Table of Contents

Introduction

The Global Blackout Fabric Market is projected to reach approximately USD 20.3 billion by 2034, up from an estimated value of USD 10.5 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 6.8% during the forecast period spanning from 2025 to 2034.

Blackout fabric is a specially manufactured textile designed to block light penetration, typically made by coating or tightly weaving multiple layers of fabric, often including polyester, acrylic, or foam backings. This fabric is extensively used in residential, commercial, and hospitality settings for window treatments to ensure privacy, reduce heat gain, and improve energy efficiency by preventing sunlight and UV rays from entering indoor spaces. The blackout fabric market refers to the global commercial landscape surrounding the production, distribution, and application of these fabrics across various end-use industries.

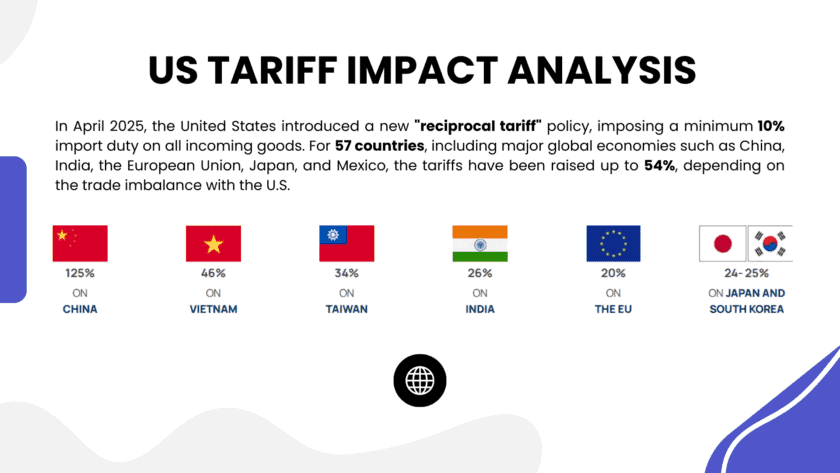

This positive outlook is now facing potential headwinds due to the recent imposition of U.S. tariffs on imported textile products, including blackout fabrics. These tariffs, ranging from 27% to 46% depending on the country of origin, are likely to reshape market dynamics across the supply chain.

The immediate impact of these tariffs is expected to manifest in increased material costs, as the U.S. has traditionally relied heavily on imports from key textile-exporting nations such as China, India, and Vietnam. For blackout fabric manufacturers, the 20% average tariff on inputs could reduce cost efficiencies, pushing production costs upward. This may result in price increases at the retail level, especially for finished blackout curtains and commercial window treatments.

Additionally, supply chain disruptions are anticipated as businesses reevaluate procurement strategies and consider shifting sourcing to non-tariffed countries or investing in domestic manufacturing. However, capacity constraints and a lack of skilled labor in the U.S. textile sector present significant barriers to near-term localization efforts. Smaller manufacturers may be particularly vulnerable, potentially facing margin pressures and diminished market competitiveness.

Despite these challenges, the market’s long-term growth prospects remain cautiously optimistic. Demand for energy-efficient, privacy-enhancing window coverings continues to rise, driven by trends in residential construction, commercial retrofitting, and eco-conscious interior design. To mitigate tariff-related risks, strategic initiatives such as supplier diversification, inventory adjustments, and increased automation may become critical.

Key Takeaways

- The global Blackout Fabric Market is anticipated to reach USD 20.3 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.8% during the forecast period from 2025 to 2034. This growth is attributed to increasing demand for thermal insulation, light control, and energy-saving solutions across various sectors.

- In 2023, the Hotels & Restaurants segment accounted for 40.5% of the overall market share. The high adoption rate in this sector is driven by the need for enhanced guest comfort, privacy, and energy efficiency, particularly in premium and luxury establishments.

- The 2-3 Ply category emerged as the leading product segment in 2023, capturing a 55.6% market share. Its widespread application across residential and commercial sectors is due to its superior light-blocking capabilities, sound insulation, and durability.

- North America led the global market in 2023, accounting for 30.5% of the total revenue share, which translates to USD 3.15 billion. The region’s dominance is supported by robust construction activity, high consumer awareness regarding energy-efficient interiors, and strong demand from institutional and hospitality sectors.

