Table of Contents

Introduction

The global Bauxite Market has been experiencing steady growth and is expected to continue expanding in the coming years. As the primary source of aluminum, bauxite holds significant importance in various industries, including aerospace, automotive, and construction.

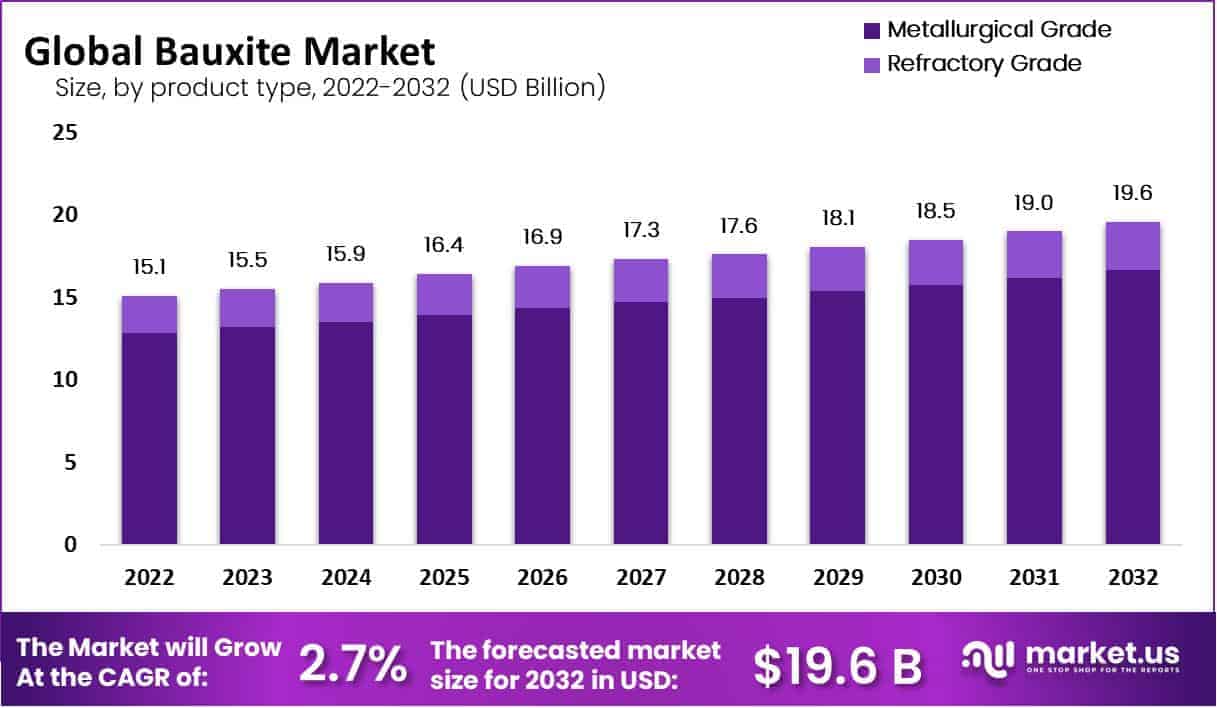

The market size of bauxite is projected to reach approximately USD 19.6 Billion by 2032, up from USD 15.1 Billion in 2022, growing at a compound annual growth rate (CAGR) of 2.7% from 2023 to 2032.

This growth can be attributed to the increasing demand for aluminum, which is widely used in the production of lightweight materials for vehicles, aircraft, and buildings. Moreover, the rise in infrastructure development, particularly in emerging economies, has contributed to the expanding need for aluminum-based products. The growing adoption of electric vehicles (EVs), which rely heavily on aluminum for battery enclosures and body components, further enhances market prospects.

Additionally, advancements in bauxite refining technologies, such as the development of more efficient and environmentally friendly processes, are likely to provide new opportunities for market players. However, challenges such as fluctuating raw material prices and environmental concerns related to mining and refining processes could impact the growth trajectory.

