Table of Contents

Introduction

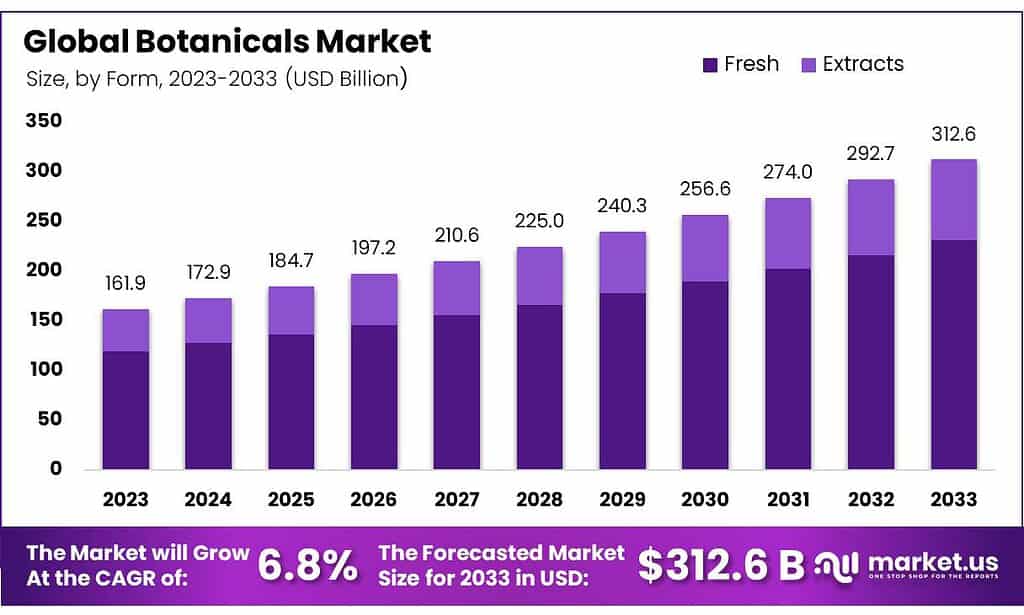

The global botanical market is set for impressive growth, projected to surge from USD 161.9 billion in 2023 to USD 312.6 billion by 2033, with a CAGR of 6.8%. This growth is propelled by the escalating demand for natural and organic products in sectors such as food and beverages, pharmaceuticals, and cosmetics. The shift towards health consciousness and clean-label products significantly contributes to this trend.

Despite the growth, the botanicals industry faces challenges, including strict and varying regulatory frameworks that influence market dynamics and trade limitations across different regions. Ensuring the quality, safety, and effectiveness of botanical products is also challenging due to the inherent variability of plant materials.

Recent developments underscore the expansion in product offerings and market strategies by leading players like International Flavors & Fragrances and Firmenich SA, who are emphasizing innovative and sustainable products. Notably, in Europe, there is an increasing trend towards utilizing botanical ingredients in the food and beverage industry, favoring natural flavorings such as fruit, cocoa, and floral extracts.

Key market participants, including Archer-Daniels-Midland Company, International Flavors & Fragrances Inc., Koninklijke DSM N.V., and Givaudan, are actively engaging in acquisitions, collaborations, and product innovations to secure and enhance their market positions.

Archer-Daniels-Midland Company, in particular, is expanding its portfolio and geographical reach through strategic acquisitions, which enhances its natural product capabilities and extends its global customer base.

While facing regulatory and supply chain obstacles, the botanical market’s growing consumer preference for natural and sustainable products opens up vast opportunities for innovation and development in the sector.

Key Takeaways

- The global botanicals market will be valued at US$ 161.9 billion in 2023.

- The global botanicals market is projected to reach US$ 312.6 billion by 2033.

- Among forms, fresh botanicals accounted for the largest market share of 74.0%.

- Among sources, root botanicals accounted for the majority of the market share with 27.4%.

- Based on application, pharmaceuticals are expected to account for the largest market share in 2023 with 40.1%.

- Increasing demand for natural and organic products is expected to drive the market.

