Table of Contents

Overview

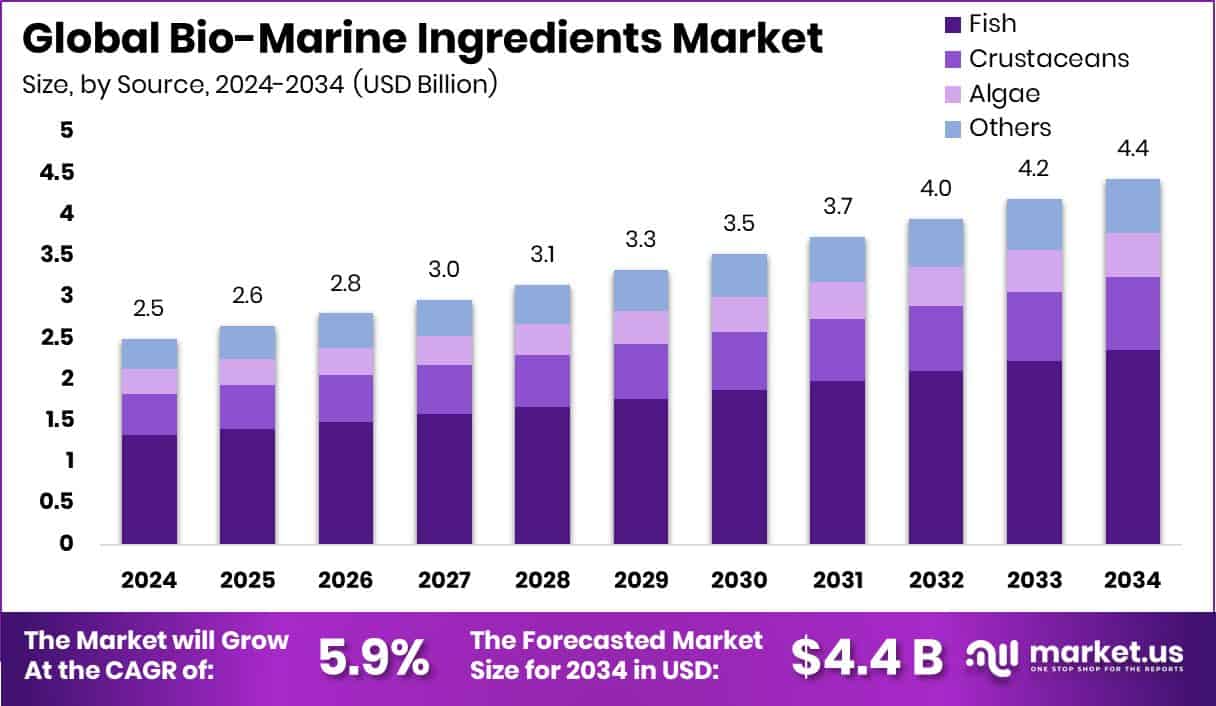

New York, NY – May 07, 2025 – The global Bio-Marine Ingredients Market is gaining strong popularity due to rising demand for natural and sustainable products in food, cosmetics, and pharmaceuticals. In 2024, the market was valued at USD 2.5 billion and is projected to reach USD 4.4 billion by 2034, growing at a steady CAGR of 5.9% from 2025 to 2034.

In 2024, Fish led the Bio-Marine Ingredients Market’s By Source segment, capturing a 53.2% share. This dominance stems from abundant raw material availability and well-developed processing infrastructure for fish-based ingredients. Proteins commanded a 25.3% share in the By Type segment of the Bio-Marine Ingredients Market, driven by their growing use in food, feed, and nutraceuticals. The Food and Beverages segment led the By Application category with a 37.3% share, fueled by the integration of bio-marine ingredients into mainstream and functional food products.

US Tariff Impact on Bio-Marine Ingredients Market

On Feb. 1, U.S. President Donald Trump signed an executive order to impose tariffs on imported goods from Canada, Mexico, and China. The government outlined that these emergency measures are in response to extraordinary threats to immigration and drug enforcement policies.