Despite these challenges, the market’s popularity remains high due to its essential role in the aluminum supply chain and its growing applications in various sectors. With increasing demand for aluminum products, bauxite mining and refining activities are expected to expand, creating significant opportunities for industry players and stakeholders throughout the forecast period.

Key Takeaways

- Market Value and Growth: The global bauxite market was valued at USD 15.1 billion in 2022 and is projected to reach USD 19.6 billion by 2032, showing a compound annual growth rate (CAGR) of 2.7% from 2023 to 2032.

- Application Segmentation: Bauxite is used in various applications, with alumina production being the dominant segment, accounting for 86% of the market share in 2022. Alumina is a key ingredient in aluminum production.

- Regional Dominance: Asia Pacific led the market in 2022 with the largest revenue share of 80%, followed by Australia as a significant bauxite producer. Europe is expected to grow at the fastest CAGR due to the demand for aluminum in lightweight vehicle manufacturing.

Bauxite Statistics

- The Bayer process refined around 79% of the bauxite into alumina or aluminum hydroxide, with the remaining portion being used as a slag adjuster in steel mills and goods including cement, abrasives, chemicals, proppants, and refractories.

- An estimated 1.3 million tons of alumina were produced in 2020, 8% less than in 2019, by two domestic Bayer-process refineries with a combined alumina production capacity of 1.7 million tons annually.

- Primary aluminum smelters accounted for around 56% of the alumina produced, with the remaining portion going to nonmetallurgical goods such as refractories, chemicals, ceramics, and abrasives.

- Jamaica accounted for 37% of bauxite imports from 2016 to 2019, with Guyana coming in second at 21%, Australia at 16%, Brazil at 11%, and other sources at 15%. Brazil was the largest supplier of alumina 47%, followed by Australia 26%, Jamaica 12%, Canada 5%, and others 10%.

- During the first eight months of 2020, imports of metallurgical-grade alumina and crude-dry bauxite were USD 370 per ton, 26% lower than during the same period in 2019, and $27 per ton, 16% lower than during the same time in 2019.

- Until the pipeline was fixed, the 6.3-million-ton-per-year alumina refinery’s output was reduced to 35–40% of its capacity, or 2.2–2.5 million tons annually.

- Between 55 billion and 75 billion tons of bauxite are thought to be found in Africa 32%, Oceania 23%, South America and the Caribbean 21%, Asia 18%, and other places 6%.

- With alumina, or aluminum oxide (Al2O3), concentration ranging from 30 weight percent to 60 weight percent, bauxite is one of the main ores that is rich in aluminum.

- To support circular economy principles and achieve sustainable growth through resource optimization, the International Aluminium Institute suggests employing 15% bauxite residue by 2025.

- Potential reuse is limited by issues such as excessive alkalinity, sodium concentration, electrical conductivity, and a smaller particle size distribution (less than 100 μm in 80% of particles).

- Even though there are many journals, only ten major journals cover 20% of all articles, and 71 are the most pertinent to this subject, accounting for 50% of all publications.

- Australia produced 98.64 million tonnes (Mt) of bauxite in 2023. The remaining amount was processed to Australian alumina, and 41.23 Mt of bauxite was shipped.

- The overall tonnage of economically viable lateritic bauxite deposits is quite substantial (>50 Mt).

- The Indian non-metallurgical bauxite producers and exporters suffer from the 15% export levy on bauxite.

- Beginning with bauxite that contains 30% to 60% Al2O3, the Bayer process typically yields smelter-grade alumina of 99.5% Al2O3.

- Australia is the world’s top producer of bauxite, which is not surprising given its reputation for having numerous natural reserves of different minerals, including bauxite. Between 100 million and 104.8 million metric tons are its usual yearly production.

- It currently yields 90 million metric tons of bauxite annually on average.

- The residual bauxite, which contains 15–25% alumina, is where the remaining bauxite is lost.

- Alumina extraction efficiency from the original bauxite ore would be 100% if this alumina content was recycled to the alumina refinery or valorized for another use.

