Table of Contents

Introduction

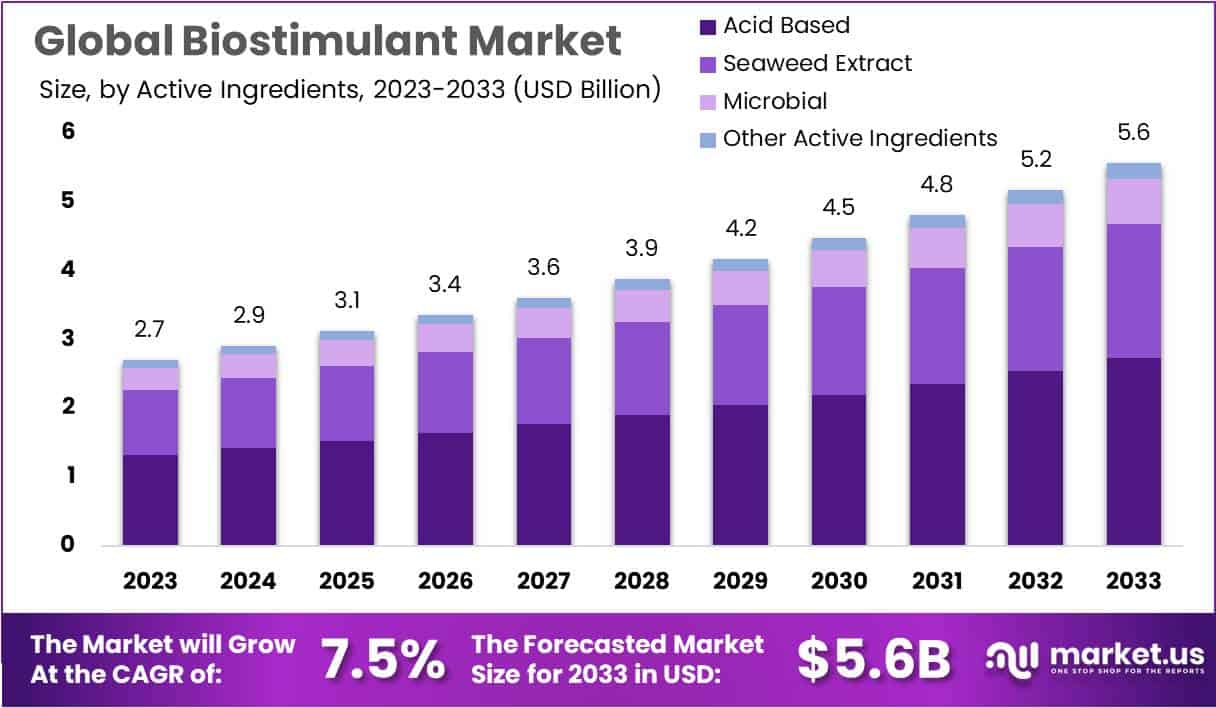

The biostimulant market is on track for substantial growth, with its valuation expected to rise from USD 2.7 billion in 2023 to approximately USD 5.6 billion by 2033, representing a (CAGR) of 7.5% during the forecast period from 2024 to 2033.

Biostimulants, which encompass humic acids, fulvic acids, seaweed extracts, amino acids, and beneficial microorganisms, are vital in enhancing plant health by promoting nutrient uptake, improving stress resilience, and boosting overall crop quality. Unlike traditional fertilizers that supply essential nutrients, biostimulants optimize plants’ ability to absorb and efficiently utilize these nutrients.

Several key factors are fueling the expansion of the biostimulant market. The growing global focus on sustainable agriculture and organic farming practices has significantly elevated the demand for these eco-friendly solutions. Additionally, government initiatives, including subsidies and supportive regulatory frameworks, are encouraging widespread adoption.

Technological advancements in biostimulant formulations and innovative application methods have further bolstered their appeal. The integration of biostimulants with precision agriculture practices enhances their efficiency, enabling precise and targeted application, which maximizes their benefits. Together, these trends are positioning biostimulants as essential tools for modern, sustainable agriculture.

