal taste and quality.