- Gallium dissipates in the alumina and BR streams and is present in bauxite ores at concentrations of 30–80 g/t.

Emerging Trends

- Sustainable Mining Practices: There is an increasing focus on adopting eco-friendly mining practices in the bauxite industry. Companies are investing in technologies that reduce environmental impact, such as minimizing land degradation, water usage, and emissions, aligning with global sustainability goals.

- Technological Advancements in Refining: Innovations in refining technologies, such as the use of more efficient and less energy-consuming processes, are emerging. These advancements not only increase production efficiency but also help reduce costs and the environmental footprint of bauxite refining.

- Growth in Electric Vehicle Demand: The rising adoption of electric vehicles (EVs) is driving the demand for aluminum, which in turn boosts the bauxite market. Bauxite is a key raw material for aluminum production, and its use in EVs’ lightweight components is becoming increasingly important.

- Expansion in Emerging Markets: Developing economies, particularly in Asia and Africa, are witnessing significant infrastructure development, increasing the demand for aluminum products. This, in turn, leads to greater demand for bauxite to meet the growing construction and automotive needs in these regions.

- Supply Chain Resilience: Bauxite producers are diversifying their supply chains to address risks such as geopolitical instability and trade disruptions. Companies are establishing stronger relationships with suppliers and exploring new mining locations to ensure a steady supply of bauxite.

- Investment in Recycling Initiatives: The push for circular economy practices is encouraging greater investment in aluminum recycling. As the demand for aluminum rises, the recycling of aluminum from bauxite waste and scrap is gaining attention as a sustainable alternative to new mining.

- Shift Toward High-Grade Bauxite: As lower-grade bauxite reserves deplete, the industry is increasingly focusing on extracting higher-grade bauxite, which requires less refining and yields higher-quality aluminum. This trend is leading to more efficient use of resources and reduced production costs.

Use Cases

- Aluminum Production: Bauxite is primarily used as the main source of aluminum. Through refining, bauxite is processed into alumina, which is then smelted to produce aluminum. Aluminum is essential in sectors like transportation, aerospace, packaging, and construction due to its light weight and strength.

- Construction Industry: Bauxite is used in the production of aluminum oxide, which is an essential material for building durable and high-strength structures. In construction, aluminum is used for windows, doors, roofing, and facades due to its resistance to corrosion and excellent aesthetic appeal.

- Automotive Manufacturing: The automotive industry uses aluminum for lightweight vehicles. Bauxite, as the primary source of aluminum, plays a key role in making car parts like body panels, engines, and frames. This helps reduce vehicle weight, improving fuel efficiency and performance, especially in electric vehicles (EVs).

- Aerospace Industry: Aluminum derived from bauxite is critical in aerospace manufacturing. Aircraft parts such as wings, fuselages, and engine components are made from lightweight yet strong aluminum alloys. The demand for lightweight, fuel-efficient aircraft has increased the need for aluminum and, consequently, bauxite.

- Electrical Conductivity: Aluminum produced from bauxite is an excellent conductor of electricity, which makes it an essential material for electrical wiring and power transmission. Bauxite-derived aluminum is widely used in electrical cables and systems, especially in regions with growing demand for energy infrastructure.

- Water Treatment: Alumina (aluminum oxide), derived from bauxite, is used in water treatment processes. It acts as a coagulant, helping to remove impurities from drinking water and wastewater, making bauxite essential in maintaining clean and safe water supplies.

- Bauxite Residue Utilization: The byproduct of bauxite refining, known as red mud, is being researched for alternative uses, including in the production of bricks, cement, and other building materials. This helps reduce waste from bauxite processing and creates additional economic value from bauxite operations.

Major Challenges

- Environmental Concerns: Bauxite mining can lead to deforestation, loss of biodiversity, and water contamination. The extraction process generates large amounts of waste, which can harm local ecosystems and communities, raising concerns about sustainability and environmental responsibility.