Access In-Depth Analysis of US Tariff Consequences on Industry Performance at https://market.us/report/blackout-fabric-market/request-sample/

Impact of U.S. Tariffs on Blackout Fabric Market

The recent escalation of U.S. tariffs on imported textiles, including blackout fabrics, is poised to significantly impact the domestic market. Effective April 9, 2025, the U.S. has imposed reciprocal tariffs on leading textile and apparel exporters, with rates such as 27% on India, 34% on China, and 46% on Vietnam .

Impact on Blackout Fabric Supply Chains:

- Cost Increases: Blackout fabrics, often imported for U.S.-based finishing processes, are now subject to a 20% tariff, leading to higher material costs for manufacturers.

- Supply Chain Disruptions: The tariffs have introduced complexities in sourcing raw materials, with businesses facing challenges in maintaining timely production schedules and managing increased expenses.

Consequences for U.S. Manufacturers and Consumers:

- Price Adjustments: Manufacturers are confronted with the decision to either absorb the additional costs or pass them on to consumers, potentially leading to higher retail prices for blackout curtains and related products .

- Operational Challenges: The increased tariffs may strain smaller businesses, which often lack the infrastructure to adapt quickly to such economic shifts, potentially leading to reduced competitiveness and market share .

Strategic Considerations:

- Diversification of Sourcing: Companies may need to explore alternative sourcing options from countries not affected by the tariffs to mitigate cost increases.

- Investment in Domestic Production: While the tariffs aim to bolster U.S. manufacturing, the current lack of infrastructure and skilled labor presents challenges that require long-term investment and planning .

Emerging Trends

- Integration with Smart Home Systems: There is a growing trend of incorporating blackout fabrics into smart home ecosystems, enabling automated control through mobile applications and voice-activated assistants.

- Sustainable and Eco-Friendly Materials: Manufacturers are increasingly focusing on producing blackout fabrics using sustainable materials and environmentally friendly processes to meet the rising consumer demand for green products.

- Enhanced Functionalities: Advancements in fabric technology have led to the development of blackout fabrics with additional features such as thermal insulation, UV protection, and flame resistance, catering to diverse consumer needs.

- Customization and Aesthetic Appeal: Consumers are seeking blackout fabrics that not only serve functional purposes but also align with their interior design preferences, leading to a trend towards customizable patterns and colors.

- Expansion in Commercial Applications: The use of blackout fabrics is expanding beyond residential settings into commercial spaces like hotels, hospitals, and educational institutions, driven by the need for privacy and light control.

Top Use Cases

- Residential Window Treatments: Blackout fabrics are widely used in homes to block external light, enhance privacy, and improve energy efficiency by reducing heat gain or loss.

- Hospitality Industry: Hotels and resorts utilize blackout curtains to provide guests with a comfortable sleeping environment by eliminating unwanted light.

- Healthcare Facilities: Hospitals and clinics employ blackout fabrics to create controlled lighting environments, essential for patient rest and recovery.

- Educational Institutions: Schools and universities use blackout curtains in classrooms and auditoriums to facilitate multimedia presentations by controlling ambient light.

- Photography and Film Studios: Blackout fabrics are essential in studios to prevent light interference during shoots, ensuring optimal lighting conditions.

Major Challenges

- High Production Costs: The manufacturing process of blackout fabrics, which often involves multiple layers and specialized coatings, can be cost-intensive, affecting pricing competitiveness.

- Environmental Concerns: The production of certain blackout fabrics may involve chemicals and processes that raise environmental and health concerns, prompting scrutiny from regulators and consumers.

- Market Competition: The presence of alternative window treatment solutions, such as blinds and shades, intensifies competition, challenging blackout fabric manufacturers to differentiate their products.

- Durability Issues: Some blackout fabrics may face wear and tear over time, especially in high-usage settings, leading to concerns about product longevity and replacement costs.

- Limited Awareness in Emerging Markets: In certain developing regions, lack of awareness about the benefits of blackout fabrics can hinder market penetration and growth.

Top Opportunities

- Technological Innovations: Investing in research and development to create advanced blackout fabrics with multifunctional properties can open new market segments.

- Expansion into Emerging Markets: Tapping into developing countries with growing urban populations presents opportunities for market expansion.

- Online Retail Channels: Leveraging e-commerce platforms can enhance product visibility and accessibility, reaching a broader customer base.

- Partnerships with Real Estate Developers: Collaborating with builders and interior designers can integrate blackout fabrics into new construction projects, ensuring early adoption.