The biostimulant market has witnessed several notable developments recently, marked by strategic investments and product innovations from leading industry players. In 2023, Sumitomo Chemical India Ltd. introduced Promalin, an advanced product developed in collaboration with Valent Biosciences, aimed at enhancing crop productivity.

BASF Venture Capital GmbH made a strategic investment in Sead Energy Pvt. Ltd., a company that specializes in biostimulants derived from red seaweed, highlighting the growing interest in seaweed-based solutions. Additionally, FMC Corporation launched its “Biologicals by FMC” brand, expanding its product offerings in the biostimulant and fungicide segments, further solidifying its presence in the biological solutions market.

Despite the robust growth potential, the biostimulant market faces several critical challenges. High research and development costs present a significant hurdle, particularly for smaller companies attempting to compete in the market. Awareness gaps among farmers, especially in developing regions, hinder the widespread adoption of biostimulants, as many remain unfamiliar with their benefits compared to conventional fertilizers.

Furthermore, stringent regulatory frameworks and lengthy approval processes for biostimulant products add complexity to market entry for new players. The continued reliance on traditional chemical fertilizers also remains a significant barrier to the broader acceptance of biostimulants, highlighting the need for greater education and outreach efforts within the agricultural community.

Key Takeaways

- The global Biostimulant Market size was valued at USD 2.7 billion in 2023.

- The market is expected to grow at a CAGR of 7.5% between 2024 and 2033.

- By 2033, the Biostimulant Market size is projected to reach around USD 5.6 billion, up from USD 2.7 billion in 2023.

- Acid-based active ingredients accounted for over 49% of total revenue in 2023.

- Row crops and cereals were the dominant crop type in 2023, with over 62% market share.

- Europe led the market in 2023, with over 38.5% of total revenue, driven by the demand for organic foods.

Biostimulant Statistics

Yield Improvement

- Chlorophyll Content: Biostimulant-treated plants showed a 12% reduction in chlorophyll content under Fe-derived stress compared to 30% in untreated plants.

- Flower Biomass: Plants treated with product 1 had a 46% increase in flower biomass, and product 2-treated plants had a 31% increase compared to the negative control (NC).

- Leaf Size: At week 6, leaf size increased by 57% with product 1, 55% with product 2, and 47% with product 10 compared to the NC.

- Shoot Biomass: Vegetative shoot biomass increased by 70% with products 1 and 2, and by 48% with product 10 compared to the NC.

Nutrient Analysis

- Amino Acid Content: Tested products had total amino acid contents ranging from 5.3% to 52.5% and free amino acid contents from 0.76% to 19.6%.

- Electrical Conductivity: Products exhibited electrical conductivity values ranging from 3.9 to 20.0 dS m−1.

Crop Significance

- Potato and tomato contribute over 50% of vegetable crop production.

- A serving of 250–300 g boiled potatoes provides 7–8% protein, 6–11% carbs, 50% vitamin C, 30–40% potassium, and 17% fiber of daily intake.

Emerging Trends

The biostimulants industry is undergoing significant transformation, fueled by technological advancements that include innovative formulations and delivery systems designed to enhance their effectiveness. These advancements are pivotal in improving plant growth, nutrient uptake, and stress resistance, leading to higher crop yields and better quality.

Simultaneously, sustainability has emerged as a key driver in agriculture, with biostimulants gaining traction as an eco-friendly solution that aligns with the increasing demand for sustainable farming practices. Consumer preferences and regulatory frameworks are further accelerating their adoption as part of environmentally responsible agriculture.

Biostimulants demonstrate remarkable versatility, being applied across a wide range of crops such as fruits, vegetables, turf, ornamentals, and row crops. This broad applicability allows farmers to optimize productivity and crop health across diverse agricultural settings.