- Europe is the leading region in the global market with a revenue share of 34.6%.

Botanicals Statistics

- There are approximately 400,000 botanical species worldwide.

- The global economic value of botanical products exceeds $100 billion annually.

- About 25% of pharmaceutical drugs are derived from botanical sources.

- There are roughly 3,000 botanical gardens globally, attracting over 150 million visitors each year.

- The botanical supplements market is growing at a rate of 7-10% annually, with a market size estimated between $100-150 billion.

- The botanical skincare market generates over $10 billion in revenue annually, with around 70% of consumers willing to pay a premium for natural or botanical skincare products.

Over 10,000 research papers on botanical medicine are published each year. - The Asia-Pacific region leads the botanical market with a 40-45% share, followed by Europe and North America.

- Botanical products have an estimated effectiveness rate of 80-90% against targeted pests and can reduce environmental impact by 20-30% compared to synthetic pesticides.

Emerging Trends

- Natural Product Demand: The botanicals market is expanding due to a surge in consumer interest in natural and organic products. This trend reflects a broader move towards healthier, environmentally friendly choices. In the food and beverage sector, botanical ingredients are becoming especially popular in functional beverages, with consumers increasingly drawn to products that offer specific health benefits.

- Technological Innovation: Technological progress is significantly impacting the botanicals market. Companies such as Novella, Ltd., and Leaven Essentials are leveraging advanced technologies like DNA fingerprinting and geo-tagging. These innovations help cultivate botanical ingredients with greater authenticity and climate resilience, enhancing product reliability and sustainability.

- Beauty from Within: Interest in “beauty from within” products is on the rise. These supplements, aimed at improving skin, hair, and nail health, are based on the idea that true beauty comes from good health. The development of these products is increasingly focused on ingredients known for their health benefits, such as collagen and antioxidants.

- Botanicals in Personal Care: The use of botanicals in personal care and cosmetics is growing, driven by their natural allure and perceived safety. This trend is supported by consumer demand for clean-label products, which emphasize transparency and the avoidance of synthetic chemicals in their ingredient lists.

- E-commerce Growth: The botanicals market is also experiencing a boost from e-commerce advancements. The convenience, competitive pricing, and wide range of products available online are making it easier for consumers to purchase botanical products, aligning with their preferences for health, authenticity, and sustainability.

Use Cases

- Food and Beverage: Botanicals are increasingly used to elevate flavors and offer health benefits within the food and beverage industry. Spices, for example, enhance the taste of meals without relying on excess salt or sugar while also providing therapeutic effects like reducing inflammation. The popularity of functional beverages infused with botanical ingredients highlights the growing consumer interest in their health-promoting properties.

- Personal Care and Cosmetics: In the personal care sector, botanicals are favored for their natural and sustainable qualities. Ingredients such as aloe vera, tea tree oil, and chamomile are widely incorporated into skincare products, prized for their calming and anti-inflammatory effects. These natural components appeal to consumers seeking safer and eco-friendly beauty alternatives.

- Pharmaceuticals: Botanicals play a significant role in the pharmaceutical industry, where they are used to create both medicines and dietary supplements. As more consumers opt for natural remedies over synthetic drugs, botanical ingredients are gaining traction for their ability to treat a variety of health conditions.

- Agriculture: In agriculture, botanicals contribute to improved crop health and productivity. Methods like integrated pest management make use of botanical extracts to manage pests without relying on chemical pesticides, offering a more sustainable and eco-conscious approach to farming while ensuring crop safety.

- Nutraceuticals: The nutraceutical industry leverages botanicals to formulate supplements that offer a range of health benefits. These supplements, designed to improve mental clarity, digestive function, and immune health, have seen increased demand, reflecting the rising awareness of health and wellness among consumers.

Major Challenges

- Quality Control and Consistency: Botanical products often contain complex mixtures of active constituents, making it difficult to ensure consistent quality and potency across different batches. Variations in raw materials, cultivation methods, and processing can lead to inconsistencies, affecting both safety and efficacy.