Until the crisis is alleviated, the U.S. government says it will implement:

- 25% tariffs on all imports from Canada and Mexico;

- 25% additional tariffs on Canadian steel and aluminum;

- 10% tariffs on all energy imports from Canada;

- 10% tariffs on all imports from China.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/bio-marine-ingredients-market/request-sample/

Tariffs on Chinese goods took effect on Feb. 2, resulting in retaliatory tariffs from Beijing on select U.S. coal, natural gas, crude oil, farm equipment, and big-engine vehicles. Canadian and Mexican leaders negotiated a 30-day pause until March 4, promising increased security and oversight at their borders.

Key Takeaways

- The Global Bio-Marine Ingredients Market is expected to be worth around USD 4.4 billion by 2034, up from USD 2.5 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034.

- Fish remains the dominant source, contributing 53.2% to the global bio-marine ingredients market share.

- Bio-marine proteins capture a 25.3% share, driven by rising demand in nutrition and health supplements.

- Food and beverages lead applications, accounting for 37.3% due to clean-label and functional ingredient trends.

- The North America Bio-Marine Ingredients Market was valued at USD 0.9 billion overall.

Analyst Viewpoint

The global demand for natural, sustainable ingredients is fueling growth, with bio-marine ingredients like fish proteins, omega-3s, and algae-based compounds finding their way into foods, supplements, and cosmetics. Investment opportunities shine in innovative startups focusing on algae-based ingredients and sustainable fish by-product processing, as these align with the clean-label trend. Partnerships with biotech firms can also unlock new product lines, like vegan omega-3s for plant-based diets.

Consumers are the heartbeat of this market, craving transparency and eco-conscious products. People are drawn to bio-marine ingredients for their health perks, think better heart health and sharper minds, especially in North America and Europe, but they’re picky, demanding sustainably sourced ingredients with clear labeling.

Technological advancements, like enzymatic hydrolysis, are game-changers, making ingredients purer and more bioavailable, which consumers love. However, the regulatory environment can be a maze. Strict rules in the EU and U.S. ensure safety but slow down approvals, costing companies time and money. Investors should focus on firms with robust R&D and regulatory know-how to navigate these waters.

Report Scope

| Market Value (2024) | USD 2.5 Billion |

| Forecast Revenue (2034) | USD 4.4 Billion |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Source (Fish, Crustaceans, Algae, Others), By Type (Proteins, Minerals, Peptides, Collagens, Chitosan, Omega-3 Fatty Acids, Polysaccharides, Others), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Agriculture and Animal Feed, Others) |

| Competitive Landscape | Aker Bio Marine, AS, Arctic Bioscience, Bio Marine Ingredients Ireland, Calysta, Cargill, Incorporated, CP Kelco USA, Inc., Givaudan S.A., Ingredion Incorporated, Marinova Pty Ltd, Seagarden AS, Symrise AG |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145448

Key Market Segments

By Source Analysis

- In 2024, fish led the Bio-Marine Ingredients Market’s By Source segment, capturing a 53.2% share. This dominance stems from abundant raw material availability and well-developed processing infrastructure for fish-based ingredients. Fish is favored for its high omega-3 fatty acid, protein, and mineral content, driving demand in functional foods, dietary supplements, and pharmaceuticals. Utilizing fish by-products like skin, bones, and offal reduces waste and boosts yield, enhancing economic and environmental sustainability.

By Type Analysis

- Proteins commanded a 25.3% share in the By Type segment of the Bio-Marine Ingredients Market in 2024, driven by their growing use in food, feed, and nutraceuticals. Marine proteins, particularly from fish, are prized for their high digestibility and rich amino acid profiles, aligning with demand for clean-label, sustainable ingredients. Protein concentrates and hydrolysates are gaining traction in sports and clinical nutrition for their rapid absorption and health benefits.

By Application Analysis

- In 2024, the Food and Beverages segment led the By Application category with a 37.3% share, fueled by the integration of bio-marine ingredients into mainstream and functional food products. Proteins, omega-3 fatty acids, and minerals enhance the nutritional value of ready-to-eat meals, dairy alternatives, snacks, soups, and health drinks.