Regionally, Europe dominates the biostimulants market, backed by stringent environmental regulations and strong institutional support for sustainable practices. However, North America and Asia-Pacific are witnessing rapid growth due to rising awareness and expanding adoption of biostimulant products.

Despite the market’s innovation pace, regulatory frameworks are evolving more gradually, focusing on standardizing biostimulant products to ensure their safety and efficacy. This regulatory progression plays a crucial role in shaping market dynamics and fostering product development.

Looking forward, the global biostimulants market is projected to grow substantially, driven by the growing need for sustainable farming solutions and the imperative for increased agricultural productivity. This growth underscores the sector’s integral role in the future of global agriculture.

Use Cases

Biostimulants, including kelp extracts, amino acids, and humic acids, play a critical role in improving crop yields and quality. For example, the application of kelp-based biostimulants has increased oilseed rape yield by 0.4 tons per hectare, with field trials demonstrating a 5-10% rise in overall crop yields through enhanced nutrient uptake and stress tolerance. These products also bolster plant resilience to abiotic stresses such as drought, salinity, and extreme temperatures. Natural growth hormones in kelp-based biostimulants, like auxins and cytokinins, promote root development and enable plants to maintain productivity under challenging conditions.

In addition to stress tolerance, biostimulants enhance nutrient efficiency by optimizing nutrient uptake, reducing reliance on chemical fertilizers. For instance, amino acid-based biostimulants improve nutrient use efficiency, resulting in better growth and higher yields in crops such as wheat and soybeans. They also contribute significantly to soil health by boosting microbial activity and enhancing soil structure. Humic acid-based biostimulants improve soil fertility and water retention, fostering sustainable farming practices. This improved soil environment promotes better root growth, aiding in water and nutrient absorption for overall plant health.

Furthermore, biostimulants strengthen plants’ natural defense mechanisms, increasing resistance to diseases and reducing dependency on chemical pesticides. By inducing systemic resistance, biostimulants minimize disease incidence and crop losses, aligning with sustainable agricultural goals. Biostimulants can be applied through various methods, including foliar sprays for quick absorption, soil applications to enhance root health and fertility, and seed treatments to improve germination and early plant growth. These multifaceted benefits make biostimulants indispensable tools for sustainable agriculture.

Major Challenges

The biostimulant market faces several challenges that hinder its growth and adoption. Regulatory complexities remain a significant obstacle, with inconsistent standards across regions placing biostimulants in a gray area between fertilizers and pesticides. This fragmented regulatory landscape creates confusion, imposes additional compliance burdens, and slows down product approval and market entry processes, ultimately hampering innovation and distribution.

High production costs also pose a challenge, as biostimulants require advanced technologies and premium raw materials, making them more expensive than traditional fertilizers. This cost disparity can deter farmers, particularly in developing regions where budget constraints are critical, and the economic viability of biostimulants is often questioned due to their variable effectiveness depending on environmental conditions and crop types.

Additionally, the market is becoming increasingly saturated, with intense competition making it difficult for smaller firms to compete against established players with more resources. This competitive landscape limits opportunities for new entrants to innovate and gain traction. Limited awareness and education among farmers further exacerbate the issue.

Despite the proven benefits of biostimulants, many farmers remain skeptical due to inconsistent results from field trials and a lack of understanding about their long-term advantages. Educational initiatives are needed to demonstrate their efficacy and justify the higher upfront costs.

Moreover, the performance of biostimulants is highly dependent on environmental conditions, including soil type, climate, and crop management practices. This variability leads to inconsistent results, making it challenging for farmers to predict the outcomes and benefits of using biostimulants. This uncertainty, combined with the other challenges, slows the widespread adoption of these products despite their potential to revolutionize sustainable agriculture.

Top Opportunities

The rising demand for sustainable agriculture is driving the adoption of biostimulants as eco-friendly alternatives to traditional chemical fertilizers and pesticides. Biostimulants play a crucial role in enhancing nutrient uptake, improving soil health, and increasing crop resilience to stress, making them indispensable in sustainable farming practices.