- Fluctuating Prices: Bauxite prices are volatile due to factors like changes in global demand, supply chain disruptions, and economic instability. These price fluctuations can make it difficult for businesses to plan long-term strategies, affecting both producers and consumers.

- Supply Chain Disruptions: Logistics and transport issues, especially in remote mining locations, are a challenge. Bauxite requires significant infrastructure, and any disruptions in the global supply chain, such as shipping delays or geopolitical tensions, can lead to shortages or cost increases.

- Regulatory Compliance: Many countries have stringent regulations on mining operations, particularly around land rights and environmental protections. Compliance with these regulations can be costly and time-consuming, especially for companies operating in multiple jurisdictions.

- Quality Variations: Bauxite quality can vary significantly from mine to mine, and processing it to meet industry standards requires advanced technology. Variations in quality can result in higher processing costs or reduced efficiency in the production of aluminum.

- Labor Issues: Mining operations often face labor-related challenges, such as shortages of skilled workers, safety concerns, and worker strikes. These issues can lead to delays in production and increased operational costs, impacting profitability.

- Depletion of Reserves: Bauxite is a finite resource, and many high-quality reserves are depleting. As lower-grade deposits are mined, extraction becomes more expensive, and this can increase costs for producers and lead to longer lead times for supply.

- Global Trade Barriers: Tariffs, export bans, and trade restrictions in key bauxite-producing countries can disrupt the global market. These barriers can cause supply shortages or price increases, especially in countries that rely on imports for aluminum production.

- Energy Consumption: The process of refining bauxite into alumina and aluminum is energy-intensive. High energy costs can significantly impact the profitability of bauxite-related industries, particularly in regions where energy prices are unstable.

- Technological Challenges: Advancements in mining technology are needed to improve extraction efficiency and reduce environmental impact. However, implementing new technologies can be expensive, and not all companies have the resources to make these investments, limiting overall industry growth.

Market Growth Opportunities

- Rising Demand for Aluminum: The growing need for aluminum in industries like automotive, aerospace, and construction is driving bauxite demand. Aluminum’s lightweight and durable nature makes it essential for energy-efficient vehicles and infrastructure, creating long-term growth prospects for bauxite extraction and processing.

- Growing Use of Aluminum in Electric Vehicles (EVs): As electric vehicle adoption increases, so does the demand for lightweight materials like aluminum. Since bauxite is the primary source of aluminum, this shift towards electric vehicles will boost bauxite consumption, supporting growth in both the mining and refining industries.

- Urbanization and Infrastructure Development: Rapid urbanization, especially in emerging markets, is driving the demand for construction materials. Aluminum, derived from bauxite, is widely used in building materials, windows, and other architectural elements. This growth in infrastructure projects presents a steady increase in bauxite demand.

- Advancements in Mining Technology: Technological innovations in mining and refining processes are making bauxite extraction more efficient and cost-effective. Improved techniques reduce environmental impact and increase production capacity, creating opportunities for growth in bauxite mining, especially in new regions.

- Sustainability and Recycling Trends: As the world focuses on sustainability, the recycling of aluminum from scrap materials is becoming more common. This shift to aluminum recycling is creating a parallel demand for bauxite to meet the needs of both new and recycled aluminum production, offering growth opportunities for the bauxite market.

- Expanding Industrial Applications: Bauxite’s usage is expanding beyond aluminum production. It is also used in the production of chemicals, abrasives, and refractory materials. As industries diversify their use of bauxite, new markets are emerging, increasing its overall demand and growth potential.

- Strategic Investments in Mining Projects: Many countries are investing in new bauxite mining projects to meet growing global demand. With these investments, bauxite production is expected to rise, especially in countries with large untapped reserves, positioning them as future key players in the global market.

- Government Policies and Trade Agreements: Government policies supporting resource extraction, along with international trade agreements, are improving market access for bauxite producers. With more favorable regulations and reduced trade barriers, bauxite producers can tap into previously restricted or underdeveloped markets, promoting market growth.