- Safety and Toxicity: Some botanical supplements have been linked to adverse health effects, including liver damage. For instance, a study found that between 2004 and 2005, 7% of drug-induced liver injury cases were associated with herbal and dietary supplements; by 2013 to 2014, this rate had increased to 20%.

- Regulatory Oversight: In many countries, including the United States, botanical products are often regulated as dietary supplements rather than drugs. This regulatory framework can result in less stringent quality control and safety testing, potentially leading to the market presence of adulterated or misbranded products.

- Efficacy Evidence: While some botanical products are used for specific health conditions, there is often a lack of robust scientific evidence supporting their efficacy. Many claims are based on traditional use rather than clinical trials, making it challenging for consumers and healthcare providers to assess their true benefits.

- Interactions with Conventional Medications: Botanical products can interact with prescription and over-the-counter medications, potentially leading to harmful effects. For example, certain herbs may affect the metabolism of drugs, altering their effectiveness or increasing the risk of side effects.

Market Growth Opportunities

- Urban Agriculture Initiatives: Public gardens and community organizations are increasingly engaging in urban agriculture to promote local food production and community resilience. For instance, the United States Botanic Garden (USBG) has awarded $445,600 to 26 public gardens across the U.S. to support urban agriculture projects, fostering public engagement and education in urban food growing.

- Organic Farming Expansion: The demand for organic products continues to rise, presenting significant opportunities for growth. Since the USDA implemented organic regulations in 2002, the U.S. organic sector has tripled in size, with over 22,000 certified organic operations and more than $43 billion in retail sales. This growth indicates a strong market for organic botanicals.

- Research and Development in Botanical Products: Investing in research and innovation is crucial for the continued growth of the botanical industry. The USDA has increased funding for organic research, with mandatory spending authorization for the Organic Agriculture Research and Extension Initiative growing from $3 million in 2002 to $50 million in 2023. This investment supports the development of new botanical products and farming practices.

- Integration of Bioinputs in Agriculture: The adoption of bioinputs—biological alternatives to traditional pesticides and fertilizers—is gaining momentum. In Brazil, the bioinputs market has grown by an average of 21% annually over the past three years, four times the global average. This trend reflects a global shift towards sustainable agricultural practices, presenting opportunities for botanical-based solutions.

- Botanical Drug Development: The development of botanical drugs is a growing field, with the FDA providing guidance for industry on the development of botanical drug products. This includes considerations for quality, safety, and efficacy, offering opportunities for innovation in botanical pharmaceuticals.

Key Players Analysis

- The Archer-Daniels-Midland Company (ADM) is a key player in the botanicals sector, known for transforming agricultural crops into vital ingredients for the food, beverage, and supplement industries worldwide. With a focus on innovation in food and agriculture technology, ADM uses its extensive capabilities in sourcing and processing to provide sustainable and nutritious solutions. The company’s commitment to plant-based and functional foods is in line with global trends toward health and sustainability, driving its product development forward.

- International Flavors & Fragrances, Inc. (IFF) is an influential force in the botanicals sector, excelling in the creation of unique flavors, aromas, and sensory experiences. By integrating natural ingredients into a wide range of consumer products, IFF enhances offerings across industries. Their work focuses on botanical-derived flavorings and fragrances, responding to the growing consumer demand for authenticity and natural ingredients.

- Koninklijke DSM N.V. (DSM) is deeply invested in the botanicals sector, applying its bioscience expertise to produce nutritional ingredients that enhance both human and animal health. Their work in health and nutrition, especially through the development of botanical ingredients for dietary supplements and functional foods, underscores a commitment to sustainability and innovation.

- Givaudan is a leader in integrating botanicals into health and wellness products, leveraging their deep knowledge to create natural, innovative solutions. They focus on holistic wellness, offering products that target cognitive, gut, and physical health. Their botanical innovations in food and beverage are designed not only for functional health but also to enhance the sensory experience for consumers, making wellness both accessible and enjoyable.

- Carbery Group, known for its work in dairy and nutritional ingredients, has also made significant strides in integrating botanical elements into its product offerings. With an emphasis on sustainable practices and health-conscious innovation, Carbery focuses on creating functional ingredients and flavor enhancements that support broader health and nutrition goals.