Their applications are expanding across a wide range of crops, including cereals, fruits, vegetables, and ornamentals. Cereals and grains, essential for global food security, dominate the market due to their critical role in meeting the growing food demand. High-value crops like fruits and vegetables also benefit significantly from biostimulants, which improve fruit set, size, and uniformity, enhancing both yield and quality.

Technological advancements in biotechnology are revolutionizing the biostimulant market with the development of more effective formulations. Innovations such as microbial amendments and plant extracts are improving the efficacy and appeal of biostimulants. For example, humic and fulvic acids enhance soil fertility and water retention, while microbial amendments improve nutrient cycling and soil health. These advancements make biostimulants a more attractive solution for modern farmers.

Additionally, the growing popularity of organic farming practices presents significant opportunities for the biostimulant market. Organic farmers rely heavily on natural inputs, and the increasing consumer demand for organic and clean-label food products further propels the use of biostimulants.

Regionally, while Europe remains the largest market for biostimulants due to its focus on sustainable agricultural practices, regions like Asia-Pacific are witnessing rapid growth.

Increasing agricultural activities and the need for efficient food production in countries such as India and China are driving the adoption of biostimulants to meet the food demands of their expanding populations. This regional expansion, coupled with advancements in technology and growing sustainability efforts, positions the biostimulant market for significant growth in the coming years..

Future Outlook of the Biostimulant Industry

Technological Innovations and Integration: Technological advancements will drive the future of biostimulants, with innovations in microbial amendments, plant extracts, and acid-based formulations leading to more effective and targeted solutions. The integration of biostimulants with precision agriculture technologies, including remote sensing and data analytics, is expected to enhance application efficiency and customize solutions for specific crop and soil conditions, making them more appealing and accessible to farmers worldwide.

Expansion of Organic and Sustainable Farming: The rising popularity of organic farming practices and consumer demand for clean-label food products are key drivers for the biostimulant market. Organic farmers, who prioritize natural and eco-friendly inputs, will continue to be significant consumers of biostimulants. This trend aligns with the broader movement towards sustainability in agriculture, further bolstered by supportive regulatory frameworks that encourage the use of environmentally friendly products.

Regional Growth Dynamics: While Europe currently dominates the biostimulant market due to stringent environmental regulations and strong support for sustainable practices, the Asia-Pacific region is expected to witness the highest growth. Countries like India and China, facing increasing food demand and agricultural challenges, are rapidly adopting biostimulants to improve crop productivity. North America is also poised for steady growth, driven by technological advancements and growing awareness among farmers about the benefits of biostimulants.

Challenges and Opportunities: Despite its bright prospects, the industry faces challenges such as high production costs, inconsistent regulations, and limited farmer awareness. Addressing these barriers through education, cost-effective production methods, and streamlined regulatory frameworks will be crucial to unlocking the full potential of the biostimulant market. As these hurdles are overcome, the industry is expected to play a transformative role in global agriculture, fostering productivity, sustainability, and resilience in the face of evolving environmental and food security challenges.

Europe Biostimulant Market

In 2023, Europe emerged as the leading market for biostimulants, accounting for over 38.5% of the global market share and generating a market value of USD 1.0 billion. This dominance is driven by the widespread adoption of biostimulants among farmers in key countries such as Spain, Italy, France, and Germany. Favorable government policies, heightened awareness of sustainable agricultural practices, and the growing need to enhance crop quality and yields are pivotal factors fueling this growth.

North America follows closely, with a strong market presence supported by key players in the U.S. and Canada who are driving innovation through advanced research and development. Regulatory support and subsidies further bolster biostimulant adoption across the region.

The Asia-Pacific region is anticipated to witness the highest growth rate in the near future, propelled by rapid population growth, decreasing arable land, and governmental initiatives aimed at boosting agricultural productivity. Major countries such as China and India are at the forefront of this regional expansion, benefiting from increased funding and policy support.