- Strong Global Trade and Export Opportunities: Bauxite is a globally traded commodity. As international trade agreements improve, producers in key exporting countries are seeing increased demand from import-dependent nations. This trade expansion creates opportunities for stronger market connections and higher export volumes.

- Integration of Green Mining Practices: The adoption of environmentally friendly mining practices is gaining momentum in the bauxite industry. By incorporating green technologies, producers can reduce their carbon footprint and appeal to eco-conscious consumers, driving growth through both regulatory incentives and market demand for sustainable products.

Key Players Analysis

- Alcoa Corporation is a major player in the bauxite and alumina sectors, focused on producing aluminum and aluminum products worldwide. With a strong emphasis on sustainability, Alcoa has invested in technologies to reduce carbon emissions and enhance operational efficiency. The company operates bauxite mines in Australia and Brazil, supplying global aluminum markets.

- Rio Tinto is one of the largest mining and metals companies globally, with a strong presence in bauxite production through its Australian operations. It focuses on sustainable mining practices, and its bauxite is a key feedstock for aluminum production, supporting industries like construction, transportation, and packaging.

- Aluminum Corporation of China Limited (CHALCO) is a leading Chinese producer of aluminum and bauxite, with operations across the entire aluminum value chain, from mining to refining. CHALCO is integral to China’s aluminum supply and has strategic interests in overseas bauxite mining operations to support its domestic industry needs.

- National Aluminum Company Limited (NALCO) is a state-owned Indian enterprise involved in bauxite mining, alumina refining, and aluminum production. The company is one of the leading suppliers of bauxite in India and has expanded its operations to include the manufacturing of aluminum products, serving both domestic and international markets.

- Norsk Hydro ASA, a Norwegian multinational, is a key player in the bauxite sector, owning bauxite mining operations in Brazil. The company focuses on sustainable aluminum production, reducing emissions, and improving efficiency. Norsk Hydro is a global leader in recycling aluminum and provides solutions to industries like automotive and construction.

- China Hongqiao Group Limited is one of the largest aluminum producers in China, with significant bauxite mining assets in the country and abroad. Hongqiao focuses on integrated operations, from bauxite mining to aluminum production, and plays a crucial role in China’s aluminum supply chain and its position in the global market.

- Emirates Global Aluminum PJSC (EGA) is the largest industrial company in the UAE and a major producer of aluminum. It operates bauxite mining operations in Guinea and produces alumina in the UAE. EGA has a strong focus on sustainable practices, reducing emissions, and supporting the global demand for aluminum in various industries.

- Metro Mining Limited is an Australian mining company focused on the extraction and export of bauxite. Operating primarily in Queensland, Metro Mining supplies bauxite to key customers in China and other parts of Asia, with a focus on sustainable mining and growing its production capacity in response to global demand.

- Hindalco Industries Ltd. is a major player in the Indian bauxite and aluminum market, with significant bauxite mining operations in India and overseas. As part of the Aditya Birla Group, Hindalco is a key supplier of aluminum products, serving sectors like automotive, packaging, and construction, while focusing on sustainability and efficiency.

- Emirates Global Aluminium PJSC, mentioned earlier, is a major global producer of aluminum with a strong presence in bauxite mining, especially in Guinea. With operations spanning the entire aluminum value chain, EGA is focused on maintaining high production standards and supporting international markets, especially in the Middle East and Asia.

Conclusion

In conclusion, the global Bauxite Market continues to experience steady growth, driven by the increasing demand for aluminum in various industries such as automotive, construction, and aerospace. Major players like Alcoa, Rio Tinto, and Norsk Hydro dominate the market, leveraging their vast bauxite reserves and advanced mining technologies to meet the rising demand. However, the market faces challenges such as fluctuating raw material prices, environmental concerns, and the need for sustainable mining practices.

As countries ramp up efforts to reduce carbon emissions, the push for greener mining operations and more efficient aluminum production methods will shape the future of the bauxite market. Overall, despite these challenges, the long-term outlook for the bauxite market remains positive, with continued demand for aluminum expected to drive further investments and innovations across the supply chain.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)