- Sido Muncul, a major player in Indonesia’s botanical market, is renowned for its traditional herbal products, particularly the well-known immune-boosting remedy Tolak Angin. The company is dedicated to innovation while maintaining its roots in traditional herbal practices. Their continued expansion and modernization of manufacturing processes highlight their commitment to meeting both modern and traditional standards of quality and efficacy in herbal products.

- Martin Bauer GmbH & Co. KG is a significant player in the botanicals industry, specializing in the processing of raw materials for tea, beverages, and dietary supplements. The company prioritizes sustainable sourcing and environmental responsibility, offering a broad range of herbal and fruit-based teas, infusions, and extracts. Their commitment to sustainability and innovation ensures their continued success in providing high-quality botanical solutions globally.

- Bell Flavors & Fragrances has made its mark in the botanicals sector through its proprietary Belltanicals® brand, offering a variety of botanical extracts, essential oil blends, and organic products. These offerings serve a wide range of industries, including personal care and food products, with a focus on natural, sustainable solutions. The company emphasizes the integration of botanicals into products that enhance both health and sensory qualities.

- Prakruti Products, founded in 1998, is a leading manufacturer of standardized herbal extracts, organic ingredients, and nutraceuticals. As the largest global producer of Garcinia cambogia extract, the company is committed to delivering high-quality botanical products with strict adherence to safety and efficacy standards. Their state-of-the-art facilities and focus on quality control highlight their dedication to premium botanical offerings worldwide.

- Eu Yan Sang has been a prominent figure in the botanicals sector for over a century, specializing in Traditional Chinese Medicine (TCM). Known for its high-quality herbal remedies and wellness products, Eu Yan Sang offers a wide range of botanicals such as Ginseng, Cordyceps, and Ginkgo Biloba, focusing on improving vitality, immunity, and overall health.

- Herbanext Laboratories, Inc., based in the Philippines, has earned a strong reputation in the botanicals sector for its sustainable farming of medicinal plants and the production of spray-dried extracts. The company is known for its dedication to quality, research, and development, and its efforts to conserve Philippine biodiversity through sustainable practices. Their GMP-certified facility is a testament to their commitment to both environmental sustainability and local pharmaceutical needs.

- Ransom Naturals Ltd, a UK-based company with over 174 years of experience, specializes in creating high-quality botanical extracts for industries such as healthcare, pharmaceuticals, and food and beverage. Their innovative approach combines traditional techniques with modern science to meet the diverse needs of the market. With a full suite of services from development to commercialization, Ransom Naturals is a trusted partner for companies integrating natural botanical ingredients into their products.

- Blue Sky Botanics, operating from a 200-acre organic farm in Herefordshire, UK, produces high-quality botanical extracts for the personal care, food, and beverage sectors. The company is dedicated to sustainability and ethical sourcing, using green chemistry methods to create natural extracts that protect biodiversity. Their Fair Trade and organic-certified products meet high standards of quality and traceability, making them a preferred supplier for global manufacturers.

- Indesso, based in Indonesia since 1968, has built a strong reputation for producing botanical extracts from cocoa, coffee, tea, vanilla, and ginger, alongside flavor, fragrance, and wellness solutions. The company’s commitment to sustainability is reflected in its use of advanced technology and quality management systems to ensure the highest product standards.

Conclusion

Botanicals are increasingly essential across diverse industries, underscoring their flexibility and the growing consumer demand for natural and sustainable products. Whether enhancing flavors in the food and beverage industry or serving as vital components in pharmaceuticals and cosmetics, botanicals are key to creating healthier, more environmentally conscious offerings. The rising focus on health and wellness, combined with advances in product development and cultivation techniques, is propelling the botanicals market forward.

As consumers continue to shift towards cleaner, more natural options, the market is set to experience strong growth, driven by ongoing innovation and sustainability efforts. This shift not only reinforces botanicals as traditional essentials but also highlights their crucial role in modern industrial applications, catering to an increasingly health-conscious and environmentally aware consumer base.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)