Meanwhile, Latin America and the Middle East & Africa currently hold smaller market shares but present significant growth potential. Factors like expanding populations, rising food security concerns, and a focus on agricultural development create favorable conditions for market growth. As more industry players turn their attention to these untapped regions, opportunities for substantial expansion can be unlocked through strategic pricing and market positioning.

Recent Developments

In 2023, Bayer AG intensified its efforts in the biostimulant sector through strategic partnerships and product launches aimed at enhancing sustainable agriculture. In February 2023, Bayer announced a collaboration with Kimitec to develop and commercialize biological crop protection solutions and biostimulants. This partnership focuses on leveraging natural sources to create innovative products that help plants cope with stress and improve yields.

Throughout the year, Bayer continued to expand its portfolio, integrating advanced biostimulants into its offerings to support regenerative agriculture practices. This included launching new biostimulant products designed to enhance soil health, nutrient uptake, and plant resilience, thereby aligning with the increasing demand for sustainable farming solutions.

In 2023, Isagro Group, a significant player in the biostimulant market, focused on expanding its biostimulant product offerings and enhancing its market presence through innovation and strategic partnerships. Throughout the year, Isagro launched new biostimulant products aimed at improving plant health, stress tolerance, and nutrient uptake.

In January 2023, Isagro initiated a collaboration with Gowan Company to leverage combined resources for better market penetration and product development. This partnership emphasized integrating Isagro’s advanced manufacturing capabilities with Gowan’s field development expertise. By mid-2023, Isagro achieved notable recognition, receiving the ECOVADIS silver medal for its sustainable practices in the biostimulant sector. The company’s focus on research and development continued throughout the year, leading to the introduction of new biostimulant formulations by December 2023, designed to cater to the evolving needs of modern agriculture and enhance crop yields sustainably.

In 2023, Biolchim S.P.A., a leader in the biostimulant sector, focused on expanding its global presence and product innovation. In January, Biolchim launched a new biostimulant product designed to enhance nutrient uptake and stress resistance in crops, significantly improving yield and quality. By April 2023, the company had participated in several international agricultural events, including the MACFRUT exhibition in Rimini, to showcase their latest biostimulant technologies.

In September 2023, Biolchim’s experts presented at the “Trends in Microbial Solutions for Sustainable Agriculture” workshop in Belgrade, emphasizing their commitment to sustainable agricultural practices. Moving into 2024, Biolchim continued to strengthen its market position with new product releases and strategic partnerships, further solidifying its role as a key player in the biostimulant industry.

In 2023, Novozymes A/S, a leader in the biostimulant sector, achieved significant growth and innovation. Throughout the year, Novozymes launched 18 new bio solutions, with seven made public, focusing on enhancing agricultural productivity and sustainability. In the first quarter of 2023, the company experienced a 7% organic growth in North America and a remarkable 21% in Latin America, driven primarily by the Bioenergy sector and Agriculture, Animal Health & Nutrition (AAN) segment. Despite facing challenges such as destocking in food-related areas and lower consumer demand, Novozymes maintained a strong performance with 5% organic sales growth for the entire year.

By the end of January 2024, Novozymes completed its merger with Chr. Hansen, creating a new entity named Novonesis, aimed at further expanding their bio-solutions portfolio and market reach.

Conclusion

The biostimulant market is witnessing rapid expansion, driven by the growing emphasis on sustainable agricultural practices and the urgent need to boost crop yields and resilience. This surge is closely linked to the increasing adoption of organic farming, where biostimulants play a crucial role in enhancing plant health and productivity, even under challenging environmental conditions.

Regions such as Europe, North America, and Asia-Pacific are at the forefront of this growth, with Europe leading the market due to favorable regulatory policies and widespread adoption among farmers. The market is further bolstered by the integration of biostimulants into modern agricultural systems, including digital farming technologies. These advancements enable improved nutrient uptake, better soil health, and enhanced crop resilience to climate change, positioning biostimulants as indispensable tools in the future of sustainable agriculture.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)