- Sustainability Certifications: Obtaining eco-friendly certifications can appeal to environmentally conscious consumers, providing a competitive edge.

Key Player Analysis

The global Blackout Fabric Market in 2024 is witnessing strategic participation from a diverse array of key players, each contributing through innovation, quality, and expanding global footprint. Although traditionally known for their prominence in the premium outdoor appliance sector, companies such as AB Electrolux, Summerset Grills, Wolf Steel Ltd, and DCS Appliances have begun integrating blackout fabric solutions as part of outdoor shading systems to complement their appliance offerings, thereby enhancing customer experience and comfort.

The integration of UV-resistant, thermally-insulated blackout fabrics aligns with consumer demand for energy-efficient and aesthetically appealing solutions. Simultaneously, specialists like Danver Stainless Blackout Fabrics, Brown Jordan Blackout Fabrics, and Kalamazoo Outdoor Gourmet are innovating within the niche, offering advanced materials with superior durability, weather resistance, and customization. Bull Outdoor Products, Alfresco Grills, RH Peterson Co., Coyote Outdoor Living, and Blaze are also leveraging these materials in luxury outdoor kitchen environments. Their strategic adoption of blackout fabrics not only diversifies product portfolios but also reflects a growing market shift toward integrated outdoor living solutions.

Key Players in the Market

- UNITEC Textile Decoration Co., Ltd.

- Etremonde Polycoaters Limited

- Indiana Coated Fabrics

- Hunter Douglas

- Dunmore

- Herculite

- P.W. Greenhalgh & Company Limited

- Sotexpro

- Bandalux

- Création Baumann

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=137272

Regional Analysis

North America Leads Blackout Fabric Market with Largest Market Share of 30.5%

North America has emerged as the leading region in the global blackout fabric market, commanding a substantial 30.5% share in 2024, equivalent to USD 3.15 billion in revenue. This dominance is primarily driven by the increasing demand for energy-efficient and light-blocking window coverings across residential, commercial, and hospitality sectors in the United States and Canada. In Canada, the need for blackout fabrics is particularly pronounced due to prolonged snow cover and freezing temperatures, necessitating solutions that preserve interior warmth and comfort.

The region’s strong manufacturing base, coupled with advanced technological integration in fabric production, further contributes to market growth. Additionally, the rising trend towards home automation and energy-saving solutions has led to increased adoption of blackout fabrics in residential settings. The hospitality industry’s emphasis on enhancing guest experiences has also spurred demand for high-quality blackout curtains and drapes.

Impact of U.S. Tariffs on Blackout Fabric Market

The imposition of tariffs by the United States on imports from key sourcing countries such as China, Mexico, and Canada has introduced challenges for the blackout fabric market. These tariffs, which include a 25% levy on Mexican and Canadian goods and a 10% levy on Chinese imports, have led to increased costs for raw materials and finished products. Smaller businesses, in particular, face difficulties in absorbing these additional costs, resulting in higher prices for consumers and potential disruptions in supply chains.

Recent Developments

- In 2024, Fabriclore raised $1.6 million in fresh funding, backed by PeerCapital from Bengaluru and Regal Fabrics from the UAE. The company, known for its digital fabric sourcing services, plans to use the funds to improve its technology and expand its global reach. This investment marks a strong step forward in connecting designers and manufacturers with diverse textile options.

- In 2024, Fabric continued expanding its digital health services with the acquisition of GYANT, an AI-powered tool for patient engagement and scheduling. This move is expected to help hospitals and clinics streamline patient communication and reduce manual workload. The acquisition supports Fabric’s mission to simplify healthcare processes and enhance access to care.

- In 2024, Fabric also secured $60 million in Series A funding, led by General Catalyst. The capital will be used to develop a unified healthcare platform that combines multiple solutions into one system. With this funding, Fabric aims to improve patient access, boost clinical efficiency, and make healthcare delivery more effective across both online and offline channels.

Conclusion

The global blackout fabric market is poised for sustained growth, driven by the increasing demand for energy-efficient and light-blocking solutions across residential, commercial, and hospitality sectors. The integration of smart technologies and the rising awareness of thermal insulation benefits are further propelling market expansion. Despite challenges such as high production costs and environmental concerns, opportunities abound in emerging markets and through technological innovations. The market’s trajectory indicates a significant role in the broader context of sustainable building materials and home furnishings.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)