Regional Analysis

- North America led the Bio-Marine Ingredients Market by region, holding a 38.1% share valued at USD 0.9 billion. This dominance is driven by strong consumer demand for functional foods, dietary supplements, and marine-based nutraceuticals, bolstered by advanced processing technologies and established producers in the United States and Canada. Europe trails closely, propelled by increasing health consciousness and a shift toward clean-label products in Germany, France, and the UK.

- The Asia Pacific region is experiencing steady growth, fueled by expanding aquaculture and rising demand for marine proteins and omega-3s in China, Japan, and South Korea. The Middle East & Africa show gradual progress, supported by growing health and wellness trends and urbanization. Latin America is emerging with moderate growth, led by Brazil and Chile’s marine resource availability, though infrastructure constraints in some areas slightly hinder expansion.

Top Use Cases

- Functional Foods: Bio-marine ingredients like fish proteins and omega-3s are added to snacks, cereals, and health drinks to boost nutrition. They enhance heart health and immunity, appealing to health-conscious consumers. Their clean-label appeal drives demand in ready-to-eat meals and fortified foods, making them a staple in grocery stores.

- Dietary Supplements: Marine-derived omega-3s and proteins are widely used in capsules and powders for supplements. They support heart, brain, and joint health, attracting fitness enthusiasts and aging populations. Easy-to-consume formats and proven benefits fuel their popularity, with brands emphasizing sustainability to gain consumer trust.

- Nutraceuticals: Bio-marine ingredients, such as fish collagen and algae extracts, are key in nutraceuticals for anti-inflammatory and skin health benefits. They’re used in gummies and tablets, targeting wellness-focused consumers. Their natural sourcing and bioavailability make them a go-to for preventive healthcare products.

- Sports Nutrition: Marine protein hydrolysates and omega-3s are incorporated into protein bars and shakes for athletes. They aid muscle recovery and reduce inflammation, offering fast absorption. Their high-quality amino acid profiles cater to fitness buffs seeking sustainable, effective nutrition options for performance enhancement.

- Pharmaceuticals: Bio-marine ingredients like omega-3s and marine peptides are used in drugs for cardiovascular and cognitive health. Their anti-inflammatory properties support treatments for chronic conditions. Advanced extraction techniques ensure purity, making them vital for pharmaceutical innovations targeting aging populations.

Recent Developments

1. Aker BioMarine

- Aker BioMarine continues to expand its krill-based ingredients, focusing on sustainability and innovation. Recently, it launched QRILL Aqua, a krill meal product for aquaculture, enhancing fish growth and health. The company also partnered with WWF-Norway to improve ocean sustainability. Aker BioMarine is investing in new harvesting technology to reduce environmental impact.

2. AS Arctic Bioscience

- Arctic Bioscience specializes in marine-derived lipids for pharmaceuticals and nutraceuticals. Its flagship product, ROVITA, is a cod liver oil concentrate for immune and metabolic health. The company is expanding clinical trials to validate its products’ benefits. Recently, it secured new patents for its extraction methods.

3. Bio Marine Ingredients Ireland

- This company focuses on sustainable marine proteins and peptides for animal nutrition. It recently introduced a new hydrolyzed fish protein for pet food, improving digestibility. The company is also scaling up production to meet rising demand in Europe and Asia.

4. Calysta

- Calysta produces FeedKind protein, a gas-fermented alternative to fishmeal, reducing reliance on wild-caught fish. It recently expanded production in the U.S. and partnered with Cargill to commercialize sustainable aquaculture feed. Calysta is also exploring new markets in Asia.

5. Cargill, Incorporated

- Cargill is investing in algae-based omega-3s to meet demand for plant-based nutrition. It partnered with BASF to develop sustainable marine ingredients for animal feed. Cargill also launched a new fish oil alternative for aquaculture, supporting eco-friendly practices.

Conclusion

The Bio-Marine Ingredients Market is set for strong growth, driven by rising demand for natural, sustainable, and nutrient-rich products across food, cosmetics, and pharmaceuticals. Fueled by health-conscious consumers and eco-friendly trends, key players like Aker BioMarine, Cargill, and Calysta are innovating with krill oils, algae-based proteins, and fishmeal alternatives to meet this demand. As technology improves and applications widen, especially in nutraceuticals and aquaculture, the sector offers significant opportunities for growth, making it a promising space for investors and manufacturers worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)